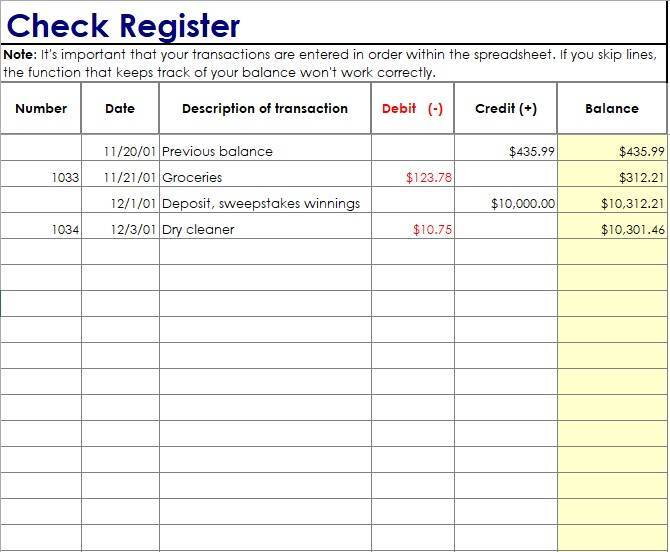

A checkbook register template is used to record all check payments. It contains check numbers, payment dates, names of payees, and payment amounts. It is a helpful document in reconciling bank details. Moreover, it is an informal record of all credits and debits that you have made from your bank account. A checkbook register also contains information about the checks that have been issued, cleared by the bank, and on the waiting list. Most bookkeepers before posting transactions to the relevant ledgers, record check transactions on the checkbook register. However, the accounts in the checkbook depend on the company. You may also like the Blank Check Template.

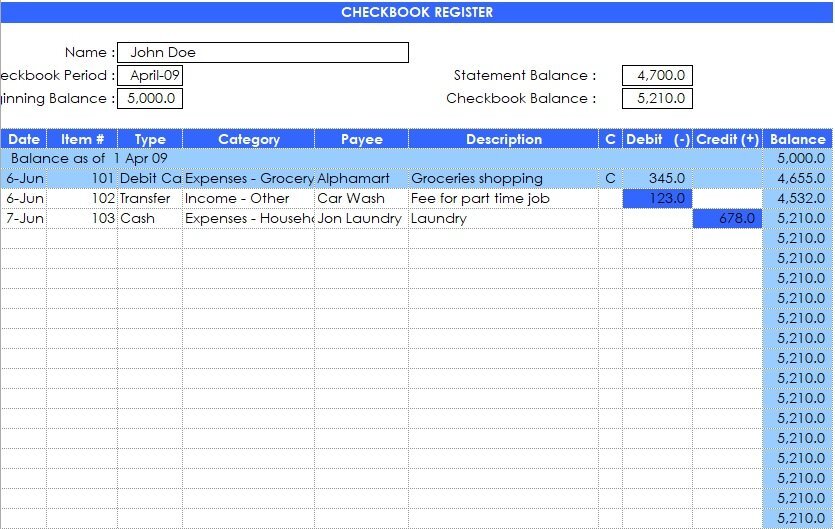

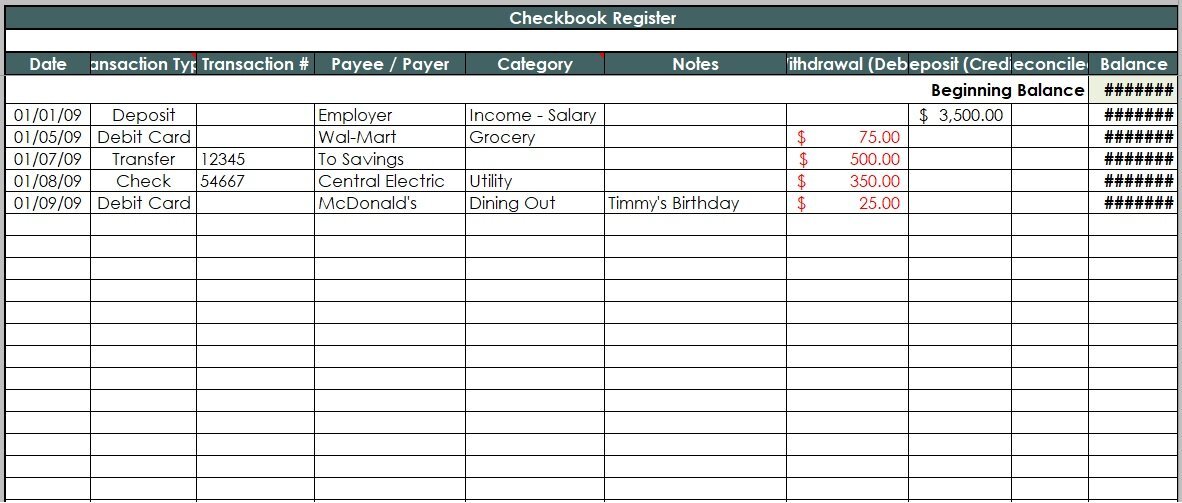

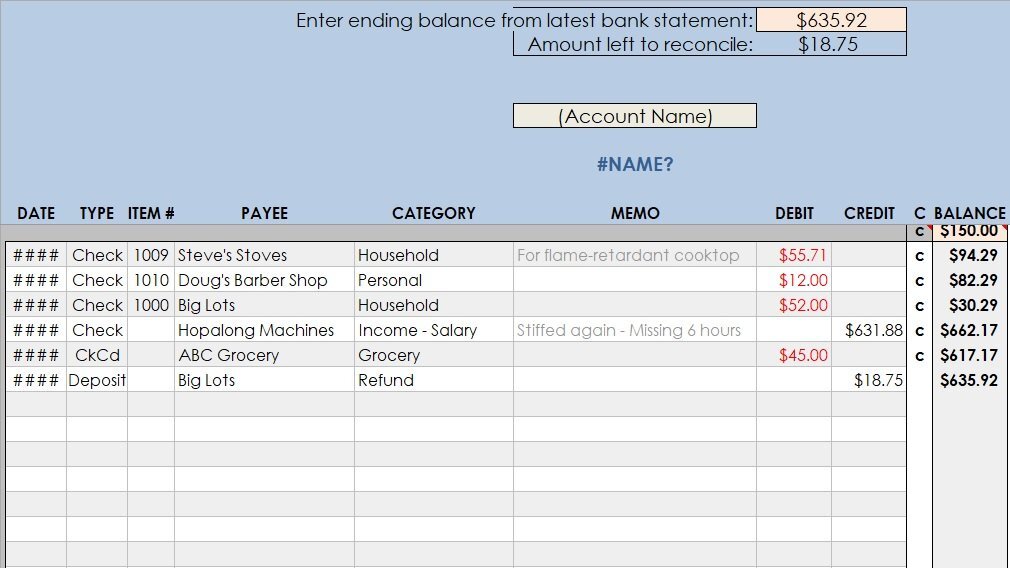

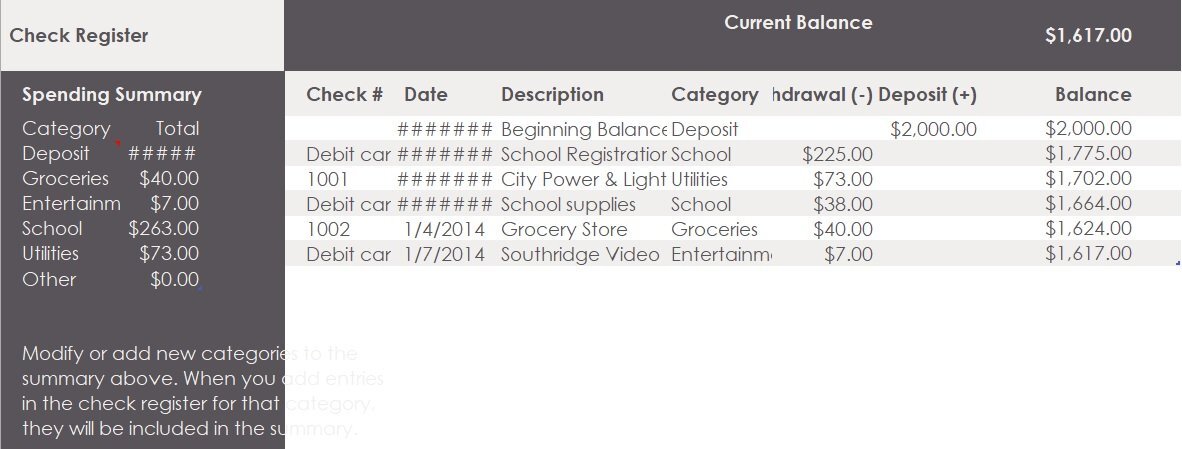

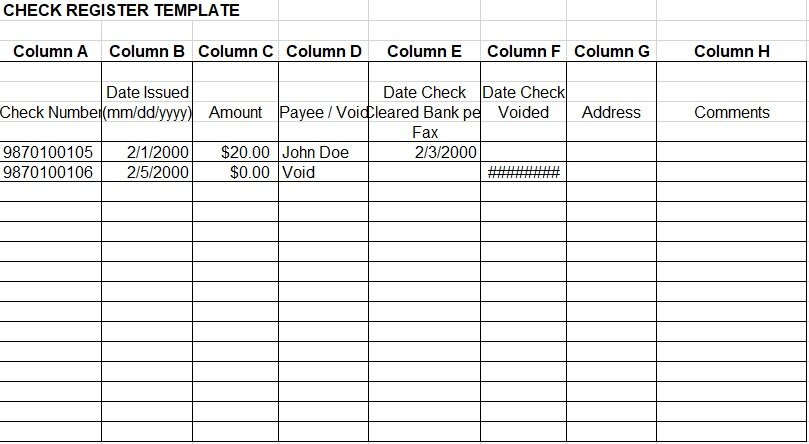

sample checkbook register template

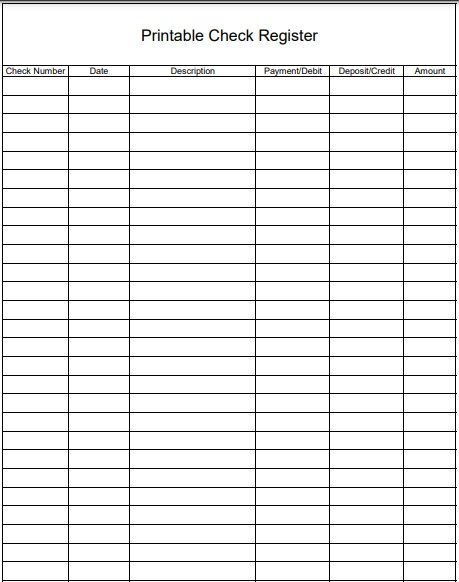

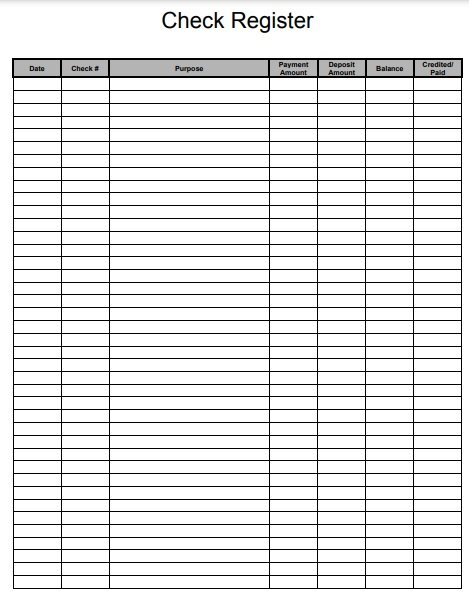

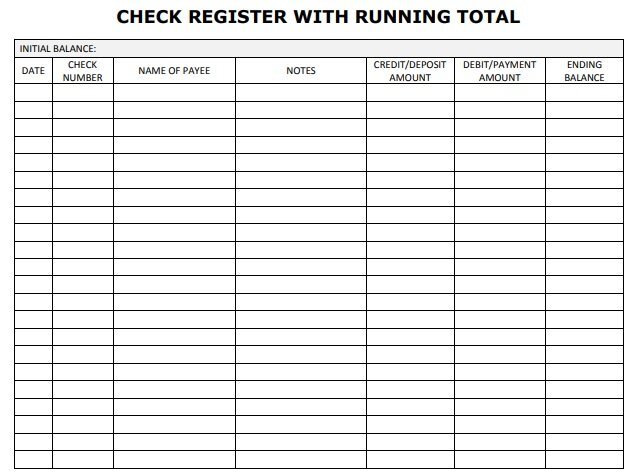

printable checkbook register template

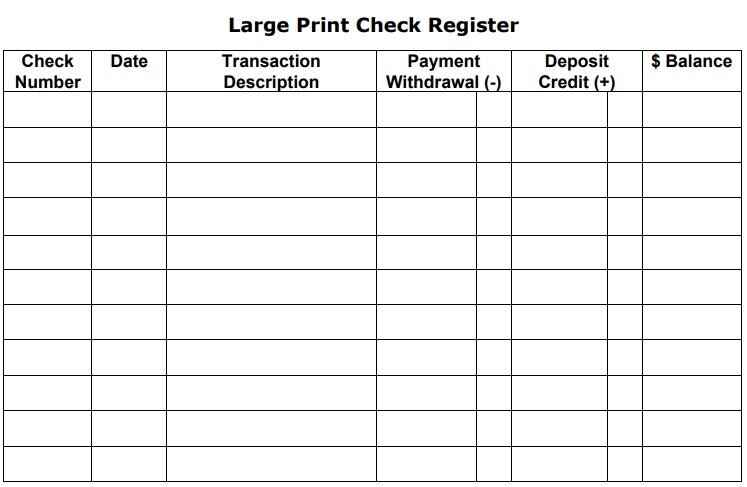

large print check register template

free checkbook register template

blank checkbook register template

checkbook register printable

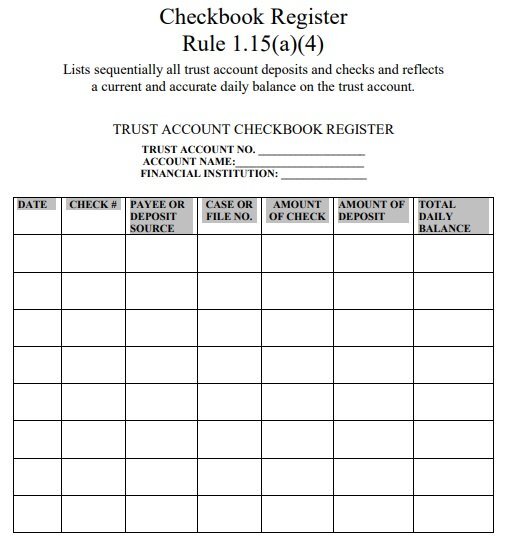

trust account checkbook register template

free checkbook register template 1

free checkbook register template 2

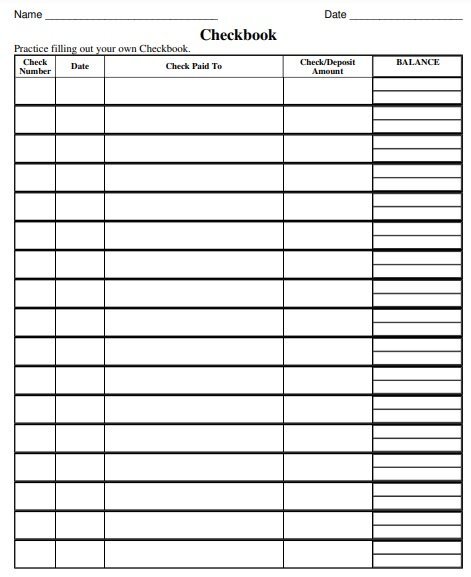

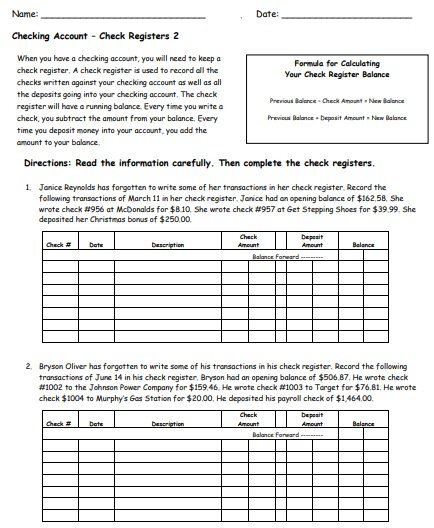

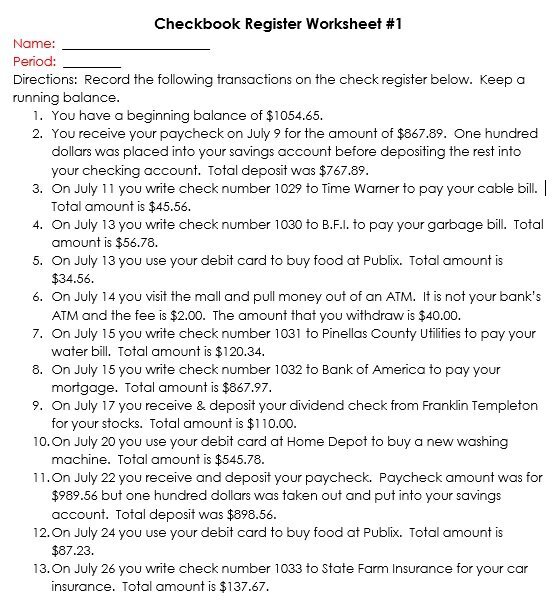

checkbook register worksheet

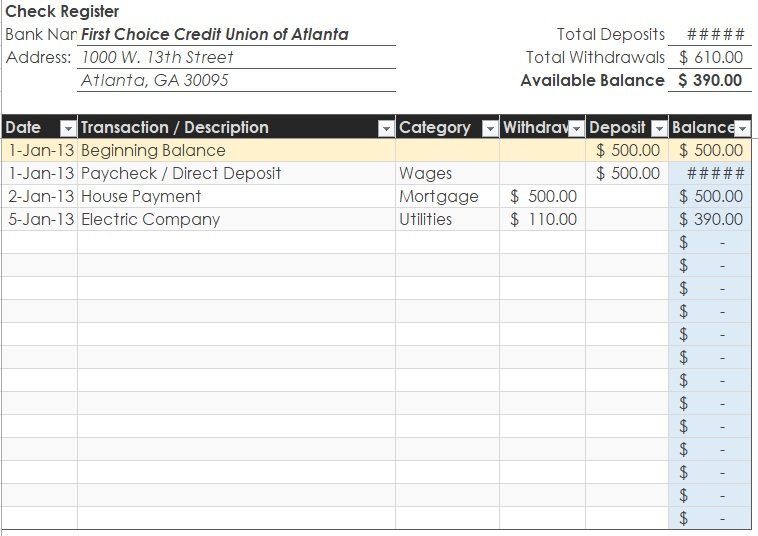

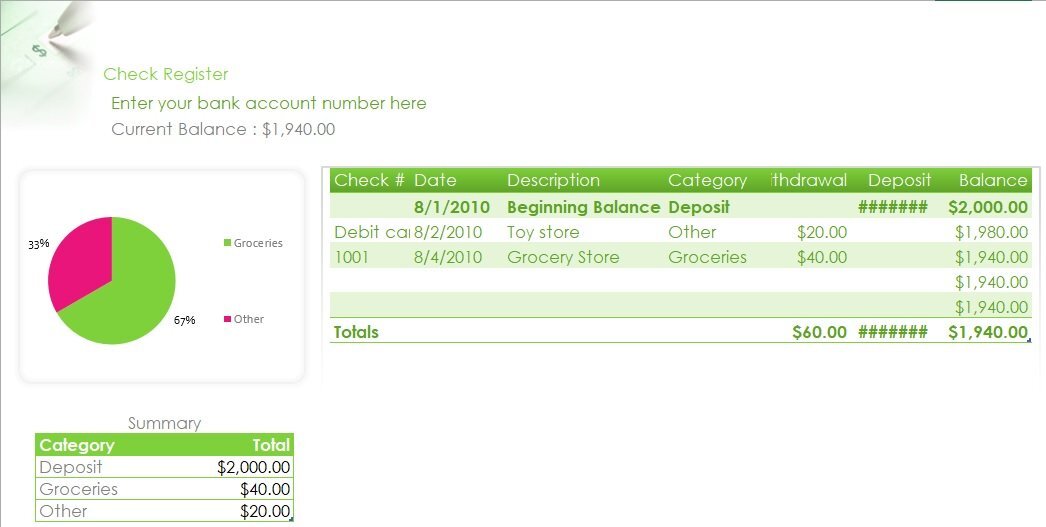

checkbook register excel template

Importance of checkbook register:

A checkbook register is really very important in order to deals with checks effectively. The checkbook registers are manually updated and provide real-time information about your finances and bank account. By maintain a check register regularly; there is no need to worry about the account balance. Additionally, it makes you able to track every single transaction. Some online banking may have some charges but at the same time, checkbook registers are free of cost. You can also make up your own, by downloading free printable checkbook register templates online. Also, you can make your budget as well by having your income and expenses all in one place. It assists you to build a practical and accurate budget. Furthermore, it records your paid debts by amount and date. With the help of a register, you can get rid of bounced checks and the associated expenses. As we discussed above, it records your transactions and makes sure that you have enough money in your check account.

Basic elements of a checkbook register:

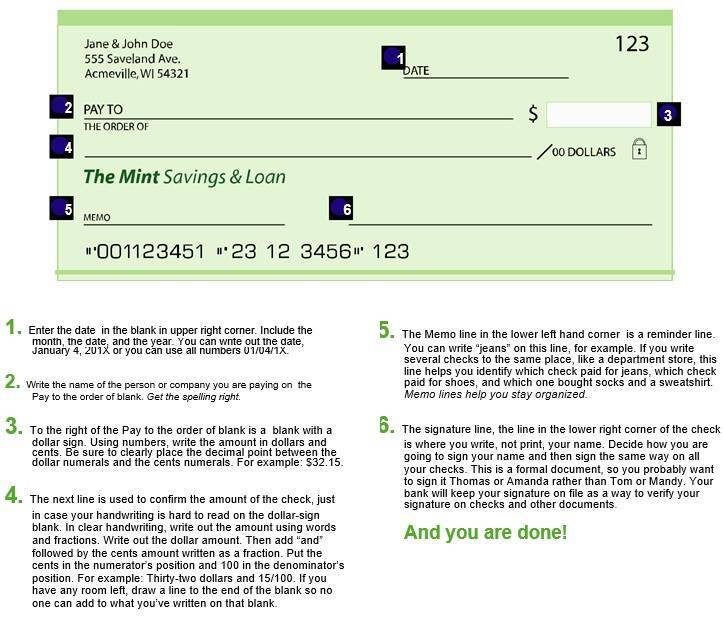

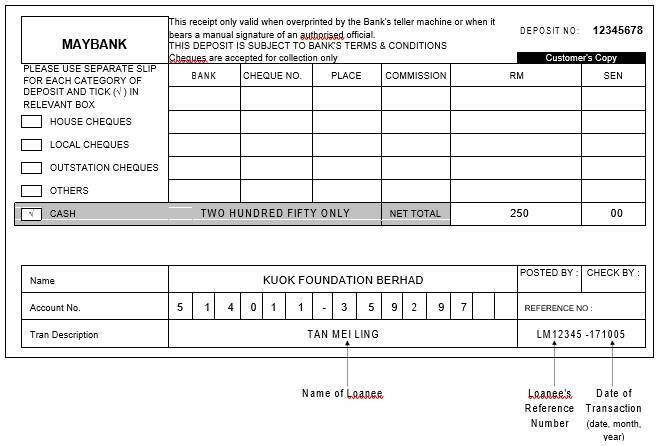

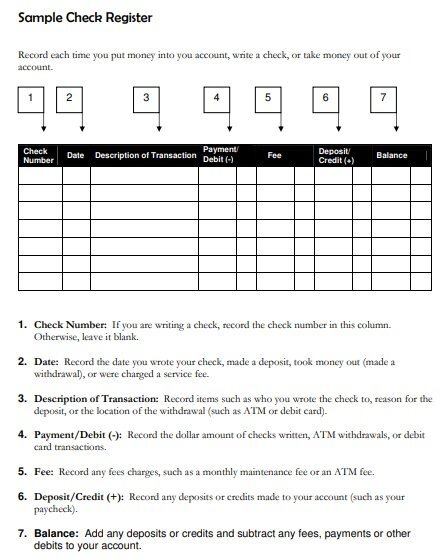

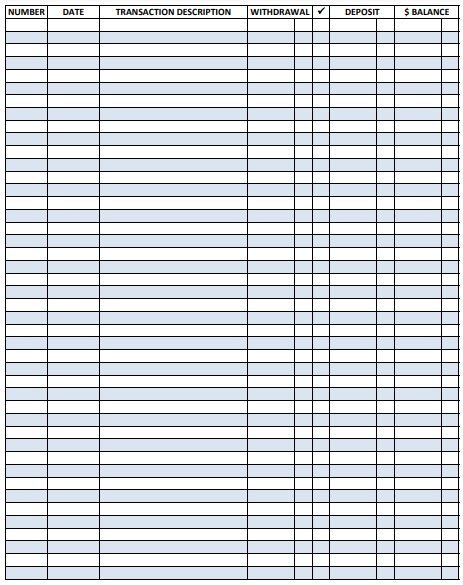

Your checkbook register should contain the following basic elements; Check number: This number commonly present on the right-hand side of the check. It follows chronological order. You just have to write the check number and ensure that you are not missing any number. The date: Write the date that indicates when you have written the check. Be sure to write the correct date. Transaction details: Transaction details identify to whom the check was given. Here you have to mention vital information such as the name of the payee, company, or business. Amount of the payment: In this section, you have to write the exact amount of payment. It doesn’t matter how you made the payment either by using a debit card, credit card, or online, you just have to make sure that exact amount goes on the check. Withdrawal amount: It is the amount that you withdrew from the bank due to any reason. You should write the complete and exact amount. Fee amount: In this column, you should write the expenses associated with the transaction. Deposit amount: It is the amount you have deposited into your account. Transfer: If you have more than one account and you transfer money from one account to another, you need to write this amount in the register. Balance: It is the balancing section depends on the transaction you have made. It matches your current balance from the previous one. You should also check Bank Deposit Slip Templates.

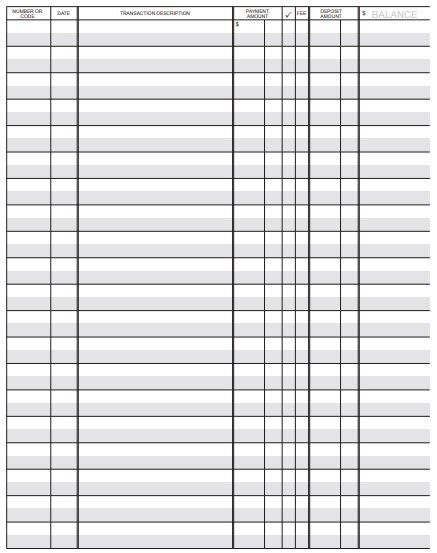

check register with running total

checkbook register spreadsheet

free checkbook register template 3

free checkbook register template 4

free checkbook register template 5

free checkbook register template 6

free checkbook register template 7

free checkbook register template 8

free checkbook register template 9

free checkbook register template 10

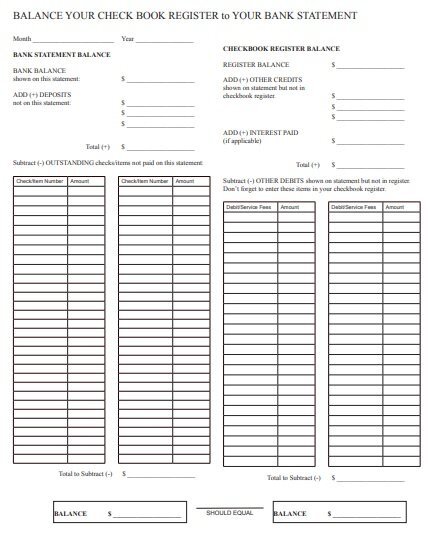

balance your checkbook register template

How to manage your check register?

You can manage your account by following the necessary tips;

- At first, track your account balances. You should manage your checkbook register timely in order to avoid credit rating disasters. Also, you should make prompt entries. Entering the transaction amount immediately is the best way to maintain a checkbook register.

- Next, calculate the balance column often so that there is no issue later on. You can do that after every 4-5 lines.

- Don’t think that entering decimals may not be necessary. You should enter exact amounts, don’t round off.

Conclusion:

In conclusion, a checkbook register template is a useful tool that allows you to monitor activities in your checking account. It makes you able to track your transactions. By having records of your payments, you can make a better budget. In addition, it helps you to determine bounced checks, credit cards, and bank errors.

![25 Printable Bank Deposit Slip Templates [Excel+Word+PDF] example of how to fill out a deposit slip](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/04/example-of-how-to-fill-out-a-deposit-slip-150x150.jpg)

![Free Bank Statement Templates [Editable] printable bank statement template 5](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/printable-bank-statement-template-5-150x150.jpg)

![Free Petty Cash Log Templates & Forms [Excel, Word, PDF] free petty cash log template 3](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/06/free-petty-cash-log-template-3-150x150.jpg)

![12+ Free Rent Payment Tracker Spreadsheet [Excel, PDF] free rent payment tracker template 3](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/10/free-rent-payment-tracker-template-3-150x150.jpg)

![20+ Printable Checkbook Register Templates [Excel, Word, PDF]](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/06/resignation-letter-template-for-part-time-job.jpg)

![20+ Printable Checkbook Register Templates [Excel, Word, PDF]](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/06/free-student-id-card-template-6.jpg)