Whether you’re anticipating retirement or are now carrying on with the resigned life, making and adhering to a retirement budget plan is critical. Planning can not just let you know if you’re prepared for retirement, however, can assist you with dealing with your cash so you can live easily without hitting rock bottom financially. Follow these means to make-and change your retirement spending plan. Normal retirement costs incorporate lodging, medical services, food and transportation. Making a financial plan for retirement is a straightforward matter of social event and breaking down your fundamental and trivial costs and contrasting your spending and your pay. A little decisive reasoning and a sound portion of discipline can lighten pressure and permit you to arrive at your retirement objectives. Planning for retirement is like planning for some other phase of life. The means are something very similar, however, the pay sources and assignment of cash are unique. For instance, you may not be gathering a check any longer, yet you are likely gathering Social Security and taking circulations from your 401(k) plan, IRA, annuity or other retirement reserve funds vehicle.

Ventures for making a retirement budget plan:

- Gather every monetary record.

- Distinguish your fixed and variable costs.

- Classify your costs as fundamental or unimportant.

- List your nonrecurring costs.

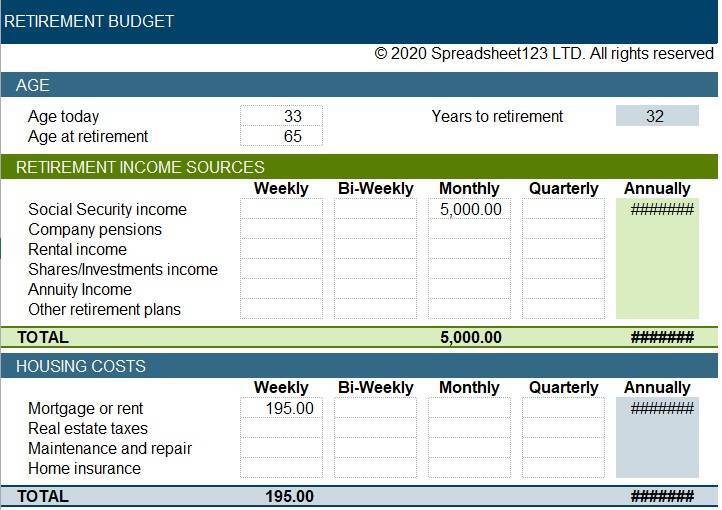

- Distinguish all wellsprings of retirement pay, including Social Security, retirement reserve funds dissemination, and annuity installments.

- Compute the proportion of crucial unnecessary costs.

- Contrast these costs with your payment.

- Decide if you want to make changes in your spending.

- Think about your objectives and optimal retirement way of life and change as needs are.

What to Consider When Budgeting for Retirement

The normal retirement financial plan depends on pay sources and cost classifications that contrast marginally from pay and costs during prior phases of life. For instance, the Center for Retirement Research at Boston College reports that “the normal family burns through 30% of its pay on cash-based clinical uses close to the furthest limit of one mate’s life, with below families spending a normal of 70%.”

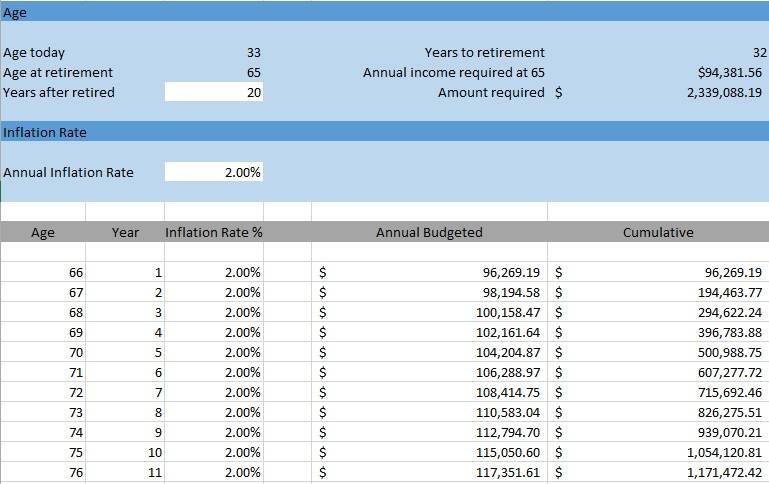

Factors that Affect Retirement Income

Monetary dangers for retired people are exacerbated by expansion, changes to Social Security and the decrease in characterized benefits plans. Anticipating retirement early can make planning at this phase of life more straightforward. Assuming you began putting something aside for retirement when you entered the labour force, or presently, your financial plan won’t feel as obliged as it could somehow or another. You should also check Bi-Weekly Budget Templates. On the off chance that, in any case, you don’t have much in reserve funds, you’re in good company. As per the Center for Retirement Research (CRR), “almost 33% of all families approaching retirement have no retirement reserve funds.” A sensible financial plan is basic for individuals without sufficient reserve funds. Begin with a total image of your assessed pay during retirement. It will undoubtedly not mirror your pre-retirement pay, so this progression is urgent to set up a dependable retirement financial plan. Represent any variables that might influence your pay, including:

- Expansion

- The pace of profit from ventures and bank accounts

- Annuity instalments

- Annuity appropriations

- Retirement date

- Age at retirement

- Charges

- Recurring, automated revenue sources, like investment property or book sovereignties

- Profit from part-time, counselling or provisional labour

Government-backed retirement benefits

When you have a smart thought of how much cash will be streaming in every month, think about your necessities and way of life objectives.

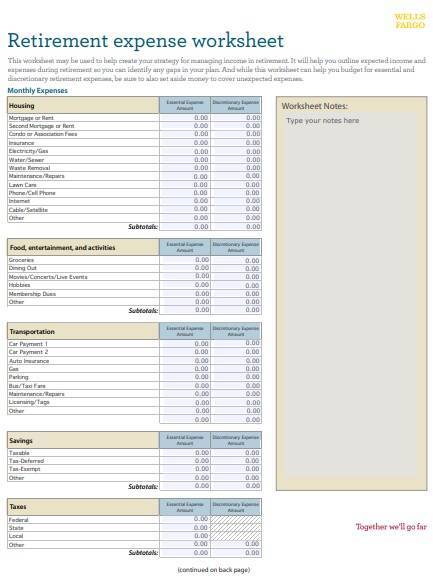

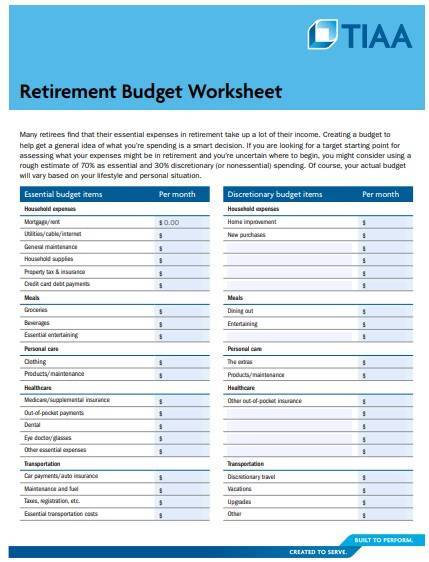

Retirement Expenses

As indicated by CRR scientists, wedded retired folks ages 53 to 64 burn through 77% of their pay on lodging, medical services, food, attire and transportation. These essential requirements represent 79% of the pay of single retired folks ages 53 to 64. Besides the fundamental fixed costs, retired people should plan and financial plan for charges, any expected estates, amusement and travel and startling costs, alluded to as “shocks,” that can’t be precisely assessed. The Bureau of Labor Statistics distributed a breakdown of costs in retirement across three age gatherings: 55-64, 65-74 and 75 and more seasoned. For each of the three age gatherings, lodging was the most elevated cost as announced by the Consumer Expenditure Survey. The examination additionally showed that medical services cost increment with age. At the point when you consolidate the medical conditions that happen normally as you age with the likelihood that your interpersonal organization will unavoidably contract over the long run, the need to financial plan for amusement ends up being more undeniable than at any other time. The National Institute on Aging has observed that social disengagement and forlornness are connected to an expanded gamble of hypertension, coronary illness, heftiness, debilitated insusceptible frameworks, tension, sadness, mental degradation and Alzheimer’s infection.

Charges and RMDs

Retired people pay charges on Social Security advantages and withdrawals from 401(k) plans and IRAs. Annuity disseminations are additionally burdened, albeit the part that is burdened relies on whether the annuity is viewed as qualified or nonqualified. At the point when you are making your retirement financial plan, ensure you consider the state and government annual expenses you will be expected to pay. Also, on the off chance that you intend to move to another state when you resign, consider the state pay and local charges, as well as deals duty and domain charges. Required least circulations are another element that can be ignored while making a financial retirement plan. You should pay charges on these IRS-ordered circulations, and neglecting to take them will bring about punishment.

Shocks and Other Considerations

Notwithstanding added monetary strain, shocks in retirement negatively affect an individual’s psychological and enthusiastic state. It tends to be hard to pursue choices when confronted with a shock like the demise of a mate, separate, an incapacity or unavoidable home fixes, so having cash saved for such an event can affect your monetary prosperity, however your passionate prosperity, as well. Planning for shocks is the same thing as having a secret stash, which most monetary specialists exhort ought to liken to 90 days’ compensation for working people. As per scientists from the Urban Institute, “more than 66% of grown-ups age 70 and more seasoned insight something like one negative shock north of a nine-year time frame.” Normal shocks among retired people include:

- Home fixes and upkeep

- Significant dental costs

- Uncommon clinical costs

- Widowhood

- Separate

- Venture misfortunes

Source: Society of Actuaries

A 2018 brief distributed by the Center for Retirement Research at Boston College inspected the capacity of the older to assimilate sharp expansions in clinical costs and a downfall in pay after the demise of a mate. The creator presumed that the “best reaction for families moving toward retirement is to build their retirement pay and decrease their decent costs.”

Higher Health Care Costs

Medical services are quite possibly the main spending changes retired people need to make. Addressing 16% of expenditure by Americans ages 65 to 74, medical services is the second greatest expense for retired people. Subsequently, the spike in clinical costs during retirement is viewed as a shock. Not many bosses offer protection inclusion for retired folks, and that implies the expense of health care coverage is for the worker upon retirement. As indicated by Medicare.gov, regardless of whether your previous boss offers medical advantages to retired people, it’s not needed and they can change or drop your inclusion whenever. Besides, Medicare doesn’t cover all well-being administrations. For instance, the program doesn’t cover most dental considerations.

Long haul Care

Long haul care doesn’t cover by Medicare, and long haul care protection can be expensive. The monetary implications for requiring long haul backing can crush. A survey alluded to in a brief from the Office of the Assistant Secretary for Planning and Evaluation uncovered that overflow drops certainly. It is for people who require nursing home thought. According to the concise, “more than nine years centre family overflow became 20% for married people. Further, ages 70 and more settled who didn’t get nursing home thought. In any case, fell 21% for their accomplices who got nursing home thought; for single people who got nursing home thought, centre family overflow fell 74%. In a perfect world, Americans ought to consider the probability of requiring long haul care before they resign because a shock of this extent is incredibly hard to survive. An annuity with a drawn-out care rider can give some security at a reasonable cost. However, whether or not you have reserve funds to cover long haul care. Further, you’ll need to fuse this into the crisis reserve funds classification of your retirement spending plan.

The Pros and Cons of Creating a Retirement Budget

Planning projects and retirement spending plan worksheets can smooth out the method involved with arranging and following costs. Some private planning programming applications currently permit you to connect to your ledgers, consequently synchronizing your exchanges. Also, many deals with monetary and planning exhortation. Be that as it may, calculating and information passage is just important for the planning system. These apparatuses are just all around as great as the data the client takes care of them. This implies you’ll need to do some decisive reasoning – and conceivably some spirit looking – before you set these devices to work.

Conclusion

The feeling of dread toward hitting a financial dead-end is a central issue among numerous retired people. The justification behind this is that many individuals don’t have the foggiest idea. They don’t know how to take advantage of their government-managed retirement advantages to cover their bills. These individuals take stress over the amount. Moreover, they will use it in their singular retirement account and subsequently the requirement for a retirement spending plan. A pre-arranged financial plan will show the amount you are procuring and the amount you are spending. The retirement budget plan will help you in making acclimations to fill in the holes. This financial plan will likewise help you in setting up a frightful astonishment, like a home or a vehicle. Moreover, surprisingly, an unforeseen doctor’s visit expense. Whenever you have a retirement financial plan, you keep away from the pressure of the unexplored world.

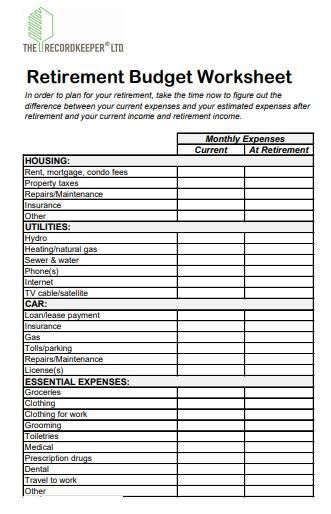

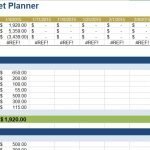

retirement expense worksheet excel

free retirement budget template

free retirement budget template 1

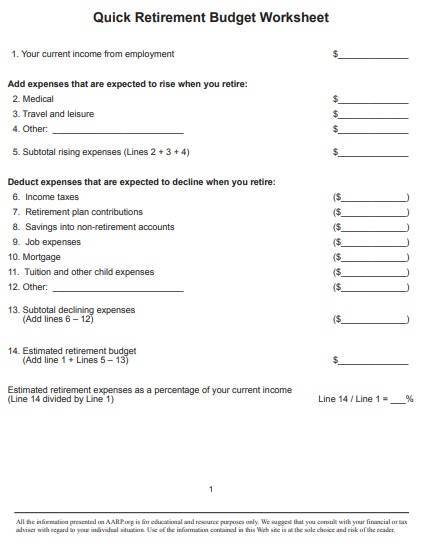

quick retirement budget worksheet

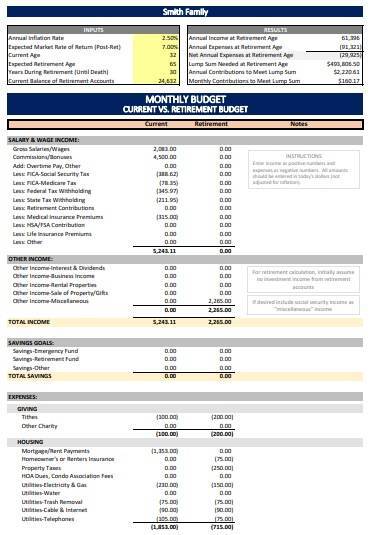

monthly retirement budget template

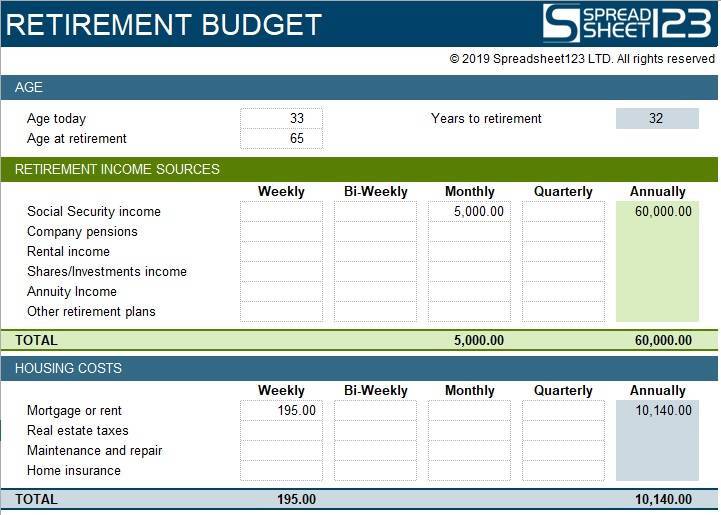

retirement budget spreadsheet

free retirement budget template 2

early retirement incentive program

retirement budget planner template

free printable retirement budget template

How would I decide on my retirement spending plan?

A decent method for starting to appraise retirement costs is to involve your ongoing month-to-month pay. As a beginning spot, and afterward, add and deduct any costs you hope to change in retirement.

How much cash do you want each month when you resign?

What amount will you want to resign at 67? Because of your projected reserve funds and target age, you could have about $1,300 each period of pay in retirement. Assuming you save this sum by age 67, you will want to burn through $2,550 each month to help your everyday costs in retirement.

What is a reasonable retirement spending plan?

“Frequently it proposes that a retired person take their pre-retirement pay and gauge 70% to 80% as a decent retirement spending plan, “Steinke says. Assuming you’re working and your compensation is $100,000 every year. As a result, you could appraise that you will require $70,000 to $80,000 every year in retirement as a beginning stage.

![Free Christmas Budget Templates [Excel] free christmas budget template 1](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/12/free-christmas-budget-template-1-150x150.jpg)