It likewise assists you with following the amount you have spent and what specific dates you have burned through most. It is vital to observe your acquiring design so as not to overspend and get nothing to save. Assuming you acquire a bi-weekly budget template, you could utilize a fortnightly spending plan format that you can chip away at by selling your costs. The budget plan is the device second to none that each blog or individual budget book prescribes to be in charge of our cash; notwithstanding, how it is customarily utilized may not be the most satisfactory to guarantee that we make our compensation pay.

What is a Budget plan?

From a severe perspective, planning implies ascertaining the month-to-month pay and costs of any monetary action ahead of time. Peruse another way; it is a series of expectations about what will befall our funds from here on out.

When and How to Make a Budget

Whenever we need to have a basic thought of the amount of cash we possess and what we will spend it on in the following days, weeks, or months, making a budget is helpful. Normally, it is prescribed to continuously do it before having the cash in our grasp and for timeframes that are neither excessively short (few can start planning consistently – even though they do it unwittingly ) or extremely lengthy (because almost certainly, they won’t do as such). Agree); Let’s say that doing it once consistently is the default choice. To do as such, simply follow these means:

- Conclude the period for which we are planning.

- Make a rundown of all the pay that will come to us in that timeframe.

- Add the upsides of our pay to acquire the all-out pay.

- Make a rundown of the multitude of costs that we should do in that timeframe.

- Add the upsides of our costs to get them all out of cost.

- Deduct the worth of our costs from the worth of our pay.

- Examine the aggregate.

The absolute of our financial plan should generally be positive; essentially it should be equivalent to nothing. This last choice, notwithstanding, is exceptionally ill-advised. The explanation is that the more attractive our spending plan, the less space we have for possibilities, and, in the event of one, we might need to search for credit or begin to quit paying the obligations we now have or forfeit a portion of our fundamental costs.

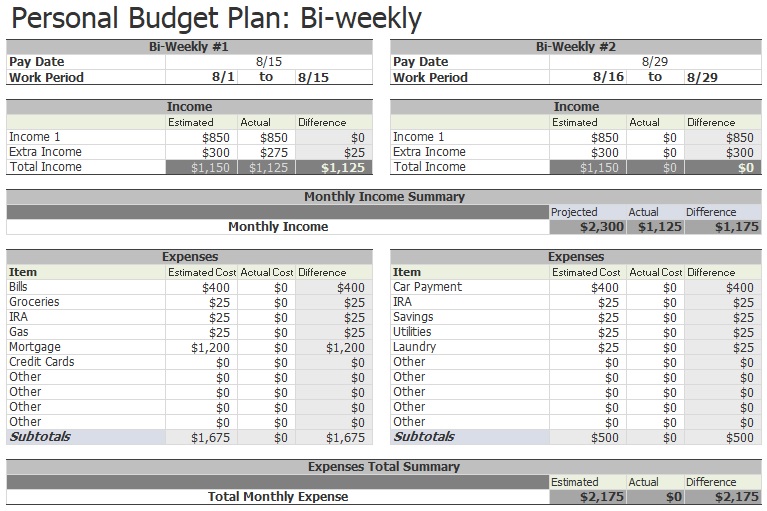

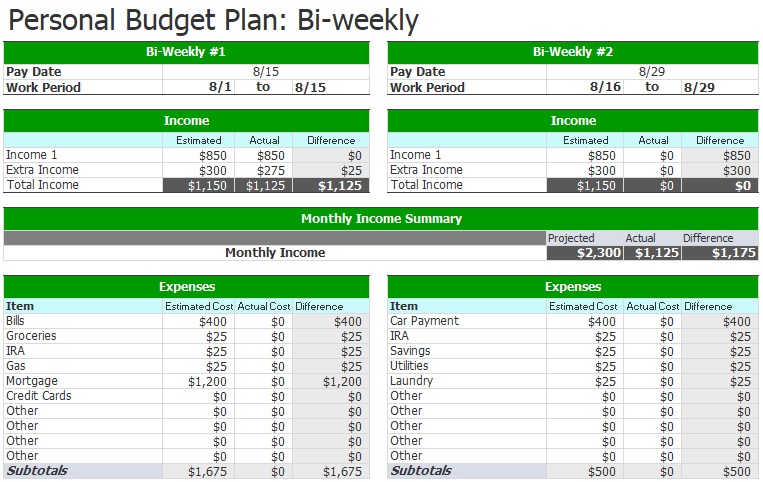

Conventional Budget versus Bi-Weekly Budget Template

Every other week financial plan format is an extremely valuable instrument to assist us with concluding the amount we need and can invest at some random energy; However, this approach to doing it has a colossal issue for a great many people: it accepts that all costs and all payments are made simultaneously.

Think about the accompanying circumstance:

You have two every other week installments in the month, on days 1 and 15. Notwithstanding, on day 5 you need to pay the lease (which is comparable to half of all pay for the month), on day 10 you need to pay public administration and you should have cash for transportation and food. After the fifteenth, you don’t have bills to pay, and you just need to stress over the most fundamental costs. Assuming we gave you esteems and made an every other week financial plan format for the present circumstance, it would presumably be positive; furthermore, unquestionably we would utilize the cash that we have left to go out celebrating and give ourselves tastes in the subsequent fortnight. Nonetheless, almost certainly, by the seventh of the month (multi-week before getting the second installment of our compensation), we will never again have cash, and we should acquire or make development on the Visa while we get the fortnight. In this situation, the spending plan – done customarily – can be a precarious device for our funds. What might we at any point do then, at that point?

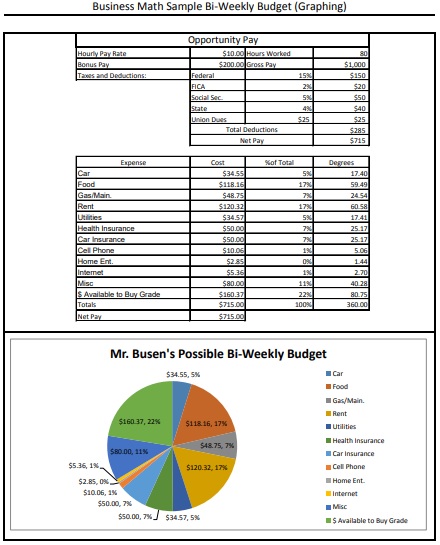

Step by step instructions to Create a Budget Bi-week after week Income

Most customary representatives are paid like clockwork, the best spending plan system is to make a month-to-month financial plan format in your fortnightly pay, and that is the thing we will make sense of! Numerous representatives (particularly the people who work in deals, including realtors) get a fortnightly check that closures with three payslips in a couple of months. Recall that there are 26 fortnightly periods in a year! You should also check Household Budget Templates. This is because they get a reward because of the commission. You will get a reward check either routinely or irregularly. Regardless, the reward check is a major success. You can utilize the overabundance money to drive off obligations, save for retirement, save for the condominium you need, or enliven your secret stash. You can make buys like another dishwasher, your next vehicle, or a family get-away.

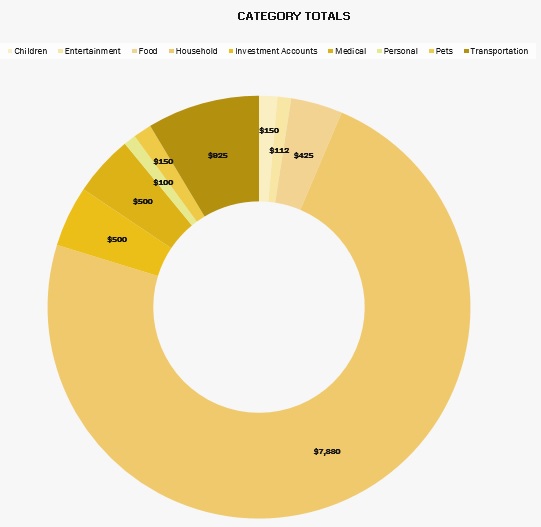

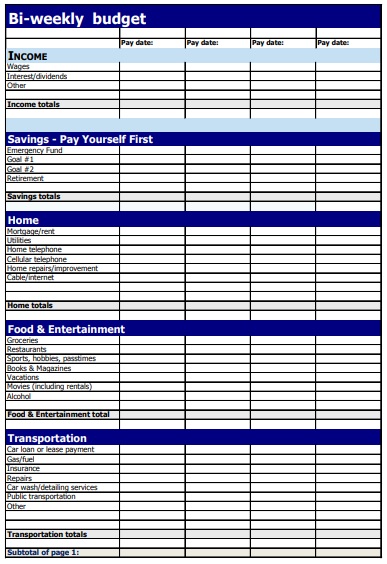

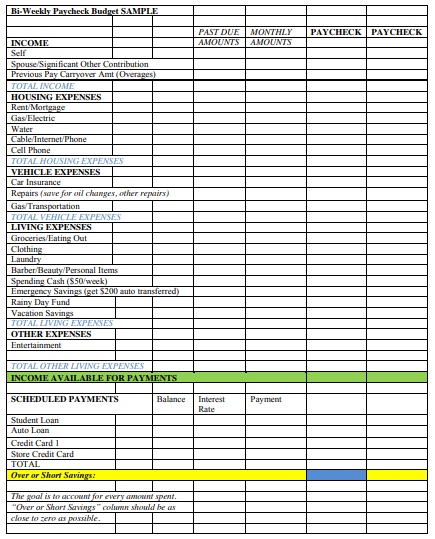

Stage 1: Create your financial plan classifications

The initial step is to make the cost classifications for your month-to-month spending plan. Your costs ought to regularly fall into two classifications: obligatory and optional. Obligatory costs: Mandatory costs should be paid month to month and incorporate things like lease, food, and utilities. Optional costs: Discretionary costs are trivial costs, for example, eating outside, heading out to a film, and amusement.

Stage 2: Identify your month to month expenses

The subsequent stage is to distinguish your costs and apportion them in the two classes you made before. Make a fortnightly financial plan format that covers the accompanying fundamental prerequisites:

- Your lease/contract

- Utilities

- Medical coverage, life coverage, and vehicle protection

- Saved cash for vehicle fixes and home fixes

- Held cash for retirement reserve funds

- Reserve funds for your children’s advanced degree

- Investment funds for an excursion

- Reserve funds for clinical costs

- Reserve funds for supplanting your portable, PC, watch, TV, and other computerized gadgets.

- You understand. List down the costs on a worksheet without failing to remember anything.

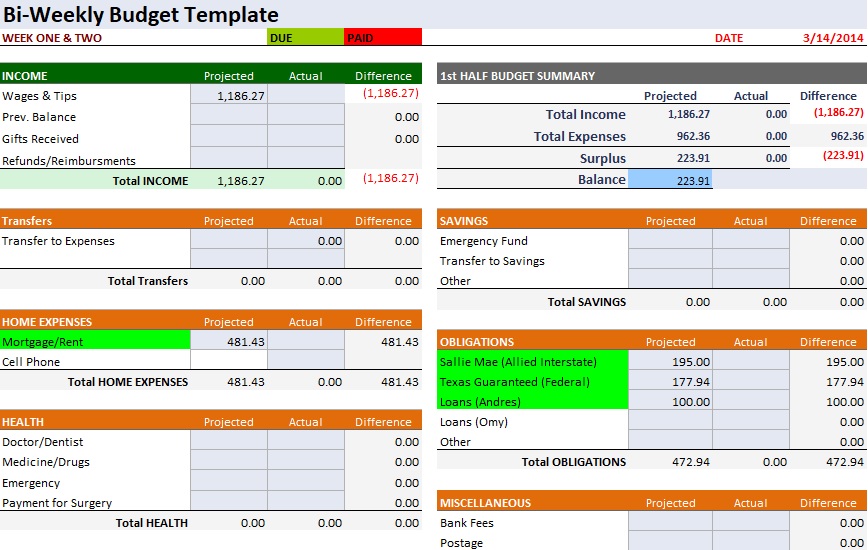

Stage 3: Allocating pay to costs

While apportioning your pay to your costs, begin with the compulsory costs. If there are subsidies left, apportion the excess sum between your adaptable costs because of shared understanding as a couple. If your ongoing pay doesn’t cover your required costs in general, or you are winding up with almost no cash close by, you ought to survey your costs and attempt to diminish them where you can.

Stage 4: How to deal with the third check

Since it has become so undeniably obvious what standard costs and reserve funds you want to remember for your financial plan, you won’t feel like you “want” that additional third check. Since there are no bills to make up for lost time with, you can divert the whole reward to another objective, put it in your retirement record, or develop your rainy day account. Or on the other hand make it in a sub-investment account that is set apart for a particular objective, like supplanting your apparatuses. This is perhaps the most effective way for individuals who are paid every other week to tap extra reserve funds regardless to stay reasonably affordable.

Conclusion

The way to have an effective Bi-weekly budget template format is to be sensible. We should make an effort not to lead a day-to-day existence that our pay doesn’t permit us. I might want to have an everyday lunch at the best eatery, will my pay permit it? No. Then, at that point, I ought to search for the least expensive other option, which could be getting ready food and taking it to work, or getting it made in a spot that accommodates my spending plan, the primary choice being the most thoughtful with my pocket. Likewise, remember to go through our huge loads of other free assets, guides, and fortnightly financial plan layouts.

How would I make a Bi-weekly Budget plan?

Picture result for every other week’s financial plan layout Step by step instructions to make an every other week spending plan

- Print out a schedule. Begin making your fortnightly spending plan organizer by printing out a schedule to follow your financial plan. …

- Organize costs. …

- Incorporate changing costs. …

- Put in support. …

- Start following.

How would I make a Bi-weekly Budget plan every other week?

Picture result for fortnightly spending plan format Regardless assuming you are going to pay every other week or double a month, the accompanying advances will assist you with composing a financial plan that you can adhere to!

- List Out Your Bills. …

- Create Your Bill Payment Calendar. …

- Write Your First Biweekly Budget. …

- Write Your Second Biweekly Budget. …

- Track Your Spending.

How would you ascertain a Bi-weekly financial plan?

“Numerous people expect there is a month out of consistently, aside from it is very troublesome.” Multiple your all-out accessible month-to-month pay by 12 to decide your complete yearly pay, then, at that point, partition that sum by 52 to show up in your week by Bi-weekly financial plan.

How would I offer a week-by-week scope?

To decide on a week-by-week stipend sum, take your optional spending sum every month and separate it by four. That sum will be the amount you can spend every week without blowing your general financial plan while as yet getting to enjoy a few things you need.

![Free Christmas Budget Templates [Excel] free christmas budget template 1](https://templatedata.b-cdn.net/wp-content/uploads/2021/12/free-christmas-budget-template-1-150x150.jpg)