A household budget template is the best document to keep track of your monthly income, monthly expenses and cash flow. Family budget bills for your family and keep track of your overall financial health. You can easily manage your household budget. This is also important because your family gets necessary household supplies. Many people think it’s quite scary, but if you are approaching your finances wisely, it helps you stay out of debt.

You should keep in mind that no one is born with money management skills. However, with a household budget, you will always be in a position to keep track of your actual spending habits. You can also have a household budget that itemizes your incomes and expenses. Moreover, this will help you to save money and how much you will spend on it.

Why You need a household budget?

From the economic point of view, if you are keeping a household budget, it will help you to provide financial welfare at your house. The following are reasons for keeping such a household budget.

- Never spend money on such things which are not on the list of your budget.

- It helps you can save in the time of emergencies.

- You can also get an alert for not spending on bad habits.

- It also helps you that you can achieve your financial goals.

How to Create a Household Budget?

If you have no idea of your monthly expenditure, you can manage your household budget template said than done. To actively manage your budget here are a few useful tips:

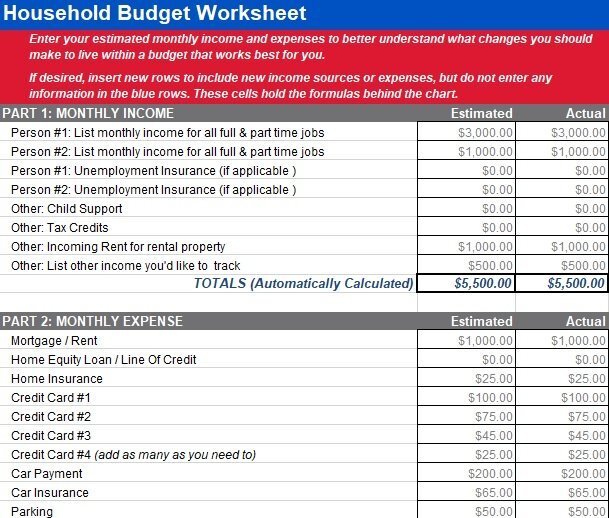

Make a list of all sources of incomes

Initially, you should check your monthly income. This will include wages, monthly salaries, child support, grants and alimony among other sources. Moreover, you need to check that all sources are reliable. Similarly, you should include other jobs and cash from your hobby in your monthly income resources. Likewise; you need to depend on your monthly budget. However, if you don’t have a fixed income or are self-employed you can still use average monthly income or make your estimation like a monthly income.

List Down Your Expenses

Once you have listed down your total assets, you should now budget for them. You now focus on the household expenses. You should first make a list of your fixed expenses such as rent, transportation, electricity, medical, water and groceries among them. Further, you can list down all the expenses which are variable household expenses.

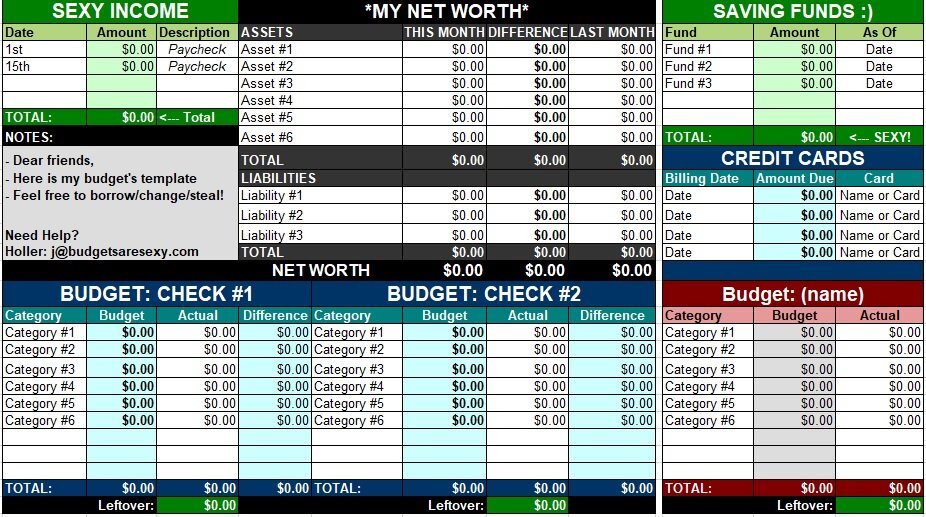

Calculation of Net Income

The net income refers to the amount you will keep after clearing all the household bills. You can get it by subtracting total expenses from total income/revenue. If you want to remain financially secure, you should try to keep your net income positive. Similarly, you can handle any uncertainty in future if your net income is saved. However, if your net income becomes negative your chances of going into debt are high. Therefore, in case of a negative, you can go for other options.

Adjust your Expenses

The negative income means that you are spending more than your earning. This is a situation where you should adjust your household expenses. If you will not follow, you will feel yourself in trouble. One of the major areas you will look at is variable expenses. You can therefore decide to cut down your expenses on phone calls, hobbies, entertainment and other non-essential expenses. You should look at the basics and give them your priority.

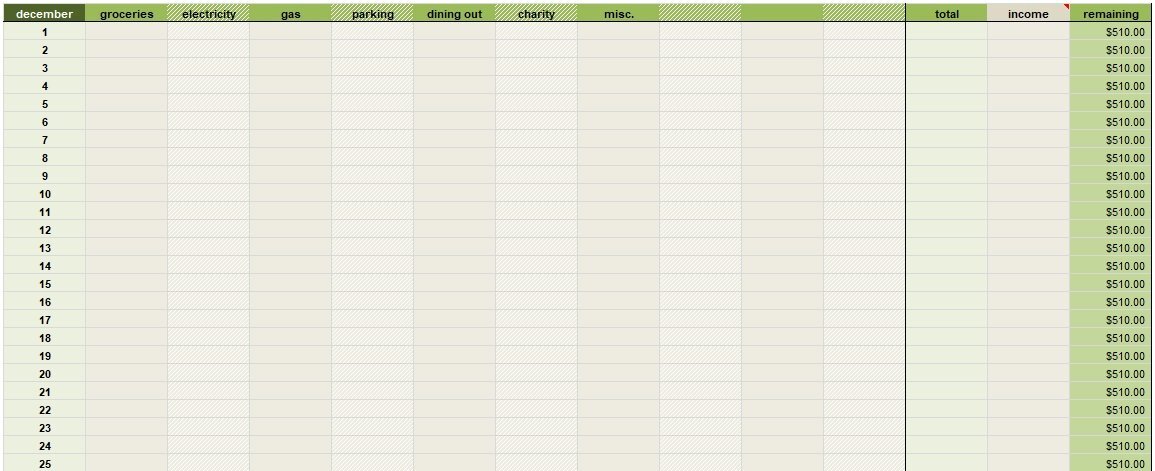

Monitor Your Spending

The other thing you need to check is your household habits against your actual budget. One importance of tracking your expenditure is it should prevent you from overspending. Moreover, when you will cross the limit, your budget will remind you to remain within your limits. On the other side, if you have budget control, it will help you during your urgency and you can compensate that money in the long run.

For example, you can knock into a chain store and realize they have great offers for household items. Like you are planning to purchase a freezer in the future, and you can see the chance too good to be ignored. In such situations, you purchase the freezer and compensate for it by forgoing your planned vacations or cancelling your gym membership. To sum up, it will help you to check your spendings and cut down your non-essential expenses.

Free Household Budget Templates and Worksheets

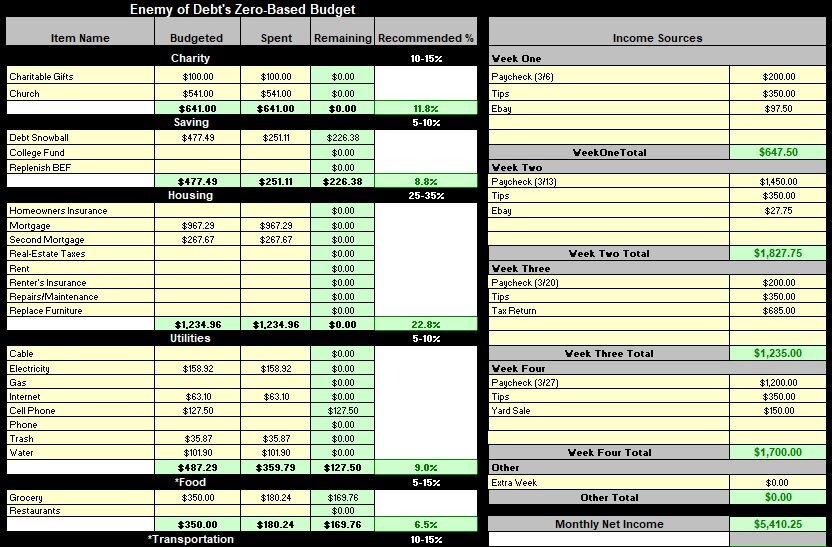

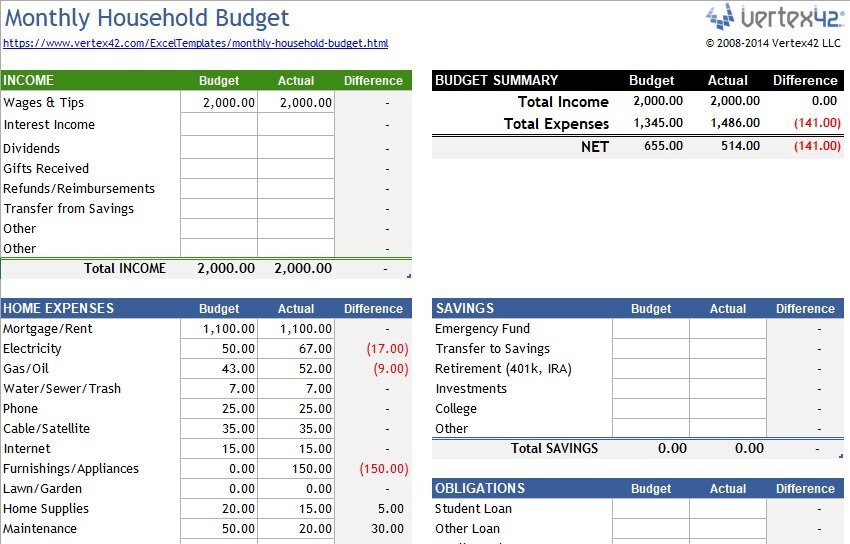

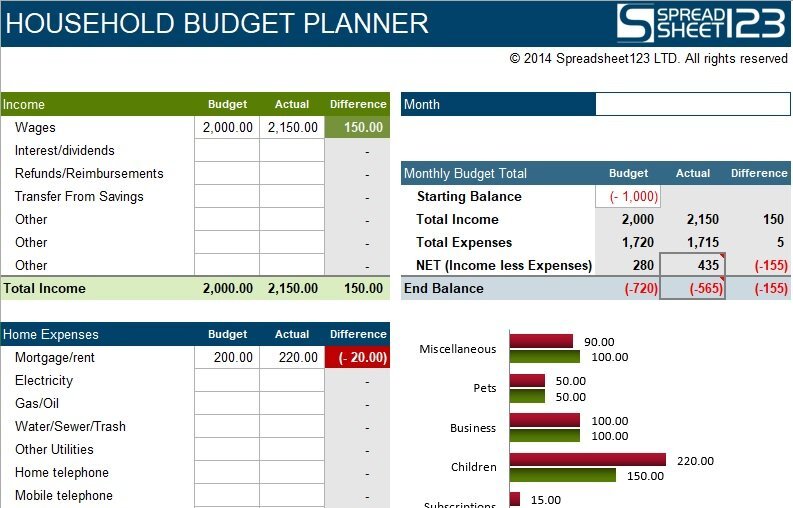

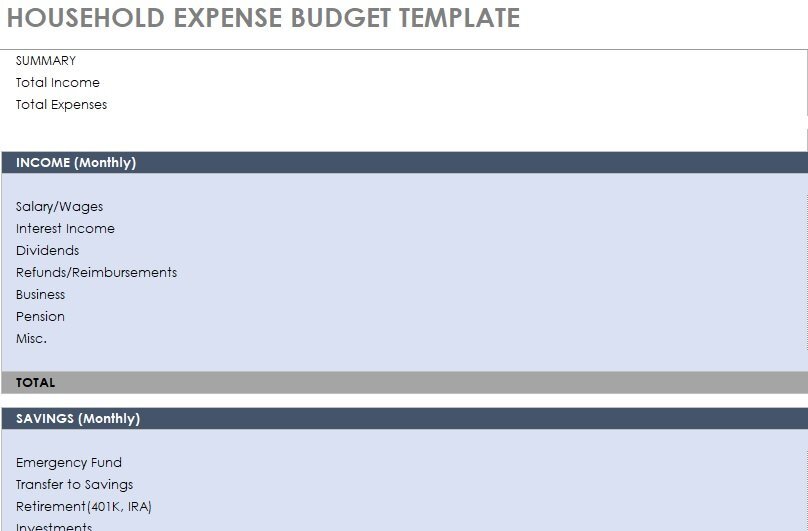

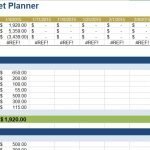

If you want an easy, simple and easy to use tool to keep your household things in order, you should don’t worry anymore. The household budget templates provide you with the best solution you need. With the help of these templates, you should detail your income, total expenses, and help you calculate and adjust your budget. The target is to remain financially stable after catering to all your expenses. You should remember that no one is born with money management skills. But with the help of templates, you can perfectly work fine.

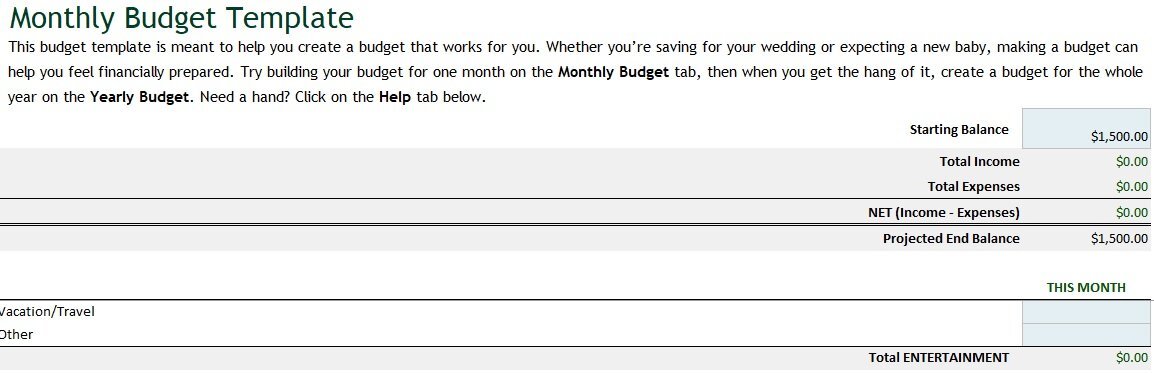

montly household budget template

household budget planner template

household expense budget template

free household budget template

household budget worksheet

household budget template excel

free household budget template 1

printable household budget template

What is the 50 20 30 Budget Rule?

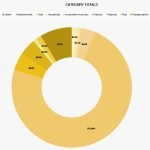

The 50-20-30 is a perfect money management technique that can divide it into three paycheck categories. When we talk about 50 % it means the essentials, 20 % for savings related and 30 % for everything else. 50 % for essentials: rent and other housing costs, groceries and gas. Therefore, for making a perfect household budget you should follow the rule that will help you to accommodate your expenses within your income and you will not face any debt.

The Federal Trade Commission’s budget plan worksheet

How it functions: The Federal Trade Commission offers a site to teach consumers about cash, including how to utilize the budget. To get everything rolling, counsel its “Make a Budget” worksheet. Further, you can download the PDF and fill in the fields. Moreover, you can see whether you’re making more than you spend or spending more than you make.

What we like: Numbers and equations can make budgeting a turnoff, however, this straightforward worksheet is the uttermost thing threatening. It’s an extraordinary leapileaping-offt on the off chance that you’ve never budgeted.

Where to get it: You can download the PDF File from the “toolbox” tab On Consumer.gov,

NerdWallet’s Budget plan worksheet

How it functions: Use this internet-based form to include your month to month pay and costs. With that data, the worksheet shows how your funds contrast and the 50/30/20 budgeting plan breakdown, which suggests that half of your pay goes toward needs, 30% toward needs and 20% toward savings and obligation reimbursement. You can likewise download these worksheets in Excel.

What we like: This exhaustive worksheet prompts you to think about a great many costs — from extra security charges to make a trip costs to Mastercard installments — so you miss nothing. You can likewise see worksheets intended for your circumstance, whether you’re an understudy, parent, property holder, senior or none of those.

Where to get it: Find it on NerdWallet, obviously: budget plan worksheet.

Microsoft Office budget plan templates

How it functions: Maintaining a bookkeeping sheet requires discipline, and making a bookkeeping sheet without any preparation takes time. Save yourself the problem of setting up lines, segments and equations by utilizing a pre-made Excel layout from Office. templates incorporate a household expense budgeting plan, holiday budgeting plan and event budgeting plan.

What we like: There’s a template for practically every budget plan circumstance, from easy to complex. Access Excel on the web and team up with others in a similar report simultaneously.

Where to get it: Visit templates.office.com and click “Budgets” to find an Excel record to download. Or then again sign in to Microsoft and alter in your work area program.

Google Drive Budgeting sheets

How it functions: Google Drive is a file storage service where clients can make, transfer and offer records. Get 15GB of stockpiling free of charge or overhaul on the off chance that that is sufficiently not. The Sheets application for Drive incorporates pre-made templates, like a yearly budget plan and month to month budgeting plan.

What we like: You can carry your budget with you by signing in to your Google Drive account from your cell phone, tablet or PC. You can likewise share admittance to a household budget plan with different individuals from your loved ones.

Where to get it: Sign in at google.com/sheets, then, at that point, peruse the format exhibition.

Conclusion

A household budget template is an ideal tool to manage your income and control your spending limits. The key requirement is to achieve your financial freedom and security in your home is making a budget. Also, it provides you with the opportunity which will help you to save your future. If you will manage your expenses according to your income, it will be made your life easy and you can utilize yours are saving money in emergencies. To conclude, it is therefore essential that you live alone, with a partner or with kids, having a household budget is necessary.

![Free Christmas Budget Templates [Excel] free christmas budget template 1](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/12/free-christmas-budget-template-1-150x150.jpg)

![Free Petty Cash Log Templates & Forms [Excel, Word, PDF] free petty cash log template 3](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/06/free-petty-cash-log-template-3-150x150.jpg)