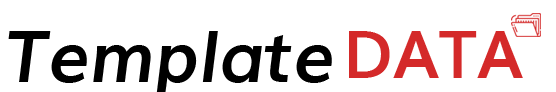

The auto expense report template is a document that keeps records of businesses, professional trips, vehicle repair expenses and maintenance. Moreover, drivers use their vehicles for business purposes. They save their money because they don’t have to buy or rent cars. Further, this does not only save money but compensate employees for driving time, gas expenses, car repairs and maintenance. The big reason they organize their business mileage perfect is due to two reasons. One is that they complete their mileage reimbursement form. The second is that they need to determine their right mileage deduction for tax returns. That’s why the figure should be accurate as possible. This is important to keep a mileage expense report every time. What type of help you can get from it? It is quite obvious that with the help of an expense report template you can produce the needed requirement of business mileage tracking logs.

Free Auto Expense Report Templates

You can easily develop your report document in Microsoft Excel. If you have no expertise, you can download the ready-made document and fill in them all the required details. So, you can keep track of all the auto expense logs, repairs and maintenance.

What is An Auto Expense Report?

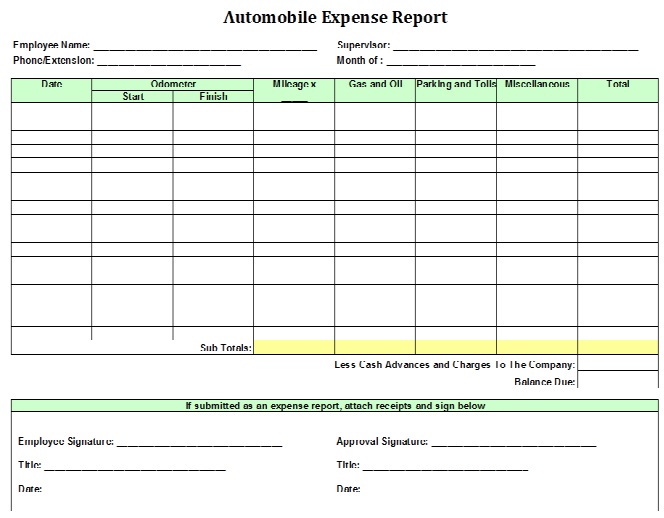

The vehicle expense report is for maintaining expense repairs and maintenance of your vehicles. Moreover, employers save money because their drivers utilize their cars for business purposes. Consequently, the employees get money in terms of gas expenses, driving time, car repairs and maintenance. The benefit goes to company owners because they don’t need to purchase or rent cars.

How to make a Vehicle Expense Report?

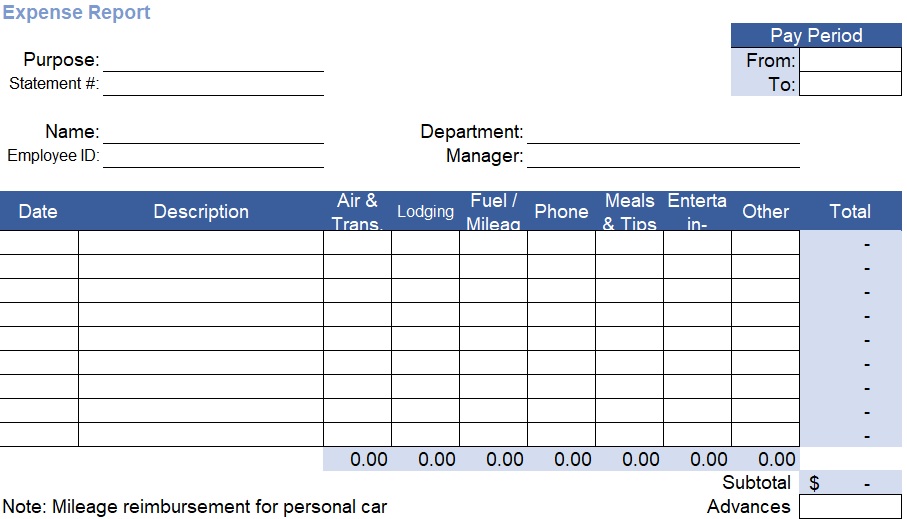

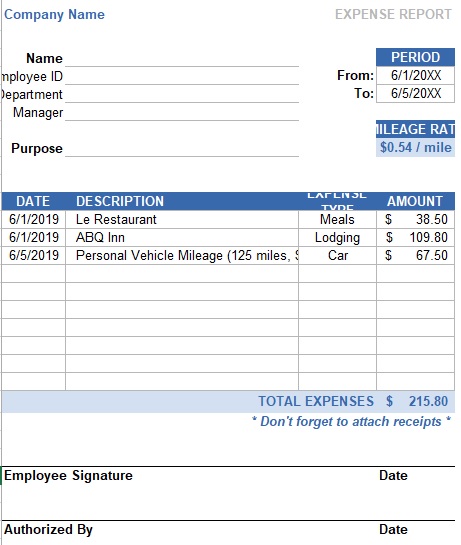

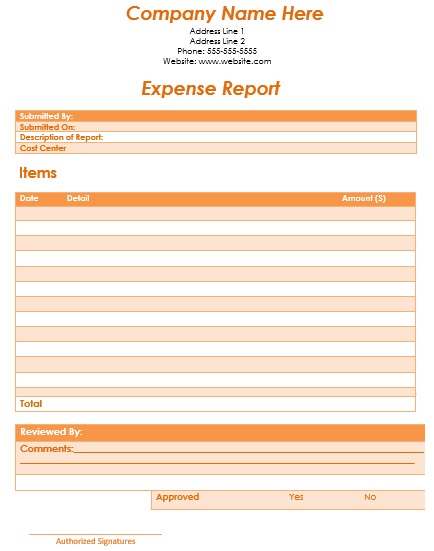

It will make more worth of your report if you will include the following details:

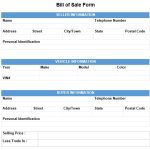

- You should write your name and address. Moreover, identify your owner and mention your company’s legal address.

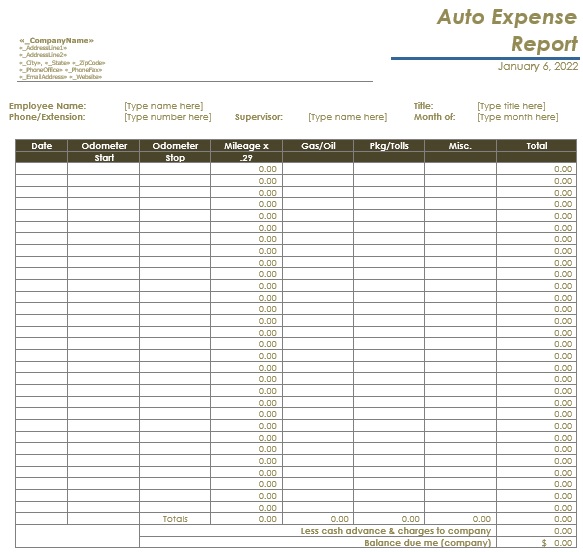

- Give details of your vehicle description. It should include car type, model, year of manufacture and vehicle identification number.

- This will make more worth of your expense report if you will include the date, reason and location of each trip.

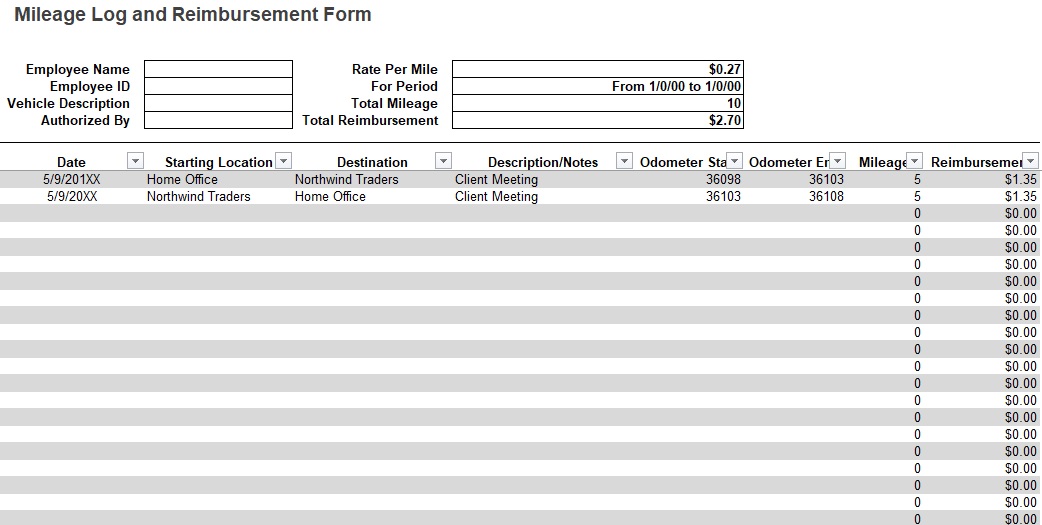

- Provide odometer readings(reading at the start and end of the trip)

- How much money do you spend on gas, tolls, oil changes, maintenance and repair.

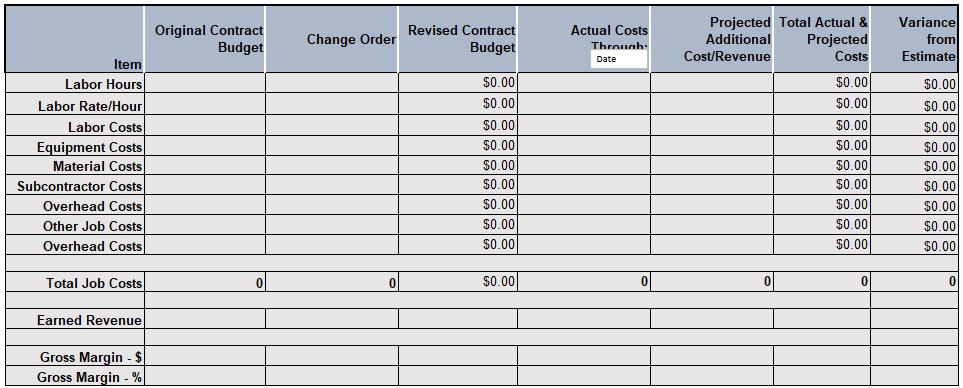

- You can compose a table for indicating the date and type of each expense, who paid it and the total amount of costs. Employees get reimbursed for the costs during the business trips. You can draft a gas mileage log to explain how much gas is used during the trips and you can get a refund from your employer.

- You can record the mileage travelled for each trip. It is allowed to maintain a separate mileage book. It is submitted to IRS for the further deduction.

- When you pay insurance fees, you don’t need to pay IRS for insurance expenses. Moreover, you need to talk to the employer who will pay for the business car insurance that covers work-related trips.

You can add any type of information that is relevant to trips. Further, you should have evidence for expenses, keep track of business mileage, gas consumption, business-related tolls and odometer readings. Similarly, you can submit an expense report to receive compensation and keep a copy of the document for record.

How to create a Car Expense report in Excel?

If you have expertise in Microsoft Excel, it is to make your report easily. The following steps are required to develop it.

- For Each expense detail you need to enter the date and description.

- Further, you use the dropdown menu to select payment type and category for each type of expense.

- For each type of expense, enter the total cost.

- Attach all necessary receipts to the document.

- Submit for review and approval of the report.

What Should Include in an Expense Report?

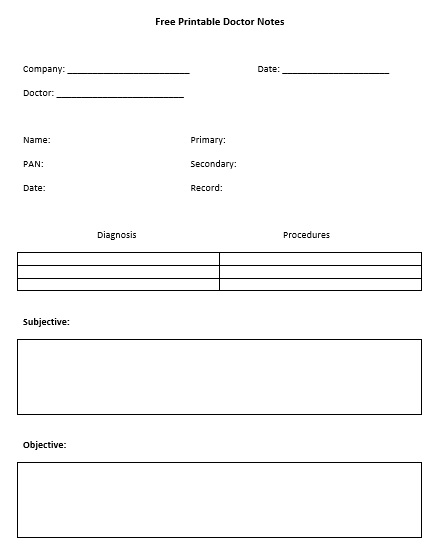

The nature of the auto expense report is such that you give details of each trip on a daily basis. Moreover, you can enter all the details of daily gas consumption, mileages before starting and covered after ending the trip. You need to enter the details of oil changes which are on a monthly basis. Therefore, you can keep your vehicle in good condition. You can also keep a record of tolls slips so that you can reimburse at the end of each month from your supervisor. Similarly, you should attach all the receipts of gas consumption and attach them to the daily expense sheet. This will make it easy for you to show the total expenses on a weekly, quarterly or monthly basis. You can report further your daily mileage for your business and enter it into the logbook. You can use the mileage reimbursement form and calculate the amount to submit an expense report. This millage reporting form is very useful for keeping track of the destinations you travelled, miles driven and the total amount for the claim.

Precautions Before Sending Expense Report

You should use these precautions so that you can efficiently manage your report.

- Keep a record of gas consumption slips on daily basis.

- Attach all the toll slips you used on each tour.

- Enter the odometer (reading before starting the trip and after finishing the trip)

- The good approach is that you make a total of your expense on daily basis and you can reimburse from the company on weekly basis or as per the policy of your company.

- Enter the car model, oil changes date, car identification number and put it in the relevant logbook of the vehicle.

- You can submit your report by preparing it in Microsoft Word or Microsoft Excel and sending it through email.

- Make sure that you attach all scanned copies of your document so that the company supervisor or manager will reimburse you all the amount.

Conclusion

The auto expense report template uses for maintaining professional trips, car tour details and maintenance expenses. Most company owners are not using their car and they utilize their drivers’ cars and save money of purchasing or rent. Moreover, drivers get reimbursement for gasoline, oil changes toll slips and repair and maintenance expenses. They submit a report which they can prepare in word or excel or reimburse the money from their employers.

![Free Petty Cash Log Templates & Forms [Excel, Word, PDF] free petty cash log template 3](https://templatedata.b-cdn.net/wp-content/uploads/2021/06/free-petty-cash-log-template-3-150x150.jpg)

![25+ Free Inventory List Templates [Word, Excel, PDF] free inventory list template 3](https://templatedata.b-cdn.net/wp-content/uploads/2021/08/free-inventory-list-template-3-150x150.jpg)