Allow your business finances with the balance sheet template. However, it shows increases and decreases in net worths, assets or liabilities. Further, with the help of this template, you can determine equity and make more informed business decisions. Moreover, you can take start by completing examples of the balance sheet. The use of this document is easy. You can customize it as per your needs. In Addition, this document helps you complete work in less time. This is also easily accessible.

Furthermore, you need a simple sheet to review your financial contents. However, the excel balance sheet is one of the third most important documents. Moreover, it helps you in tracking the business performance.

A balance sheet is a financial statement. It shows the details of assets, liabilities and owner’s equity at an exact point in time. Further, it gives you a foundation for computing rates. Similarly, it is useful in return and assessing capital structure. Moreover, a balance sheet expresses in the following way:

Assets = Liabilities + Owner’s equity.

It means the stakeholder’s equity must be equal to Assets minus Liabilities.

The date in the balance sheet also represents that date in which information about the financial position. Further, the date is normally the end of the month, quarterly or yearly.

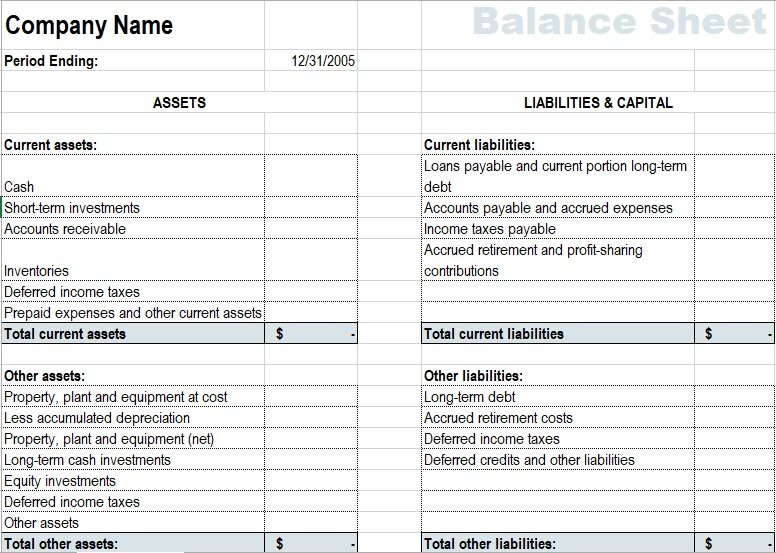

Balance Sheet Templates

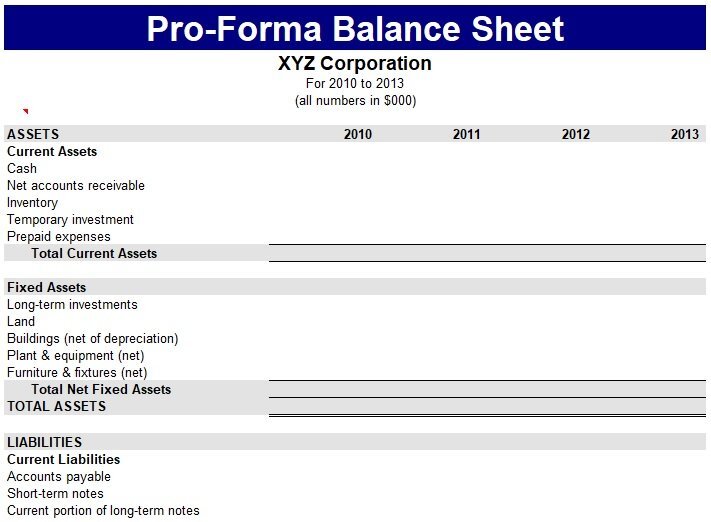

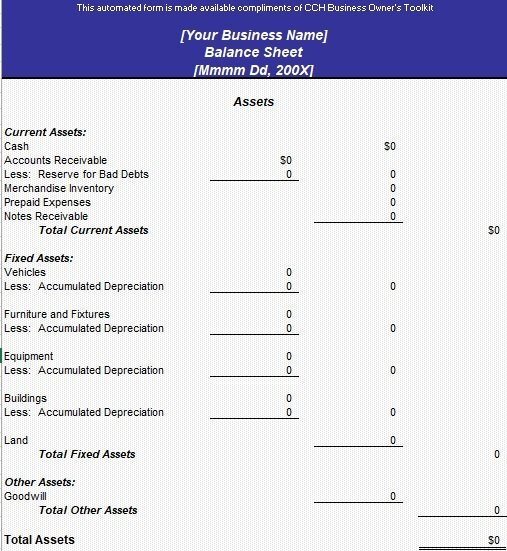

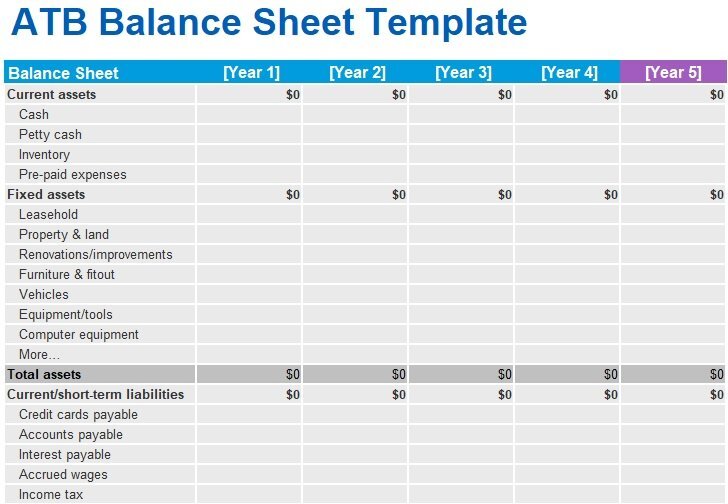

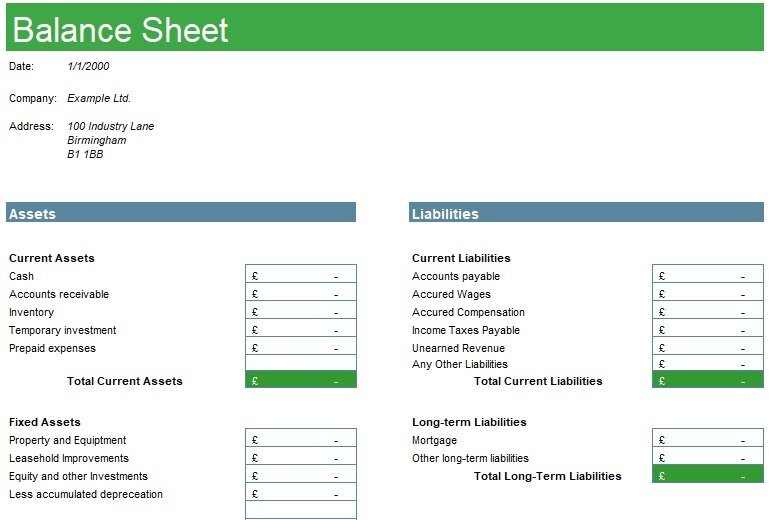

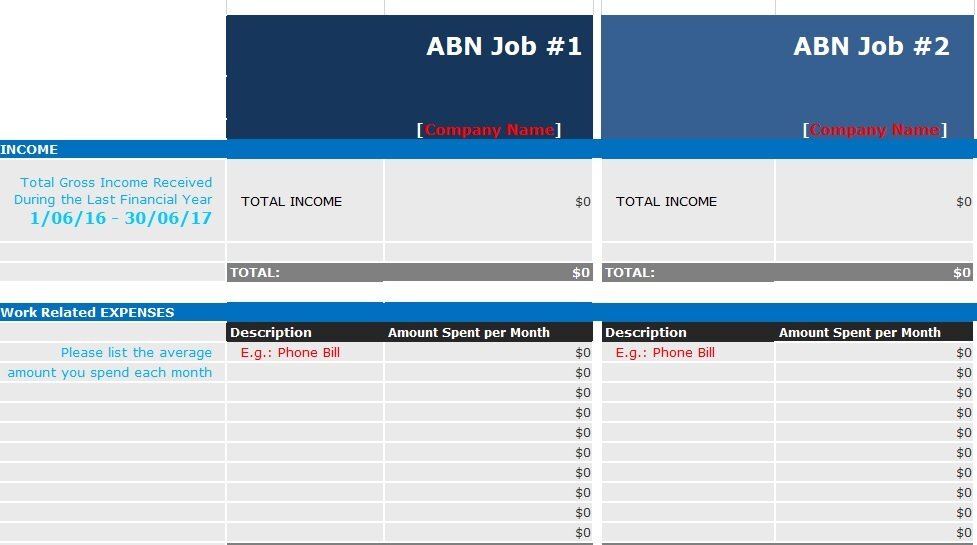

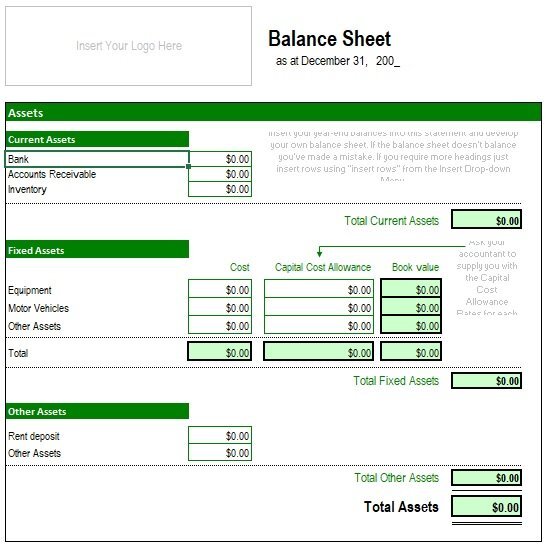

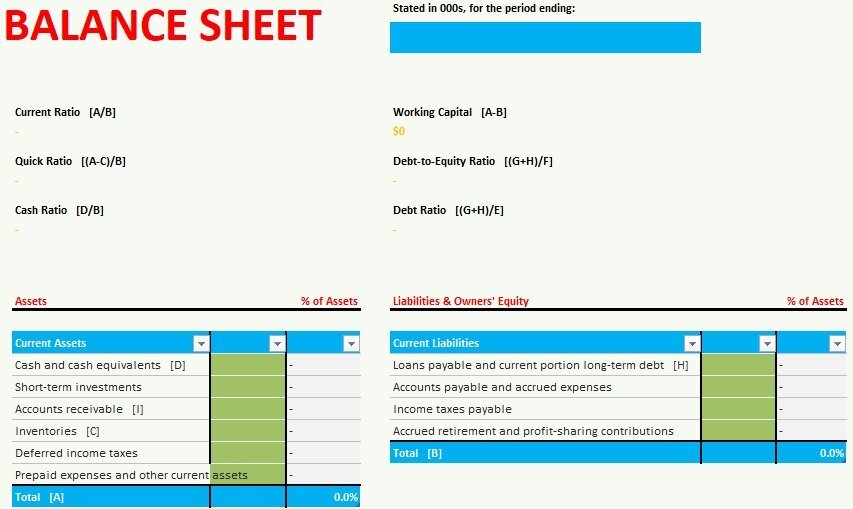

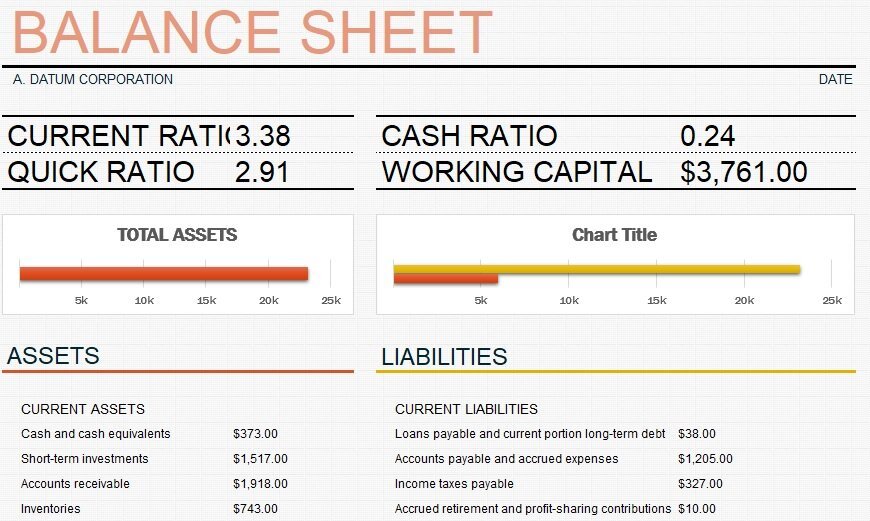

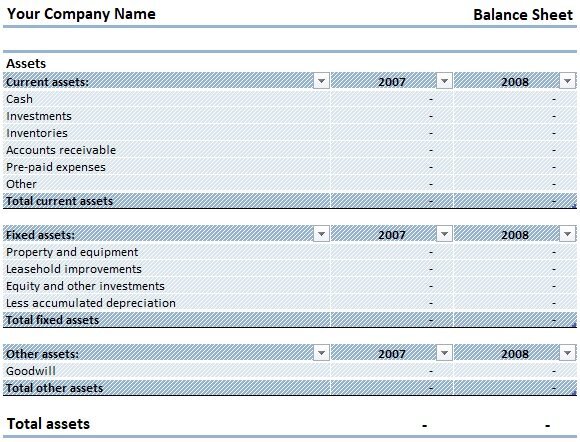

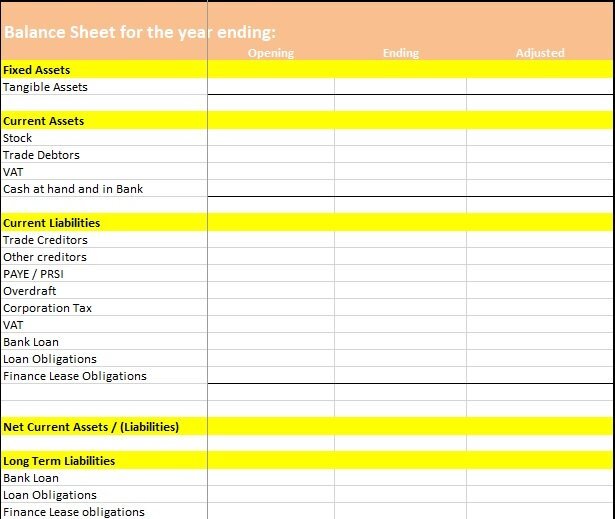

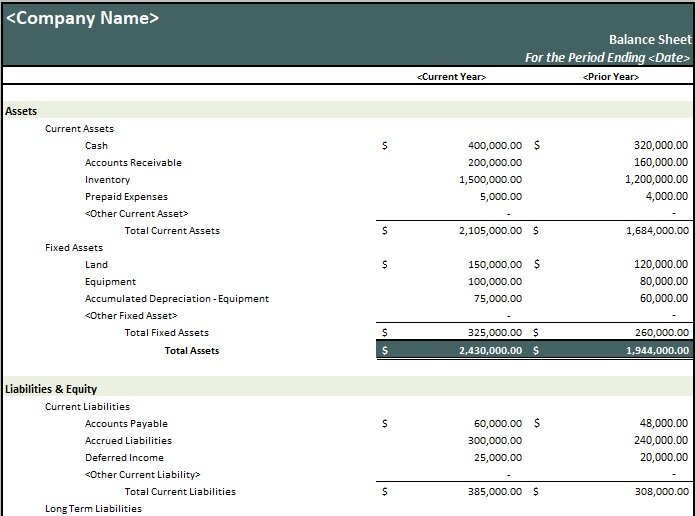

There are different formats of balance sheet documents are available. You can save time by selecting any pattern. Further, it fills in all the details as per your company’s requirements.

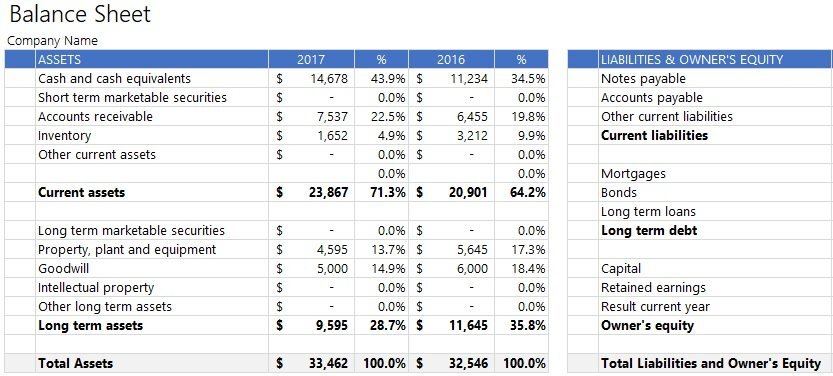

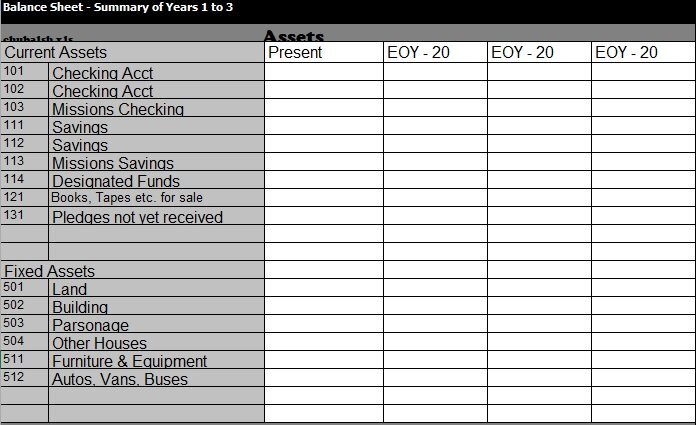

pro forma balance sheet

free balance sheet template 8

free balance sheet template 9

free balance sheet template 10

free balance sheet template 11

free balance sheet template 12

trial balance sheet excel

free balance sheet template 13

free balance sheet template 14

free balance sheet template 15

free balance sheet template 16

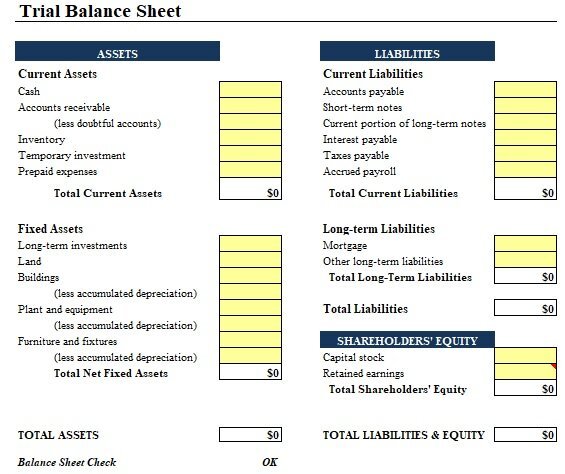

Balance sheet document components

The balance sheet is generally a financial statement of the organization. Further, it consists of liabilities, assets and the stakeholder’s equity at a specific time duration. As a result, this template shows you the net worth of the company.

Another useful part of a balance sheet is that works as a solution to financial duties. Further, it explains the use of credit for funding your business operations. In Addition, among the three most financial reports, the balance sheet is the key.

This sheet gives you an overview of the growth of your business. Further, it gives you an option of a single proprietorship or partnership commercial. Moreover, it’s still important to check how your business is progressing. As a result, this should be accurate and up-to-date.

This also emphasises if you are searching for added equity financing or debt. Further, if you want to sell your commercial and you think there is a need to create total assets. Further, all your account items in the ledger express as assets, liabilities or equities. In addition, you can show by this formula:

Assets = liabilities + Equity

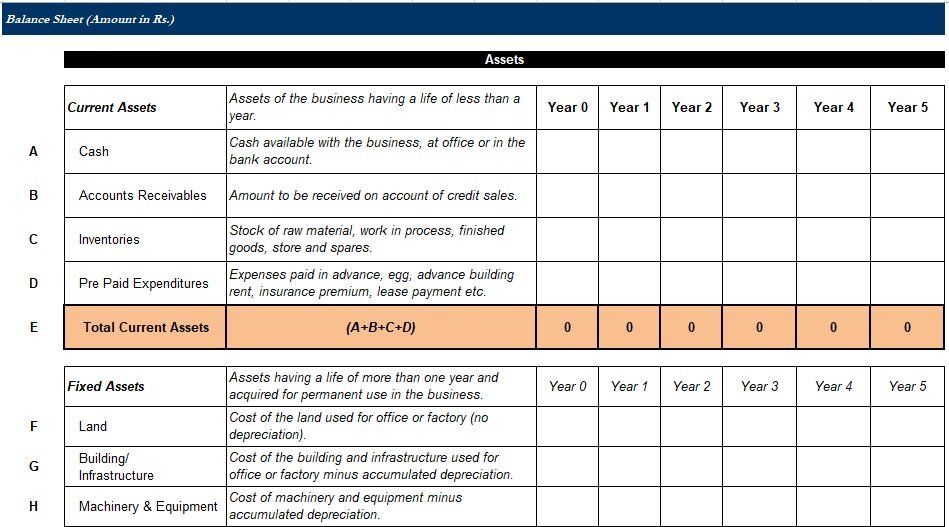

There are different ways of entry in a sample balance sheet. However, it can be changed according to business. For Instance, in every balance sheet there are three main components:

Assets:

It divides into liquid and Non-liquid. The first one represents the assets in the form of cash which can easily convert into cash. Whereas, the second one targets the assets that you can’t convert easily to cash like buildings, equipment and land. Moreover, there are intangible assets that are a lot tougher to value. According to General Accepting Accounting Principles, intangibles assets are part to be of your balance sheet format:

- They are such assets that have a lifespan.

- They have a good market value that easily identifies and get repaid.

You can enter these in the excel balance sheet at the original cost with less reduction. Intangible items are copyrights, patents and franchise agreements.

Liabilities:

These represent the finds that the business is indebted and fall under two categories.

Current Liabilities:

These are the ones outstanding within a year. Few instances are:

- Accounts payable

- Customer Deposits

- Contributions to pension plans

- Equipment and building rents

- Income tax deductions

- Interest

- Maturing Debt

- Payments for medical plans

- Sales tax or services or goods tax-charged on purchases

- Temporary loans, credit lines or overdrafts

- Utilities

- WagesLong Term Liabilities are due after one year and the items come under like:

- Deferred tax liabilities

- Long-term debts like primary and interest on bonds

- Pension fund liabilities

Equity Or Earnings:

This is also famous as shareholder’s equity. This remains after the deduction of liabilities from assets. The booked earnings are those earnings that the company keep with them. Further, they don’t pay shareholders. Moreover, you can use reserved earnings in paying your debt and invest in your business. In Addition, there are more opportunities to grow. As a result, when the company is progressing. They use their reserved amount to fund expansion rather than paying it to stakeholder’s dividends.

What are liabilities on a balance sheet?

To finish your balance sheet template you’ll have to include insights regarding the obligations and liabilities your organization owes. Here is a gone through of the data you want to catch.

Current liabilities

Current liabilities are the things an organization owes in the following year, and can incorporate things like neglected provider Invoices, or impending repayments for debts you’ve resolved like business loans. You can hope to incorporate things like these:

Accounts payable— otherwise called AP, the debts you owe to providers or to cover anything more purchased using a loan

Current debt/notes payable, which covers all non-AP bills you’ll have to pay in the approaching a year

The current part of long haul obligation, so the sum you want to repay in the following year, from any drawn-out liabilities like a home loan or business credit

Non-current liabilities

Non-current liabilities imply any drawn-out liabilities. The following are several models.

Organization-Issued bonds

Long-term debt like a home loan, including the chief sum left to reimburse and any interest which will be added

What is equity on a balance sheet?

At the point when you start a business, you’ll frequently have to back it with your cash. It’s vital to catch this in the equity segment of the balance sheet— although it wouldn’t be viewed as equivalent to a loan from the bank.

Shareholder’s or alternately proprietor’s balance sheet

This is anything that will remain to assume you deduct the liabilities of the organization from the assets. Precisely the way that the value is made up will differ from one organization to another, contingent upon the business type and stage. You could incorporate this.

Proprietor’s investments in a business

Share capital assuming the organization has been investor funded Retained earnings, Held income, where the business has chosen not to give all benefits as profits but rather has held some itself to reinvest

Get Your Free Balance Sheet Template

The accounting report model from FreshBooks simplifies working out your business equity.

Simply download the free template and modify the form in a flash. Pick the document type that works best in your favoured program to keep things straightforward. You can utilize word handling programs like Microsoft Word, Google Docs or Excel. Accounting sheets are superb in sorting out things and working out numbers.

Assuming accounting sheets turn out best for you, keep things basic with the balance sheet template excel. With simple to-utilize capabilities and natural design, it guides you through the balance sheet rudiments to get you right where you need to be.

The report layouts from FreshBooks are all suitable for download in .xls, .doc, PDF, Google Docs and Google Sheets. The ability to make the ideal accounting report is in your grasp.

With the balance sheet template, Google Sheets gives, you’ll fill in fields effortlessly. It keeps the spreadsheet design clean and exact, permitting you to quickly adjust numbers.

If you lean toward an alternate configuration, the Google Docs balance sheet template is completely adjustable and gives you orchestrate things to access an organization that turns out best for yourself as well as your necessities.

You could project future business development or misfortune by utilizing a balance sheet forecast template— allowing you to pursue the most ideal choices workable for the fate of your organization.

Why Use a Sample Balance Sheet?

Concerning accounting, making financial reports with blunders isn’t regularly something you need to do. The uplifting news is, that the asset report templates from templatedata.net are here to take care of you. At the point when you follow a template, you’ll make certain to incorporate the numbers you want.

The templatedata.net balance report sample will get a good deal on your accounting. Download your preferred layout in the organization, and redo it to meet your requirements.

Need to mechanize your bookkeeping and balance tracking? Allow templatedata.net to assume control over your books. Begin today.

Balance Sheet Examples:

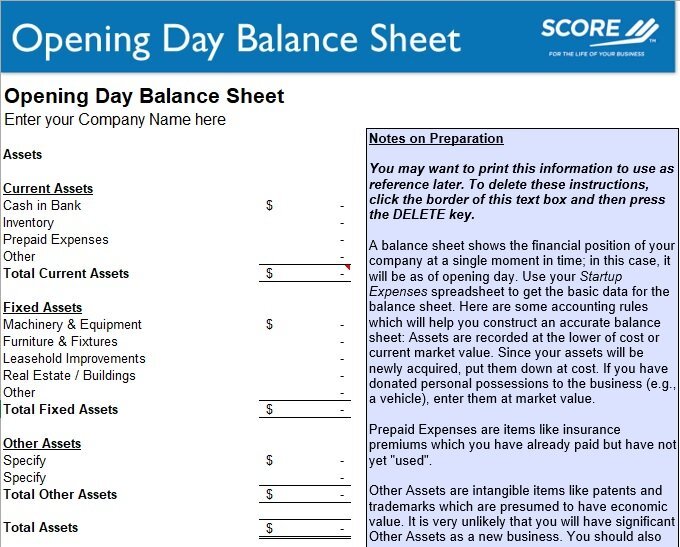

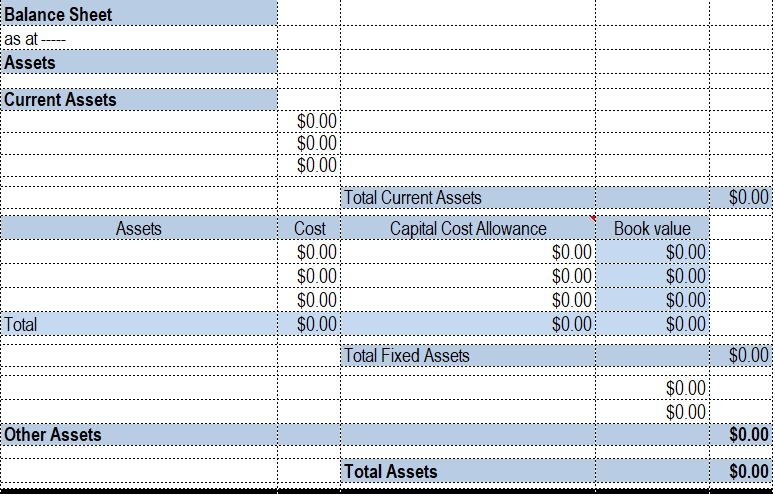

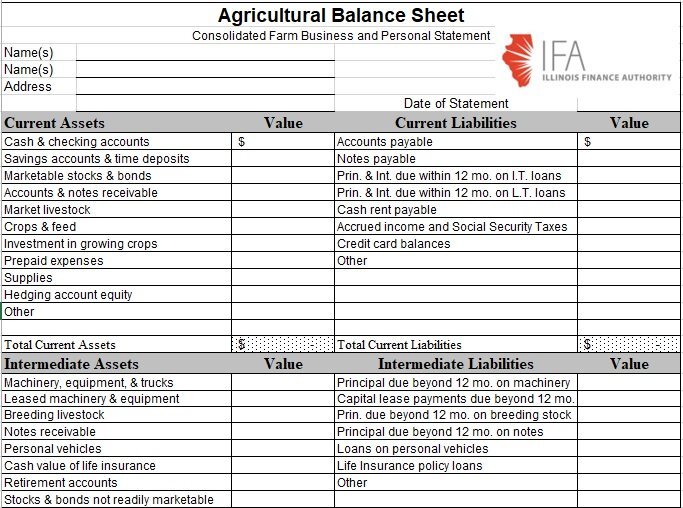

There are free formats available for your use. You can customize any excel based balance sheet and work as per your business requirements.

opening day balance sheet template

free balance sheet template

agricultural balance sheet template

free balance sheet template 1

free balance sheet template 2

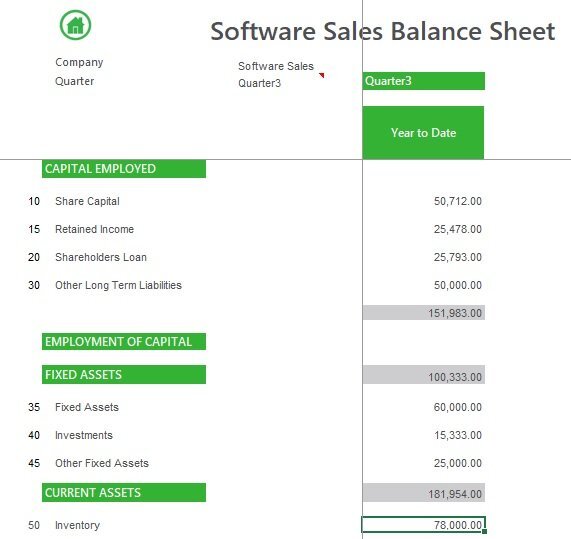

software sales balance sheet template

free balance sheet template 3

free balance sheet template 4

free balance sheet template 5

free balance sheet template 6

free balance sheet template 7

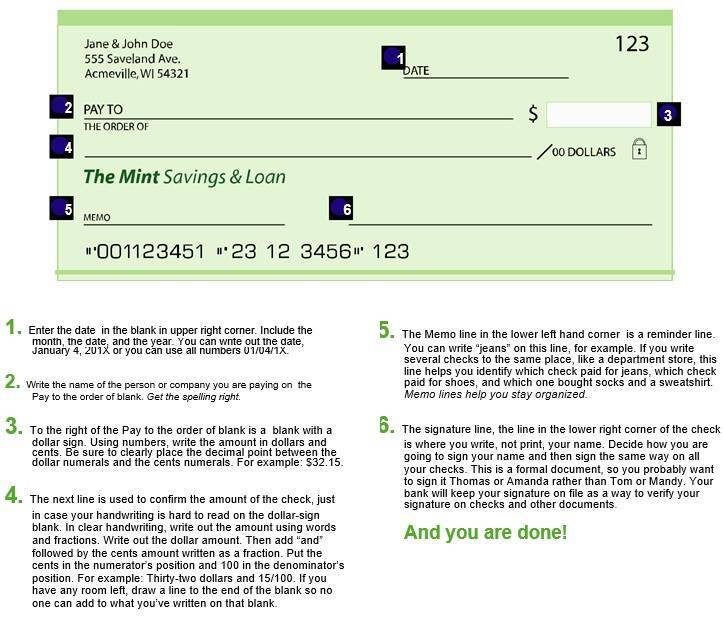

How to Prepare a Balance Sheet?

The three most valuable financial statements of a business entity are income statement, cash flow statement and balance sheet statement. Further, mostly the accountants use the balance sheet to check the viability of the commercial. Moreover, you need to follow some steps when creating a balance sheet:

- AS we know the formula

- Assets = liabilities + Equity

- It consists of three sections assets, liabilities and equity.

The company ledge has the information which is for balance sheet purposes. It’s in pages and you record all the financial transactions for a certain time. Further, the creation of a balance sheet is to show the assets, liabilities and equity for a particular date. Moreover, it’s an exercise with other companies to show quarterly and by the end of each fiscal year.

First, prepare your balance sheet header, Further, give the title “Balance Sheet ” on the top and below of the sheet. Later, include your company name and effective date.

Set up the assets section

Include all the current assets that you want to convert to cash within a year of the excel balance sheet. Lean in their order of liquidity, means the comfort of converting them into cash.

Add all non-current or long term assets. Further, these are the business’ value of equipment and property for over one year, less depreciation.

Take in all intangible assets which are non-monetary. Moreover, they have no physical substance that will last more than one year.

Add the current and non-current assets and give the heading as “Total Assets”. Further, this amount should equal your business’ general ledger. Moreover, if there is any difference you need to check and resolve it.

Set up the Liabilities section

Explain the current liabilities payable within a year of the balance sheet sample date. Further, the most shared current liabilities are short-term notes payable, accrued liabilities and accounts payable.

You need to calculate all long-term liabilities that are not done within one year of the balance sheet. These are long-term loans and notes, pension plan duties and bonds payable. Further, you can add subtotals of long-term and current liabilities. Moreover, give name as “Total Liabilities”. Moreover, this will as the second section of your sheet. You will add it to the value of the owner’s equity.

Compute the Owner’s Equity:

Calculate the retained earning or profit amount that your business earned for the specific period. Further, you need the retained earnings ending balance for the last period. Further, you make the addition of the net income from your company’s income statement. Moreover, deduct the dividends which you give to investors to get the reserved earning.

Calculate stakeholder’s equity using the donated capital and the company’s booked earnings. Further, note down all the company’s equity account like common stocks, retained earnings and treasury stock.

Sum the value of “total Owner’s equity” and “Total liabilities”. Further, give name as “Total Liabilities and Equity”. Moreover, your calculations are correct if the Total assets and Total liabilities and Equity are equal.

AS a result, if they are equal your balance sheet is complete. However, if there is a difference, you need to review and recheck. Moreover, the reason can be errors, duplication and wrong categorization of one of the accounts.

Benefits of balance Sheet Template:

Using this document is one of the best sources for your current and future growth of the business. Further, this is the best tool for your internal use and discussion outside your company. Further, when you are running the company the cash is flowing in and out of the accounts. Moreover, with the help of this document you have complete detail. You can understand your company’s revenue effectively.

The balance sheet can be helpful in any internal operation. For instance, an investor can see when you plan to apply for a business loan. As a result, the supplier will take interest after looking at your balance sheet. This is proof of your business’s overall steadiness.

Conclusion:

Balance Sheet Template is one of the best sources to review your business performance. However, different types of financial statements are available but one of the best is the balance sheet. Further, you can track the progress of your corporate. Moreover, it consists of the assets, liabilities and stakeholders’ equity at a specific duration. As a result, it shows the finances of your organization.

With the help of excel based balance sheet document, you can get complete information about your company. Similarly, you have a better idea of your company’s income. As a result, it is a good approach to use the template and customize it as per your business requirement.

FAQS (Frequently Asked Questions)

What items are included on a balance sheet?

Balance sheets include equity, assets and liabilities. With the help of such hands-on information, you can make better business decisions.

What balance does a balance sheet show?

The balance that comes through the balance sheet is equity- which is assets that subtract liabilities. While knowing your equity will give you an idea of how your business is growing and what is its value.

Do I want some other sheets other than a balance sheet?

General ledgers are many times considered the last part of the significant accounting report duo. The two reports contain a large number of similar things however are not indistinguishable. Having both will assist you with holding your finances in line.

Two different records go close by the balance report and supplement the general ledger. These are the pay and cash flow statements.

The income statement monitors any pay the business has been producing from a more extensive perspective by taking a gander at components like depreciation or Inflation, while the cash flow statement gauges precisely how much cash flow an organization has created.

How does a monetary record help my business?

Making a business balance sheet is fundamental to completely comprehend your business finances. It separates the worth of your business from your resources for your liabilities, with the goal that you can arrive at taught and skilled conclusions about the fate of your business.

An investor will be cautiously taking a gander at the records created before pursuing an informed decision. Ensuring that your edge and money accounts are all together is a significant stage to satisfy before moving toward financial backers.

By utilizing a balance sheet template in either Excel spreadsheets or Google Sheets spreadsheets, you can undoubtedly adjust your numbers and make a coordinated and precise professional financial statement.

![20+ Free Balance Sheet Templates & Samples [Excel]](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/free-project-charter-template-16.jpg)

![20+ Free Balance Sheet Templates & Samples [Excel]](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/free-business-reference-letter-15.jpg)