A good document retention policy template is key for keeping data safe and in line with the law. With many companies using over 130 digital apps, a solid policy is vital. It helps follow rules like the Bank Secrecy Act and the California Consumer Privacy Act. Our guide covers the basics, best practices, and what laws you need to follow.

Workers spend a lot of time finding and dealing with documents. This shows why a good policy is important for saving time and money. With data breaches costing millions, keeping data safe is crucial. Our free template helps you make a policy that fits your needs and follows the law.

Having a document retention policy helps meet legal standards and lowers the risk of data loss. Our template guides you through making a policy. It includes tips, examples, and what laws you must follow, making it easy to start.

Key Takeaways

- Implementing a document retention policy is essential for maintaining organizational efficiency and compliance with regulatory requirements.

- A well-structured document retention policy template can help organizations create a tailored policy that meets their specific needs and compliance requirements.

- Our free document retention policy template provides a comprehensive guide to creating a document retention policy, including best practices, sample documents, and compliance requirements.

- Regulatory requirements, such as the Bank Secrecy Act (BSA) and the California Consumer Privacy Act (CCPA), require organizations to limit data retention and disclose retention periods.

- Implementing a document retention policy can help organizations reduce the risk of data breaches and non-compliance, and promote efficiency and reduce costs.

Understanding Document Retention Policy Fundamentals

A document retention policy outlines how an organization handles data. It tells us what data to keep, for how long, and how to store it safely. It also explains how to delete or archive data properly. This policy is key for good data management and record keeping.

A good document retention policy should have a few important parts:

- Retention schedule: a timeline for keeping different types of documents

- Data storage: how to safely store documents, both in person and digitally

- Deletion process: how to delete or archive documents when their time is up

Having a document retention policy can save money by cutting down on storage costs. It also makes it easier to recover data. Only 20.5% of organizations meet basic records retention standards. A clear policy helps follow laws like GDPR and HIPAA.

It’s important to update and review the policy often. This keeps the organization in line with new laws and changes. By focusing on document retention, organizations can manage their data better. This leads to more agility and better user experiences.

| Benefits of Document Retention Policy | Description |

|---|---|

| Cost Savings | Reducing digital storage costs by deleting unnecessary documents |

| Improved Recovery Readiness | Ensuring that critical documents are easily accessible in case of data loss or system failure |

| Compliance | Ensuring adherence to relevant laws and regulations, such as GDPR and HIPAA |

Benefits of Implementing Structured Document Management

Using a structured document management system brings many benefits. It improves data security, cuts storage costs, and helps follow compliance rules. Studies show that 47% of workers struggle to find important documents they need for their jobs.

A good document management system solves these problems. It keeps all documents in one safe place. This lowers the chance of data loss and keeps sensitive info safe. It also saves money by storing less data in a smart way.

The main advantages of a structured document management system are:

- Improved data security and reduced risk of data breaches

- Reduced storage costs and improved cost-effectiveness

- Enhanced compliance with regulatory requirements

- Improved productivity and efficiency

- Better management of documents throughout their lifecycle

By using a structured document management system, companies can manage their documents well. This makes sure documents are safe, follow rules, and don’t cost too much. It helps companies save money, work better, and avoid legal problems.

| Benefits | Description |

|---|---|

| Improved Data Security | Reduced risk of data breaches and unauthorized access |

| Reduced Storage Costs | Minimized storage requirements and cost-effective storage solutions |

| Enhanced Compliance | Improved compliance with regulatory requirements and reduced risk of non-compliance |

Legal Requirements and Compliance Standards

Organizations must follow many rules to keep documents properly. Laws like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) are key. They help set the standards for keeping documents.

Creating a document retention policy involves looking at federal, industry, and state rules. For example, nonprofits must have a written policy, as the IRS requires. State laws also differ, affecting what and how long documents must be kept.

Federal Regulations

The Sarbanes-Oxley Act has rules for document retention that many organizations must follow. It outlines which documents to keep and for how long. For example, tax records need to be kept for at least six years after filing.

Industry-Specific Requirements

Some industries have their own rules for keeping documents. For example, those handling large funds or overseeing activities face specific rules. Also, certain corporate records, like meeting minutes and financial statements, must be kept for a set time to avoid fines.

State-Level Considerations

State laws are also important for document retention policies. Local associations offer sample policies for nonprofits. It’s vital for organizations to talk to advisors or accounting firms about IRS audits and document retention.

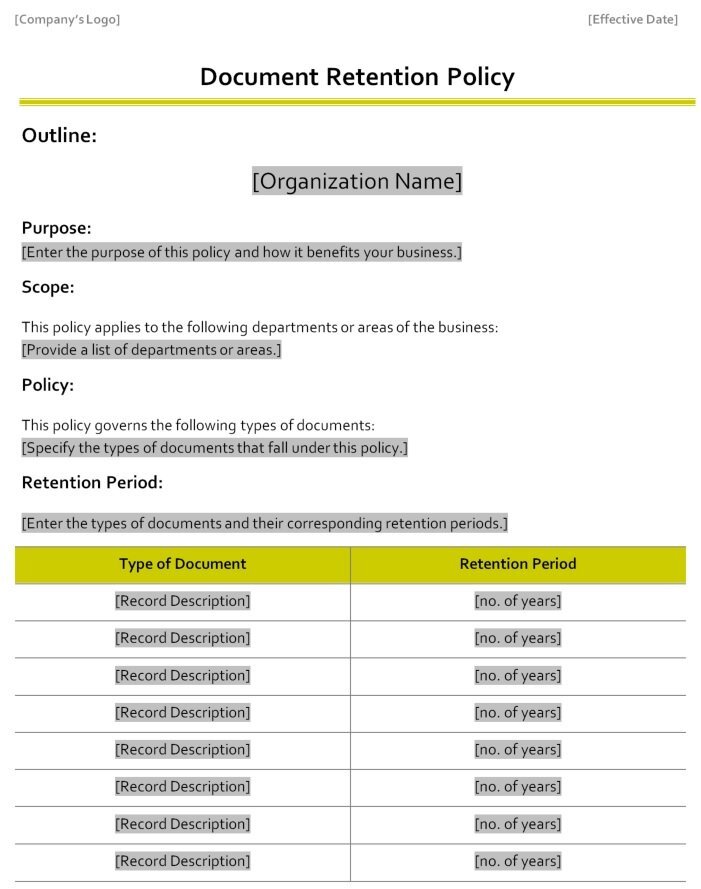

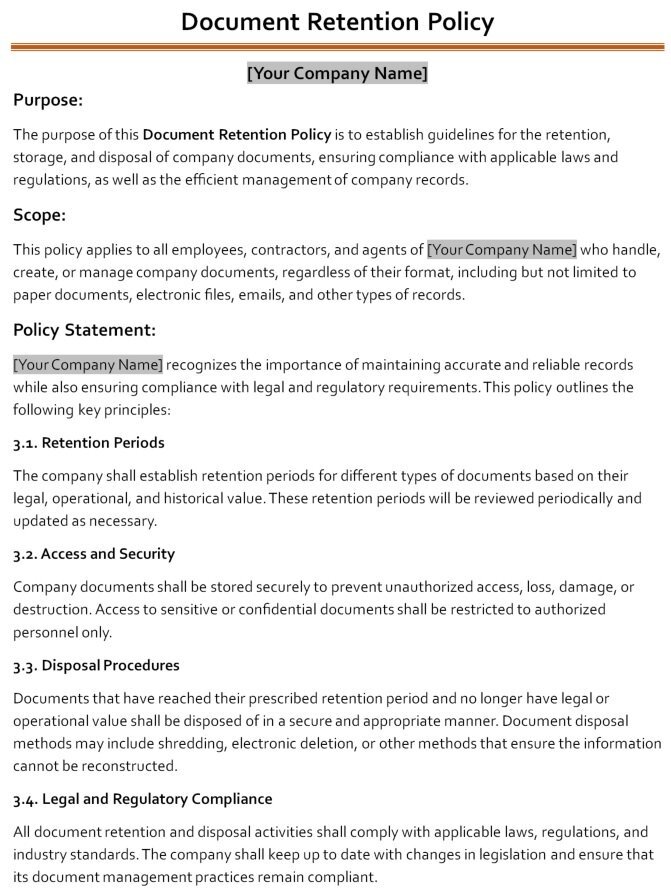

Our Free Document Retention Policy Template Overview

Our free document retention policy template helps organizations create a detailed policy. It meets their specific needs. This template offers a way to manage data securely and follow industry rules.

The template has features like data classification and storage guidelines. These can be adjusted to fit the organization’s needs. It helps set clear data retention periods and categories. This makes data management easier and lowers risks from legal issues and security breaches.

Our template lets organizations customize the policy to fit their needs. You can change it to follow specific rules, like GDPR and HIPAA. It also ensures you follow state and federal laws.

Using our free template can make data management simpler. It can lower storage costs and reduce the chance of data breaches. The template is easy to download and use. It’s a simple way for organizations to create a detailed document retention policy.

Essential Elements of the Template Structure

The template structure is key in a document retention policy. It outlines how to manage and store documents. A good template should have data classification, retention periods, and storage rules. This ensures data is kept safe and follows the law.

Experts say a data retention policy should cover data classification, retention periods, and storage rules. For instance, Wikipedia keeps nonpublic info for up to 90 days. But, it keeps non-personal info forever.

Here are important parts to think about for a template structure:

- Data classification: This means sorting documents by how sensitive and important they are.

- Retention periods: This is how long to keep documents, which changes based on the document type and needs.

- Storage guidelines: This explains how to store and manage documents, like using secure servers and backups.

By adding these key elements to the template structure, companies can make sure their document retention policy works well. This helps avoid legal problems and improves how documents are managed and stored.

| Document Type | Retention Period |

|---|---|

| I-9 Forms | 3 years after hiring or 1 year after separation |

| W-2 and W-4 Forms | As long as the document is in effect plus an additional 4 years |

| Corporate Records | Permanently |

Customizing the Document Retention Policy Template for Your Needs

Every day, organizations create huge amounts of data. On average, they make about 2.5 quintillion bytes of data. To handle this data well, having a document retention policy is key. You can make this policy fit your organization by using customization options.

It’s important to make the policy fit your industry and size. This ensures you follow rules like HIPAA. Not following these rules can cost you a lot, from $100 to $50,000 per mistake.

Risk assessment is also vital. It helps spot and fix potential problems. This way, you can avoid data breaches and their high costs, which can be up to $3.86 million, as shown by the IBM “Cost of a Data Breach Report.”

To make the document retention policy your own, consider these steps:

- Look at industry rules and change the policy as needed

- Adjust the policy based on your organization’s size

- Do regular risk checks to find and fix problems

By tailoring the document retention policy, you can make sure it fits your needs. This helps avoid legal issues and big fines.

| Organization Size | Customization Options | Risk Assessment |

|---|---|---|

| Small | Industry-specific modifications | Regular audits |

| Medium | Size-based adjustments | Vulnerability assessments |

| Large | Comprehensive risk assessment | Advanced threat detection |

Best Practices for Document Classification

Document classification is key for keeping sensitive info safe. It sorts documents by content, sensitivity, and importance. This step is vital for setting data retention policies, deciding what to keep, for how long, and in what form.

Data categorization groups documents by type, like financial or medical records. Sensitivity labeling spots sensitive info, like personal data or confidential business info.

Here are some top tips for document classification:

- Set clear rules for sorting documents

- Use standard labels and categories

- Limit access to sensitive documents

- Keep document classification policies up to date

By following these tips, companies can make their document classification system work well. This makes them safer, more transparent, and better at managing info.

| Document Type | Retention Period |

|---|---|

| Financial documents | 7 years |

| Medical records | 40 years |

| Personnel files | 4 years |

Setting Appropriate Retention Timeframes

Setting the right time to keep documents is key. You need to know the document type categories and their standard retention periods. For example, tax records should be kept for at least seven years after filing. Employment and personnel records are kept for the time you worked plus seven more years.

When deciding how long to keep a document, think about its type and how sensitive it is. Some documents, like meeting minutes and press releases, should be kept forever. Others, like marketing materials, might only need to be kept for a few years. Always check the laws and industry rules for your field to set the right standard retention periods.

Here are some examples of document type categories and how long to keep them:

- Tax records: 7 years

- Employment and personnel records: duration of employment + 7 years

- Meeting minutes: permanent retention

- Press releases: permanent retention

- Marketing and sales documents: 3 years

To learn more about keeping documents, check out this resource. It talks about the role of retention timeframes and standard retention periods in a good document management system.

| Document Type | Retention Period |

|---|---|

| Tax Records | 7 years |

| Employment and Personnel Records | duration of employment + 7 years |

| Meeting Minutes | permanent retention |

Implementation Strategies and Timeline

Creating a document retention policy needs careful planning and stakeholder involvement. You must decide which documents to keep, for how long, and how to store and dispose of them. A detailed timeline is key to a successful policy.

It’s important to know who does what in the policy. This means training employees on the policy’s importance and how to handle sensitive info. Also, regular checks and updates are vital to keep the policy on track.

Some top tips for a document retention policy include:

* Having a central place for documents

* Making a clear retention schedule

* Keeping employees informed with regular training

* Doing audits and checks to make sure the policy is followed

* Updating the policy often to keep it useful and up-to-date

By using these implementation strategies and setting a clear timeline, companies can make sure their policy works well. Stakeholder involvement is key, and keeping an eye on things and making changes as needed is important.

| Document Type | Retention Period |

|---|---|

| Financial Records | 7 years |

| Personnel Records | 3 years after employment ends |

| Legal Records | Permanent or as determined by legal counsel |

Digital vs. Physical Document Considerations

Organizations face a choice between digital and physical document storage. Digital storage is safer and cheaper, but physical storage is needed for some documents. This includes original contracts and sensitive financial info.

Electronic storage solutions make managing digital documents easy. They include cloud services like Google Drive and on-premise systems. It’s key to pick one that’s secure, easy to access, and can grow with your needs.

Electronic Storage Solutions

Some top electronic storage options are:

- Cloud-based services like Google Drive or Dropbox

- On-premise systems, like NAS devices

- Document management software, such as SharePoint or Documentum

Physical Storage Requirements

Physical document storage needs a secure and organized setup. This includes filing cabinets, storage rooms, or off-site facilities. It’s important to think about security, ease of access, and keeping documents in good condition.

The choice between digital and physical storage depends on your organization’s needs. By weighing the pros and cons and picking the right solutions, you can manage your documents well.

| Storage Type | Advantages | Disadvantages |

|---|---|---|

| Digital Document Storage | Improved data security, reduced storage costs, increased accessibility | Dependence on technology, potential for data breaches |

| Physical Document Storage | Tangible storage, easy to access, no dependence on technology | Space-consuming, prone to damage or loss, high storage costs |

Staff Training and Policy Communication

Effective staff training is key to making sure employees get the document retention policy. It includes awareness programs that teach the value of document management. Regular policy communication keeps employees up-to-date with policy changes.

Some important parts of staff training are:

- Compliance training to make sure employees know their duties

- Awareness programs to teach the importance of document management

- Policy updates to inform employees about policy changes

Investing in staff training and policy updates helps organizations. It makes sure employees are well-informed and follow the policy. This reduces the risk of not following the rules and helps meet legal standards.

Monitoring and Maintaining Your Document Retention System

Keeping an eye on and taking care of your document retention system is key. It helps it work well and follow the rules. You need to set up audit procedures to spot and fix any problems.

A good document retention system needs regular checks and updates. This makes sure it stays in line with new laws and safety standards. Watching user activity and limiting who can see documents helps keep things safe and in line with the law.

Here are some important things to think about for maintenance and audit procedures:

- Make sure your document retention policy is up to date with the latest laws.

- Have clear steps for keeping documents safe and getting rid of them properly.

- Do regular checks to find and fix any weak spots.

By doing these things, companies can keep their document retention system working well. It will be safe and follow the rules, lowering the chance of data leaks and fines.

| Regulation | Retention Period |

|---|---|

| Federal tax returns | At least 3 years, preferably 7 years |

| Payroll records | Minimum of 3 years |

| OSHA accident forms | 5 years after an accident occurs |

Handling Document Disposal and Destruction

Proper document disposal and document destruction are key to keeping sensitive info safe. It’s important to use secure deletion methods to block unauthorized access. When getting rid of physical papers, shredding or burning is best to destroy the data completely.

Electronic documents need secure disposal too. This can be done by wiping or degaussing, making the data ungettable. It’s also good to recycle paper and cut down on waste.

Some important things to think about for document disposal and document destruction include:

- Contracts and agreements: 7 years after they expire

- General letters: 3 years

- Business expense records: 7 years

- Payroll and state unemployment tax records: keep forever

Having a solid document disposal and document destruction plan helps protect sensitive info. It also makes sure you follow the law. This means stopping document destruction if there’s an official probe or lawsuit. You can start again once the probe or lawsuit is over.

Conclusion

A well-structured document retention policy is key for keeping your business running smoothly and following the law. It ensures your data is safe and handled correctly. This article has shown the importance of knowing the basics, following legal rules, and using a template to fit your business’s needs.

By focusing on the best practices for document retention, your business can thrive. It protects important information, reduces legal problems, and makes your operations more efficient. With the right approach, your company can lead the way in ethical data management and grow for the long term.

administrative records retention schedule of the records management guide

document retention and destruction policies for digital data

document retention and destruction policies for nonprofit organizations

document retention policy

document retention policy template

FAQ’s:

A document retention policy outlines how an organization manages its data. It tells what data to keep, for how long, and how to store it safely. It also explains how to delete or archive data properly.

A good document retention policy keeps data safe and compliant. It helps protect data, saves on storage costs, and meets legal rules.

An effective policy includes data classification, how long to keep it, and storage rules. These parts make sure data is handled and stored safely and legally.

Laws and regulations set rules for keeping data. Organizations must follow these to avoid penalties. They need to consider federal, industry, and state rules when making a policy.

The free template has data classification, retention periods, and storage rules. It helps organizations make a policy that fits their needs.

You can adjust the template for your organization. This includes making changes for your industry, size, and risk level. This way, the policy fits your organization perfectly.

Good practices for classifying documents include categorizing data, labeling it for sensitivity, and controlling access. These steps help keep sensitive information safe.

Set retention times based on document type, sensitivity, and legal rules. This makes sure data is kept only as long as needed.

To implement a policy well, involve stakeholders, train employees, and monitor the policy. This ensures everyone knows and follows the policy, keeping it effective and compliant.

Dispose of documents securely and legally. Use safe deletion methods, physical destruction, and think about the environment. This protects sensitive information.

![20+ Free Information Security Policy Templates [Word, PDF] safeguarding customer information security policy template](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/07/safeguarding-customer-information-security-policy-template-150x150.jpg)

![Free Employee Information Form Templates [Excel, Word, PDF] free employee information form 10](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/08/free-employee-information-form-10-150x150.jpg)

![Free Disciplinary Action Form Templates [Word] free disciplinary action form 5](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/08/free-disciplinary-action-form-5-150x150.jpg)