A promissory note release form is an agreement framing the provisions of an obligation owed between a creditor (lender) and a debtor (borrower). The agreement is then endorsed by the two parties. It incorporates a report illustrating the exact agreements of the game plan between the lender and the borrower, including the interest rates, reimbursement plans, models for deciding damages, and strategies for reimbursing the debt. If a loan obligation is fulfilled alongside the legally binding prerequisites in general, or, on the other hand, on the off chance that the lender excuses the debt, a promissory note ought to be given.

The arrangement between the moneylender and the borrower has been completed, as per the record. It likewise absolves the gatherings named in the promissory note from their legitimate commitments and shields them from any legal repercussions that might emerge from here on out. A promissory note discharge form can be referred to by different names depending on the setting where it is utilized.

The elective names include:

- An arrival of debt form

- Promissory note result letter

- A credit fulfilment letter

- Debt help form

When to Utilize a Promissory Note Release Form

A promissory note discharge form is normally given after a borrower has satisfied their unique debt commitment. This generally implies reimbursing the whole amount owed to the lender, including the centre in addition to the premium and any appropriate late expenses or punishments (if any). The arrival of the debt form is endorsed by the lender and given to the borrower as verification that the exchange has been completed. The first note should then have the release form attached for the borrower’s records.

A promissory note release form may likewise be sent when a creditor pardons a borrower’s exceptional debt or excuses and drops a current commitment under specific circumstances. For this situation, the form lets the borrower out of all commitments under the advance agreement and safeguards them against any lawful activities on the off chance that they emerge. The arrival of a debt help form before it is completely paid off is otherwise called a “wiping out and the release of the promissory note” and is completed in light of multiple factors. These are the circumstances for which the borrower no longer wishes to make a legitimate move against the borrower in case of a default or when the borrower can’t reimburse the credit. The IRS-Inward Revenue Service might believe such an activity to be available to pay for the borrower. The aggregate amount of debt forgiven may likewise be viewed as a gift and dependent upon the gift charge.

It is critical to note that a borrower’s demise doesn’t naturally bring about the arrival of the debt. This is completely dependent upon the particulars of the first promissory note and whatever other arrangements that might have been examined and settled upon by the loan specialist and the borrower throughout the contracting system. The debt turns into a resource of the borrower’s estate if the first note doesn’t determine that the debt is dropped upon the borrower’s death.

The Process

A promissory note release form is an authoritative report that should be written cautiously. It should incorporate every single appropriate detail, for example, the date it was given and language that proclaims any commitments under the first promissory note to be void.

You can compose a successful promissory note release utilizing the means recorded underneath as an aid:

Stage 1: Take a look at every single legitimate term

Before you compose and sign a promissory note release form, ensure you see each of the lawful terms of the first promissory note. Guarantee that the borrower has completely met all forthcoming obligation commitments and that any legitimate terms connected with the cash owed, for example, financing costs, late fees, punishments, and deadlines, have been followed likewise. This step guarantees that you are safeguarding your inclinations since marking the arrival of debt legally gives up the borrower’s liabilities and commitments and renders the first promissory note invalid and void.

Stage 2: Address any liens

A powerful delivery release form should distinguish any lawful issues that might emerge from the first promissory note. If, for instance, the borrower’s property was utilized to get the promissory note, any liens and encumbrances on the property should be tended to exhaustively as a lien release. Your release of debt form ought to plainly express that the borrower is not generally committed under the lien. An affirmation that any home loans on the property are presently void ought to be marked assuming the promissory note was gotten by a land contract.

If there is a deed of trust, a deed moving the property to the borrower should be joined. If a leader chooses to document a UCC (Uniform Commercial Code), which demonstrates the presence of a security interest and is recorded at the secretary of state’s office, an affirmation ought to be incorporated expressing that the lien is dropped and any dynamic UCC on the property is delivered.

Stage 3: Fill in the template

The third move toward making and utilizing a promissory note release form is to draft the actual note. You can set one up yourself, recruit a lawyer to set it up for your benefit or utilize pre-planned promissory note release forms or layouts that are typically accessible on the web. Assuming that this is your most memorable time making a promissory note payoff letter, it is suggested that you utilize a pre-made template to guarantee that your record is exact and very well expressed.

Think about utilizing the web, and downloadable templates to set aside cash, time, and exertion while making a promissory note release. The templates are editable, and they have fields where the fundamental data should be placed. Each field has clear directions on the best way to finish it. At the point when the template has been redone to meet your particular necessities, ensure it is finished up, save your changes, and print it out to utilize.

Stage 4: Notarize it

By and large, a promissory note release form doesn’t need to be notarized to be authorized. Even though it may not be a lawful command to legally notarize the form in your province, this step is urgent to keep away from any future case connecting with the legitimacy of the arrival of the debt. Notwithstanding, you can sign a promissory note release without the presence of an observer or notary public. If you decide to do so, consider erasing any notice of a public accountant or observer from your last promissory note release form.

Stage 5: Send and save the form

The last step toward making a promissory note release form includes giving the form to the borrower and any closely involved individuals. While sending the form to the borrower, consider using enrolled mail to guarantee there is a record of your action. However, before sending it off, survey the promissory note release form to be sure that all means, conditions, and strategies recommended in the report are complete. At that point, connect the last form to the first promissory note and track something very similar for reference purposes.

It is fundamental to have a record of these marked documents since they will be alluded to later on when there is a random tax audit or when a borrower is approached to demonstrate that their old debts have been completely settled by other possible lenders. Similarly, in case of a clerical error at the Credit Department, the reported, marked promissory note release form might be utilized as evidence that the debt was for sure paid off.

What to Remember for Promissory Note Release Form

All appropriate insights about the first promissory note and the debt release should be remembered for a powerful promissory note release form. The record should likewise be written in straightforward language that can be understood by all parties. Also, the recordation language ought to express that the borrower’s obligations under the first credit contract are released.

The accompanying fundamental details should be consolidated in any promissory note release form:

Names of the borrower and lender

The promissory note release form ought to contain the recognized data of the involved parties. This incorporates the borrower’s complete name and the lender’s full legitimate name, as well as their comparing addresses. The names given in the underlying promissory note ought to match those on the release form.

Note: If a solitary noteholder marked the first promissory, the release form shouldn’t contain any language recommending a second noteholder, for example, “we.” To forestall false impressions, ensure the release form is finished up precisely and try not to incorporate any explanations that should be retracted.

Dates of both the release and the underlying promissory note

The dates on which the release was given and when the gatherings included signed the first note should be remembered for the advance satisfaction letter. Precisely dating the form guarantees there is no disarray concerning when the release is executed and its connected documentation.

Reference to the original note

Any promissory note release form ought to plainly express the name of the underlying agreement to which it is connected and incorporate any important and interesting numbers. The archive should likewise express the motivation behind the credit as well as some other terms or conditions framed in the first promissory note. A release of the debt obligations determined in the first note ought to likewise be expressly expressed in the delivery report. Finally, for consistency and documentation needs, copies of the first signed note ought to be incorporated with the release form.

The aggregate amount of debt settled

The promissory note release form ought to plainly express the aggregate amount that has been paid under the first advance agreement. The assertion ought to show how much amount of the principal paid off, any charges paid to settle the debt, like late fees or penalties, as well as the interest paid.

Marks of both the lender and the borrower

The promissory note release form should sign by both the lender and the borrower to show that all prerequisites have been met and the arrangement is conclusive. Be that as it may, it isn’t lawfully important for the borrower to sign the promissory note release form.

Free Forms & Templates

You can download free forms from the website.

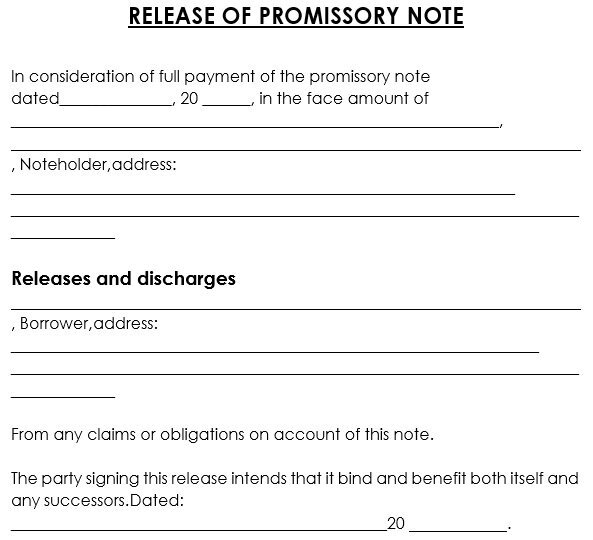

free promissory note release form

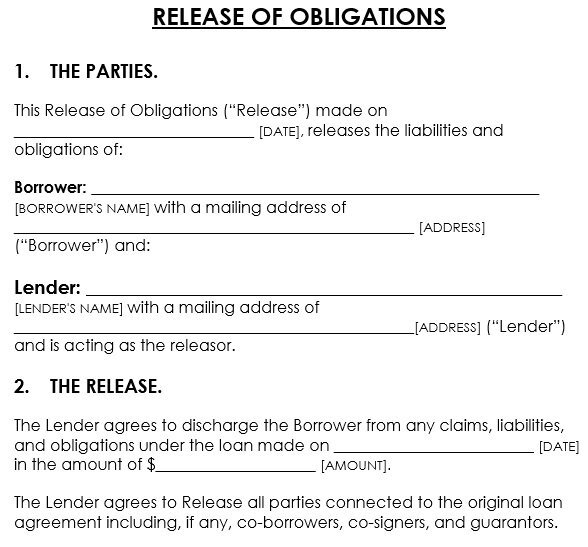

promissory note satisfaction release form

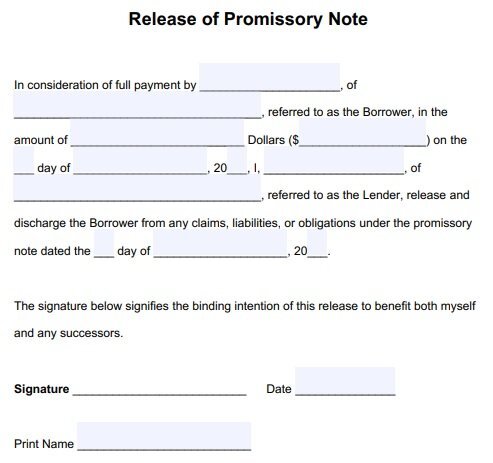

release of promissory note template

Conclusion

A promissory note discharge structure is a legitimately restricting record that the lender normally composes, signs, and provides for the borrower to liberate them from all obligations under a promissory note. The document is commonly signed after the debt has been comfortably satisfied and all conditions outlined in the first note have been met.

A “promissory note is a conventional understanding related to tangible collateral such as land, stock, hardware, or some other individual property. The collateral guarantees that the borrower satisfies all their loan obligations and liabilities. Whether or not a promissory note is gotten or unstable, delivering a borrower’s loan obligation is regularly something very similar. Nonetheless, there are additional means that should be taken into account for a tied-down promissory note to deliver the collateral. For instance, if the borrower’s land property was utilized to get the promissory note, the lender should likewise execute a discharge of security or release of a lien. A release of the mortgage should likewise be completed if the land has a mortgage.

FAQS (Frequently Asked Questions)

The promissory note release form is an authoritative document. When the lender signs it, it becomes restricted, and it consequently invalidates and voids the conditions of the first promissory note agreement.

A promissory note is, by and large, basically the same as a loan. Both are legitimate official agreements between a lender and a borrower in which the borrower consents to reimburse the credit in full within a predefined period. They are unique, however, in that, a promissory note is as often as possible less exact and unbending than a loan contract.