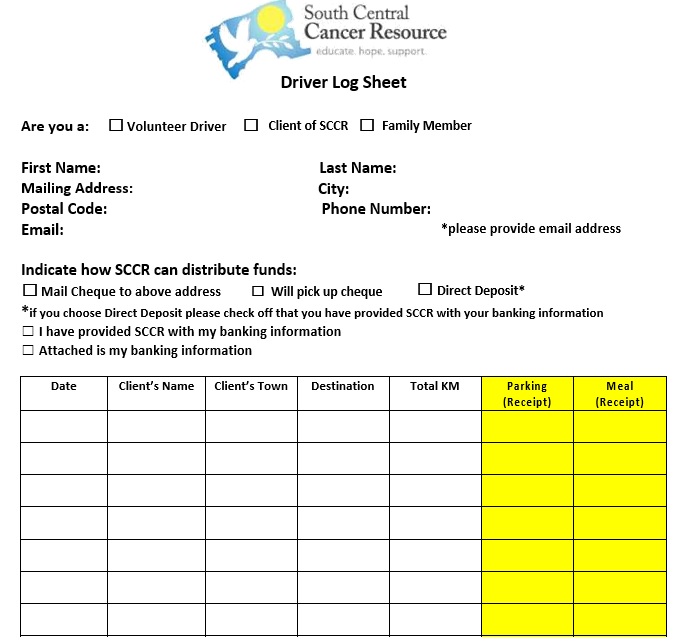

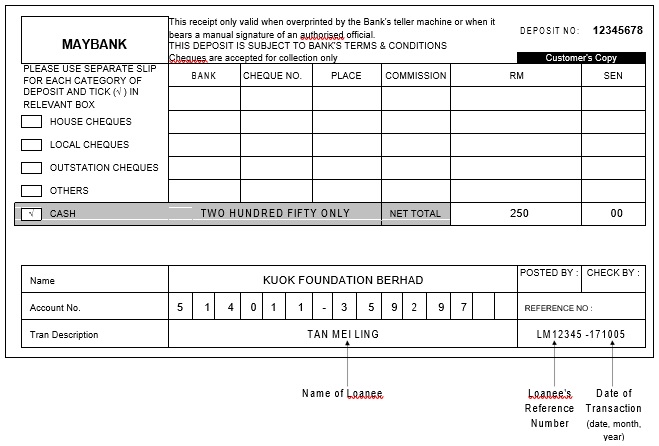

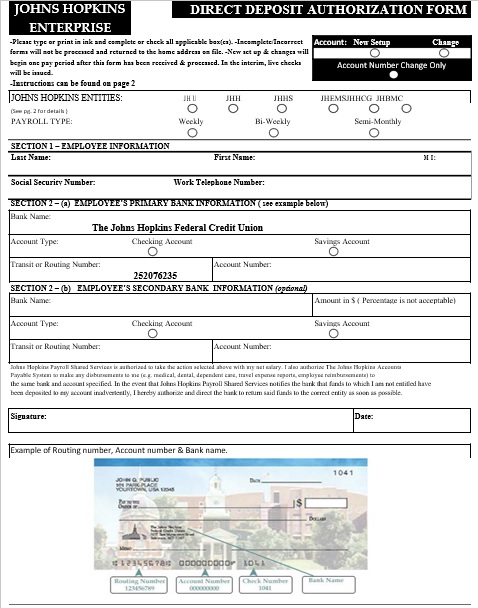

A direct deposit authorization form is a document that authorizes a third party like an employer for payment. Similarly, an employer sends the money to the bank. Further, it includes the name of the account, routing number and account number. If you ever heard about the deposit slip? It’s a process of sending money to the bank and you don’t need to waste your time. In Addition, many people are adopting such ways to have paychecks, payments and direct deposits to bank electronically. This is nowadays easy to deposit your money. Similarly, you don’t need to visit a bank. You don’t need to schedule a day for banking purposes. Further, you can do everything while sitting at home and the good thing is the same day your money will deposit in your account. Let’s explain it with the example of the process of bank deposit. For instance, you are a small business owner and you have to give payments to your suppliers and employees. Further, the easy way is to adopt a direct transfer management system. Through this way, the money will directly transfer in the suppliers’ accounts and salaries to your employees’ accounts. For this purpose, you have to fill deposit authorization form. This will authorize the bank to deposit money either from your account or to your account electronically.

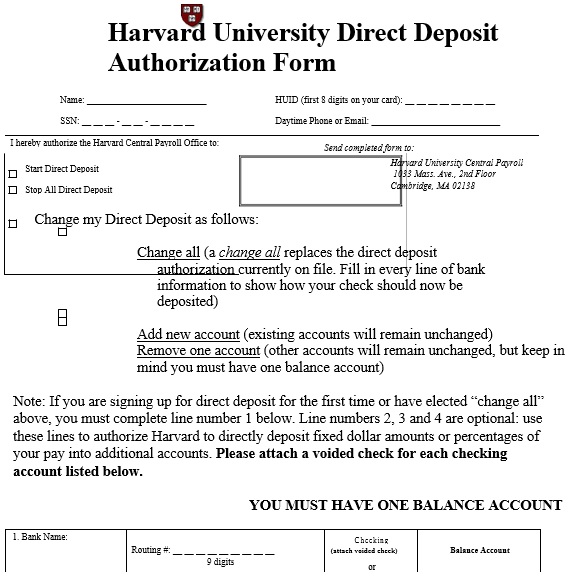

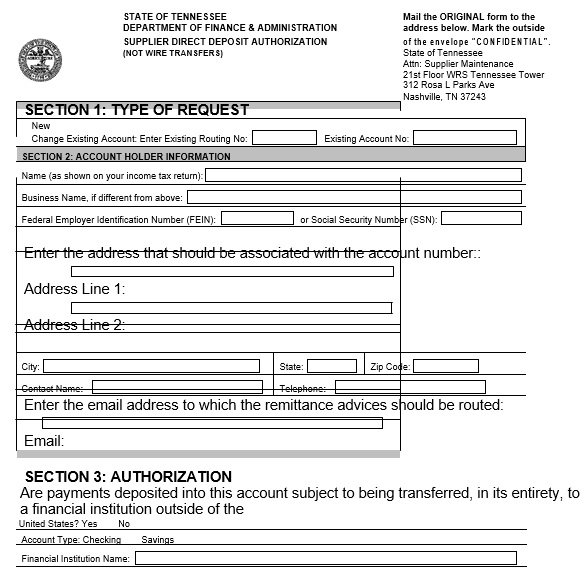

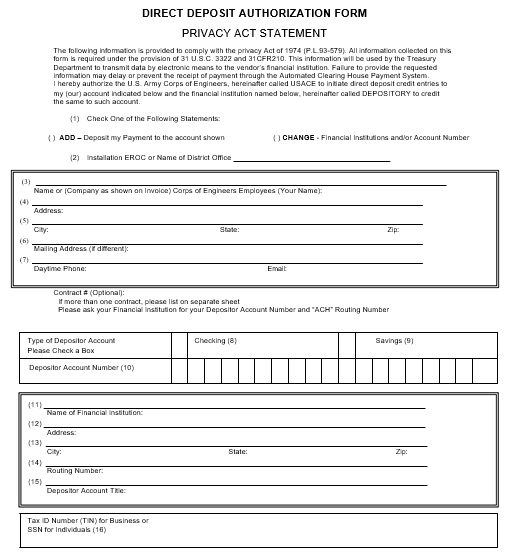

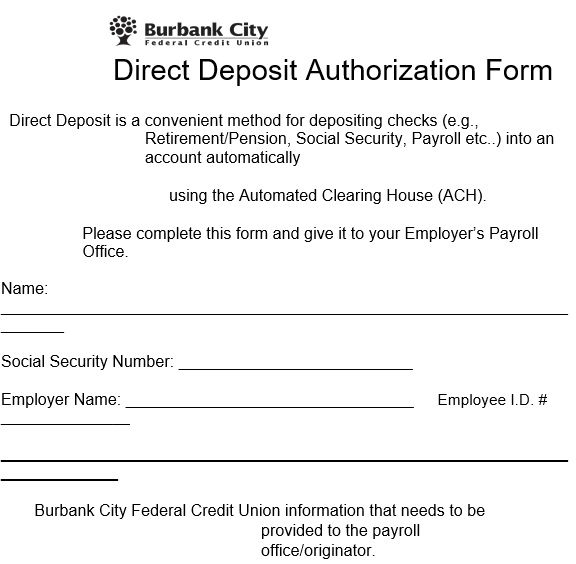

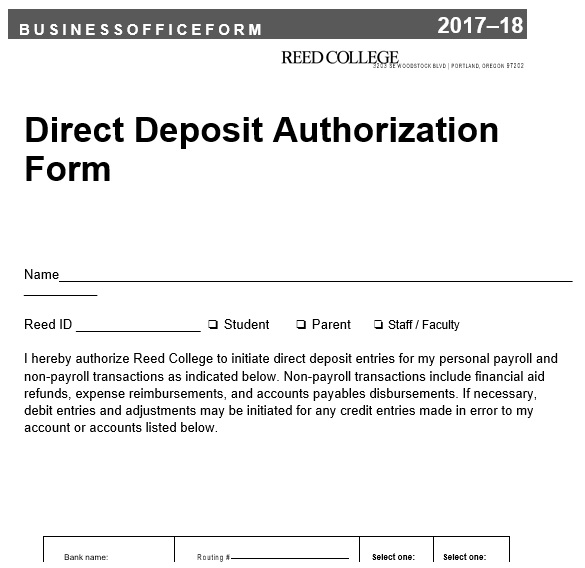

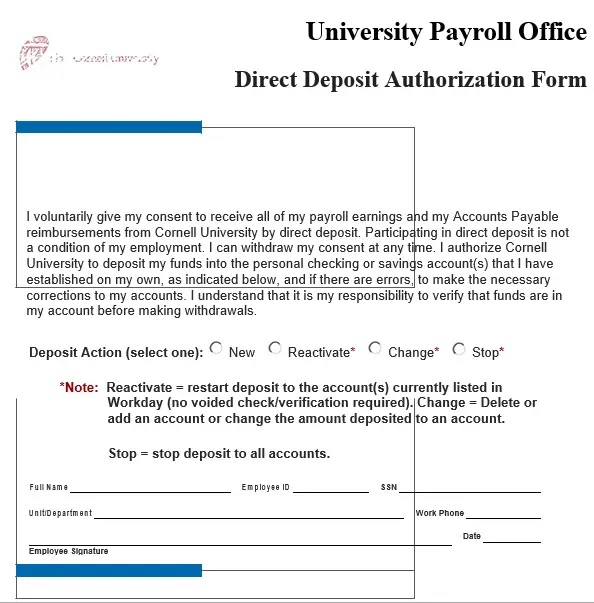

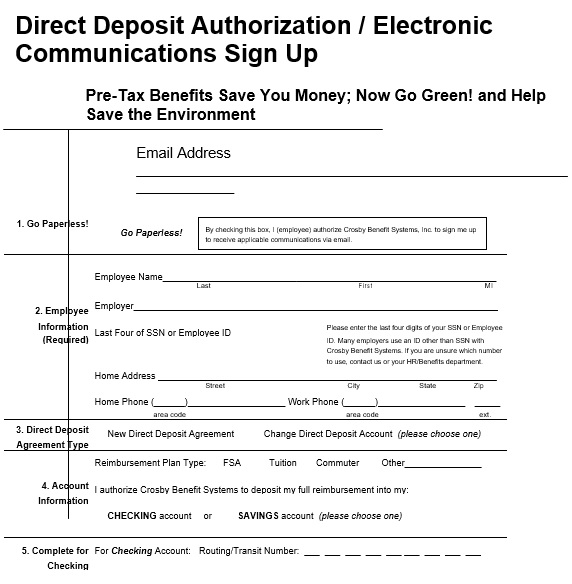

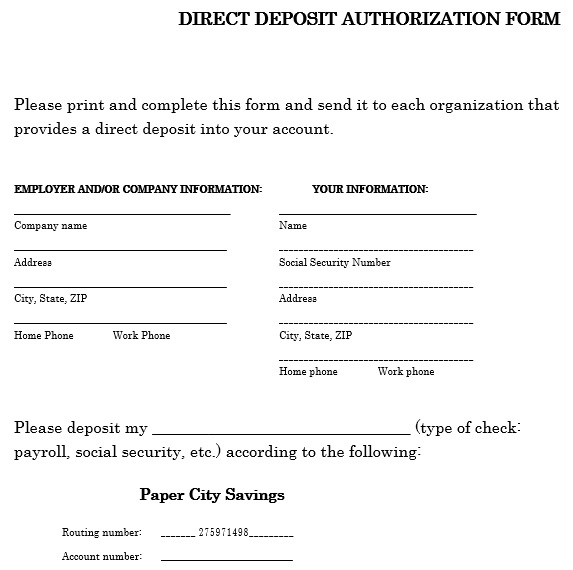

Templates for Direct Deposit Forms

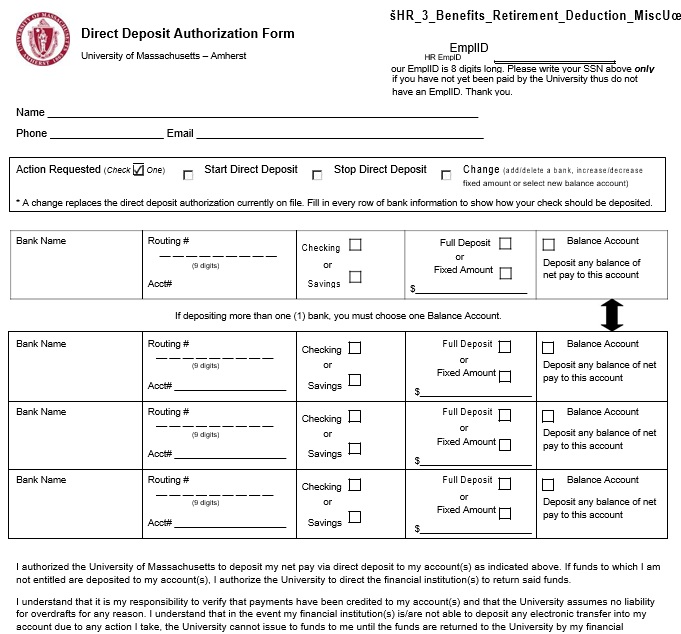

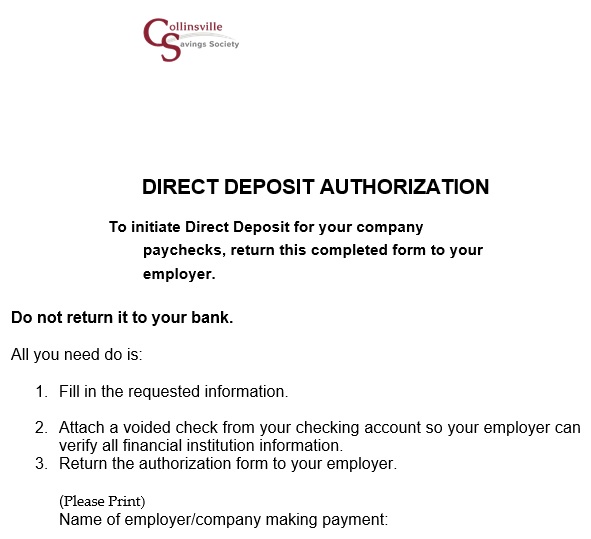

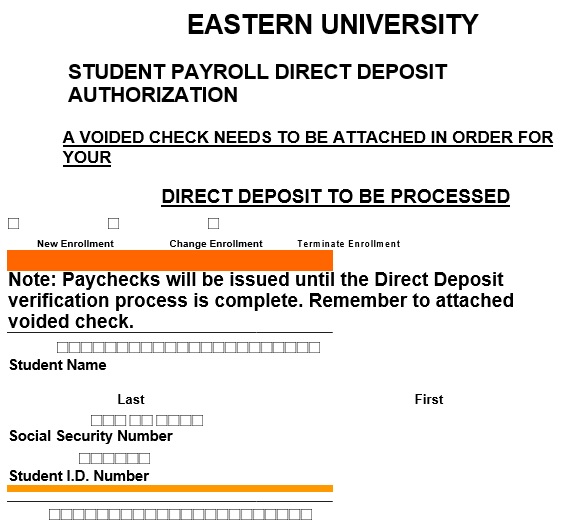

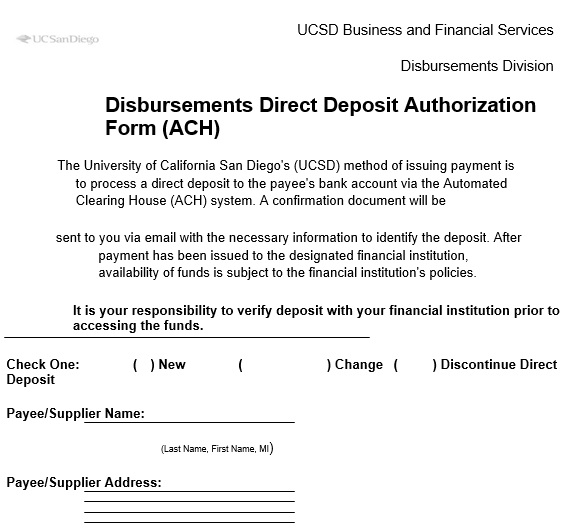

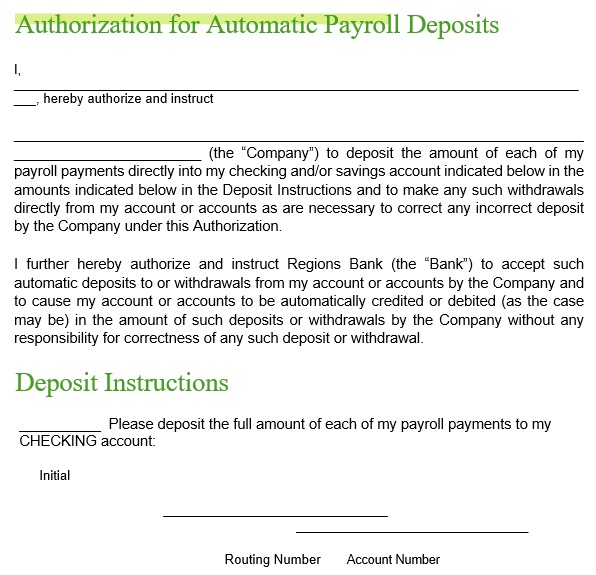

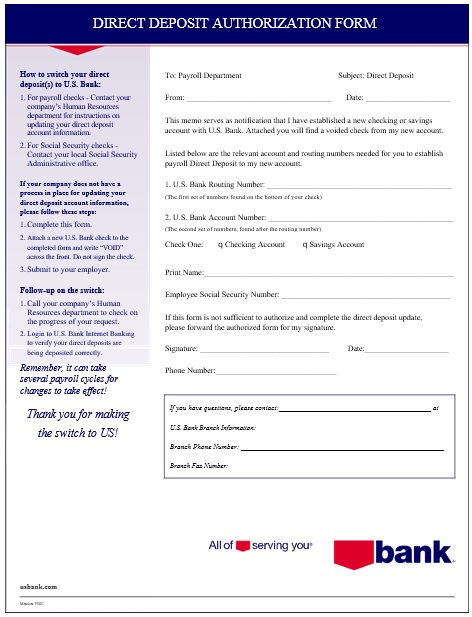

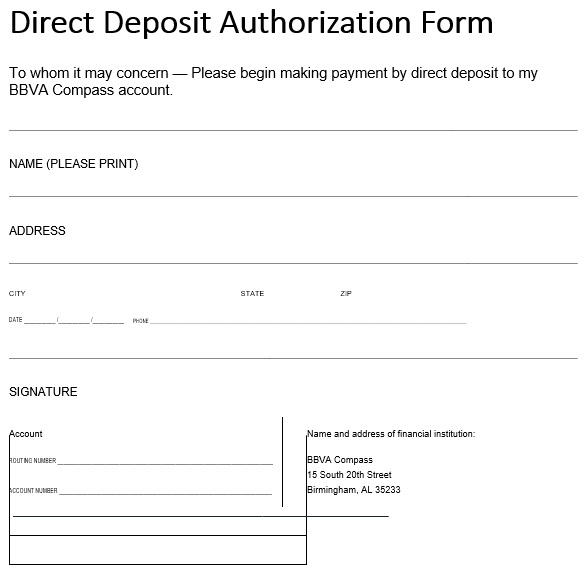

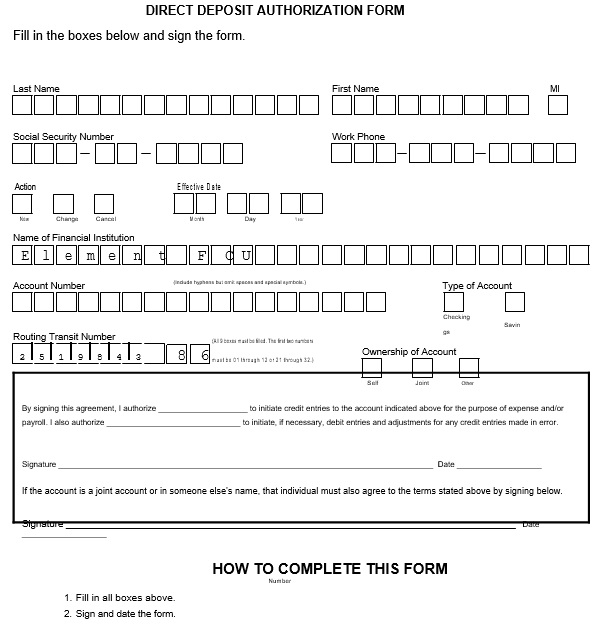

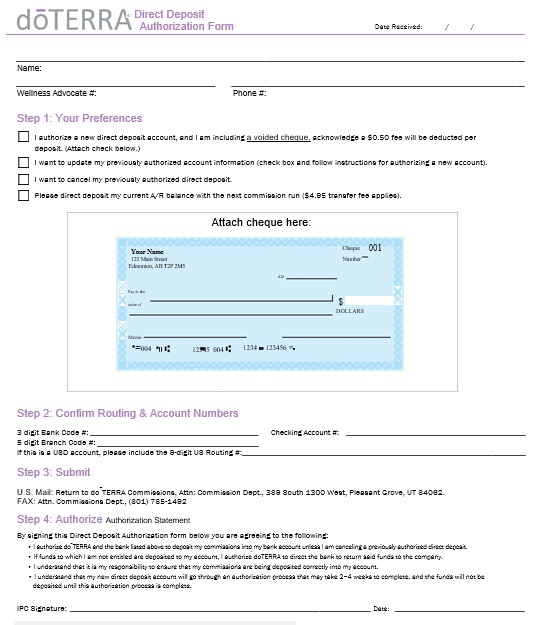

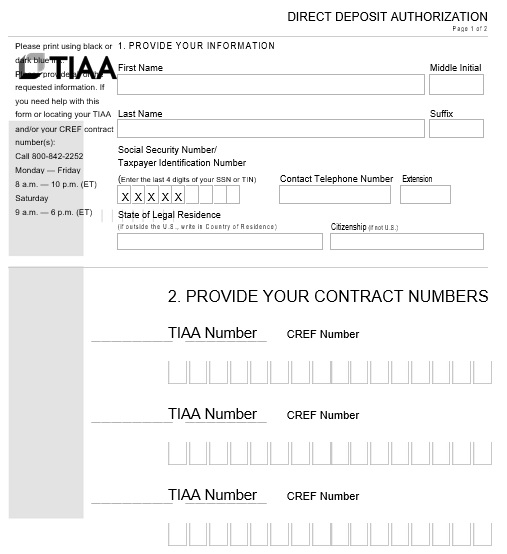

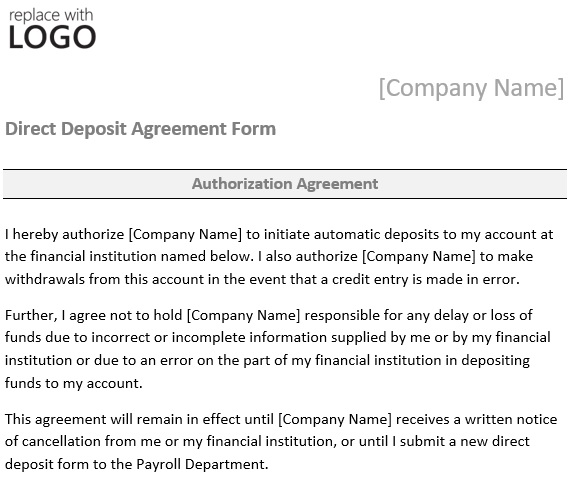

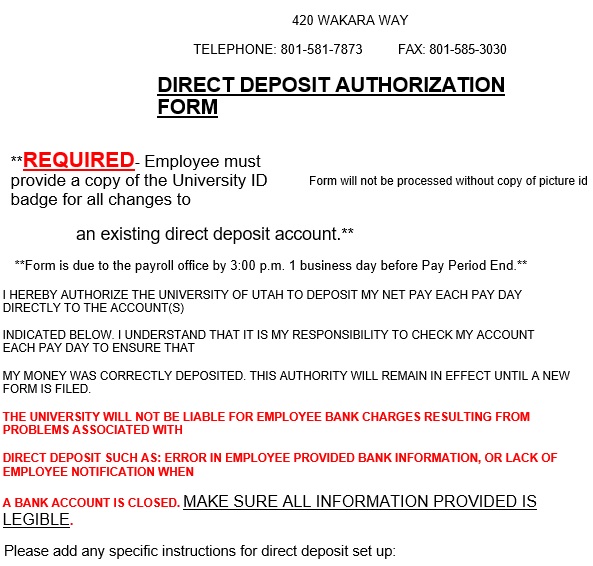

There are online templates available that are free to download. For any business owner, it’s an ideal situation to deposit form in the bank and authorize the bank to transfer money to their suppliers and employees salaries. These templates are easily available from any related website and you can customize them as per your requirements.

Step-by-step instructions to Add an Employee to Payroll

A business will require a singular’s private and banking data to add them to their payroll service. This will permit the employer to pay the employee while deducting government, State, and any nearby expenses straightforwardly from their gross pay.

Stage 1 – Employer Needs to Have an EIN

- Employer applying for EIN on IRS site

- Apply on the IRS Website

- Apply Through the Mail with Form SS-4

This is frequently alluded to as the ‘Social Security Number’ for organizations. Like a social security number, it’s nine (9) numbers although is introduced in this organization: xx-xxxxxxx. This is allowed to get for a business element that is made in any of the 50 States and territories. The IRS will pose generic questions about the situation with the substance and its capabilities and following 10-15 minutes the EIN will be given in a finished Form SS-4 toward the finish of the meeting. Assuming the candidate applies through the mail, it will take around 10-15 work days.

Stage 2 – Collect Required Government Forms from an Employee

An employee holding government-required forms The business should gather the essential government-required forms to guarantee the individual is permitted to work in the United States. These include:

- Work Eligibility (USCIS Form I-9)

- Charge Withholding (IRS Form W-4)

The previously mentioned structures are expected for the business to keep on record.

Stage 3 – Give and Collect Employer Forms

The employer in discussion with the employee The employer ought to give the accompanying forms to the employee:

- Employee Contract Agreement

- Employee Handbook

- Onboarding/New Employee Letter

- Direct Deposit Approval Form (Adobe PDF, Microsoft Word (.docx) or Open Document Text (.odt)

The employee will be required to finish and return the Direct Deposit Authorization Form for the employer to add the data to their finance and start depositing their pay into their account.

Stage 4 – Add to Payroll

Closeup of the employer including worker electronic payroll While adding an employee to an employer’s finance plan, they will be liable for saved portions and deductions. A business can decide to deduct these things all alone or choose to pay for a finance service that does this consequently. The employer will have two (2) decisions. DIY Payroll – Use a Free Online Calculator while utilizing IRS Publication 15 (look to ‘Rate Method Tables for Income Tax Withholding’ on Page 45). Payroll Providers – The most famous suppliers are Gusto, OnPay, Xero, and ADP. These suppliers permit the cycle and instalment to Federal and State charge specialists to be a lot more straightforward for the payment. If assuming the help saves sufficient opportunity to make up for the payment, this might be the best answer for a bustling business visionary that lacks the opportunity and willpower to deal with payroll manually. The allowances the business is expected to make are as per the following: Government Deductions – These incorporate Federal Income Tax (FIT), Social Security and Medicare (otherwise called FICA), State charge derivations, and any neighborhood annual duties. Other Deductions – If the employer has different derivations they should be deducted too. These incorporate, yet are not restricted to, Health Insurance, Retirement Plans (401(k)), and any derivations for Charitable Donations.

Stage 5 – File Form 941 with the IRS Every Quarter

Employer recording required structure on the web IRS Form 941 should be recorded with the Internal Revenue Service on a quarterly premise. The form details the accompanying quarterly data:

- Total number (#) of employees;

- Social Security and Medicare keeping amounts;

- Wiped out or leave pay;

- Insurance claims; and

- Some other required revenue details.

The form ought to be recorded as per the following periods:

- First Quarter – January 1 to March 30 is expected May 10;

- Second Quarter – April 1 to June 30 is expected August 10;

- Third Quarter – July 1 to September 30 is expected November 10; and

- The fourth Quarter – October 1 to December 31 is expected February 10.

As of now the bookkeeping of the business is finished with the representative effectively added to their finance framework.

How to complete a Direct Deposit Form?

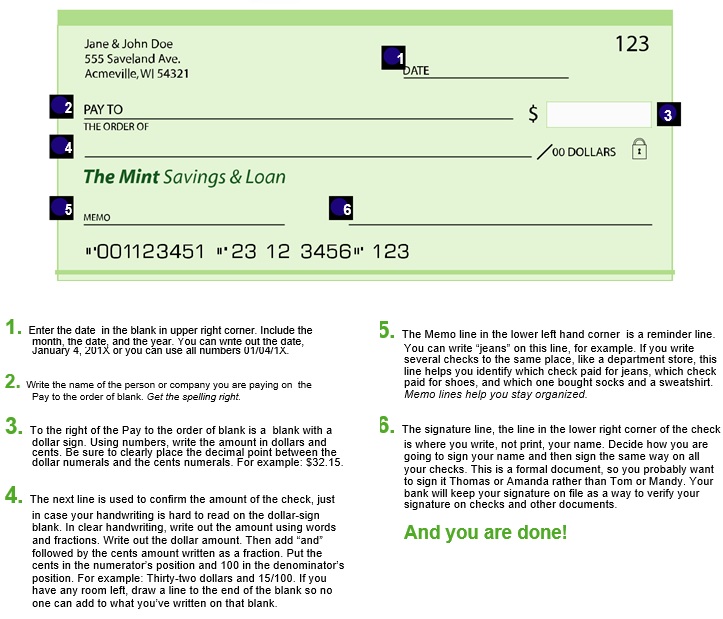

Stage 1 – Complete the Account Holder’s Name and Address. Direct-store approval form-name-address Stage 2 – You should report the Name of your Bank on the first line. Then, enter your Account Number on the suitably named blank line. At last, find the 9 Digit Routing Number on your check and enter it on the lank line marked “9-Digit Routing #.”

- Account-number

- Routing number

- Bank name

Stage 3 – Select the kind of Account you would like the store to be made to by filling in one of the actual take-a-look at boxes. You might pick “Checking” or “Reserve funds.” You should join a voided check for each Account being connected to the Direct Deposit activity. Stage 4 – On the blank line going before the words “Organization Name,” report the Name of the Company you are approving to set aside deposits to your account. Stage 5 – Sign your Name after the words “Employee’s Signature,” then, at that point, give the date you marked this on the precise line straightforwardly beneath this.

- Sum kind of account

- Organization name

- Representative mark

Stage 6 – Submit this form to your Employer’s Payroll or Human Resources Department. Ensure, you are submitting it to the appropriate office.

- Word

- ODT

- Search Documents

Do you want assistance?

Our help specialists are holding on to help you. Kindly know that our representatives are not authorized lawyers and can’t resolve legitimate inquiries. Telephone 1 (844) 533-6767 (9am to 9pm, Sat/Sun 9am to 5pm) Talk Disconnected Email Send Message Make Document Make a top-notch report online at this point!

Advantages of Direct Deposit

Let’s look at the benefits of direct deposit as compare to visit the bank for transactions. For this purpose, you have to deposit a form for direct transfer to your account. This authorizes the bank to transfer money in your account without visiting a bank for a transaction.

Quick Access for money:

When you have paychecks through direct deposit, the money goes to your account immediately. Further, when your payment is ready, it can go into your account the same day. While for those who don’t have direct paychecks, they have to wait and visit the bank to transfer their salaries in few days.

Payment Received on Holidays:

If you have a direct deposit facility, you can get your pay even on holidays. Similarly, for those who don’t have direct deposits, they visit the bank and paychecks will take days. When there is a holiday, they have to wait to transfer their salaries. The direct deposit account holder employees will get their salary directly in their account on holidays as well.

Earn Points:

Most banks give you promotions or reward points if you have a direct deposit facility. Further, your bank will provide you with points whenever you do transactions. As a result, this will give you benefit in the long run.

Maintenance is free:

Direct deposit provides you with the facility to direct handle paychecks. However, they don’t need to pay a fee for check handling. It also enhances the cash flow of banks and they will not charge any specific banking fees. Further, the monthly maintenance fee will be waived if agree to transfer your paychecks to your direct deposit account. As a result, you will be eligible for more improve interest rates.

Consider Your Savings More Often:

You can manage your money in a better way with a direct deposit. Moreover, if you set up your direct deposit in different accounts. Further, the ones you use for spending and the other for savings. Ultimately funds will transfer directly into them. You will boost your savings in no time.

Payment on time:

Similar to savings, you can set up your direct deposit so that payments are deposited from your account at the right times. Moreover, you will get a better understanding of payments and you don’t need to worry.

Better Budgeting:

With the direct deposit, you can avail a trip, car or housing as well. Al you have to do is open your account and manage part of it goes directly into your account every payday. Further, by doing this you will be able to specify the amount that goes into your spending account. As a result, you can spend less overspending on things where you don’t need.

Free and Easy:

Doing direct deposit in your account is very easy and without any hidden charges. However, the amount you receive on payday is the same amount you will receive in your account. Further, it’s easy to set up. You just need to fill direct deposit authorization form and submit it to your bank.

Environment Friendly:

Keeping direct deposits is very easy and saves a lot of bookkeeping processes for employees. Keeping checks and give to everyone is very tedious when you have a lot of workers in your company. Further, if you choose direct deposit, you eliminate the need for checks which is a saving of paper and ink. As a result, it contributes to saving the environment.

No chance of Losing Checks:

Online transactions provide you facility that you don’t need to worry about losing checks. However, there is a possibility you lose a check in the mail or it misplaces in the bank.

Avoid Delay and Increase Productivity:

You receive paychecks at the end of the day. You have to wait at the office later than they have to pay. This is frustrating and inconvenient. Further, employees can’t manage easily to go to the bank to deposit the checks and being absent for just a visit to the bank. Therefore, employees who got the direct deposit, are confident that their salaries will transfer to their account on time.

Easy to Change Banks:

If you have a direct deposit facility, it’s easy when you change your bank. Similarly, you just need to fill payroll authorization form or employee authorization form. Fill it with your new bank details and your employer reroute your paychecks to a new bank.

Effortless Access to Finances:

Through online or mobile banking you can review your payment at any time in your account. However, you just need to sign in. On the other hand, you have to fill paper payslip when you need to review your account.

Ensure Privacy:

If you have a direct deposit, no one at the workplace can access your financial information. You know that your salary with go through your employer to your bank account.

Types of Direct Authorization Forms

If you are planning to go to the bank for direct deposit or your employer is willing. You just need to know that which authorization form you need to fill. There are few common kinds for use.

Generic Direct Deposit:

This is the most common form which is used to set up your account to receive deposits or payments or easy for you to pay your monthly bills or belongings from your account.

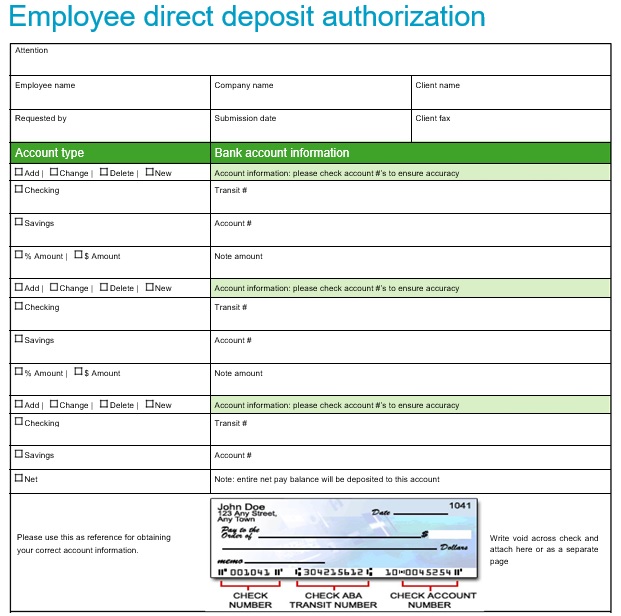

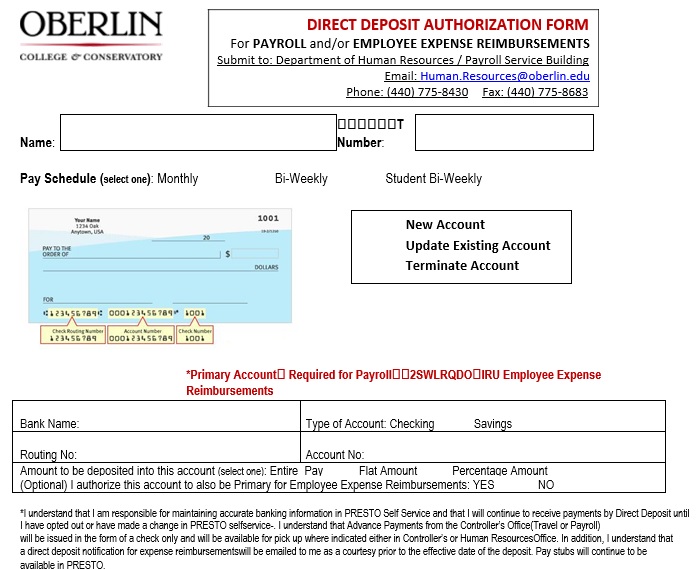

Employee Direct Deposit:

This is a form in which an employee of the company fills the form. Moreover, he authorizes an employer to directly deposit funds in his/her account and specify his/her authorization. If there are changes in the form, it’s informed to the employer so that it will update before the next payday. This form contains options of authorizing, revising, approving, and canceling direct deposit to the account.

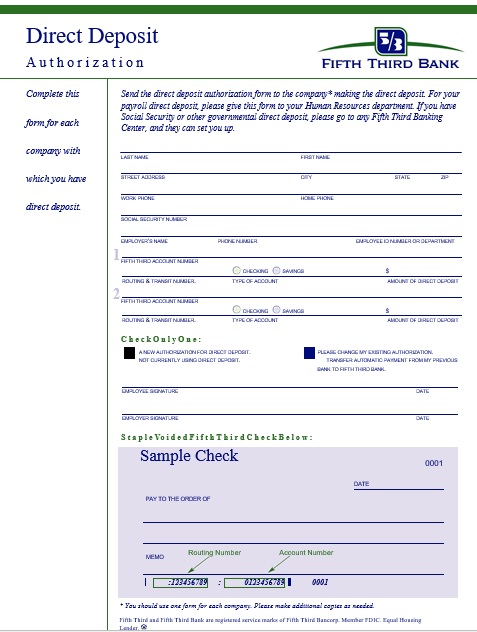

Payroll Direct Deposit Form:

This form is common to the employee direct deposit authorization form. Its common use is to deposit an employee’s paycheck directly into his/her account. The payroll department normally uses this form because they keep tracking of employees who have authorized them for direct deposit. In all different kinds of forms, this information is common that should be filled out carefully. Choices for places to deposit your money(at least 3 different places) and contain the following information.

- Name of the Bank

- Account Number

- Routing Number

- Click the boxes whether it is savings, Investment or Checking account

- The amount deposit in each account(It’s complete money or a percentage of the money in paychecks)

- Statement about supplementary document along with the authorization form.

Conclusion:

A direct deposit authorization form is a document that authorizes an employer or third party for payment. Further, through the employer money goes into employees’ accounts. You don’t need to visit a bank and the salary comes directly into your account. Moreover, through the authorization form, you authorize the bank to take care of your account. In Addition, if it’s the holidays you can get funds into your account through direct deposit. On the other hand, employees who don’t have direct deposits, need to visit the bank for their paychecks. There are a lot of authorization forms as per your requirement. You can fill direct deposit form, generic form, and direct payroll form whatever suits your needs.

![25 Printable Bank Deposit Slip Templates [Excel+Word+PDF] example of how to fill out a deposit slip](https://templatedata.b-cdn.net/wp-content/uploads/2021/04/example-of-how-to-fill-out-a-deposit-slip-150x150.jpg)

![20+ Printable Checkbook Register Templates [Excel, Word, PDF] free checkbook register template 4](https://templatedata.b-cdn.net/wp-content/uploads/2021/06/free-checkbook-register-template-4-150x150.jpg)

![Free Employee Information Form Templates [Excel, Word, PDF] free employee information form 10](https://templatedata.b-cdn.net/wp-content/uploads/2021/08/free-employee-information-form-10-150x150.jpg)

![Free Bank Statement Templates [Editable] printable bank statement template 5](https://templatedata.b-cdn.net/wp-content/uploads/2021/09/printable-bank-statement-template-5-150x150.jpg)

![Professional Behalf Authorization Letter Templates [Word] authorization letter to get documents on my behalf](https://templatedata.b-cdn.net/wp-content/uploads/2021/12/authorization-letter-to-get-documents-on-my-behalf-150x150.jpg)

![Fillable Blank Check Template Free [Word, PDF] blank check template 5](https://templatedata.b-cdn.net/wp-content/uploads/2021/04/blank-check-template-5-150x150.jpg)