A financial statement template alludes to an authority record of an element’s monetary exercises, either an association or a person. These composed reports evaluate your organization’s presentation, monetary strength, and liquidity. It additionally mirrors the monetary effects of occasions and deals of your organization.

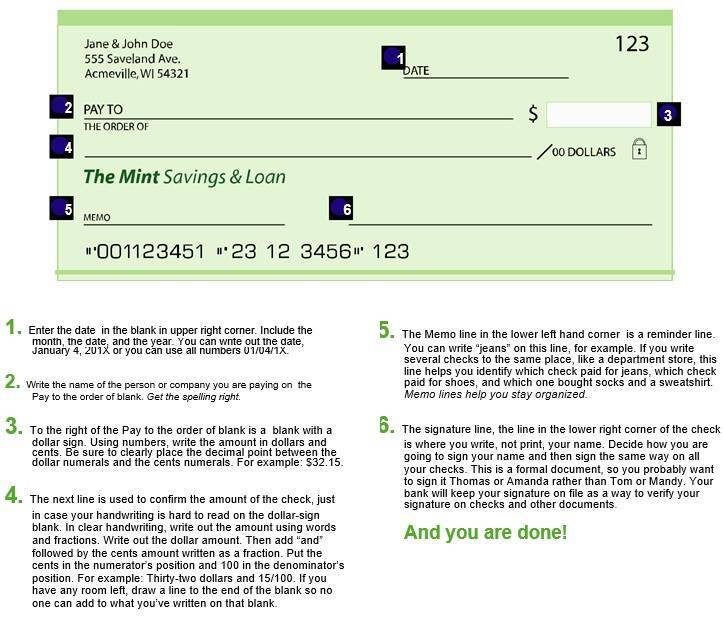

What is a financial statement?

You can likewise portray a financial statement template as a depiction of your monetary situation at one point in time. It characterizes your resources, your total assets, and your liabilities. In a perfect world, your total assets ought to be the contrast between your resources and liabilities. If you think of positive total assets, this implies that you have more resource liabilities. Be that as it may, on the off chance that you come by an adverse outcome, you have a greater number of liabilities than resources.

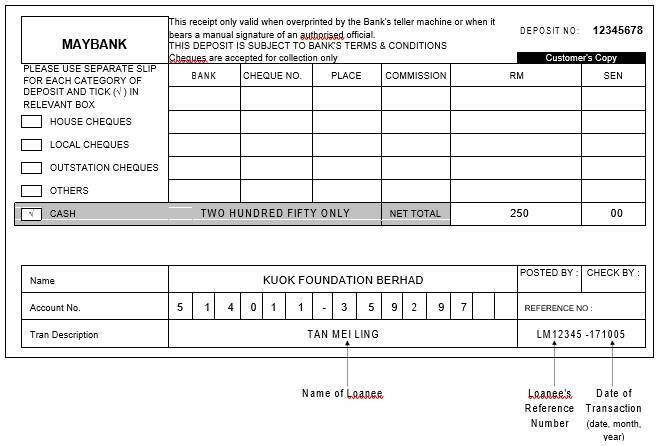

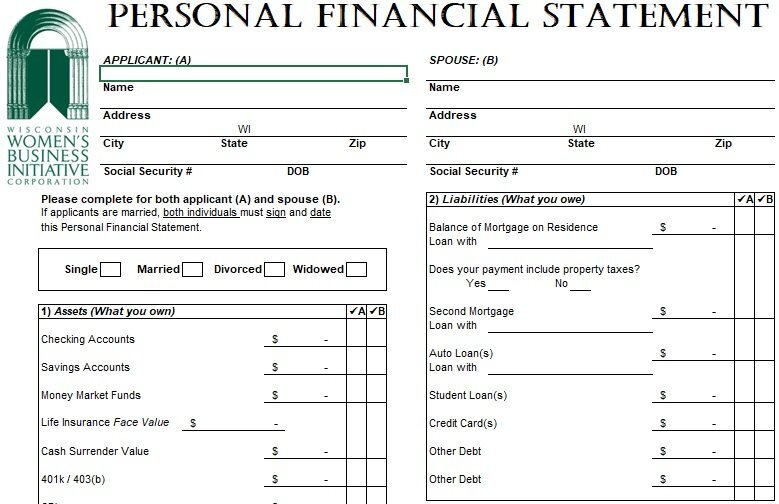

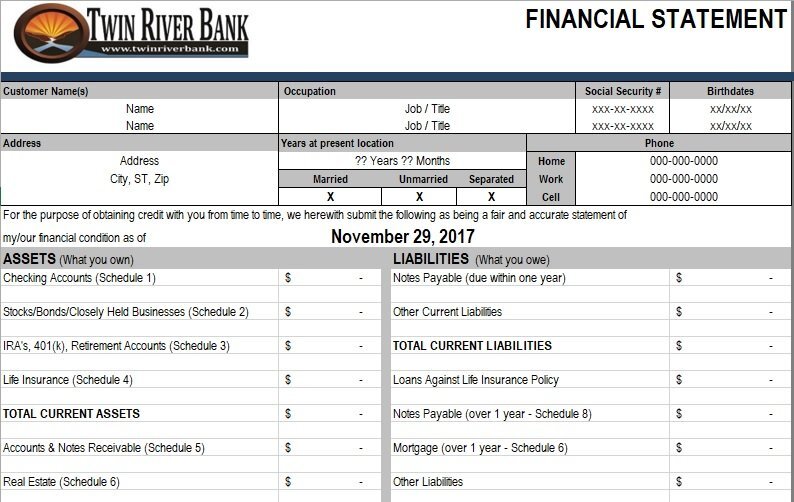

personal financial statement template

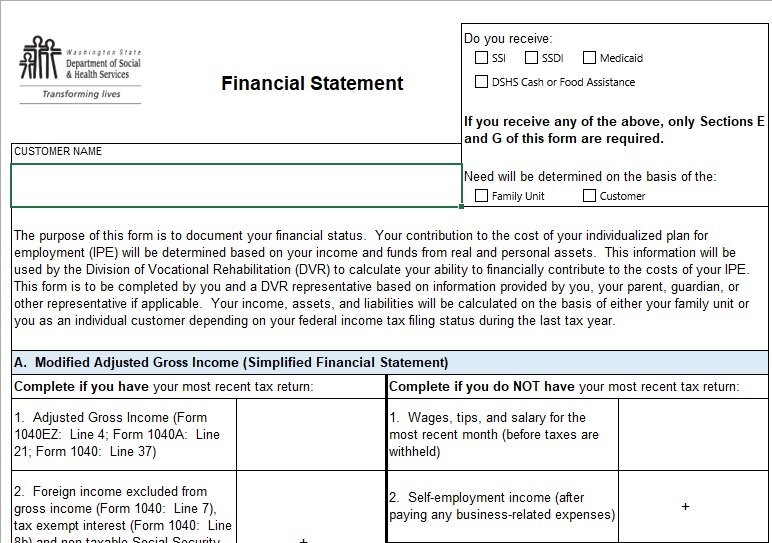

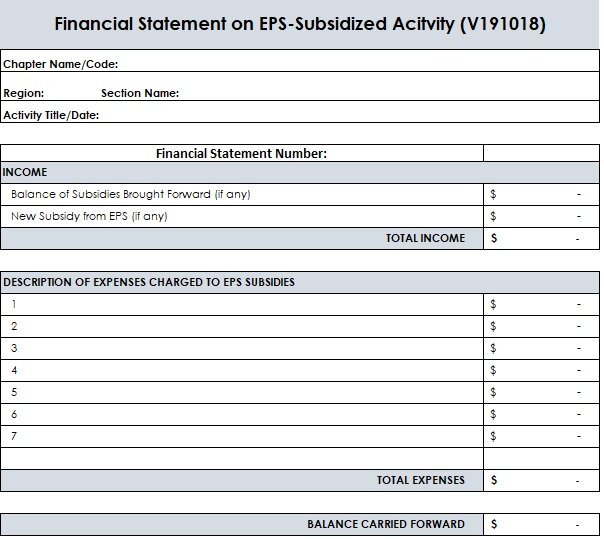

free financial statement template

free financial statement template 1

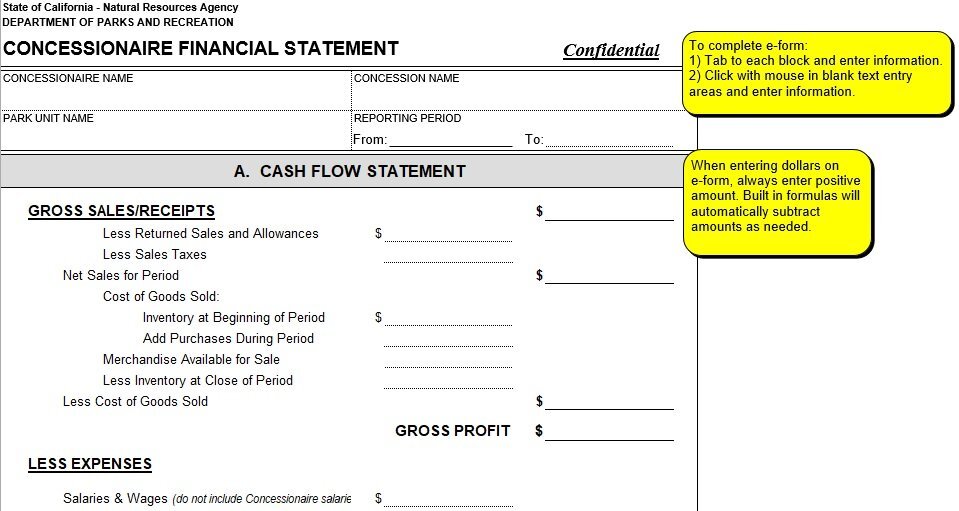

monthly financial statement template

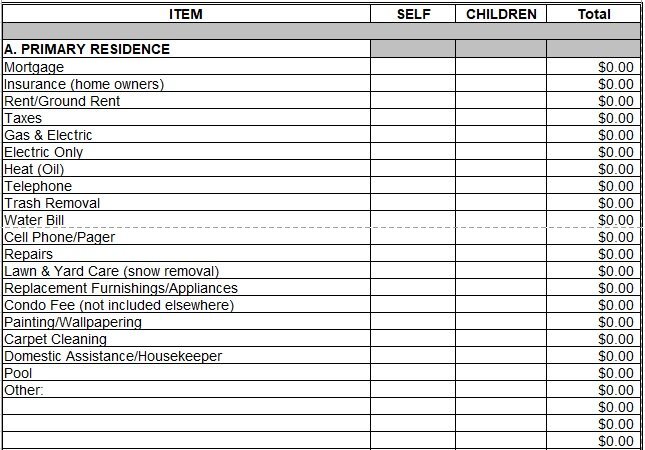

free financial statement template 2

free financial statement template 3

free financial statement template 4

free financial statement template 5

free financial statement template 6

free financial statement template 7

Types of Financial Statements?

As a rule, the financial statement template comes in various kinds. Before making a financial report template of your own, figure out what type you want first:

Income Statement

This is the most notable sort of explanation that contains your financial information for a predetermined timeframe – expenses, revenues, and loss or profit. This is otherwise called the statement of Financial Performance as it permits you to assess and gauge your financial performance starting with one period and then onto the next.

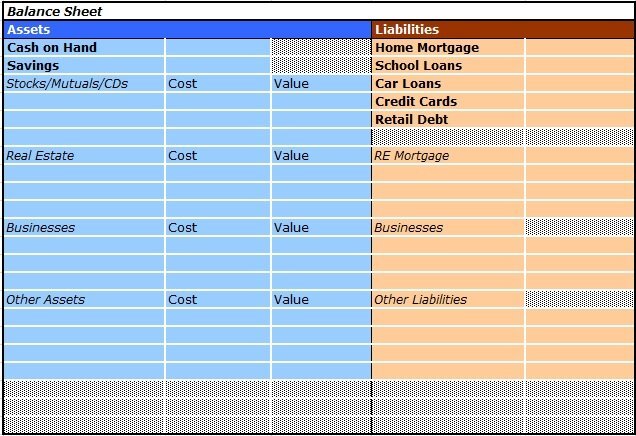

Balance Sheet

Likewise called the Statement of Financial Position, this assertion shows you the equilibrium of your liabilities, assets, and equity toward the finish of a specific period. It likewise shows you the upsides of your total assets. You can decide your total assets by deducting your liabilities from your total assets.

Statement of Change in Equity

This shows your organization’s investor commitments, equity movements, and equity balances toward the finish of a specific bookkeeping period. The data contained in this articulation incorporates the arrangement of offer capitals, complete offer capitals, retain earnings, profit payments, and other state reserves.

Statement of Cash Flow

This assertion shows the development of your money during a specific timeframe. You can utilize it to assist you with grasping your money development. This assertion has three segments – cash flow from your operation, cash flow from your investments, and cash flow from your financing activities.

Note to Financial Statements

Albeit this significant statement is frequently overlooked, it is a necessity by the IFRS. Through this statement, you reveal all of the information that matters so you can have a more profound comprehension of such. Use it to detail your financial information related to specific accounts.

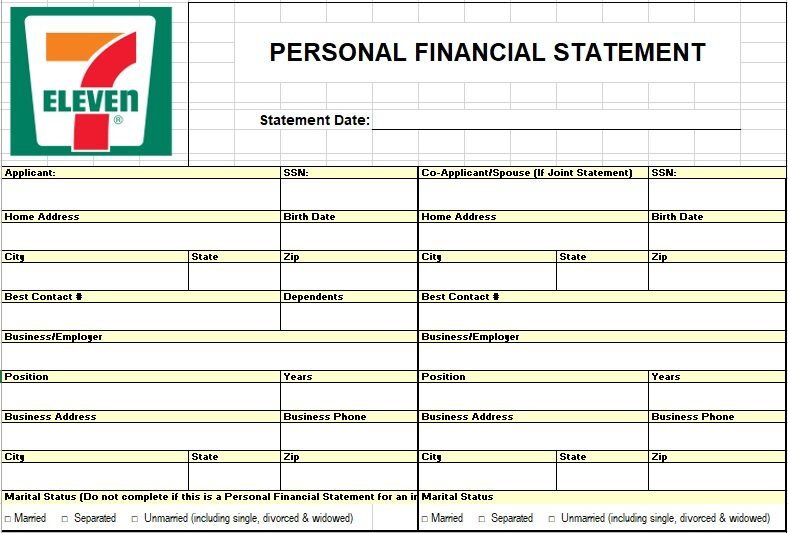

How would I compose a financial statement?

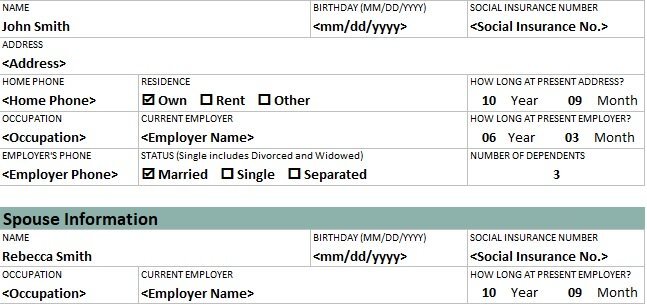

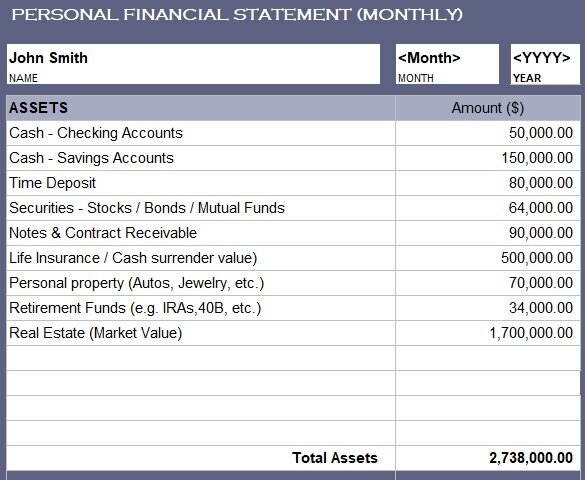

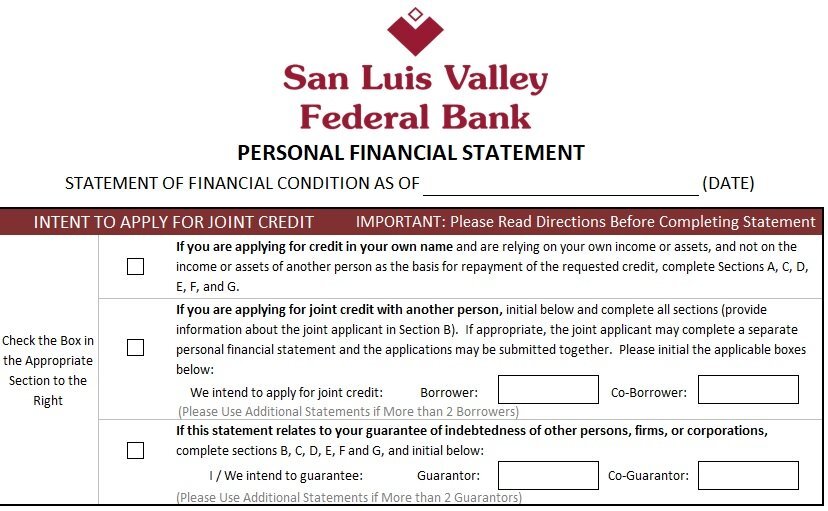

You would likewise utilize the financial statement template to report your financial activities and well-being to your possible creditors and investors. In such a manner, it becomes fundamental that your financial statement or business financial statement ought to incorporate the following elements:

Assets

These are the conceivable economic advantages that an outer entity gets and oversees past transactions.

Comprehensive Income

This is a difference in equity during a specific period from occasions, conditions, and transactions from outside sources. It ordinarily remembers each of the progressions for equity during the characterized period besides those approaching from distribution to investments.

Distributions to Owners

These are the decreases in net assets achieved by delivering services, causing liabilities or moving assets for proprietors. In addition, the distributions to owners diminish ownership interest.

Equity

This is the residual value in the remaining assets after you have deducted the liabilities. In an organization, equity alludes to an ownership interest.

Expenses

These are the outflows, causing liabilities or resources use during a specific period from creating or conveying services or merchandise that structure your organization’s central operations.

Gains

These are the equity expands that come from deals and a wide range of different transactions besides the ones that come from investments or incomes.

Investments by Owner

These are the net asset increments coming about because of the exchanges of something important from different entities to increment or acquire ownership interest.

Liabilities

These are the potential penances of economic advantages in the future from current obligations to offer types of assistance or transfer assets in the future because of occasions or transactions made before.

Losses

These are the equity diminishes from all occasions, conditions, and deals influencing your business during a specific period, except those which result from distributions or expenses.

Revenues

These are the upgrades or inflows of resources or a settlement of liabilities during a specific period from delivering services, creating or conveying products or different activities that comprise your central operations.

How to read a financial statement?

To comprehend what is the financial situation in your organization, both all alone or inside your industry, you initially should audit and assess a few financial spreadsheets including every one of the various sorts referenced previously. You will find the significance of these financial statement templates when you figure out how to understand them:

Reading a Balance Sheet

This report gives your organization’s “book value.” With it, you can see the assets your organization has and how you funded these assets starting around a predetermined date. The record shows your organization’s liabilities, proprietor’s equity, and assets.

Reading an Income Statement

This report provides you with an outline of the cumulative effect of gain, expense, loss, and income transactions for a specific time frame period. You would share this as a feature of your organization’s yearly or quarterly report. It shows the data on business exercises, comparisons, and financial trends, throughout set periods.

Reading a Cash Flow Statement

The principal reason for this record is to provide you with an itemized preview of what befalls your organization’s money during a specific period. It shows how your organization can function in the long-and present moment, in light of how much money streams into and out of your organization.

Reading an Annual Report

This is a composed report that you should distribute every year to your shareholders. It describes your organization’s financial and functional circumstances. Past the publication, the report gives an outline of your organization’s financial data that incorporates your organization’s balance sheet, cash flow statement, and income statement. Furthermore, it likewise gives you experiences about your industry, the conversation and assessment of your accounting arrangements, your organization’s supervisory group, and any extra information about your organization’s investors.

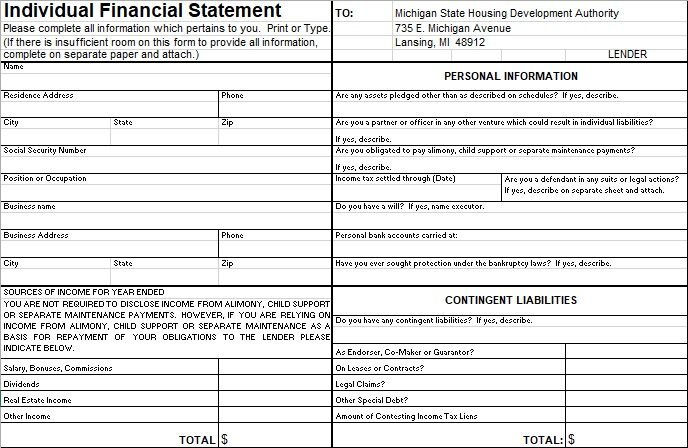

individual financial statement template

free financial statement template 8

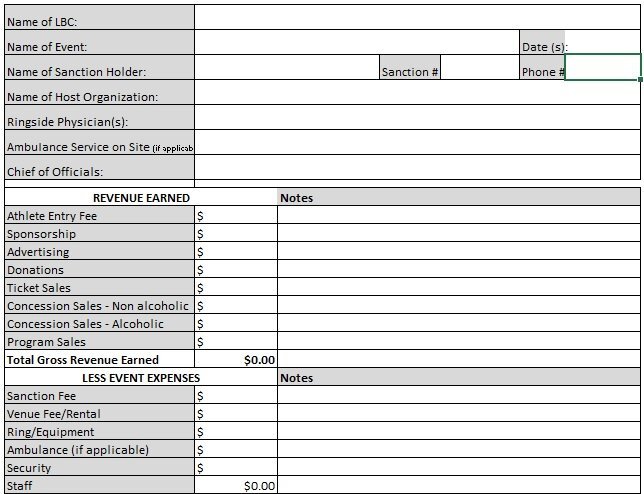

financial statements competition

free financial statement template 9

printable financial statement template

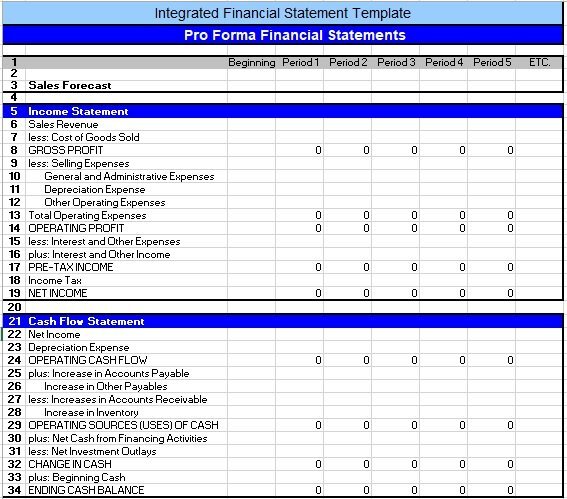

integrated financial statement template

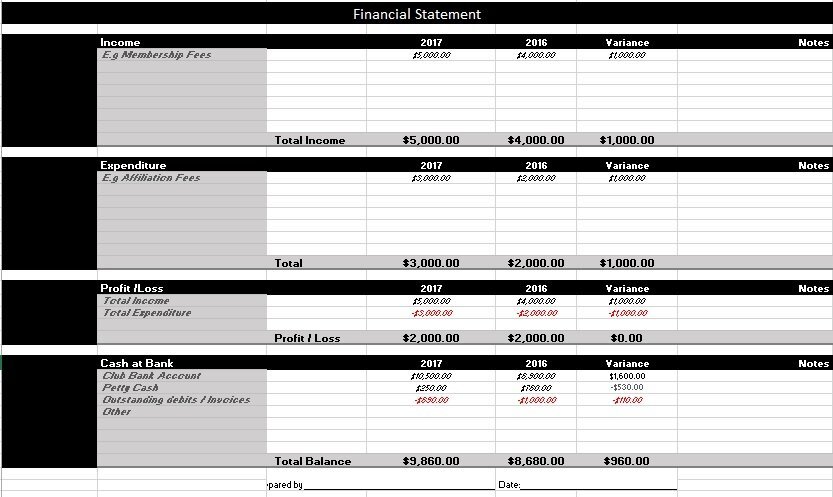

financial statement template excel

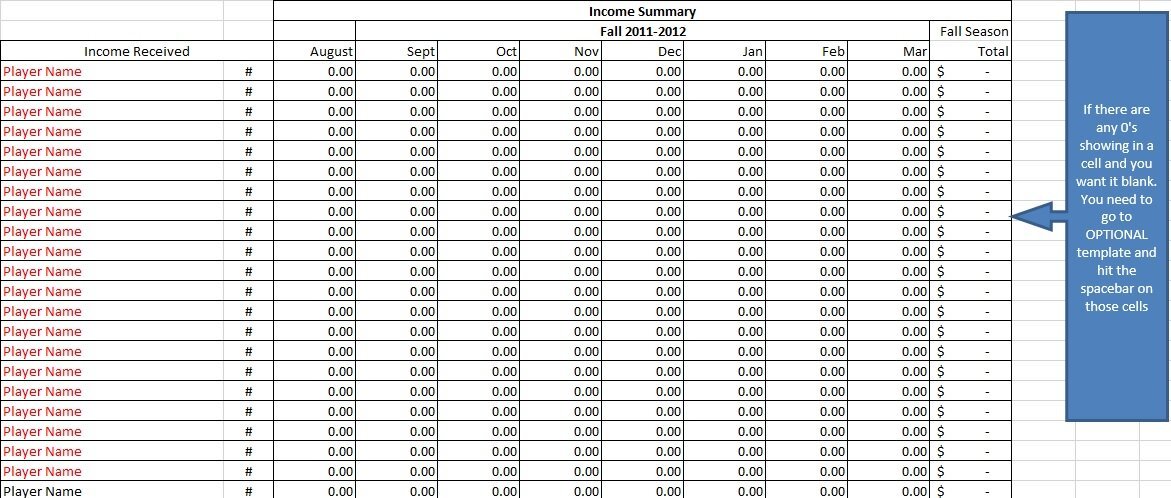

financial statement spreadsheet

How would I make financial statements?

Step-by-step instructions to Offer a Financial Statement for Small Business

- Accounting report.

- Pay Sheet.

- Explanation of Income.

- Stage 1: Make A Business Estimate.

- Stage 2: Make A Financial plan for Your Expenses.

- Stage 3: Foster a Cash Flow Statement.

- Stage 4: Project Net Benefit.

- Stage 5: Manage Your Assets and Liabilities.

Conclusion

The financial statement templates include monetary records, income, and income statements and get a superior comprehension of your organization’s finances. Taking care of your private company finances requires something beyond understanding what’s in your financial state. These three financial statements give a preview of the financial statements of your business. This will permit you to make heads or tails of your accounting and can be a helpful instrument while pursuing investors or applying for a business loan. Entrepreneurs utilize various sorts of financial statements to acquire a superior viewpoint of their organization’s ongoing financial state. Every one of the three principal financial statements centres around a specific part of your finances. While a whole arrangement of financial statements recounts the total story of an association, each report can remain all alone for various purposes and is frequently utilized for outer reporting.

FAQs (Frequently Asked Questions)

What is a financial reporting template?

A financial reporting template is a record used to execute the accounting ideas of Shutting the Books and Groundwork for Financial Reporting.

Can I prepare my financial statements?

Be that as it may, with the assistance of the program, you might have the option to set up your financial statements. Assuming you want to get ready financial statements for an outsider, for example, a financier, once in a while the outsider might demand that the budget reports be ready by an expert accountant or certified public accountant.

What are the 4 fundamental financial statements?

There are four primary financial statements. They are (1) balance sheets; (2) income statements; (3) cash flow articulations; and (4) explanations of shareholders’ equity. Balance sheets demonstrate what an organization possesses and what it owes at a decent moment.

Who makes a financial statement?

Who prepares a Company’s Financial Statements? An organization’s management has the obligation of setting up the organization’s financial statements and related divulgences. The organization’s outside, the free reviewer then subjects the financial statements and revelations to an audit.

What is the most important financial statement?

The main financial statement? for most of the clients is probably going to be the income statement, since it uncovers the capacity of a business to produce a profit.

![20+ Free Balance Sheet Templates & Samples [Excel] trial balance sheet excel](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/trial-balance-sheet-excel-150x150.jpg)

![Free Bank Statement Templates [Editable] printable bank statement template 5](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/printable-bank-statement-template-5-150x150.jpg)