The financial power of attorney form is expressly composed to let another person go about as one’s legitimate agent while making cash decisions. By definition, it very well may be expressed as,

The Financial Power of Attorney (POA) is an authoritative document that authorizes another person to follow up for your benefit in financial decisions and matters.

This document is typically made according to one’s will. Like different forms of power of attorney, a person who makes the Financial POA is known as the Principal. In more straightforward terms, the Principal, in this specific circumstance, is the individual whose money is being protected. The individual who chose to follow up for the principal is known as the “specialist” or Agent as an Attorney-in-fact.

The financial Power of attorney is once in a while known as a general power of Attorney or Power of Attorney of Property. This kind of POA enables the agent to deal with the financial life of the principal when he/she can’t do as such. Much of the time, this report is given when the principal agent is not well, crippled, or is truly not present to sign the vital paperwork.

Financial Power of Attorney Versus Other POA

Financial power of attorney is one of the form of POA. There are a few different kinds of POA that one can use depending upon their particular reason:

- Limited Power of Attorney: The restricted POA gives the Agent insignificant power and as a rule, gives a given end date to the agreement. For example, a principal might designate a relative or a companion as a limited POA agent if he/she is inaccessible to sign the essential paperwork at a given time. In different cases, this kind of POA approves the agent to pull out cash from the Chief’s financial balance. The Limited Power of Attorney is likewise a sort of non-strong POA.

- Clinical Power of Attorney; A Clinical POA is otherwise called a Medical care POA. It permits the Specialist the power to pursue and execute significant clinical choices concerning the Foremost’s medical care when he/she is seriously debilitated or crippled to do so.

- Springing Power of Attorney: This sort of POA possibly becomes compelling when the agent is debilitated and can’t pursue choices autonomously. To produce results, the Springing Legal Power of attorney should frame the specific meaning of inadequacy to such an extent that there is no confusion concerning when the agent can start following up in the interest of the principal.

Understanding Financial Power of Attorney

The authority framed in the Financial POA can be genuinely expansive or prohibitive at times, restricting the agent to just unambiguous obligations. The specialists named in the financial POA are lawfully permitted to make choices about the Principal’s money, property, and clinical health. Following are a couple of questions that one necessity to comprehend to find out about the Financial POA:

Working on financial POA

Regularly, a financial POA is utilized during a health-related crisis. At the point when made up for the lost time in a health-related crisis, your financial necessities probably won’t be the first spot on your list. Tragically, these requirements don’t simply vanish because you are lying defenceless in a clinic bed. Your normal bills should be paid, your business accounts should be made due, and, surprisingly, the emergency clinic charges should be cleared.

Similarly, as Clinical POA just applies to clinical decisions that somebody makes for your sake, the Financial POA broadens something like the appropriate for a specialist to make and execute money choices for you on the off chance that you are not accessible to do as such without help from anyone else. In this way, if something unbelievable happens to you that keeps you from settling on dire financial choices for yourself (maybe because of a mishap, unexpected sickness, or basically because you are truly inaccessible), with a financial POA, your named Agent can keep everything chugging along as expected with your cash.

The primary justification behind making a Financial POA is to safeguard yourself and your family from a preventable fight in court. In this unique circumstance, the thought is to be certain that somebody reliable is consistently accessible to conclude what happens to your cash assuming you are crippled or inaccessible.

When a Financial Power of Attorney is executed, the first record is given to the Agent, who may consequently introduce it to an outsider as proof of your Agent’s power to follow up for your sake in financial issues. This implies that you are lawfully committed to vigorously on an outsider POA in managing your Representative.

Need of power of attorney

You want this lawful instrument in the accompanying three significant case situations:

- Busy schedules: Assuming that you work a bustling schedule, particularly one that involves normal ventures, you probably have the opportunity to embrace the jobs above all alone. In addition, you may frequently be punished if you don’t meet the specified titles. To that end, you need to designate something similar to a less bustling individual.

- Limited expertise: A portion of the tasks above requires a skill to embrace. The odds are you might not have the fundamental mastery to do as such. To have the option to work hard and meet the necessities of the letter, you will once more need to pick somebody with the right ability to do them for you.

- Legal compliance: In certain states, some issues are just performed by people who are capable and properly authorized to do likewise. On the off chance that you are not authorized, the main way forward for you is to pick somebody who has the very ability to do that.

Effectiveness of financial POA

Contingent upon how the document is phrased, a Financial POA can either become taking effect right now or in the event of a future occasion.

Immediate effectiveness

For this situation, the financial POA approves your Representative to follow up for your sake in any event, when you are free and not weakened.

For instance: If you are hitched, you will without a doubt need to have your mate pursue financial choices for you at whatever point confronted with a health-related crisis. Considering this case, making the financial POA take effect right now is an insightful decision.

For the most part, the more firmly related the Agent is to the Principal, the more probable the Chief would decide to quickly make the financial POA viable. Essentially, making the report take effect right now is likewise a savvy choice when the Principal is regularly out and about, yet he/she has loads of financial necessities that require official approval to finish.

The following is a list of key motivations behind why you should seriously mull over making your Financial POA take effect right now:

- Assuming you hope to be truly inaccessible for a specific deal that can hardly hang tight for your return

- At the point when you expect a forthcoming clinical issue that will deliver financial tasks troublesomely

- In situations where one needs to permit their life partner to finish financial commitments assuming they are much of the time away.

Specific effectiveness

A great many people need to save the choice of going with financial choices for themselves however long it might take. If you might want to name one of your kids or somebody all the more remotely connected with you as your Representative, making a springing power of attorney would be a smarter decision. For this situation, the occasion that would set off a financial POA to produce results is assuming that the Principal is crippled. Albeit this is a misfortune that nobody at any point needs to manage, it’s consistently inside the domain of probability.

Considering that a financial POA is attached to a crippling occasion, the document can become compelling when at least one specialist has confirmed that you are in a condition of being intellectually or genuinely unfit to pursue huge choices all alone. This is alluded to as “springing into impact” in the lawyer world.

Coming up next are a portion of the genuine circumstances that could make a financial POA spring into impact:

- If the Principal is in a state of unconsciousness

- The beginning of Alzheimer’s illness

- Psychological maladjustment

- The Essential’s powerlessness to impart.

Whether your financial POA produces results right away or later on after the event of an occasion, your Representative just gets the ability to go with financial choices for your sake when you award it.

Ending of financial POA

Normally, the power given by a Financial Power of Attorney closes upon the:

- The passing of the Principal

- The Principal chose to revoke the power whenever

- A court request proclaiming the POA invalid

- The Foremost’s insufficiency except if expressed in any case in the POA. A financial POA can be composed to especially express that the Principal’s power proceeds even in case of the Main’s insufficiency. This kind of POA is known as a Solid Financial Power of Attorney (DFPOA)

- In certain states, when the Principal has both named their life partner as the Agent and later separated from their companion

- The Main’s Representative neglected to satisfy their commitments as a financial POA. In any case, this can be tried not by naming a replacement specialist in the financial POA.

Who is an agent

For most expresses, the main legitimate necessities for turning into an agent are that the individual is of a sound brain and lawful age. Since your Agent can pursue financial choices for you, guarantee that you pick somebody who is mindful and has your well-being on the most fundamental level.

Legitimately, the named Agent must act to your greatest advantage, track exchanges, a commitment not to blend your property in with theirs, and not take part in any irreconcilable circumstance. Nonetheless, at times the Agent can act unlawfully.

Keep in mind: You should choose an individual that you can completely trust.

Commonly, a principal can concede an agent any financial honours they might see fit. Notwithstanding, it is fundamental that you first ponder the Agent’s genuine capacities and skills before allowing them the Financial POA.

Acknowledgement by outsiders

Maybe, you may be puzzling over whether a POA is OK by Outsiders. Regularly, an outsider isn’t expected to acknowledge an overarching legal authority. By the by, it is a legitimate necessity in certain states, and any outsider who will not acknowledge a legal authority is punished by utilizing the state’s true structure.

As recorded beneath, here are a few normal types of abilities that a financial POA specialist can do:

The most effective method to Get a Monetary Legal authority

Laying out a Financial POA includes a few stages. It is really smart to talk with a legal counsellor even as you go through the cycle. Coming up next is a framework of the means you will take while laying out a monetary legal authority:

Select an agent

You need to name one grown-up in your financial POA as the Agent answerable for pursuing financial choices for your benefit. Subsequently, sort out who will best suit this obligation. You can counsel your lawyer, family advisor, or confidence pioneer to assist with working with this process. When choosing the Agent, it is great to pick somebody who can serenely do these obligations while likewise thinking about others’ perspectives.

Determine the powers

Under a couple of explicit conditions, a power of attorney may not be important. For instance, if an individual’s resources and pay are likewise for the sake of their companions like on account of a joint financial balance or a joint bank account, then an overarching power of attorney isn’t required. Most people may likewise have a ling belief that selects a confided in a grown-up family member or companion to go about as a legal administrator, and in which they have put every one of their resources and pay. In any case, having a sturdy power of attorney is as yet smart in any of these referenced conditions. A POA gives a specialist who can be similar individual as the living trust’s legal administrator to deal with these issues at whatever point they emerge.

To be sure that your FPOA is satisfactory, contact anybody you figure your Representative would need to manage and check with them assuming your POA is adequate.

- Pay bills

- Purchase insurance

- Operate a business

- Sell assets

- Make taxes

- Contribute

- Gather retirement benefits

- Banking and other financial organization exchanges

- Claims and litigation

- Safe-store box access

- Giving gifts to people or charities

- Estate or business the executives

- Procure, rent out, or discard the property

- Issue out gifts

- Arrangement and handle motor vehicles

- Handle general healthcare issues

- Medical coverage Portability and Responsibility

- Sue outsiders

Seek after legitimate guardianship

In the event you can’t acquire this power yourself, think about seeking lawful guardianship. This guardianship ought to likewise be sought after if the man who is you are debilitated and can’t follow up on your own.

Take a look at the necessities of your state

Acting inside the law is consistently fundamental. Keep in mind, these arrangements and powers are administered by regulations that are made and differ from one state to another. You must check the prerequisites of your states that oversee such powers. Make certain to act stringently inside these limits to try not to cause some disruption to authority.

Execute

Whenever you have distinguished an agent, continue to finish up your state’s standard structures or financial foundation’s custom structures. A while later, execute the Financial POA by having the composed report authenticated and seen as required, putting away it securely, and giving duplicates to fundamental individuals. The first duplicate of the report ought to be given to your Representative, and your family and friends and family ought to be educated about the individual you select as your Representative.

Edit your document

After recording the details, you need to edit the report to make sure that every one of the snippets of data you outfit is exact and direct. It should explicitly explain the names of the agent, principal, and the sorts of abilities that are designated to an outsider.

Gather some witnesses

It is consistently important that you assemble a few observers to vouch for your understanding and choice, regardless of whether none is expected by your state. These are people who are not able to you two and in this way can offer dependable affirmation later on.

Notarize the document

However, this is likewise a discretionary step, which is enthusiastically suggested. You ought to authenticate the record to make it OK by the state. The system additionally wipes out any doubts and questions that might emerge concerning its legitimacy later on.

Save the document

Ultimately, you ought to save the document. Let each party to the understanding recover a duplicate for himself. These are you, the head, the observers, and the agent himself.

Audit the Financial POA occasionally

Preferably, a financial POA must be ready before you need it. Furthermore, since that time might be unforeseeable, a POA could exist for quite a while or many years. Consequently, occasionally evaluating the report along with your friends and family is smart. While auditing it, give close consideration to whether your Agent is as yet ready to serve in that limit or not, as conditions and regulations might have changed after some time.

Drafting a Financial Power of Attorney Form

A financial POA should be lawfully restricted to be powerful. To accomplish this, the document ought to be endorsed in Infront of a legal official public. In different cases, the FPOA form should be seen at the hour of marking. In any case, different states require the Agent to sign the document to demonstrate that they acknowledge the obligation.

By and large, while making a Financial Power of Attorney Form, your first and most significant step ought to finish up your state’s true form. In any case, remember that a few banks might expect you to involve their particular forms for your Agent to lead business there for you.

Additionally, some title insurance agencies, moneylenders, and closing agents have exceptional forms that the Principal should finish up before tolerating an agent’s activities. It is logical for you to wind up with more than one financial POA by the day’s end.

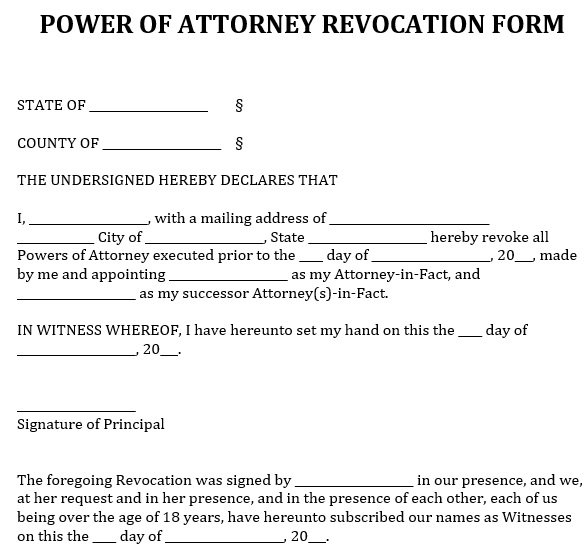

Revoking Financial Power of Attorney

Coming up next are the means expected to revoke a general power of attorney:

- Build the revocation document: Get going by developing your revocation document. While at it, pick an organization that is effectively perceptible and which shows the data you want in a decipherable way. You might look for motivation from legitimate sites.

- Fill out the form: Go on to finish the form. Make certain to make it plain that you are revoking a full power of attorney. Distinguish yourself and name the specialist as well. Ultimately, date the form suitably.

- Gather witnesses and notarize it:-To make the form all the more legitimately satisfactory, you need to show the form to certain witnesses and a legal official public. These people, you will track down in a regulation office or a bank. Allot their IDs and authenticate the form from that point.

- Write the word ‘REVOKED’: Write the word ‘Revoked’ in striking, dull, and huge letters. Make a few duplicates and your goal is to revoke the understanding. Join a duplicate of your ‘revoked power of attorney to each duplicate of the ‘first legal authority.’

- Inform your current specialist As a last measure, you need to tell your current agent of your choice to revoke the underlying power of attorney you had designated to him. Do likewise to all foundations which you might have a few dealings with. Use the ensured mail to demonstrate that the people to whom they are tended to get them.

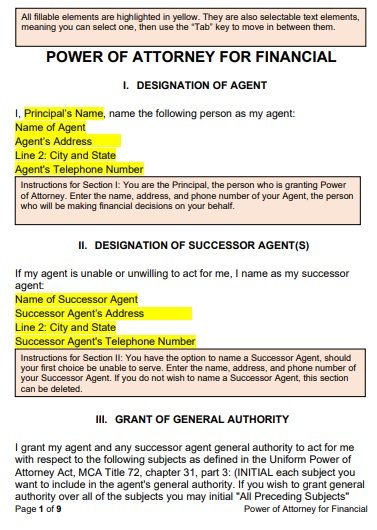

durable financial power of attorney form

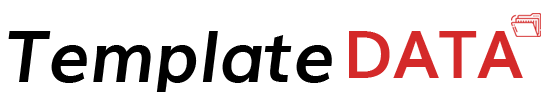

free financial power of attorney form

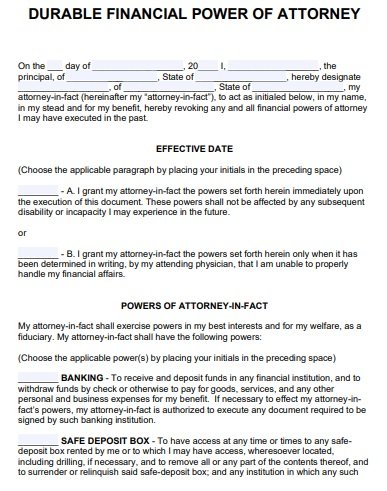

general power of attorney form

Conclusion

A Financial POA is an authoritative document that concedes a confided-in specialist the position to settle on financial choices for a principal agent. A financial POA is naturally viewed as solid in certain states, implying that it stays as a result of the Principal’s insufficiency. In any case, in different states, a financial power of attorney consequently becomes ruined once the Principal becomes debilitated or bites the dust.

Frequently Asked Questions (FAQS)

A ‘durable power of attorney’ comes as a result when the chief is either crippled or critically ill to such an extent that he can’t go with pivotal choices all alone. The ‘general power of attorney,’ in any case, is in force inside the lifetime of the head, not except if it is repudiated.

This necessity differs from one state to another. In many states, two witnesses are sufficient. Others might force three witnesses, yet others require no witness by any means. It is thus fundamental that you get to know the necessities of your state before continuing.

You have the elbow room to select anybody to go about as your lawyer. These people should be mature 18 years or more, intellectually steady, notable to you, and adequately reliable to deal with secret issues for your sake. Look at your state necessities, as well, all together that you do everything as per the law.

You truly need no legal counsellor to draft this arrangement. Nonetheless, a legal counsellor comes in while evaluating and legally approving the understanding later on. It is likewise great to enlist a legal advisor to survey the language utilized and to guarantee that each part of the report meets the current lawful limits.

Considering that you and your mate or someone else own property mutually, the property will naturally be moved to the survivor upon your demise. By the by, this won’t permit the other individual to sell or home loan the property if you become weakened, however, a Sturdy POA will.

Typically, a living trust will permit the legal administrator to execute business for the trust on the off chance that you become crippled. Nonetheless, a great many people don’t place all their property in that frame of mind of a legal administrator. Assume you own any property that isn’t in the trust; you ought to think about a DPOA for that property.

An ideal solution for this question would be; but lengthy you put it in a position to endure. Be that as it may, assuming you make a general power of attorney and set no date for which it will slip by, then the POA will go on until you pass on or become weakened.