A cash flow budget template uses for the estimation of all cash receipts and all cash expenditures during a certain period. However, a sufficient cash flow is important to the existence of the business. This template will help you to predict that you have sufficient cash flow to meet its requirements. In Addition, it will help you to show when more cash is going out of the business than in.

How does a cash flow budget work?

A cash flow budget is an approximation of the amount of money. Similarly, you expect your business to take in pay-out for a certain time Including all of your projected income and expenses. Moreover, it covers the 12-month period, however, shorter terms also covered like week or month. By understanding how sustainable your plans are, you will be able to forecast your business’ future financial performance.

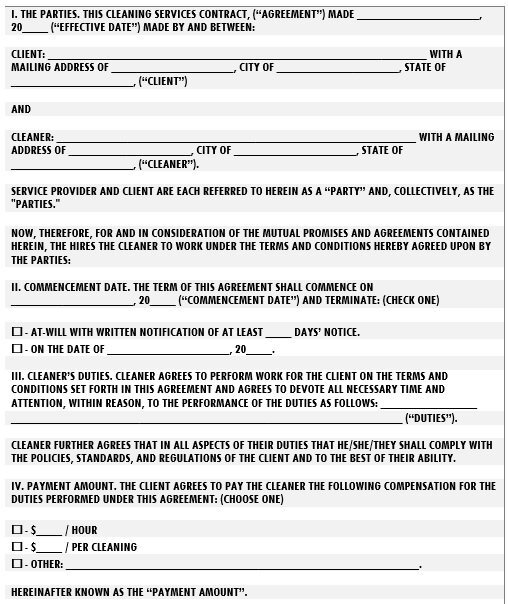

Cash Flow Budget Templates

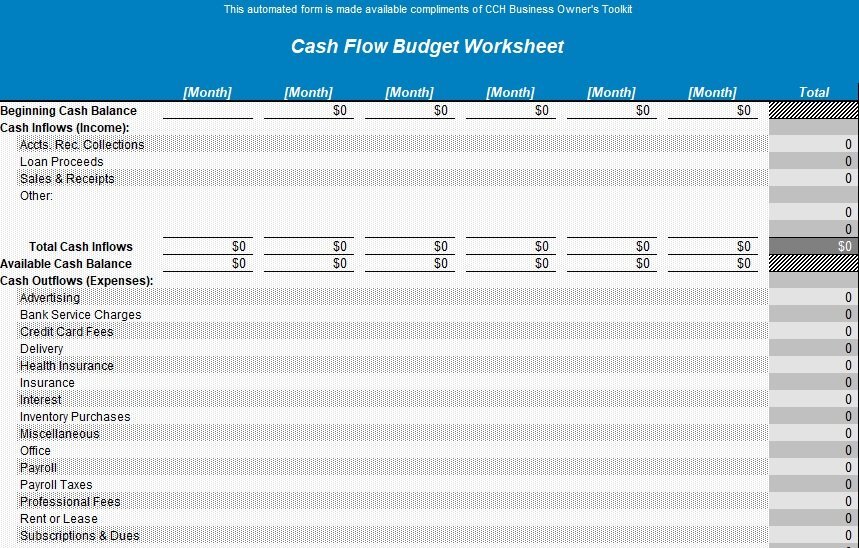

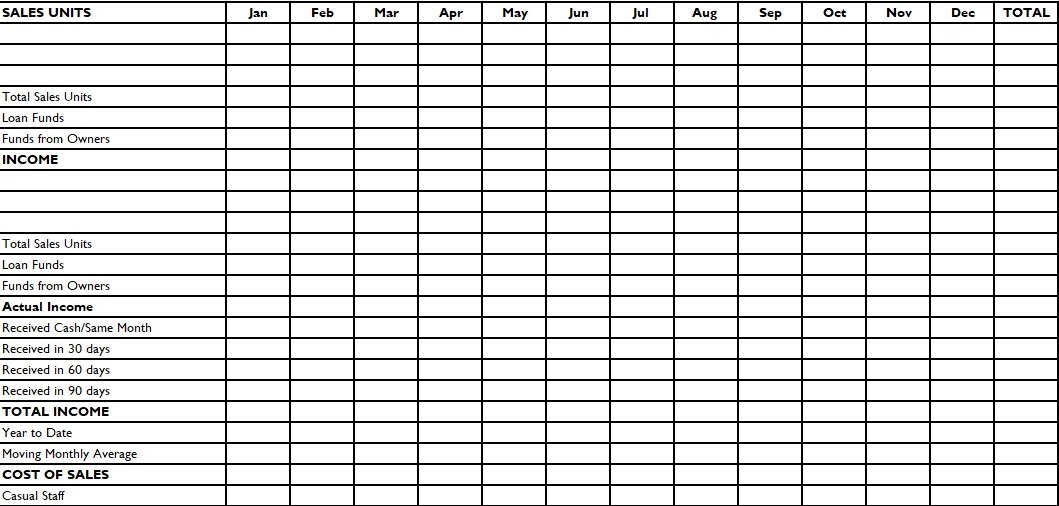

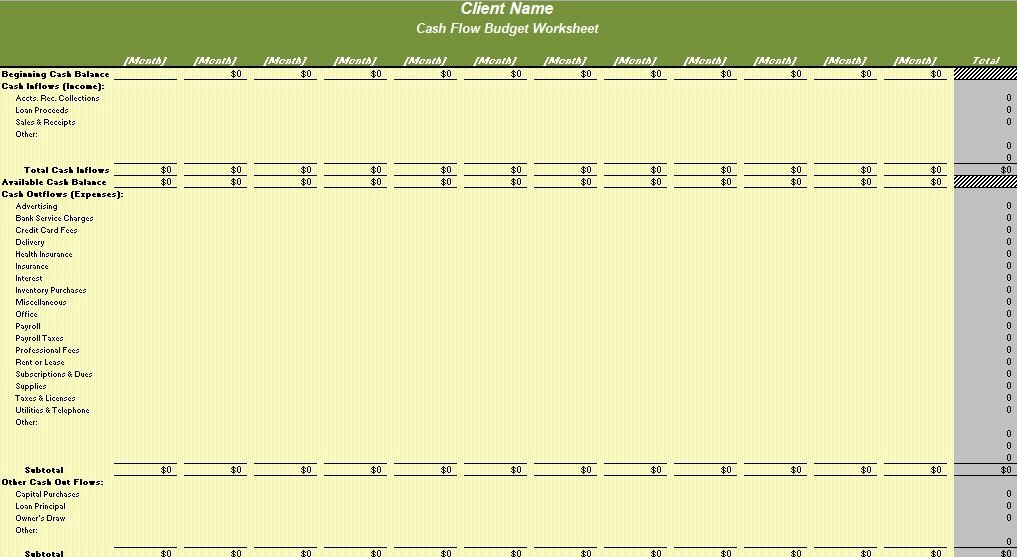

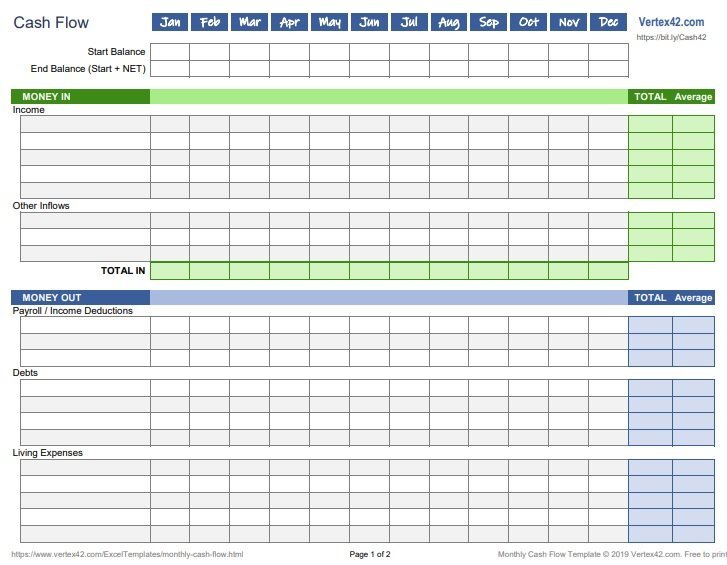

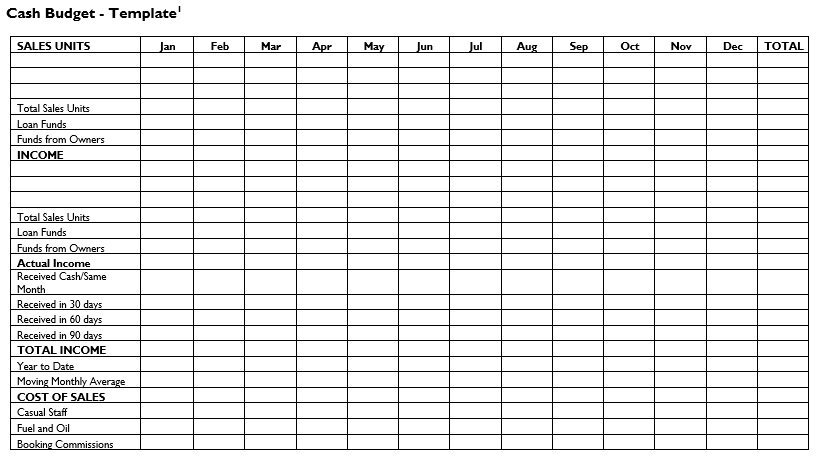

The cash budget uses for inflows and outflows of your business cash over a certain period. You just need to download the worksheet once and you can utilize it again and again. Further, when you open the sheet, it makes another copy for you and the original reserved. It is easy to use, you just enter your numbers and take a printout. The categories for inflows and outflows are there in the sheet. In Addition, it is easy to modify as per your needs.

free cash flow budget template excel

free cash flow budget template

cash flow budget worksheet

free cash flow budget template 1

printable monthly cash flow budget template

personal cash flow budget template word

Main Functions of Cash Flow Budget

The followings are the main functions of the cash flow budget:

- Forecasting your cash requirements. Similarly, it is vital to do an estimation of your budget for a specific time.

- Cash Situation

- How to control cash expenditure

- Betterment in expansion schemes

- Complete dividend plan

Cash flow budgeting: How to do it

For cash flow budgeting, there are steps you need to follow. The procedures are explained below.

Decide on a timeframe

You can start your cash budgeting by setting a timeframe. Next is to project the cash inflows and how it works. This should be in line with past trends and revenue inflows. However, if there is no previous data, you should blank the column and fill it in when the project inflows start.

Estimate the cash outflows

Repeat the same procedure for cash outflows. Similarly, using the previous data you can estimate the future, like cash outflows. However, if there is no past data, you can fill it out at a later date when it starts cash flowing out. The cash flow budgeting is helpful in this regard.

Calculate the ending cash balance

With the projections, you have already made you can go for calculating the ending cash balance. Therefore, this is the difference between cash inflow and cash outflow. You can see what’s in your bank account or what’s outstanding.

Establish a minimum cash flow balance

According to the metric above, you can set the minimum cash flow balance. However, this is the rough guide that provides the idea about your money at your fingertips at any given time. Moreover, it works as future expenses and cash handling tool.

Benefits of Cash Flow Budgeting

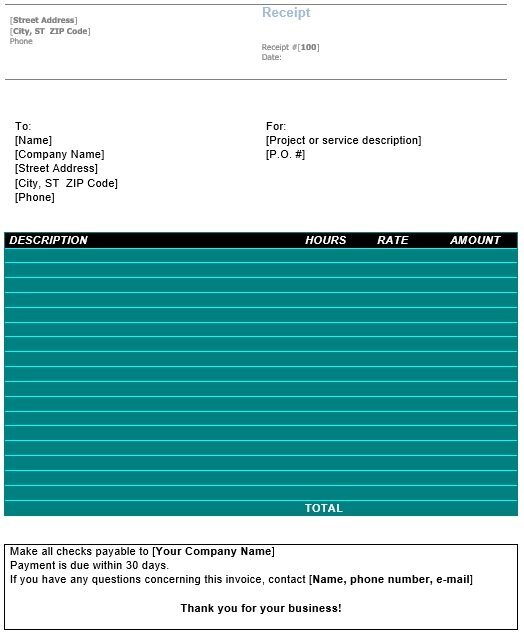

The cash flow budget template is used to estimate your business’s cash inflows and outflows over six months. This template is very useful.

Moreover, it can determine the ability of your business to generate the cash required for expansion or to support you.

The software can calculate your business’s cash inflows and outflows and predict cash flow gaps, or periods when cash outflows exceed cash inflows.

In addition, it can also be used to prepare a formal cash flow budget for your lender to assure them that you will be able to repay the loan.

We designed the attached cash flow budget template to make it easy for you to prepare a cash flow budget.

This template has been set up for budgeting your cash flow for six months and contains most of the cash inflow and outflow categories.

Why Use Cash Flow Budgeting?

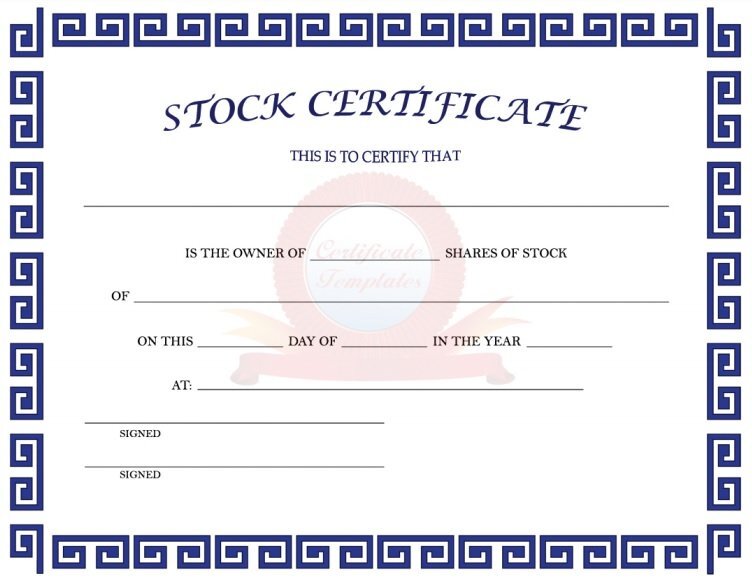

Cash flow budgets track the flow of cash in an organization during a specific time. In addition, it checks cash on hand, receivables, outstanding payables, loans, and other monies. Further, you owed for the purchase of capital and other investment opportunities.

There are some reasons to use cash flow budgeting:

- You can see the position of your cash at any given time.

- Compare the budget with the cash flow.

- Lists the cash inflows and outflows

- To know how to adjust each expense

- Provide for any impending losses or loopholes in budgeting.

As a result, if we follow the above instructions, it will be easy to adjust your cash flow budgeting. Moreover, you will be aware of your ending balance. Everything will be at your fingertips regarding ending balance.

How to use Free Cash Flow Budget Worksheets?

To draft a proper cash flow budgeting, you need some worksheets. Similarly, for your use, we have quite a few of them in stock. Moreover, you should feel free to download and make a draft of such a type of budgeting for yourself.

As a result of the insights we have provided, we believe you have what it takes to develop a nice cash flow budget for your business. To reach that goal, follow the steps we have outlined diligently. In addition, download and use the free worksheet templates we have prepared for you.

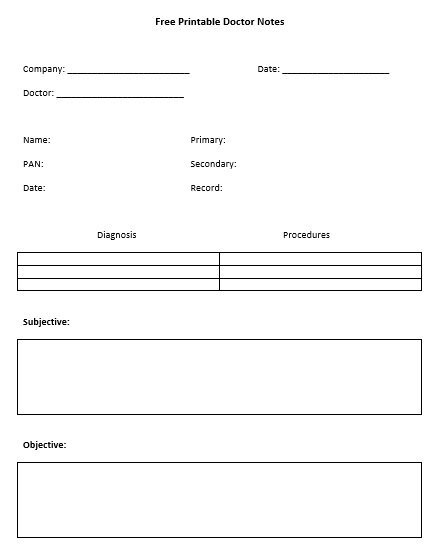

The most effective method to Use the Cash flow Budget Template

To make the template work for you, you’ll have to roll out a few changes to it. The principal thing is to add your organization name and change the dates or periods as appropriate.

Then, change the names of the multitude of the wellsprings of inflows/outflows of money in the activity area and add or eliminate columns as the need might arise. Ensure the totals summarize accurately after rolling out the changes.

Following that, add any investing and finance cash flows as suitable. A typical methodology is to leave financing until the end and choose if any is required or if the excess cash might be returned to investors.

At last, take a gander at the net figures in the last column called “total increase/decline in cash” and analyze your cash budget. You might conclude expenses ought to be increased or decreased and different changes are expected to improve the budget for your organization.

Note: The cash budget template is for instructive purposes just and ought not to be depended upon without professional advice.

Advantages and disadvantages of a Cash Budget

There are a few benefits and burdens in setting up a budget on a cash basis. Here are a few vital upsides and downsides:

- Gives exact timing of when cash comes all through the organization

- Gives a reasonable image of the net financial position of the business

- Testing to get insights concerning when money will be gotten for income and when each bill will be paid

- Doesn’t tie precisely to the income statement

Ideally, a monetary examiner would set up a working operating budget, and a capital budget, and tie everything together in a completely connected three-statement financial model.

Conclusion

The cash flow budget template uses to see the flow of cash in any organization for a specific time. Moreover, it sets eyes on cash at hand, deliverables, loans, outstanding payables for the purchase of capital and other investments. The cash flow budget can be weekly, monthly, quarterly and yearly. In addition, the purpose of the company to use a cash flow budget is to determine whether it has sufficient operating money to operate its expenses during a certain time.

As a result, cash flow budget template worksheets are ideal. Further, you just need to fill in it the numbers and you get the desired result. Similarly, you don’t need to worry about a specific time.

![Free Petty Cash Log Templates & Forms [Excel, Word, PDF] free petty cash log template 3](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/06/free-petty-cash-log-template-3-150x150.jpg)

![Free Christmas Budget Templates [Excel] free christmas budget template 1](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/12/free-christmas-budget-template-1-150x150.jpg)

![20+ Free Balance Sheet Templates & Samples [Excel] trial balance sheet excel](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/trial-balance-sheet-excel-150x150.jpg)