A credit application form is a standard form used by financial institutions, such as banks and lenders, to determine if a borrower should be given a loan or credit line. Similarly, business owners make money by selling goods or services to other businesses. Moreover, it will most likely want to reward good customers and make ordering easier for them by extending credit. Businesses tend to spend more when they have access to a line of credit. A credit plan for your customers makes sense if you want to expand your business and increase your sales. Customers will be able to purchase products or services today and pay for them later. To achieve this, you will need to add an application form to your toolbox of business templates. As a business that works with consumers, extending credit is still an option. Moreover, to make a credit decision, you’ll need to use a credit application and credit check since extending credit directly to consumers carries a greater risk. To compensate for the higher risk, small retailers charge higher interest rates. You may not want to extend credit to your customers if they mostly make small purchases. However, if you’re a private caterer who helps affluent people plan their parties, you may be able to extend credit to grow your business. As a result, you can secure the credit you extend by ensuring your customers have a track record of repaying their debts using a credit application form.

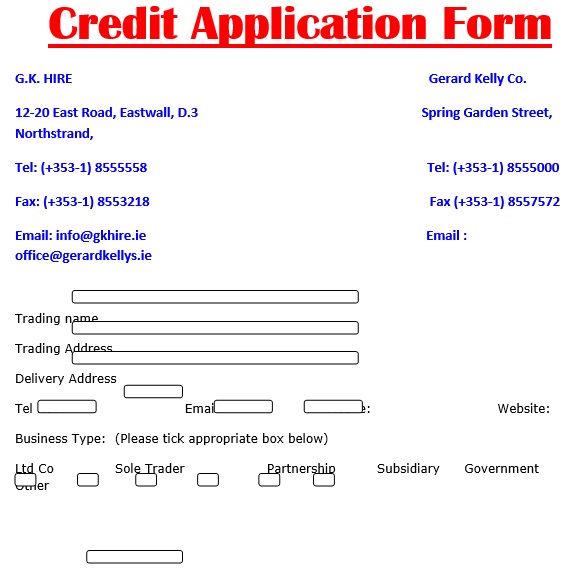

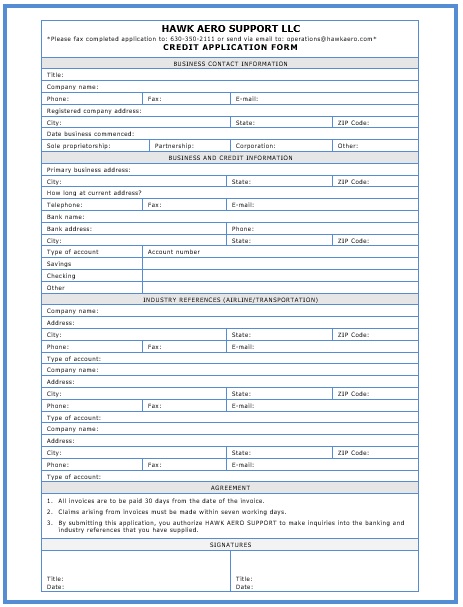

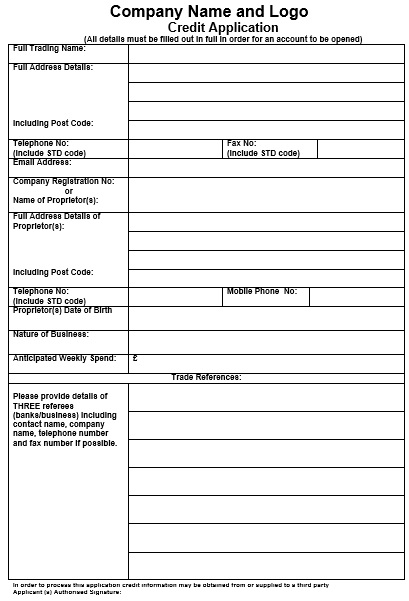

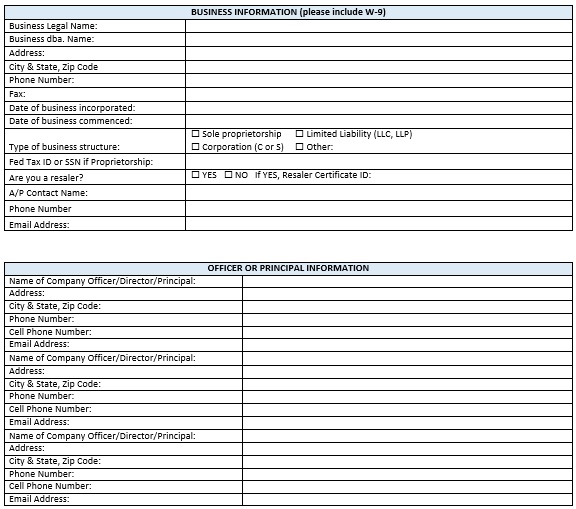

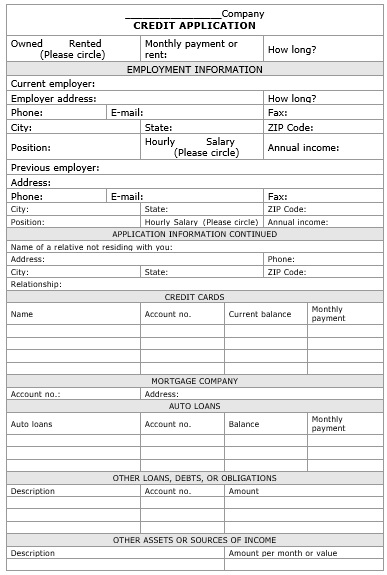

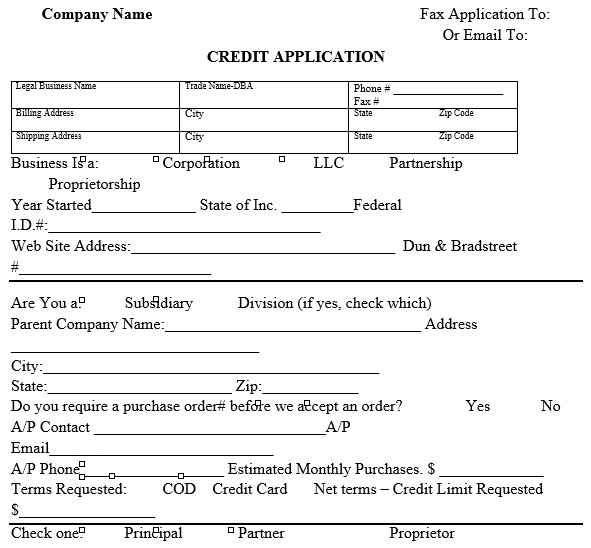

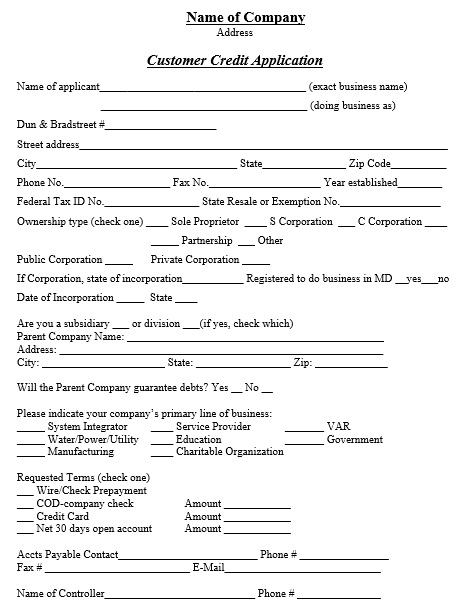

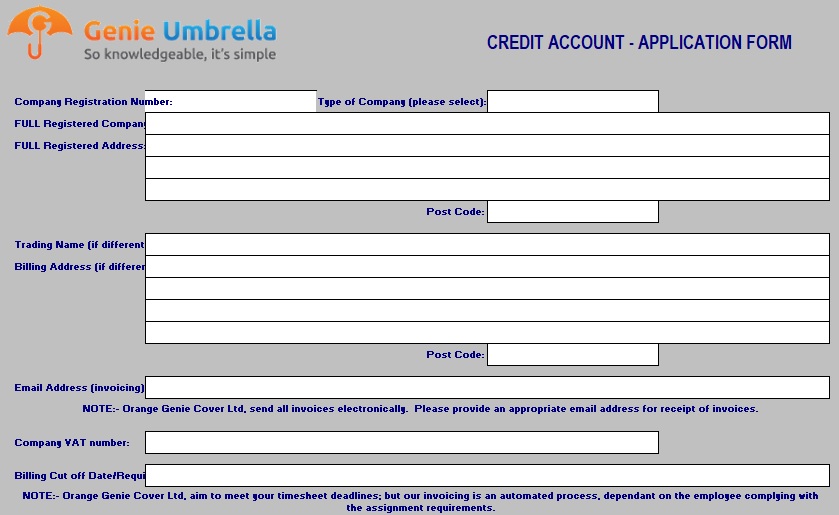

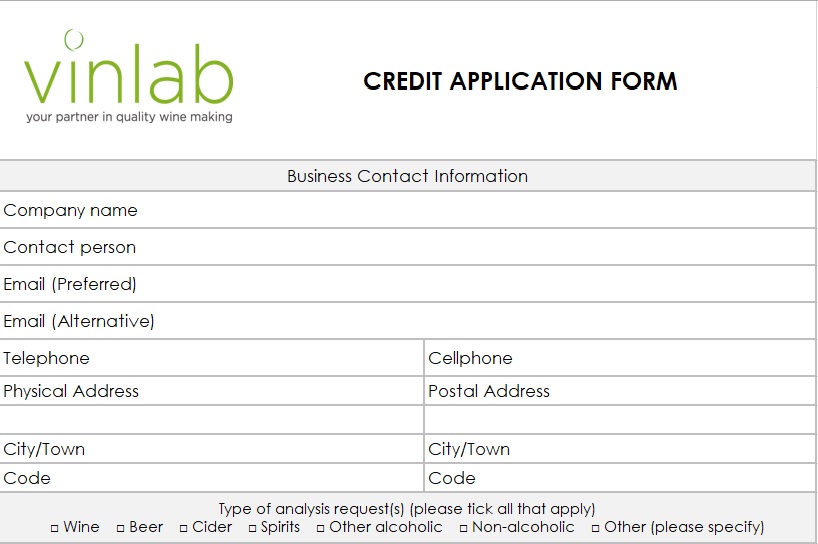

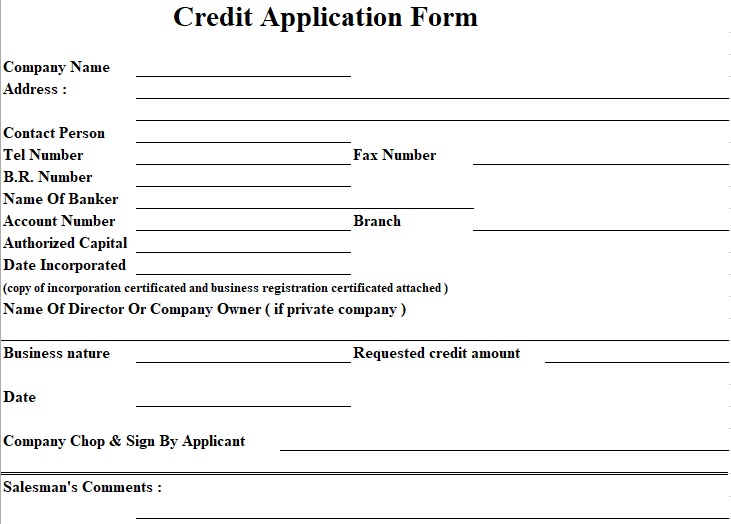

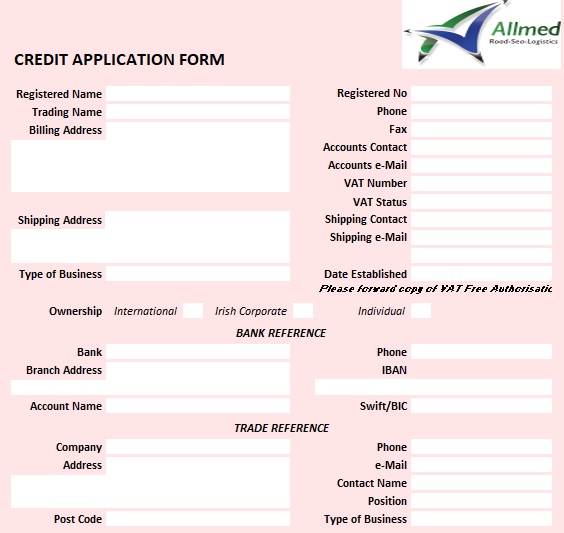

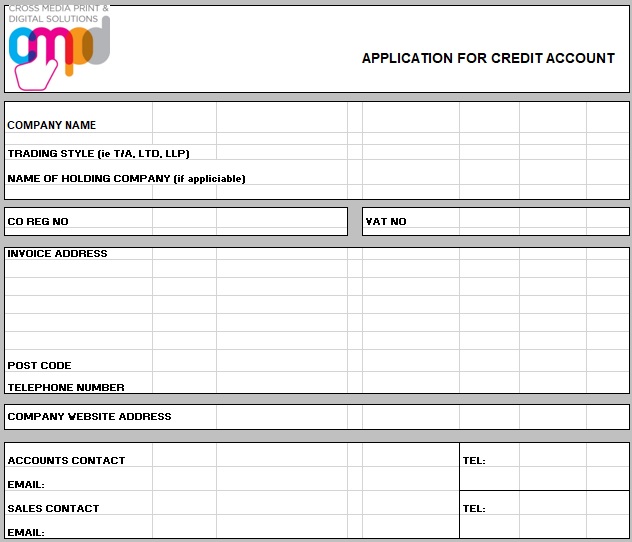

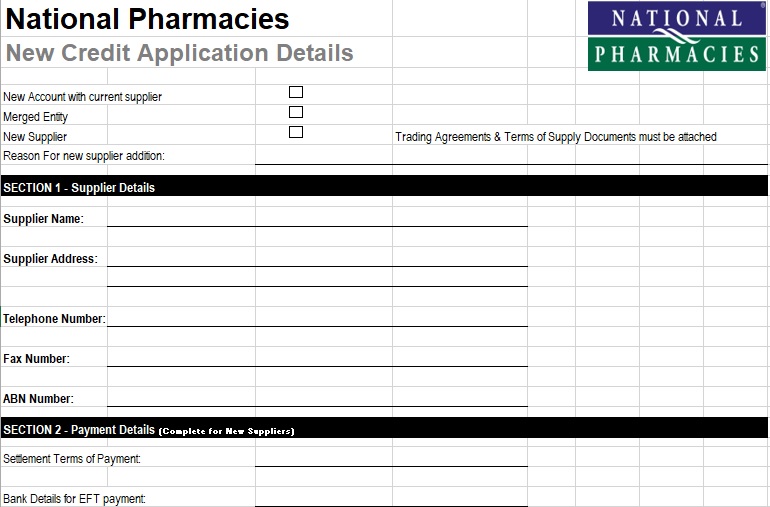

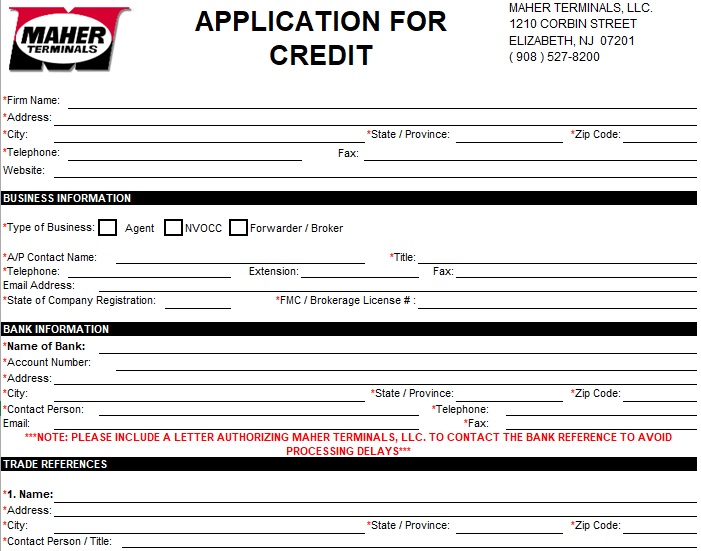

Credit Application Form Template

Different formats are available online for your comfort. You can easily download with free of cost. Moreover, you can edit the font and text as per your requirement. Similarly, you can create your template if you have expertise in Microsoft Word.

Why should I Extend Credit Using Credit Application Form?

Don’t know if you’re ready to extend credit? Consider this: you probably already do it. If your business accepts credit card payments, checks or even sends invoices to customers, you are essentially extending credit. These payment types are accepted on the assumption that the customer has the funds to complete the transaction. When you accept credit card payments, your merchant account provider assumes all risks. By extending credit through invoices or checks, however, you transfer the risk to yourself. It’s your responsibility to verify and accept payments and to manage the associated risks. In some industries, such as construction or manufacturing, credit is often extended through invoicing. Invoices are usually due within 30 days of receipt. Businesses offer credit to help customers focus less on prices and more on their needs. Additionally, you can make more sales and improve your relationship with your customers if you offer credit. It’s important to note that extending credit incorrectly can cost you money. Moreover, when you sell something on credit, you won’t get immediate reimbursement. You will need to temporarily make up the difference, which usually means borrowing from other areas of your operating capital. It’s important to note that extending credit incorrectly can cost you money. Moreover, if something goes wrong and your customers cannot pay, you may have to spend money on collection activities and other costly measures to try to recoup your losses. Ensure you have a genuine business reason to extend credit to all your big customers before you give them credit forms. Identify the risks of several of your larger customers defaulting. How will you survive a financial crisis if your outstanding invoices are not counted as income? It may not be the right time to extend credit to your customers if you can’t handle much risk. It is important to be able to extend credit without becoming overly dependent on it. You may or may not be paid for outstanding invoices depending on your cash flow. Do you think extending credit that may not be repaid will hurt your cash flow? In that case, it may not be the right time to offer credit options to your customers.

Establishing a Credit Application Process

It’s important to decide how you will manage credit accounts long before you offer credit to your customers. If you can charge late fees (and how much) as well as the collection laws in your area, you should know. Similarly, when it comes to extending credit, you’ll need to speak with a lawyer to understand the policies and procedures in your state. It is possible to make mistakes when it comes to consumer protection laws. Creating a uniform process and clearly stating your policies can help you comply with these laws. Think about the following:

- What are your ideal customers? What kind of credit do you offer?

- Will you run a credit check on your customers when they apply for credit?

- What is your payment policy? When are your billing dates? What payment options are available?

- Who will be the point of contact for your customers with credit plans?

- Who will invoice your customers?

- How will you outsource these tasks?

- What policy do you have in place to protect consumer information?

- How do you plan to protect sensitive financial data?

- What are our plans for collecting late or delinquent payments?

- In addition to ensuring compliance with local laws, what other factors should we consider?

You can use these questions to create a detailed credit policy that outlines everything from interest rates to procedures when a customer fails to pay. Customers should receive a copy of these items once a year and be notified of any changes. These are often called “Terms and Conditions” and they can change according to local and federal laws. You should document all legal information, dispute resolution procedures, and what happens when the account has to be placed in collections in your terms and conditions.

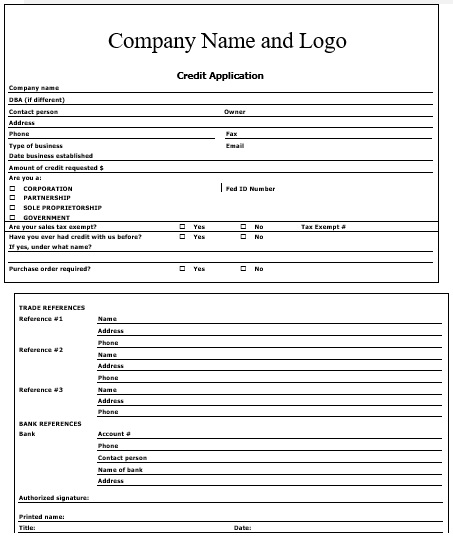

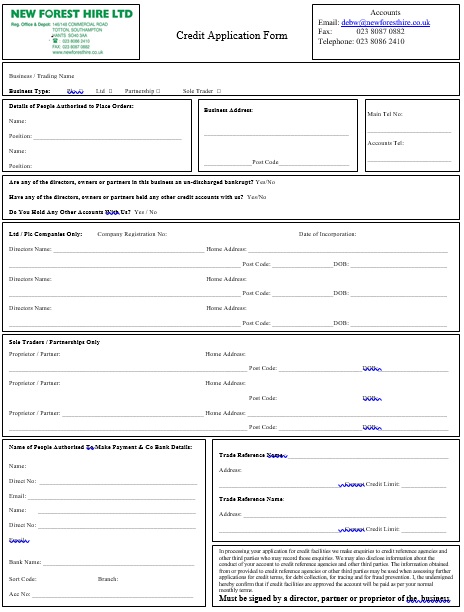

What Should My Credit Application Template Include?

As you prepare to launch a new credit program for your customers, you should record all their details in writing. Similarly, regularly ask them if the information is correct when you send their statements. You will have documentation from the application you use in case you encounter a fraudulent or delinquent credit transaction. On your credit application template, you will need the following information:

Income Verification

You’ll need tax documents, bank statements, or the HR department’s number to verify a person’s income. Businesses may need to submit a profit and loss statement, bank statements, tax documents, or other information to show regular profits.

References

Check references: You must ask for references. These can be banks or credit accounts for consumers applying for credit. Businesses seeking credit must include their vendors and any other creditors they may have.

Addresses

An individual’s address history over the last two years is an important factor in pulling a credit report. You will need to know what states, counties, and towns the individual has lived in so that you can pull their credit report accurately. A business should have all of its addresses.

Contact Phone Number

For individuals, this will be their home phone, cell phone, and work phone. When it comes to businesses, you’ll want to find out who pays invoices. It’s important to determine who is responsible for paying invoices for businesses.

Tax Id and other Identifying Information

You’ll need tax documents, bank statements, or the HR department’s number to verify a person’s income.

Background Information, assets

In the case of individuals, you will need the names of their last two employers, their employment dates, and any collateral such as equity in a home. Employers will want to know what type of equity they can offer. How long they’ve been in business, and may even request backup documents such as the business plan.

Signature

A signature is a must. Don’t pull a credit report without permission from the person signing the credit application.

Personal Guarantees

An individual with a better credit record may co-sign their credit application. However, you’ll also need to collect all the information about this individual, preferably on another application form. In case a business fails to pay on time, you’ll want to get personal information from the person responsible for payment. The person will usually be a corporation’s officer, the CEO, or another person in upper management.

Conclusion

The credit application form gives the lender the power to determine whether or not a borrower receives a loan. Moreover, obtaining the loan before giving credit information also allows the lender to gather the information that borrowers would not be able to provide otherwise. Credit applications are used by financial businesses to create contractual relationships which legally bind the borrower and lender to the terms and conditions they stipulate.

FAQS

What is the description of the credit application form?

A credit application is a standardized form that a borrower or customer uses to request credit. The form asks for information such as The amount of credit requested. Identification of the applicant. The applicant’s financial status.

Why is credit application important?

It serves as both a data-collection tool and a contract, specifying the mutual rights of the parties involved, as well as the individuals you will be working with.

![Free Petty Cash Log Templates & Forms [Excel, Word, PDF] free petty cash log template 3](https://templatedata.b-cdn.net/wp-content/uploads/2021/06/free-petty-cash-log-template-3-150x150.jpg)

![Free Bank Statement Templates [Editable] printable bank statement template 5](https://templatedata.b-cdn.net/wp-content/uploads/2021/09/printable-bank-statement-template-5-150x150.jpg)

![20+ Printable Checkbook Register Templates [Excel, Word, PDF] free checkbook register template 4](https://templatedata.b-cdn.net/wp-content/uploads/2021/06/free-checkbook-register-template-4-150x150.jpg)