As a business owner, you must have a framework to screen your financial standing. This incorporates observing costs, pay, planning, legitimate preparation, etc. Utilizing an operational expense spreadsheet guarantees that your business is monetarily stable and it can continue working without a hitch.

Types of spreadsheets for business expenses

You want a framework for your business to monitor the amount you’re spending – and you will help a great deal by utilizing the expense of doing a business spreadsheet. Making your report template doesn’t need to be a test of the same length as you understand what kind of a template you want:

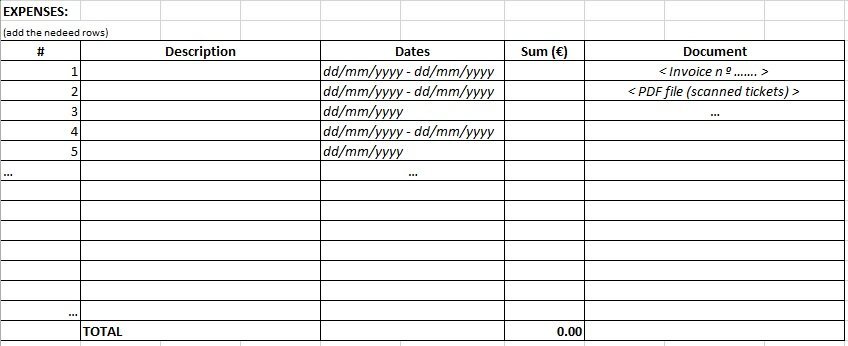

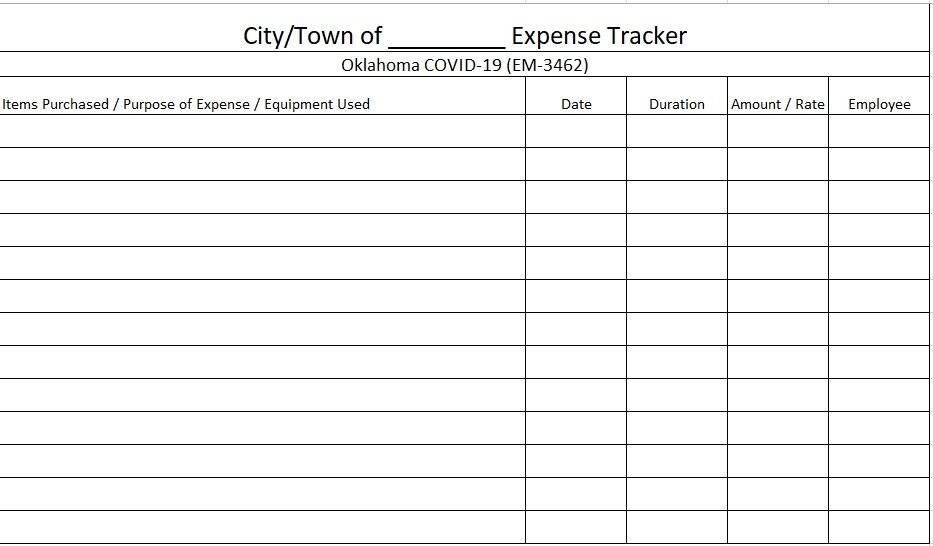

Essential Expense Format

Utilize this layout to record the payment technique, date, expense description, merchant, and sums. These are particularly fitting for new businesses and private companies since they’re extremely basic.

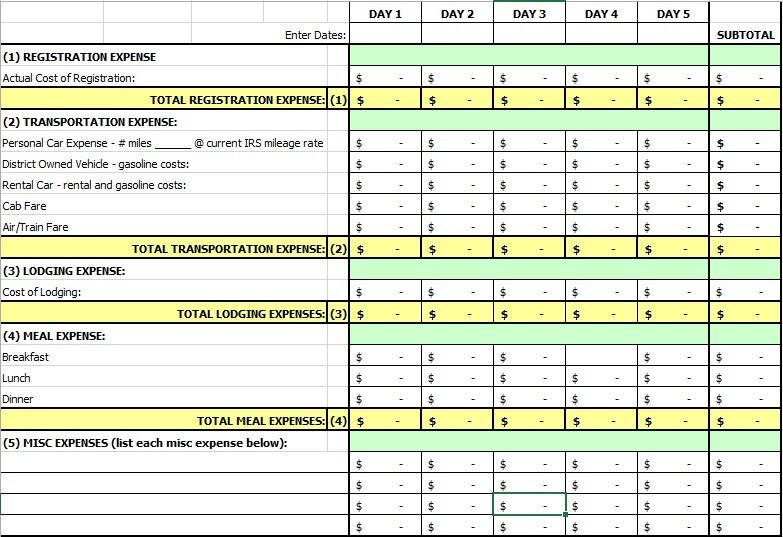

Travel Expense Format

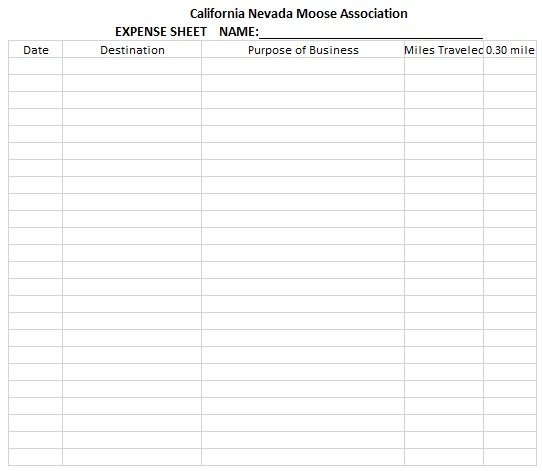

This layout is fundamentally used to coordinate charges for dinners, transportation, and inns including the mileage of the vehicle that you use.

Business Mileage Expense Format

Generally speaking, representatives utilize their vehicles for business excursions. While the facts confirm that the organization will set aside cash that it would have spent on a leased vehicle, it needs to repay the representative for the time they utilized their vehicle. Organizations can monitor this data through this layout.

Event Expense Format

Utilize this layout to follow assessed against the genuine expense for every part of an occasion. Thusly, the report acts both as a cost report and a financial plan since it gives an additional layer of information that ensures that the occasion remains focused.

Project Expense Layout

This report reports and tracks each of the inferable costs caused during a particular project. Generally speaking, the cost types and costs have been pre-endorsed by the administration to line up with financial plans and, as such improves on compromises from here on out.

Planned Discounted Reports

By and large, expense reports get documented on a yearly, quarterly or monthly or weekly premise. You might utilize at least one of these cost report templates relying upon your association’s accounting practices and payment format.

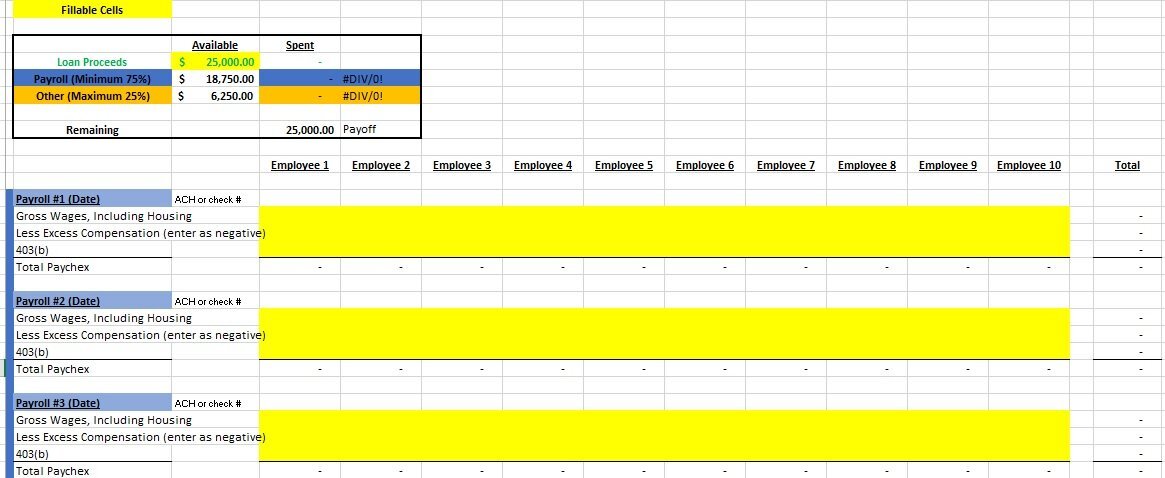

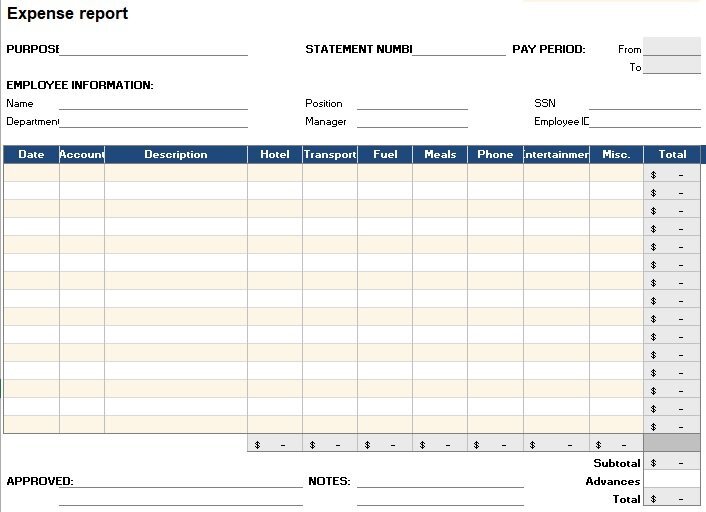

free business expense spreadsheet

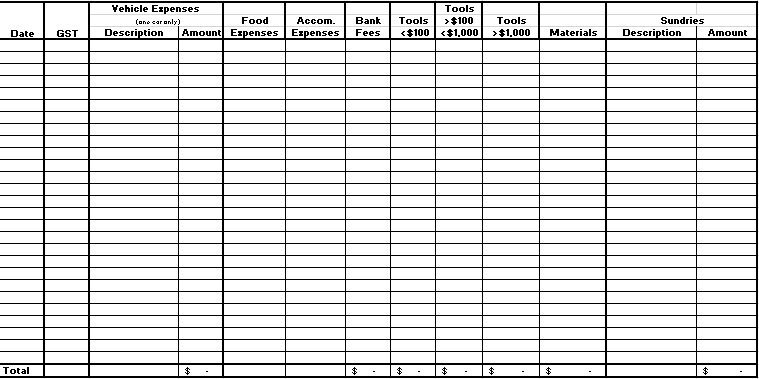

free business expense spreadsheet 1

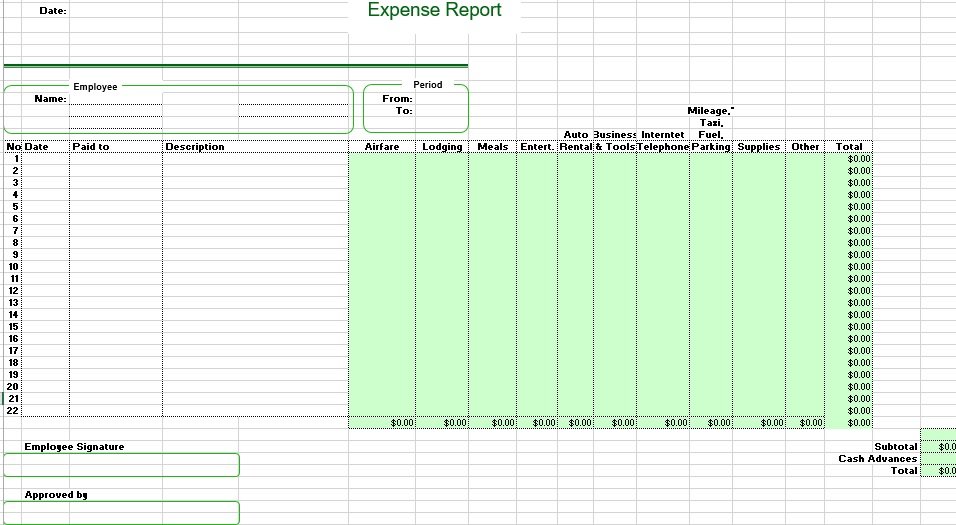

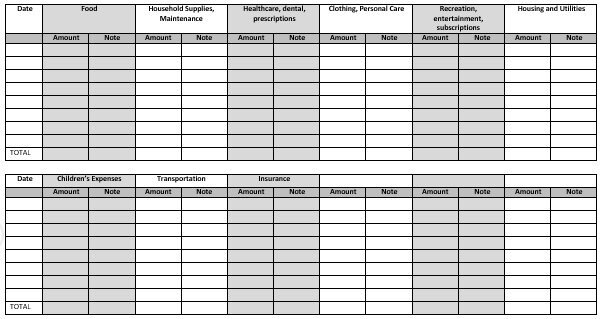

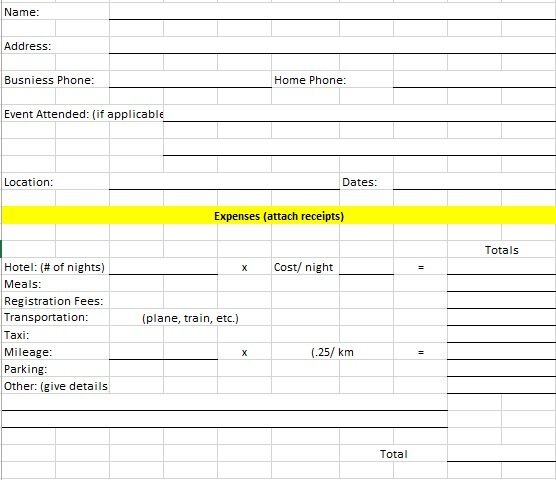

free business expense spreadsheet 2

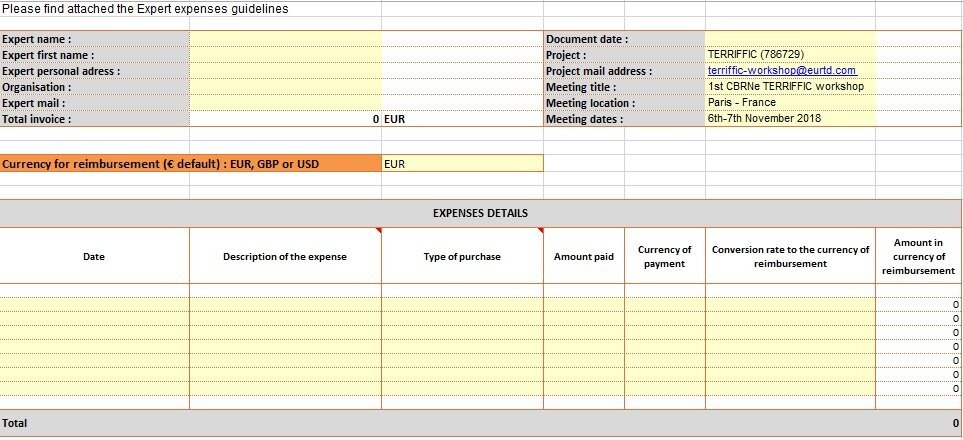

free business expense spreadsheet 3

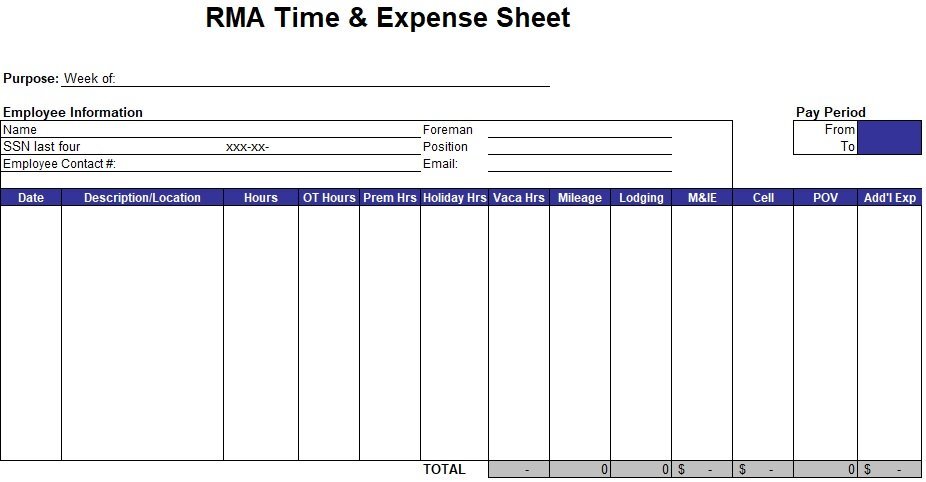

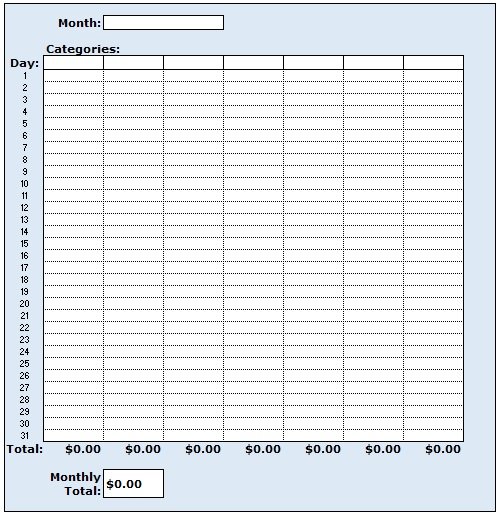

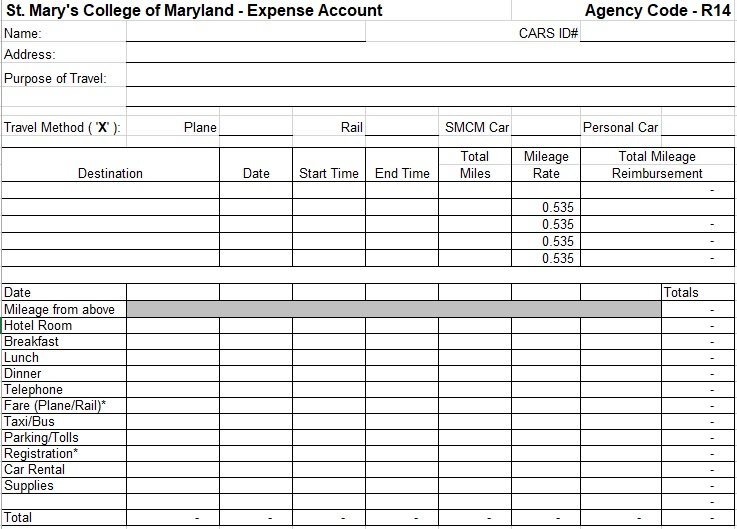

free business expense spreadsheet 4

weekly business expense spreadsheet

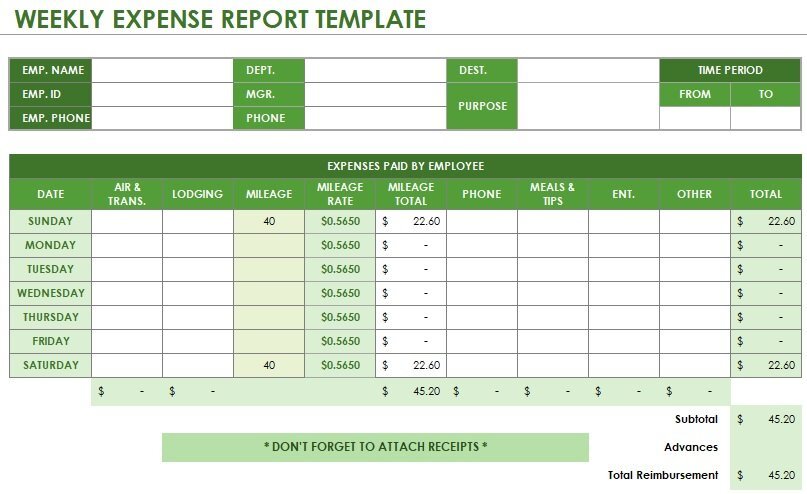

free business expense spreadsheet 5

free business expense spreadsheet 6

How do businesses keep track of expenses?

To guarantee that your business will constantly have refreshed financial data, you want to monitor your costs of doing business utilizing an operational expense spreadsheet. Doing this makes it simpler for you to guarantee charge deductible operational expenses. The accompanying advances can make your expense following more straightforward and quicker:

Separate business and individual costs

Never have a go at combining these two as one. If you keep these costs separate you will have a superior comprehension of your business costs. It likewise fills in as a confirmation that you will guarantee the specific measure of duty deductible costs come tax season. Pick your accounting technique for your business The act of most private companies while following costs is by utilizing the money accounting method where you record pay when you get it and costs while making payments. There is likewise the gathering technique which counts deals when you make them regardless of whether they haven’t gotten compensated at this point and expenses when you get a buy or a help regardless of whether these haven’t gotten paid at this point. One way or another, utilize an expense tracker template for documentation purposes.

Save your expense receipts

Ensure that you keep all receipts of any business-related buy while following operational expenses. You can improve on this cycle on the off chance that you consider utilizing one charge or Mastercard while making business-related costs.

How would you do an expense spreadsheet?

A business expense spreadsheet is a far-reaching report made consistently. It represents each of the costs your business has caused. This record just tracks the cash that you have spent. You might make your own month-to-month expenses layout by observing these rules:

Start with a blank spreadsheet

It’s prescribed, to begin with, a perfect sheet while making the report. It resembles clearing your brain so you have the choice to modify the record to fill its need.

List your expenses as a whole

Assuming your list down the expenses, it becomes more straightforward for you to make classifications or add to existing gatherings.

Sort your expenses into classifications

From the rundown you have assembled, begin arranging the working expenses into one or the other variable, intermittent or fixed consumptions.

Be just about as fair as could be expected

Never attempt to bar any purchases. Their consideration offers you the chance to make enhancements so that sometime in the not-so-distant future, you will just focus on what is important. Without trustworthiness, you won’t ever get to the next level. You ought to focus on making a cost sheet that is both successful and great. For this, you can either make it yourself or utilize a free layout that you download on the web.

How would you monitor business expenses and income in Excel?

Assuming that you’re now acquainted with Microsoft Excel, you can plan an Excel expense layout with the right recipes. This makes it more straightforward for the cost of doing a business spreadsheet to fill its need. Here are the means:

Categorizing

The classifications that you use for the sections of the accounting sheet will decide how you will separate the strategies by which your business will burn through cash. To keep away from any issues with the Interior Revenue Service, you might utilize the categories remembered for their Timetable C tax document. These incorporate categories like supplies, cost of products sold, lease, deterioration, and utilities.

Making the Spreadsheet

Any spreadsheet that can keep track of costs can likewise act as your ledger. Here are the means for this:

- Utilize the main line of the sections for the classes.

- Utilize the segments on the extreme left for the date and the sections close to those for the vendor’s name.

- Input each cost amount in the segments that compare to their class.

- Compute the aggregate total that your business has spent on every one of the classes by adding the right recipe.

- If you’re involving a transcribed diary for a similar reason, utilize a mini-computer to get the aggregate amounts.

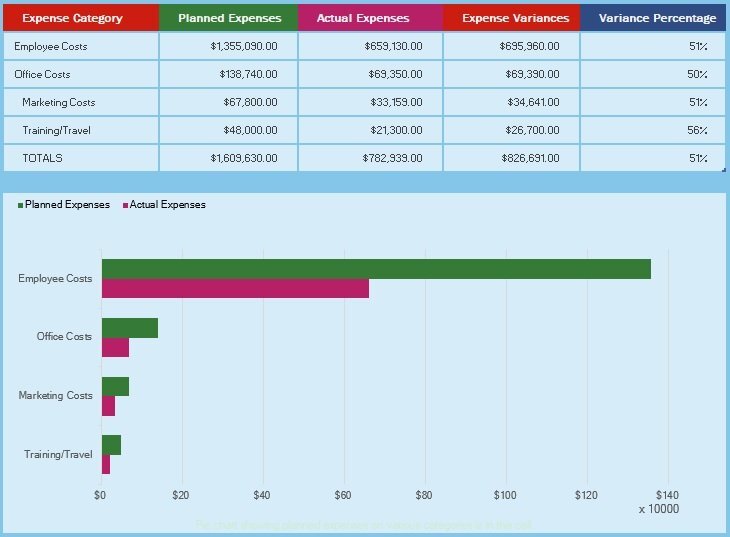

Utilizing Various Spreadsheets

You can utilize a spreadsheet to make a summary of your costs and look at the costs after some time. Numerous organizations utilize this spreadsheet for catching an outline since it empowers them to plainly and immediately perceive how their costs in every category differ over time from one month to another, and how their costs in the different classifications look at.

free business expense spreadsheet 7

free business expense spreadsheet 8

free business expense spreadsheet 9

free business expense spreadsheet 10

free business expense spreadsheet 11

free business expense spreadsheet 12

free business expense spreadsheet 13

free business expense spreadsheet 14

Conclusion:

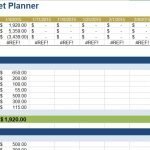

Consider actual expenses in business in contrast to your yearly plan arrangement with this business financial plan format. It includes outlines and graphs of your month-to-month differences. Business budget templates from Excel ascertain your details, making financial administration quicker and simpler than at any other time. Intended to follow costs north of a year – and complete with classes – this budget template is great for following medium and independent company budget expenses. This cost of doing a business tracker is not difficult to utilize and change for your business. This is an accessible format.

FAQS (Frequently Asked Questions)

How would I compose an expense sheet for my business?

To put it plainly, the moves toward making an expense sheet are:

- Pick a format or cost following programming.

- Alter the sections and classifications (like lease or mileage) depending on the situation.

- Add organized expenses with costs.

- Include the aggregate.

- Append or save your related receipts.

- Print or email the report.

Could I at any point utilize Excel to follow business expenses?

To follow operational expenses in Excel, you’ll have to make a spreadsheet and fill in the suitable data. The main segments are probably going to be “date,” “description,” “category,” and “sum.” You can likewise add extra sections if necessary, similar to “vehicle number” for the following vehicle expenses.

How would you keep an expense spreadsheet?

A bookkeeping sheet that monitors expenses that can act as a record. Utilize the top line of every segment for the categories you’ve characterized. Utilize the extreme left-hand section for the date, and the segment second to one side for the name of the vendor. Enter how much each expense in the segment compares to its classification.

![20+ Free Balance Sheet Templates & Samples [Excel] trial balance sheet excel](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/trial-balance-sheet-excel-150x150.jpg)