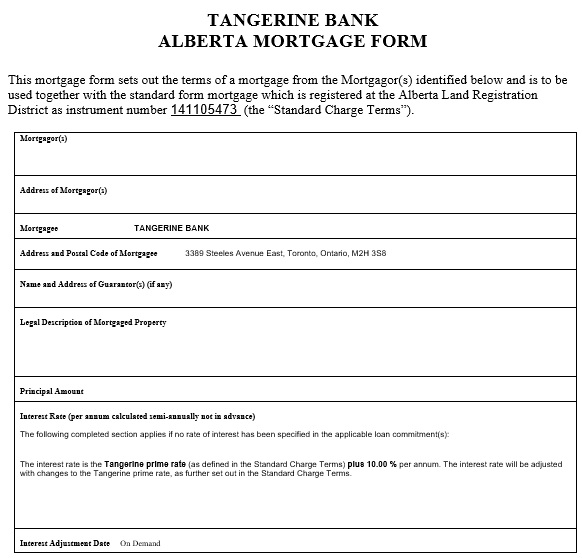

The mortgage lien release form is such type of a document which is also famous with the name of “satisfaction of mortgage”. Moreover, this form is also an acquired document and signed by a mortgage creditor. Similarly, this document is proof that the borrower has completed a payment agreement. Therefore, it will be documented by all the parties as “paid in full”. Further, the document has been filed and updated with the land registry, clear form of title should be delivered to the new landowner.

What is Satisfaction of Mortgage?

A satisfaction of mortgage also uses as Mortgage Lien release form is a legal document by the financial institution. Moreover, it is advising that the mortgage has been paid in full capacity and there will be no more lien on the property. Further, it states that the borrower has repaid the complete loan amount to the lender. It is agreed upon(include late payment fee or required payment by the lender).

What is Lien Mortgage?

A Lien mortgage is a lawful document claim on your home as an asset. However, it is complete when you are securing a complete loan(mortgage). The law gives the lender the right to liquidate the property if the borrower does not repay the loan.

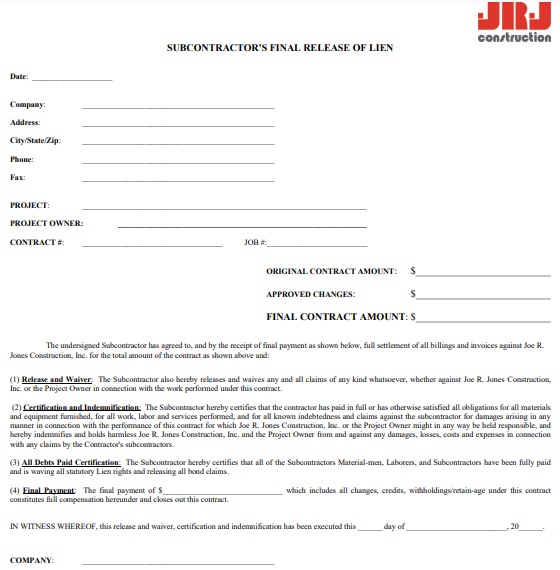

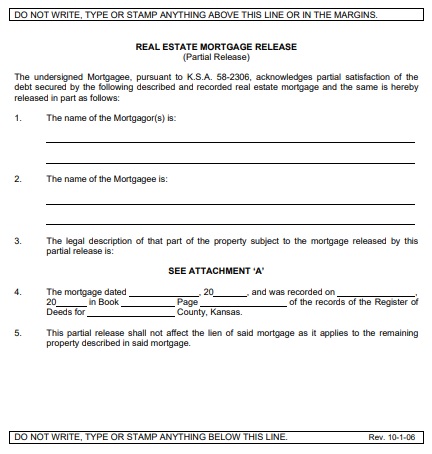

Instructions to make a mortgage lien release form

The Mortgage Lien Release structure might contrast starting with one state and then onto the next; nonetheless, there are key things that should be on it:

- Name of the payee

- Contract holder owner

- Amount of mortgage

- Mortgage’s date of execution

- Property’s full lawful details, which ought to incorporate the assessment bundle number

- An affirmation that instalments have been made in full

- An acknowledgement that the lender is set free from recording a lien on the property

- The mark of everything vital gatherings and the date the report was agreed upon

- At the point when the borrower has gotten the Mortgage Lien Release form, they should sign it and afterwards send it to the County Recorder or Land Registry Office for the lien to be eliminated. The record might be authorized and endorsed by an observer.

The states that as of now require both a public accountant public and an observer mark are:

- Arkansas

- Georgia

- Michigan

- Ohio

- South Carolina

- Vermont

A few districts in certain states that are not on the above rundown may likewise require a deed to be seen, so it is ideal to check on the off chance that this is required with your province recorder.

At the point when the loan specialist has not sent a mortgage lien discharge

By regulation, the lender should give the borrower a Mortgage Lien Release form once the obligation has been fulfilled. Without this desk work, the lien can’t be delivered. It can for the most part require as long as 3 weeks to get the desk work for a Mortgage Line Release. Be that as it may, on the off chance that you haven’t gotten one, you might have the option to set the line free from your end. This will rely upon if the state or province that you live in permits this. You would have to bring documentation that shows proof you have settled upon the obligation completely:

The Deed of Trust or Recorded Mortgage – can be gotten from a title attorney, title organization, or your County Public Records office where the property being referred to is enlisted

Recorded Assignments

Recent title responsibility, title search, or attorney’s title assessment

Confirmation of the home loan has been settled completely – instalment look at duplicates, settlement explanations, paid notes, and so forth.

Note: The territory of California just permits the evacuation of a lien by the lien holder. Banks should likewise send the release form in 30 days or less.

What occurs on the off chance that a mortgage lien discharge isn’t documented?

You should check what as far as possible is for a mortgage lien delivery to be filed in your state. If a loan specialist neglects to sign the delivery, they are at risk for any harm done and should suffer the borrower any consequences.

Assuming the borrower neglects to present the Lien Release, they will most likely be unable to sell the property on the off chance that verification that the obligation was settled completely can’t be introduced.

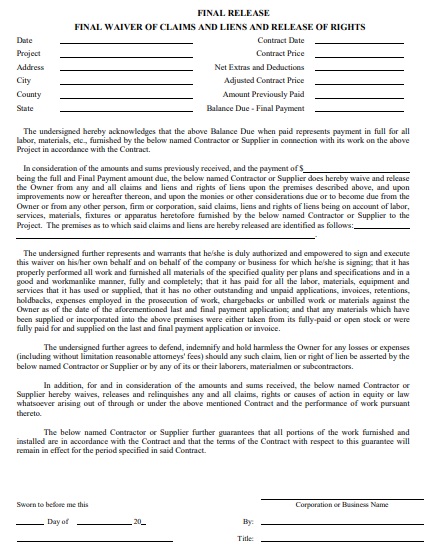

How to complete a Satisfaction of Mortgage?

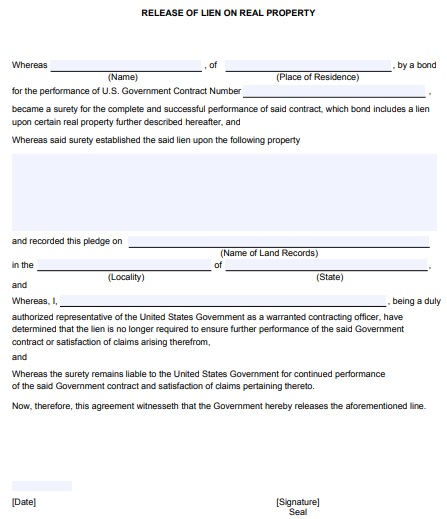

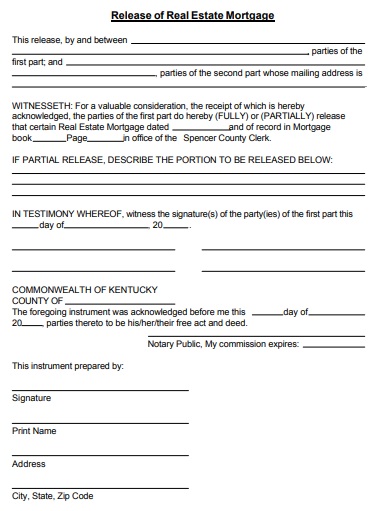

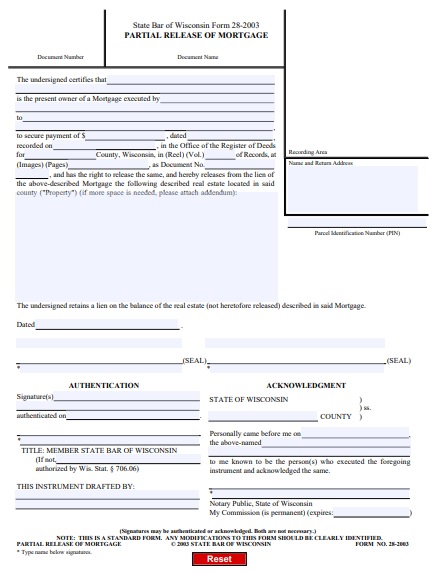

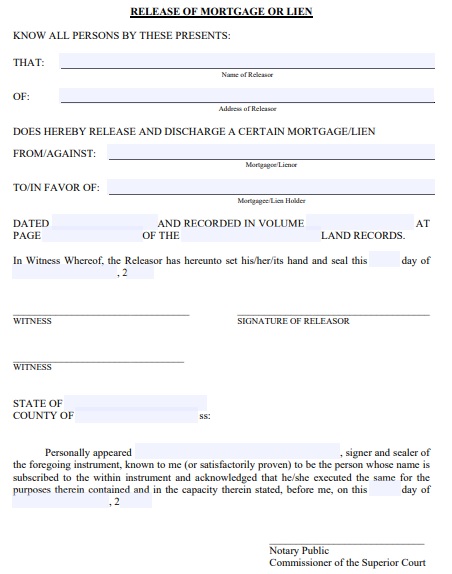

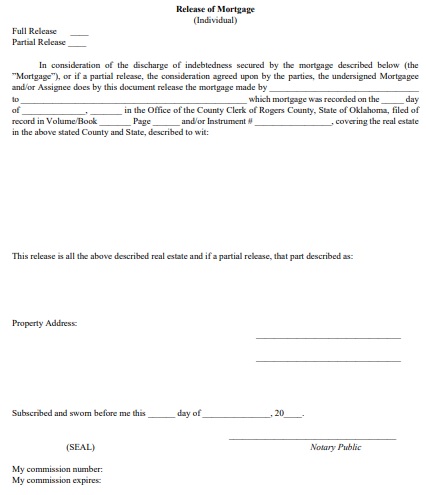

Identify the parties

The parties should list on the Satisfaction of Mortgage. The two main parties in the mortgage process are the mortgagee and the mortgagor. Moreover, an individual or family uses a home as collateral to secure and pay for a loan to secure and pay for a home. A mortgagee is a financial institution or entity that provided the funds that the mortgagor used to purchase the home.

Fill and Sign

After the issuance, the satisfaction of the mortgage should be signed by the mortgagee. However, there is a requirement for witnesses in some states. In addition to that following information should follow:

- The Payee name

- The owner of the mortgage holder

- Total amount by the mortgage.

- The full and legal description of the property to include the tax parcel number.

- The assurance that all payments are with full payment.

- The heading is about releasing the lender from filing a lien against the property.

- The date with the signature of all appropriate parties.

File and Record the Form

After the signature and notarization of the document. All the records of the document should be in the county local recorder’s office or land registry. Therefore, after the satisfaction of the mortgage, the line should lift. You may also like Open House Sign in Sheet.

Why Does Satisfaction of Mortgage Form Have a Large Blank Header?

The satisfaction of mortgage form has a blank header that is vital for the county recorder. Moreover, the county recorder will return the document after stamp and filing the number. Further, any necessary information will help to identify and record the document. To Conclude, you should leave this space blank and not alter it.

What’s the Main Difference between a Deed of Reconveyance and a Satisfaction of Mortgage?

Documents called Reconveyances transfer the title of a property from a trustee to a mortgagee. Moreover, in a Deed of Trust, the document acknowledges that all borrower obligations should be met and the payment should receive. They both serve the same purpose, though some states use one over another. The Deed of Reconveyance is most commonly used to refinance a home mortgage loan.

Does my Satisfaction of Mortgage need the Notary Republic?

The Notarization of the Satisfaction of Mortgage is necessary so that the document is authentic by a state-appointed official.

Where should I record the satisfaction of my mortgage?

The County Recorder or the City Registrar should be notified of satisfaction of mortgages. Likewise, the loan document will acknowledge and document that the previous mortgage pays amont in full and there is no longer a lien on the property. Depending on the state, some states require a Deed of Reconveyance rather than a Satisfaction of Mortgage. A lien will remain on the property title if the Satisfaction of Mortgage does not record.

What is a notary public?

Notaries Public are people who is going to appoint by the state to authenticate and authorize specific legal documents, such as deeds, contracts, mortgages, acknowledgements, and declarations. Therefore, no one denies the importance of this department for the verification of these documents. That’s why you should be careful when you are going to authenticate these documents.

Should Mortgage Lien Release Requires

Yes, after attesting from notary republic ensures that the document is authentic by a registered official point by the state. That’s why you must take necessary measures in all the mortgage documents when you are verifying them through the notary republic.

Penalties For Not Filing a Satisfaction of Mortgage,

There is a different statutory deadline by which the Satisfaction of Mortgage files in each state. Consequently, if the lender or responsible financial party fails to record and sign the Satisfaction of Mortgage, they will be responsible for all damages and penalties payable to the borrower. If the borrower is unable to provide legal documentation that the property is free from the full payment they may be unable to sell it in the future. Therefore, You should take the necessary measures when you are going to finalize the document. Further, you need to confirm all the steps so that you don’t find any problem in selling the land.

Conclusion

The mortgage lien release form is a document that uses when you have paid the full amount. It is also commonly famous with the name of the lien of release. The general lien attaches to all the debtor’s property. Moreover, when buying a house, the difference between a mortgage and a lien is negligible. Likewise, a mortgage is a loan you take out to buy property, whereas a lien is a clause in the mortgage. The Mortgage Lien release form is easily available online. You can download this document free of cost. This form is having different requirements according to state.

![Room Rental Agreement Templates & Forms [Word, PDF] free room rental agreement template 9](https://templatedata.b-cdn.net/wp-content/uploads/2021/08/free-room-rental-agreement-template-9-150x150.jpg)