Managing bills effectively is one of the most crucial aspects of personal and financial organization. From utility bills to credit card payments, rent, and subscriptions, staying on top of due dates ensures you avoid late fees, maintain a healthy credit score, and keep your finances stress-free. A bill payment schedule template can be a lifesaver, providing structure and visibility to your financial commitments.

In this comprehensive guide, we’ll dive deep into the importance of a bill payment schedule, how to create one, tools you can use, and tips to make it work seamlessly for you.

What is a Bill Payment Schedule Template?

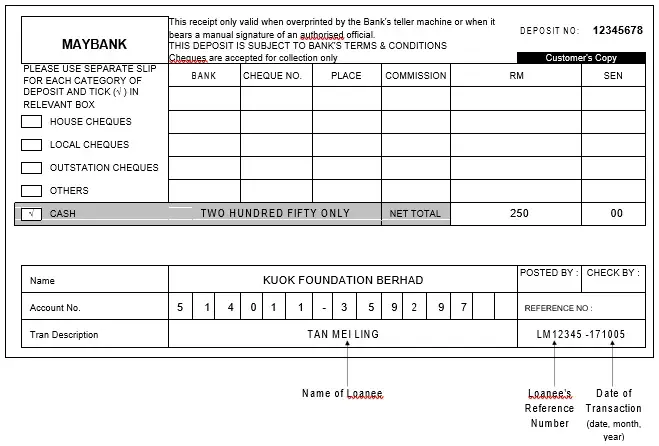

A bill payment schedule template is a document or tool that allows you to organize all your recurring payments in one place. It includes details like:

- Bill description (e.g., electricity, internet, mortgage).

- Payment amount.

- Payment frequency (monthly, quarterly, annually).

- Due dates.

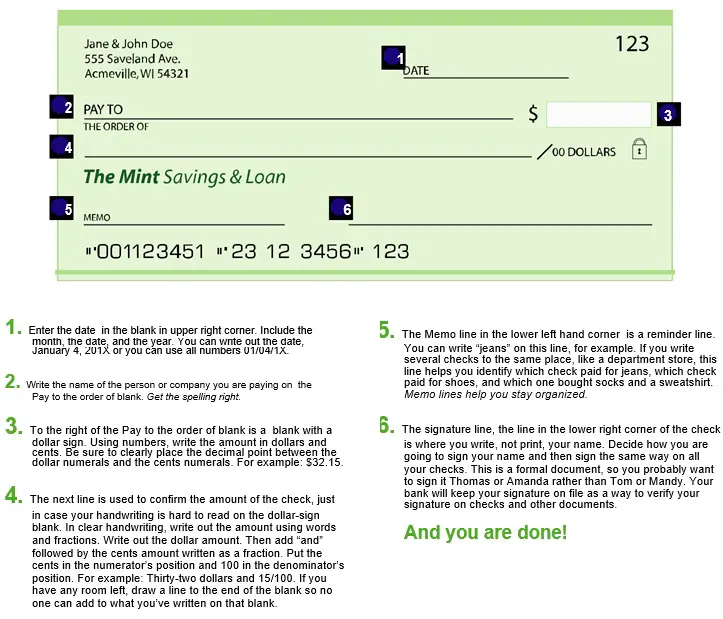

- Payment method (online, direct debit, check).

Having such a template helps track your financial obligations, avoid late payments, and maintain an overview of your spending habits.

Why Do You Need a Bill Payment Schedule?

- Avoid Late Fees and Penalties

Missing due dates can lead to costly late fees, penalties, or even service interruptions. A schedule ensures all payments are made on time. - Improve Credit Score

Late payments can negatively affect your credit score. A payment schedule helps keep your credit report spotless. - Budgeting Made Easy

Tracking payments allows you to allocate funds efficiently, making budgeting a more straightforward process. - Reduced Stress

Knowing when payments are due removes the guesswork and financial anxiety from your life.

Step-by-Step Guide to Creating a Bill Payment Schedule Template

Step 1: Gather Information

Start by listing all your bills. This includes everything from fixed expenses like rent and car loans to variable ones like credit card payments and utility bills. Include:

- Service provider name.

- Account number (optional but helpful).

- Billing cycle (monthly, bi-monthly, quarterly, etc.).

- Payment method.

Step 2: Choose a Template

You can create a simple bill payment schedule using tools like:

- Microsoft Excel or Google Sheets: Highly customizable for creating a spreadsheet.

- Pre-made Templates: Platforms like Vertex42 offer free bill payment schedule templates.

- Apps: Budgeting apps like Mint or YNAB (You Need a Budget) have built-in bill tracking features.

Step 3: Organize Bills by Frequency

Categorize your bills based on their payment frequency:

- Monthly: Rent, internet, utilities.

- Quarterly: Insurance premiums.

- Annually: Subscriptions, memberships.

Step 4: Add Payment Deadlines

Include specific due dates for each bill. Consider adding reminders 2-3 days before the due date to ensure timely payments.

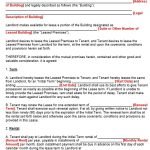

Step 5: Include Payment Methods

Specify how each bill is paid:

- Auto-pay: Great for fixed bills to avoid forgetting.

- Manual payment: Useful for bills with variable amounts.

Step 6: Regularly Update the Schedule

Make it a habit to review your schedule monthly to account for changes like new bills or canceled services.

Recommended Tools for Bill Payment Scheduling

1. Spreadsheets

Using platforms like Google Sheets allows for customization, sharing, and access from any device. Start with a template like the Bill Payment Tracker by Smartsheet.

2. Mobile Apps

- Prism: Consolidates all your bills in one app and sends reminders.

- PocketGuard: Tracks payments while keeping tabs on your overall budget.

3. Bank Alerts

Many banks provide bill payment alerts via text or email, helping you stay ahead of due dates.

Tips for Making Your Bill Payment Schedule Work

- Set Up Automatic Payments

Auto-pay ensures recurring bills are paid without manual intervention. - Review Monthly Statements

Double-check for discrepancies or unauthorized charges. - Keep Emergency Funds Handy

Having a financial cushion helps cover bills in case of unexpected expenses. - Sync with Your Calendar

Link your schedule to Google Calendar or iCal for added convenience and reminders. - Go Digital

Switch to electronic bills to reduce paper clutter and access records easily.

Frequently Asked Questions (FAQs)

A simple spreadsheet works best for most people due to its flexibility. However, dedicated apps can provide additional features like automated reminders.

Review it monthly to ensure all bills are accounted for and reflect any changes in payment amounts or new subscriptions.

Contact the service provider immediately to explain the situation and request fee waivers if possible. Update your schedule to avoid future misses.

![12+ Free Rent Payment Tracker Spreadsheet [Excel, PDF] free rent payment tracker template 3](https://templatedata.net/wp-content/uploads/2021/10/free-rent-payment-tracker-template-3-150x150.jpg)