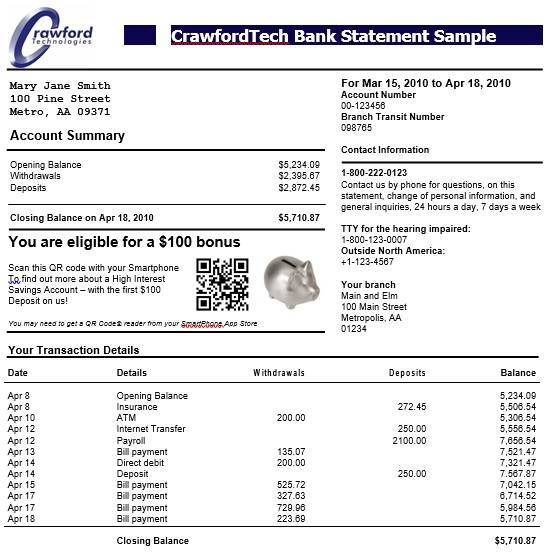

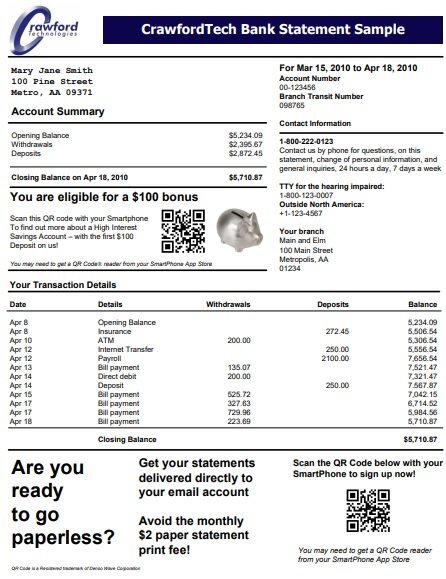

The bank statement template is such a document n which every account holder gets in touch every month. Further, they receive bank statements from their respective banks against their transactions that took place in a month. The bank deals with thousands of customers and it is impossible to provide a separate financial statement to everyone. To overcome this issue, all the banks use pre-formatted statement templates. Moreover, banks save a lot of time by using these formats. A standard bank statement contains details of deposits and withdrawals. However, the customer does all the transactions from the bank. Against those transactions, it provides a financial statement to its clients every month through the postal address or in the email provided to the bank at the time of account opening.

What is a bank Statement?

By definition, a bank statement is an outline of transactions that are monetary and which have happened over a while. You can get a free bank statement template from your bank or different kinds of financial institutions. The transactions which show up on the statement in corporate deposits, withdrawals, debit, and credit. Generally, financial institutions send these through the mail which is the reason they typically come as written documents. Although we can now get e-statements utilizing email, many individuals favor paper bank statement templates so they can keep these in their records and allude to them on a case-by-case basis. Since bank statements come from financial organizations straightforwardly, you won’t see a ton of editable bank statements except if you’re wanting to make one for your foundation.

Purpose of a bank statement

One significant reason for bank statements is to furnish you with data about how many assets stay in your account. They likewise contain explicit sums which you have paid or received within a given period. It’s your account, so you reserve the option to know these details. The report can be exceptionally useful to make yourself mindful of your financial status. It will likewise permit you to as needs be plan your expenses. After you’ve affirmed the balance in your record through a bank statement template, you can give checks as payment for things you buy. Through this basic report, you will likewise find out about the various kinds of bank schemes. This is because banks regularly use bank statements to publicize their arrangements, items, and financial plans. Some of the time, you could involve the archive as your confirmation of address. A bank statement is vital. That is the reason you must be cautious when you get one, and you ought to ensure that it’s anything but a fake bank statement.

How to make a bank explanation?

As previously mentioned, you can’t make your bank statement template and make it look like an official document. You can download a fake bank statement for your very own utilization to contrast it and the one given by your bank. What you can do is download a duplicate of your unique bank statement. You can get this straightforwardly from your bank. Bank statement templates come from banks, and they’re made utilizing a great deal of time and exertion. A group of originators goes through a tedious process to make the format and make a significant layout that everyone will comprehend. It ought to pass all of the monetary data on to the record holder. No one ought to make a fake bank statement to make it look like an official document. This is an unlawful demonstration, and you can cause problems for it. On the off chance that you want to see your bank statement, simply demand it from the bank, and they will print one out for you.

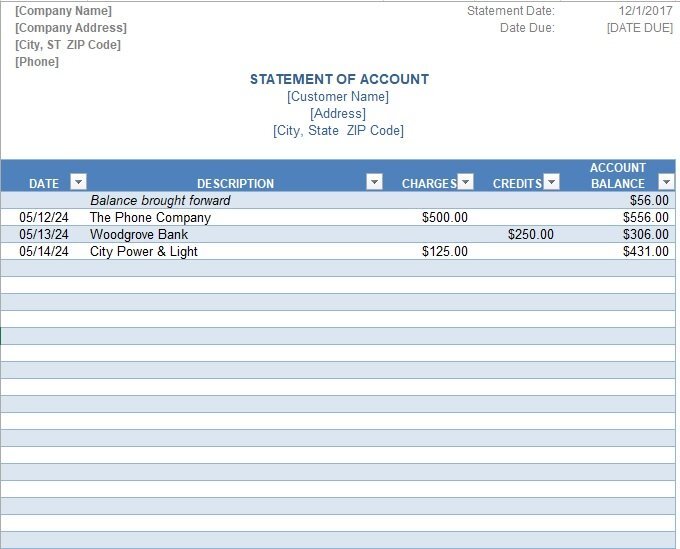

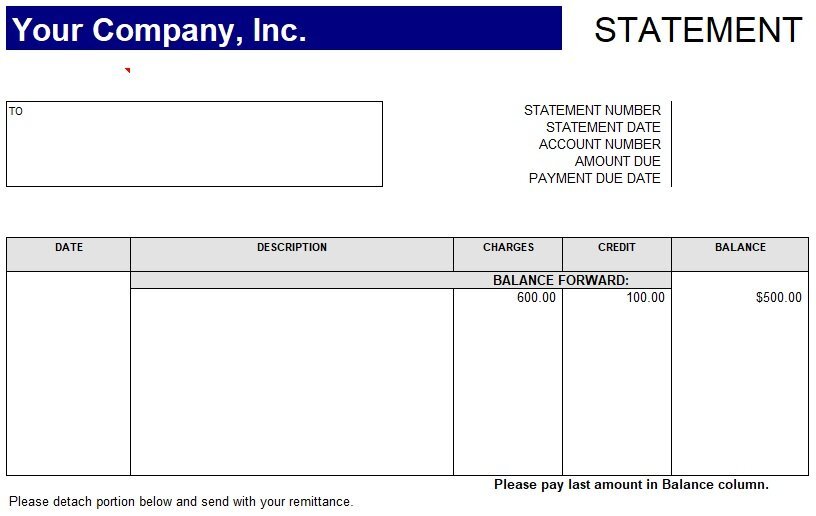

Sample Bank Statements

There are different types of bank statement documents available on the internet. Every bank uses a different format to facilitate the customer to provide the statement every month. Bank deals with hundreds of customers on daily basis. However, if they don’t use a proper format they can’t provide financial documents to all clients. Every bank uses format as per their requirement and creates a facility for them to send quick statements to their clients every month.

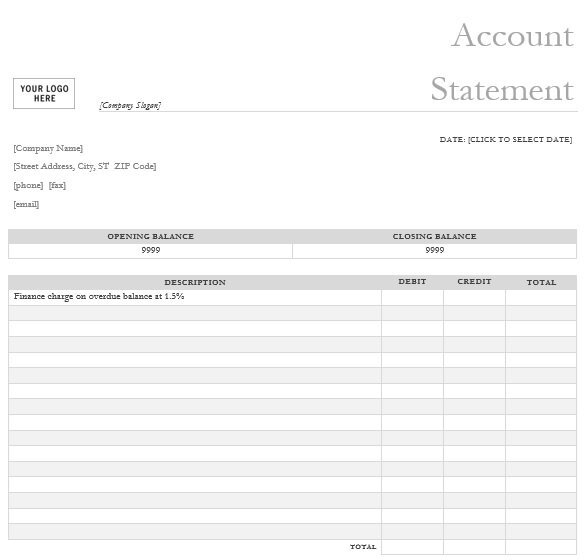

personal bank statement template

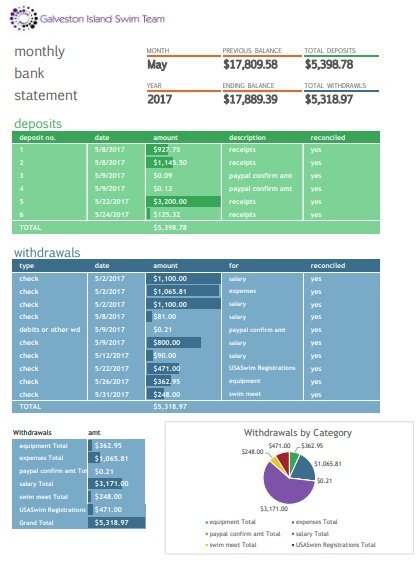

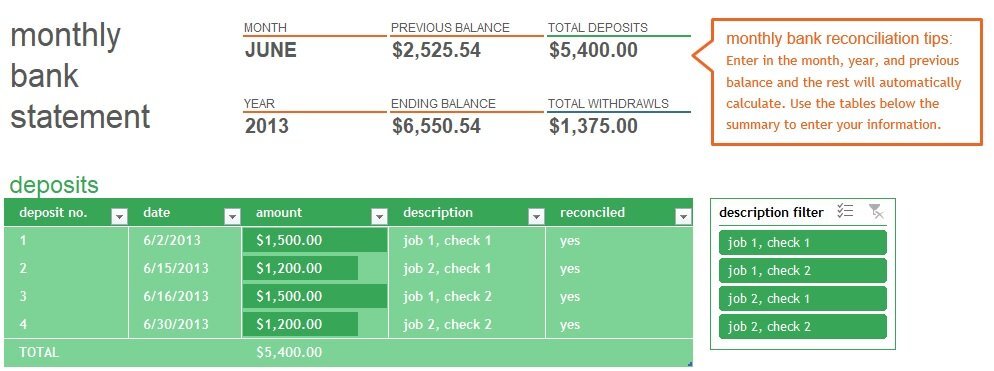

monthly bank statement template

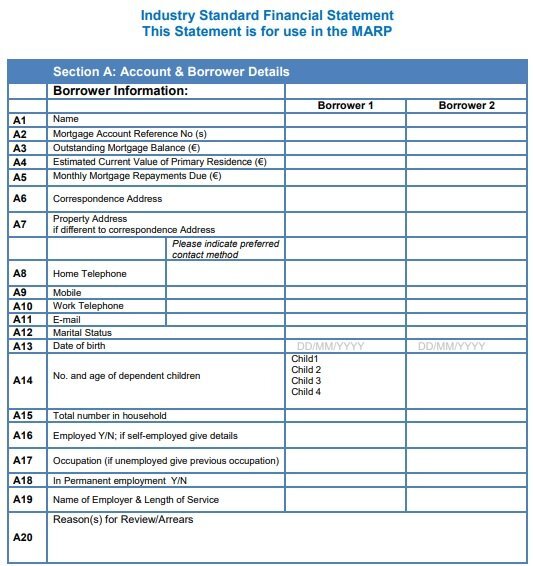

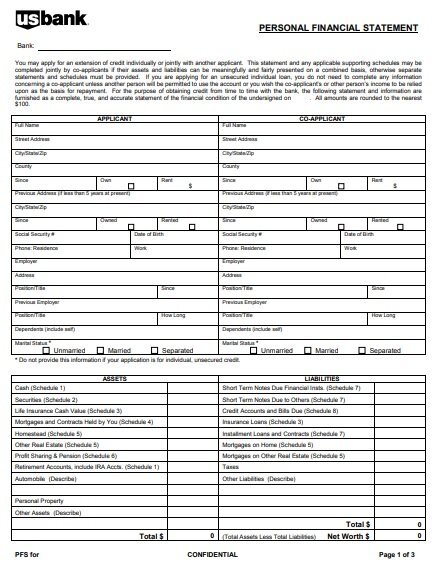

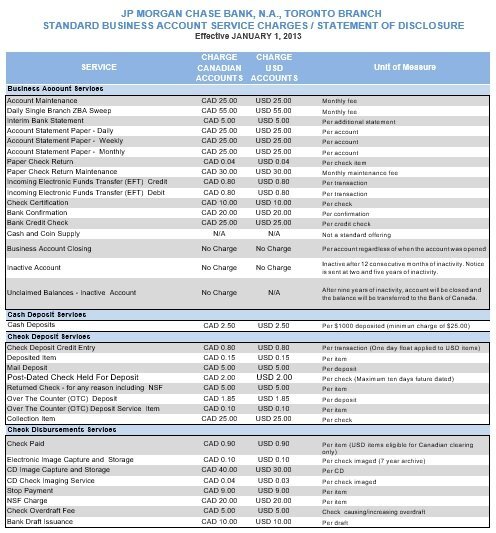

industry standards financial statement template

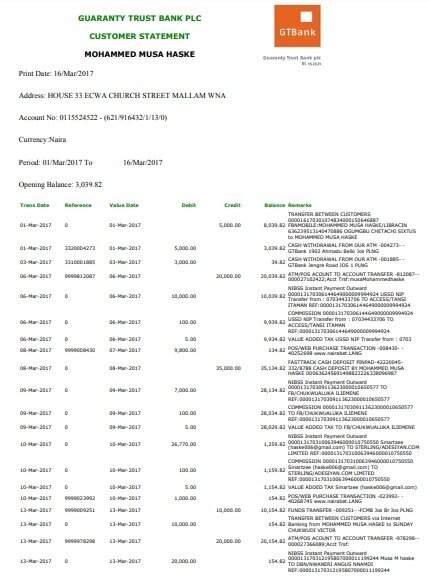

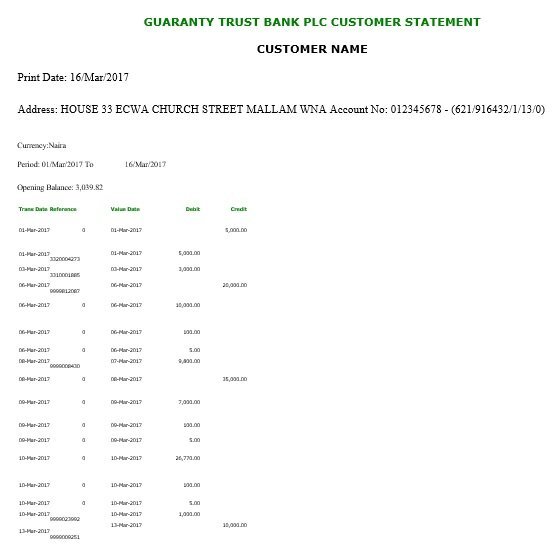

customer bank statement template

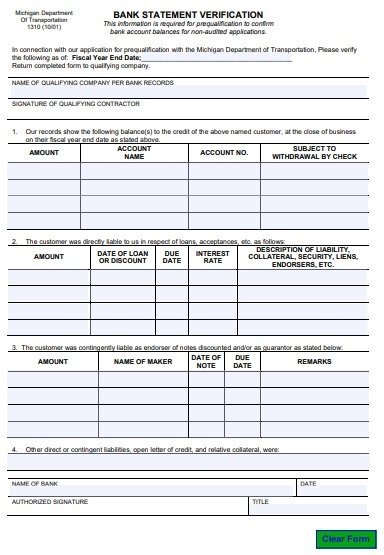

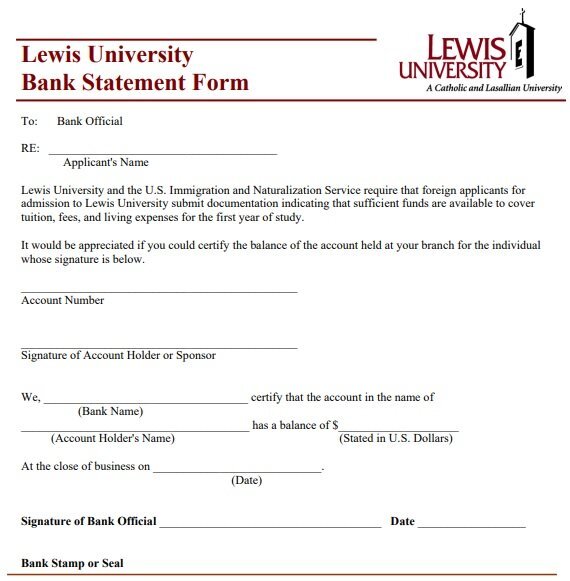

bank statement verification template

bank statement form

bank financial statement form

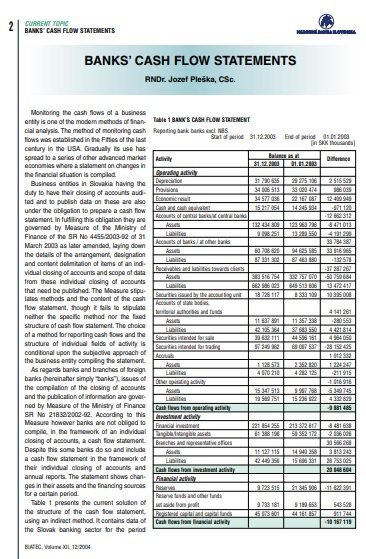

bank cash flow statement template

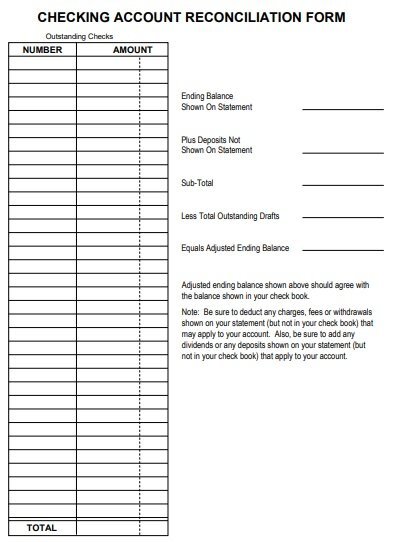

bank account reconciliation form

printable bank statement template

printable bank statement template 1

What is a Financial Statement?

A Bank statement is against the transactions of their client. The transactions are in the form of deposit, withdrawal, debit, and credit. The bank statement template is free of cost and you can get it from your concerned bank. Normally banks send these statements through the mail and in the form of written documents. Moreover, there is a facility to receive e-statements through your email. However, people prefer to get a paper statement. The reason is they can keep it as a record and refer to it whenever needed.

What a bank statement is for?

The bank statement gives you the exact information about the remaining funds in your account. Further, you can tally the amount which you paid and received in a specific period. Being a customer of the bank, it’s your right to know your financial details. Moreover, you are always aware of your financial status. In Addition, you can check and plan your expenses accordingly.

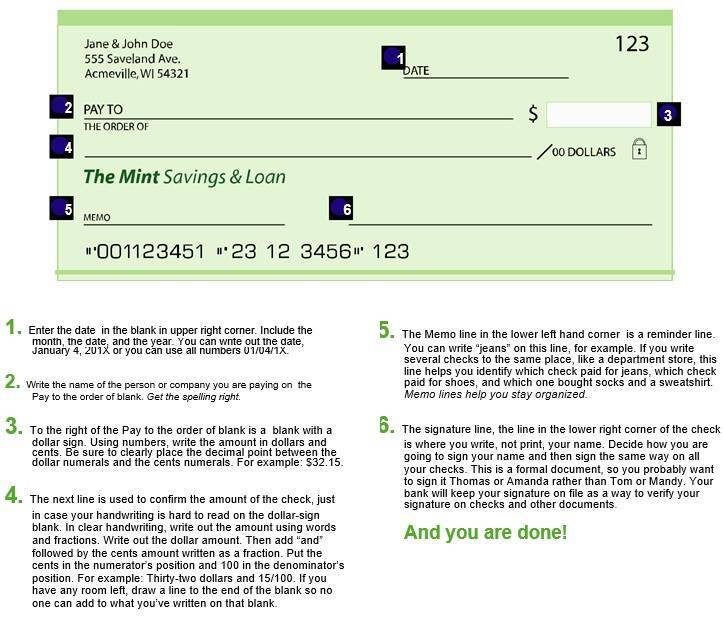

A bank statement template’s basic components

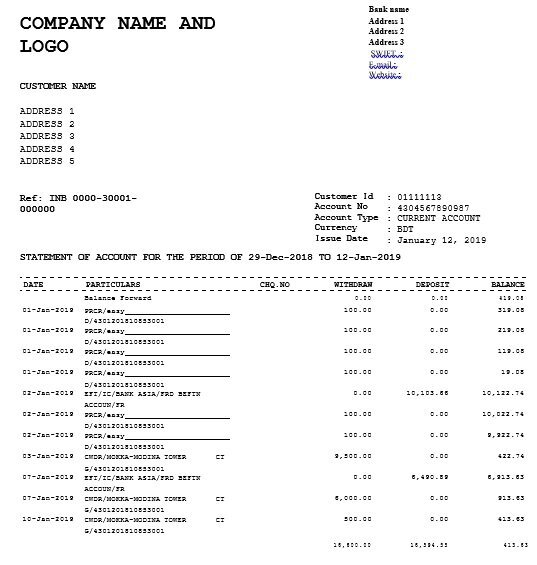

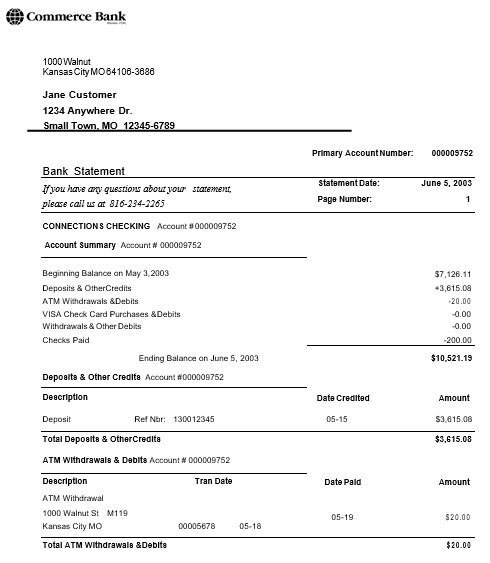

The format of bank statements in every bank is slightly different from each other. However, their content can be different, but the basic components are common everywhere.

Bank’s Information:

In the financial statement document, there are relevant details of the bank is there. The information contains the bank name, address, email address, and contact number.

Information about Account Holders:

Like bank information, there is also detail about the account holder. It contains name, address, email address, and contact information, etc. The account holder can be an individual or business account. The information is the same for business and individual accounts.

Account Details:

Account details contain the account title and the account number. Further, it’s important to give the right information about your account number. Similarly, when you are entering account details for bank statements.

Bank Statement Date:

The bank statement date is the issue date. Similarly, it can be a period in which the bank issues the statement. Moreover, this is necessary that all relevant information should be on the bank statement template.

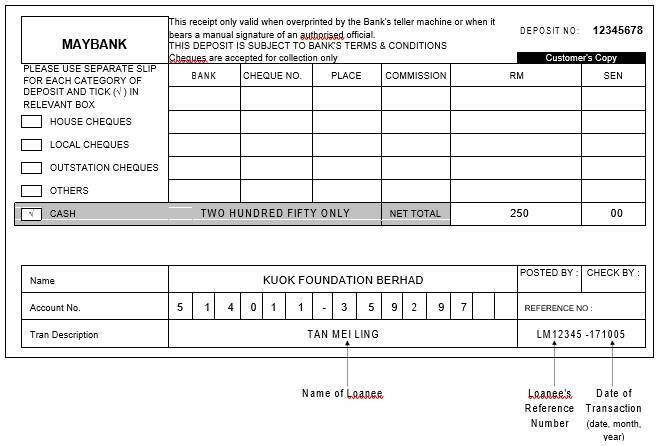

Transaction details:

The details about the transaction are vital information in the financial statement template. Similarly, this is the column that covers most of the area in the statement. Moreover, all the details must be arranged along with proper dates and specific periods. Further, its the bank’s responsibility to check all the necessary details in which dates and account number is vital. In Addition, to make your statement effective it is necessary to check all the transactions are there in chronological order.

Account’s Summary:

After the details of the transaction, it is necessary to give information about the account summary. For Instance, for any particular account, the summary includes the opening balance, total deposits, total withdrawals, and the closing balance at the end of a specific duration.

How to utilize a bank Statement Template?

While you’re attempting to accommodate the data for you against the records of the bank, you ought to go through your bank statements to check whether there are any disparities. On the off chance that you find any differences, report these to the bank immediately. You can call them, yet it would be smarter to compose a formal letter to make sense of your situation. Banks and other financial institutions issue bank statement templates to their account holders which show every one of the details of the transactions in the account. It furnishes you with data about the financial activity which happened in your record in something like a month or a particular timeframe. As a rule, banks send these statements to their clients month to month on a given date. Likewise, the transactions on the explanation show up sequentially. These days, a few banks have gone paperless which implies that they email electronic statements to their clients. For certain banks, they give you the choice to pick whether you need to get the printed archive or you need to accept your statement through your email. The electronic statement or e-statement permits you to see your bank statement on the web. You can download it, save it on your PC, and print it out is important. There are likewise ATMs accessible that offer you the opportunity to print out a rundown of your bank statement known as your transaction history. Although you might have your bank statements shipped off your email straightforwardly, many individuals like to get the printed report from the bank. This is because you can record every one of the month-to-month statements you get to monitor your financial history. You can likewise utilize them to find out about your ways of managing money and watch out for any errors or disparities. Assuming you end up finding any blunders or errors, you should report them to the bank immediately. Regularly, you have as long as 60 days to question such blunders to the bank.

Advantages of Bank Statement:

If you keep your bank statement with you, it will help out to check your financial status. There are many financial benefits.

- The financial statement is a good supporting document for your effective and correct tax reporting.

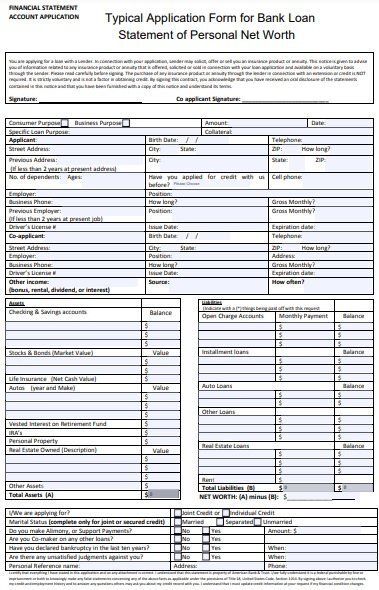

- All the transactions are in one document which is good evidence for proof of your account activities. For demanding a loan from the bank many documents are needed and one of the most important documents is a bank statement.

- Through a financial statement, you can keep a record of unpresented and uncollected checks.

- Bank Statement plays a vital role in major businesses and planning their budget.

- The financial document provides a key role in reconciling your account with your books along with the account of banks. Further, if there is any discrepancy, error or mistakes that can be easily rectified.

- Schools and other organizations maintain their bank statement. Therefore, it’s proof that students made their payments.

False Bank Statements

In earlier times people prepare their fake statements. This was possible when there is a manual system in the banks. Further, nowadays everything is computerized. All banks have online systems that are why there is no chance of fake statements.

How To Request For Bank Statement?

The account holder can go to the related branch and request for bank statement. However, this is the right of customers to request statements wherever they need them. Banks are bound to provide the document their client is requesting. Moreover, you should have knowledge of how to request a bank statement. The easiest way to request a financial statement is to give the application along with your account number and account title and the period. Bank staff will give you a financial statement free of charge. Further, if you need more copies and printouts you have to pay.

printable bank statement template 2

printable bank statement template 3

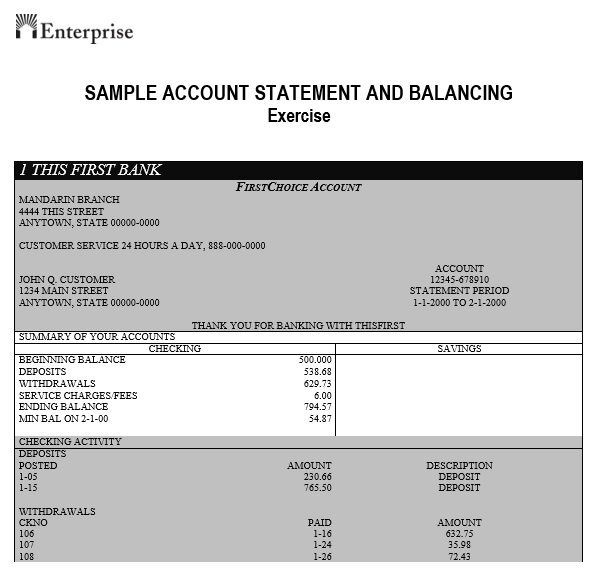

sample account statement and balance exercises

printable bank statement template 4

printable bank statement template 5

printable bank statement template 6

printable bank statement template 7

printable bank statement template 8

balance bank statement template

application form for bank loan statement template

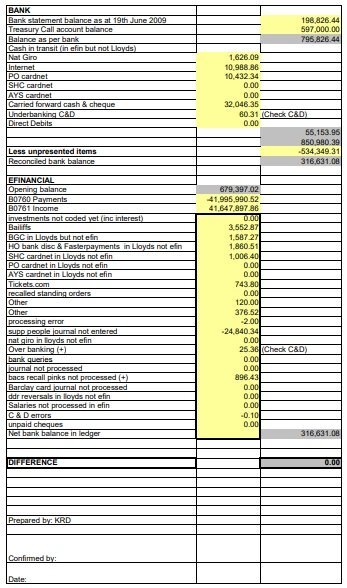

Bank Statement Reconciliation:

For reconciling the information with that of the bank you need to request for a bank statement. Sometimes there are differences which means the information is not tally and there are several reasons for that. For Instance, your bank has credited the requested amount or debited charges from your account. Further, for reconciliation, the information is put side by side with each other. Moreover, if you find any errors, highlight them. In Addition, write a letter regarding discovery and send it to your concerned bank along with a financial statement.

Conclusion:

A bank statement template is a requirement of every account holder on a monthly basis. Further, the account statement gives details about the transaction and you can maintain your account status. If you need a loan from the bank one of the major documents is a financial statement. You can download different formats of bank statements and use any format which will help you send timely statements to your customers.

![20 Free Creative Brief Templates [MS Word] free creative brief template 12](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/free-creative-brief-template-12-150x150.jpg)

![Free Bank Statement Templates [Editable]](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/free-risk-register-template-11.jpg)

![Free Bank Statement Templates [Editable]](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/10/free-sop-template-11.jpg)