A commercial lease agreement can be utilized to lease any sort of property that isn’t utilized for individuals to live in. This implies that your occupants will have business needs that should be met as well as decisions and guidelines that they should keep because of the drafting of the property. Your necessities for how the area is focused on and worked will likewise be remembered in the details of your lease agreement. Simply taking a gander at a commercial lease agreement template probably won’t give you enough data to proceed with composing your own.

What is Commercial Lease Agreement?

A commercial lease agreement is utilized to lease any property. This may be an office, a store, a distribution centre, or some other sort of property where business is finished. Occupants will carry on with work in this area, and you should address their issues while they should follow your requests and prerequisites for the utilization of your property. Commercial lease agreements characterize the connection between the inhabitant and the property manager cautiously, so the two players understand what the prerequisites are for the relationship.

The commercial lease agreement or commercial property lease format gives inhabitants the legitimate right to utilize the property and to work their business insofar as their business is a legal one. The inhabitant simply needs to consent to pay the lease and to follow your necessities for the way that they carry on with work on your property.

What are the Various Kinds of Commercial Lease Agreements?

There are four principal sorts of commercial lease agreements that you could have to use to lease a property to an occupant. You ought to know about these different form types, so you should rest assured that you are using the right sort of form for the circumstances.

Full administration or Gross Rent: This course of action is taken when the rental rate incorporates all the property’s working costs as well as utilities and upkeep. Land charges are quite often included as a component of the lease. The property manager should save directly in this sort of consent to pass down any sort of future expansion in expenses to keep up with and own the structure to the occupant.

Net Rent: This agreement does exclude any of the working costs in the rental rate. This intends that there is a base lease, and afterwards, the occupant pays any remaining costs supportive of rata on top of the base lease. This is the “working expense” to utilize the property, and it can fluctuate as charges and nearby costs increment. Normal region support is likewise remembered for this piece of the expenses. The CAM will likewise incorporate utilities and working costs.

There are various types of net leases: The Triple Net Rent permits the inhabitant to pay a piece of the local charge, the property protection, and the CAM. With a Twofold Net Rent, the occupant will pay a piece of the local charges and property protection. At the point when a Solitary Net Rent is marked, the occupant simply pays for a part of the local charges.

Adjusted Gross Rent: In this renting style, the occupant’s expense is half of the gross rent and net rent. The working costs are arranged and parted between the occupant and landowner in this course of action. This means that much of the time, the inhabitant pays for the base lease and CAM, and the landowner deals with the local charges and property protection.

Rate Rent: In a rate rent, the occupant pays the base lease for the property and then a month-to-month level of the gross income from their business that is housed in the structure or space. This is normally only utilized for retail organizations and isn’t reasonable for some other business types.

What should be included in a commercial lease agreement?

Regardless of the other subtleties of the commercial lease agreement that you are drafting, you will require these essential things to be remembered for your archive for it to be restrictive and enforceable.

Property manager: This is likewise the individual who is the lessor. This is the party who claims the business property and needs to lease it to another person to use for their business.

Occupant: This individual is likewise called the tenant. This is the individual who leases a commercial property to carry on work out of it.

Term: This shows the number of years or months that the inhabitant consents to lease the space and pay for it. You can involve this piece of the agreement for a settled-upon length, or you may very well demonstrate that this arrangement will be reestablished from one month to another. The majority of these agreements recharge naturally if nobody breaks the agreement; however, you don’t need to set up your business rent arrangement along these lines.

Demised Premises: This is a depiction of the actual space into which the occupant is rising. This may be retail space in a shopping centre or a whole structure that a business is working out of. There should be a property map that gives the details of the property’s plan and game plan. This piece of the commercial lease agreement will likewise show the stopping, the cleaning necessities, what security is set up, and any standards about finishing support, snow expulsion, and warming and cooling.

Genuine Property: The whole property may be claimed by the landowner or only one unit in a bigger structure may be the space that is presented for lease. Business properties frequently have common areas like walkways and parking garages that different occupants will utilize.

Base Lease: This is how much the base lease is. This is the expense of utilizing the space alone, with practically no other expenses contemplated. Regardless of whether you are simply charging a level rate for your lease, some portion of this aggregate sum will be your base lease, and you want to demonstrate that in this part of the record.

Working Expenses: Property managers frequently request that inhabitants offer or split the all-out working expenses for an enormous structure that has numerous normal spaces. Assuming you are the main tenant, you will be charged for these expenses without dividing them with any other person. This is often charged as a level expense, but you can likewise favourably rate these costs in any capacity that you pick.

Security Store: This is the sum that is given to the landowner with the honest intention that the rent won’t be broken early and that the property won’t be harmed. The store is often used to hold the property before moving into it.

Property Use and Inhabitance: The utilization of the property and the all-out inhabitance that it can bear are incorporated into the understanding that an occupant finishes paperwork justifiably. These things are frequently spread out by district or state regulations and can’t be adjusted or overlooked. Depending on the way that the business will be operated, it could likewise be set up in areas that serve food. Things like trash evacuation and nighttime clamour may be addressed here as well.

Upgrades: Changes to the property and adjustments should be made with the consent of the proprietor, and they could likewise be made at the expense of the occupant. Numerous tenants of business property don’t have to make changes to it to lease it out. They could likewise not maintain that you should make changes to the property, assuming they make it difficult to lease to others later.

How to Write a Commercial Lease Agreement

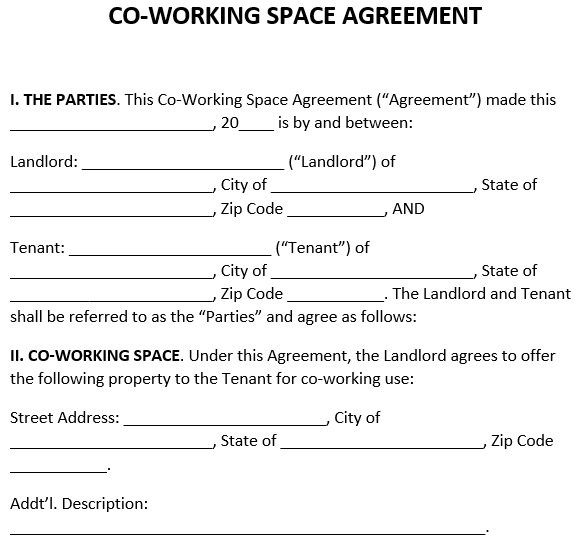

Stage 1: Compose the Successful Date

Successful Date: Give the successful date of the business rent understanding.

Stage 2 – Fill in Landowner and Occupant Information

Landowner Data – Enter the property manager’s complete name or organization name, whether the landowner is an individual or a substance, and the property manager’s location.

On the off chance that the landowner is an organization, give the complete name and title of the organization’s delegate who will consent to the arrangement.

Inhabitant Information – Give the occupant’s complete name or organization name, whether the inhabitant is an individual or a substance, and the occupant’s location.

On the off chance that the inhabitant is an organization, compose the complete name and title of the organization’s delegate who will consent to the arrangement.

Stage 3 – Recognize Premises

Demised Premises – Determine the sort of commercial property being rented. You can keep in touch with one by assuming that none of the choices given depict the property type.

Assuming that the business building or complex has a name, give that name (e.g., Westfield Shopping Center). Give the road (physical) address of the commercial property.

Incorporate a suite number if pertinent.

You can likewise decide to incorporate a guide of the property, which will connect to the furthest limit of the understanding as Display A.

Size of Premises: Enter the inexact number of square feet of property. You can work out the area by duplicating the length with the width. Give the estimated level of the property and the absolute leasable region in the structure or complex.

Normal Regions: Demonstrate whether the demised premises incorporate normal regions.

Parking spots: state what sort of stopping honours the inhabitant might utilize, if any. In the case of stopping honours, determine whether they incorporate any parking spots or just a particular number.

You can likewise compose extra data, for example, where the parking spots are found, whether the inhabitants can relegate or rent their parking spots and whether occupants should pay an expense to stop.

Storerooms: Determine whether the inhabitant has the privilege of storage spaces. On the off chance that indeed, portray the storage spaces and state whether the inhabitant should pay a capacity charge.

Stage 4 – Portray Rent Terms

Term of Rent – Give the beginning and end dates for the rent term. The term is the period for which the occupant will lease the space.

Restoration – Demonstrate whether the inhabitant might reestablish the rent. If indeed, express the number of years for the reestablishment term.

Additionally, indicate whether the lease will increment whenever restored. If indeed, state whether the base lease will increment by a rate or dollar sum.

In conclusion, give the number of days before the finish of the rent that the occupant should give the property manager composed notice of re-establishment.

Stage 5: Note Rental Terms

Base Lease: Determine the dollar amount of the base lease (beginning expense) and how frequently the inhabitant will pay the lease (i.e., month-to-month or yearly).

Furthermore, express the day of the instalment time frame that the lease is expected (i.e., the first day of the month or the fifth day of the quarter) and the instalment strategy.

Working Expense: Show whether the base lease incorporates any part of the structure’s working expenses. If not, express the month-to-month sum the occupant should pay for a proportionate portion of the working costs.

Indicate the most extreme level of the all-out functional expenses for the inhabitant’s portion and the level of the costs saved for critical fixes and redesigns.

If the occupant comes up short on their portion of the working expenses, determine the days on which the inhabitant should pay the sum due.

Stage 6 – Pick the Tax Option

Charges: State whether the inhabitant is liable for land property tax and appraisal instalments. On the off chance that indeed, determine whether the base lease incorporates the real estate property taxes.

Step 7 – Discuss Past Due Payments

Past Due Installments: Give an elegant time frame (number of days) before a late charge is expected if the occupant is late with lease instalments. Determine whether the late charge will be a level of the month-to-month lease or a dollar sum each day.

Extra Late Charges: You can decide whether to charge interest notwithstanding the late expense if the lease is more than a specific number of days late.

Stage 8 – Note Security Store

Security Store – Compose the all-out dollar measure of the security store the inhabitant will pay the landowner. Indicate whether the security store will accumulate interest.

Remember that a few states and urban communities expect landowners to pay interest on security stores.

Stage 9 – Enter Leftover Subtleties

Holding Over – If there is a leftover (the occupant stays on the property past the end of the rent term), the landowner might charge a particular sum over the base lease for the period past the lapse of the rent term.

Stage 10 – Depict the Utilization, Inhabitance, and State of the Premises

Use and Inhabitance: Enter the trade or business reason and the occupant’s utilization of the property.

Indicate whether the landowner will provide janitorial services. Show whether the occupant consents to these assertions by choosing the appropriate and pertinent assertions.

Moreover, On the off chance that the occupant consents to the assertion in regards to no smoking inside a specific separation from the property, express the length in feet.

Express the times when the base lease is expected right away.

Condition and Acknowledgment of Premises The occupant has a particular number of days in the wake of moving in to tell the landowner of any imperfections found on the property. Express the number of days the occupant needs to give notice.

Stage 11 – Demonstrate Property in Demised Premises

Right to Leasehold Enhancements: Pick whether the inhabitant might make enhancements to the property. If indeed, state whether the occupant might eliminate their exchange apparatuses and hardware at the rent ends.

Apparatuses and Goods are Given via the property manager. Indicate whether the landowner will provide any installations or decorations. If indeed, express the apparatuses and goods provided. You can compose any of your own.

Individual Local charges of the inhabitants. Determine whether the landowner or inhabitant will pay the individual local charges on the installations and decorations.

Assuming that the inhabitant is liable for the assessments and necessities to take care of the property manager for such duties, express the number of days the occupant needs to pay after getting notice from the landowner.

Stage 12 – Enter Fixes and Support Details

Property manager’s Commitment to Fix and Keep up with. Pick the things the landowner should fix and keep up with on the property. You can compose some other things.

Likewise, state whether the inhabitant is responsible for the expenses of any upkeep, fixes, or substitutions the occupant’s activities cause.

Occupant’s Commitment to Fix and Keep up with. Express the things the inhabitant is liable for fixing and keeping up with on the property. You can compose any extra things.

Renovating: State whether the inhabitant should acquire the landowner’s consent before painting, renovating, or introducing hardware, wires, or shows.

Liens: Determine the number of days after genuine notification of the recording of a lien; in the occasion, the landowner documents a lien on the property, the occupant needs to deliver the lien.

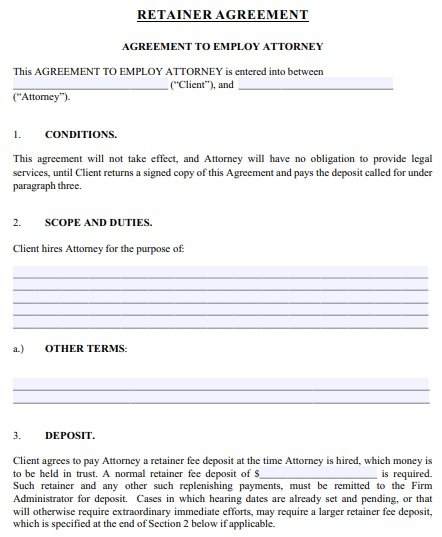

Stage 13 – Examine Protection and Repayment

Occupant’s Public Obligation and Property Harm Protection. The occupant should purchase public obligation and property harm protection for the rented property. State whether the inhabitant should add the property manager as an extra-protected party to the strategy.

Compose if the strategy will have a base total arrangement or a restriction of risk for each event.

Indicate the base total sum or least obligation sum per event. Likewise, express the necessary and greatest deductible dollar sum.

Authentication of Protection: Show the number of days the occupant needs to give composed notice to the property manager that the insurance contract is facing undoing.

Property manager’s protection State whether the landowner’s property protection on the structure incorporates working expenses.

Stage 14 – Address Signage

Outside Sign: State whether the landowner should support the occupant’s outside business sign before establishment. Determine whether the landowner or inhabitant is liable for the expense of the business sign.

Different Signs: Note whether the landowner should endorse some other signs, pennants, or promotions noticeable from an external perspective of the property before establishment.

Stage 15 – Pick Utility Administrations

Utilities: Indicate the utilities the occupant should pay. You can compose some other utilities not recorded. Additionally, note the utilities the property manager will pay. You can compose any utilities not recorded.

Stage 16 – Record Access, Give up, and Task

Apparatuses and Gear Introduced by Inhabitant. State whether inhabitants, upon rent end, can eliminate the exchange apparatuses and gear they introduced.

Doling out and renting Determine whether the inhabitant can sublease the property with the landowner’s earlier endorsement.

Stage 17 – Talk about Harm to Premises

Significant Harm: Give whether the expense of fixing or swapping for significant harm in the case of a fire or one more debacle is estimated by a rate or dollar sum.

Determine the sum by which the substitution value should surpass the expense of fixes.

Also, express that in the days after a fire or fiasco, the gatherings need to end.

Incomplete Harm: State whether the property manager or occupant is accountable for fixes in the event of halfway harm because of fire or another fiasco.

Likewise, determine the days after getting protection instalments; if fire protection continues to be lacking to fix the premises, the landowner should end the rent.

Stage 18 – Enter Prominent Space Details

Judgment of Demised Premises. Express the level of the property or normal region that should be taken assuming a piece of the property is dependent upon prominent space for the landowner to early end the rent.

Also, determine the number of days after the receipt of the remuneration; on the occasion that the property manager is deficiently redressed, the landowner needs to early end the rent.

Stage 19 – Fill in Default Data

Freedoms In case of Default of Occupant. Indicate the number of days after receipt of the landowner’s composed notification the occupant needs to pay the lease or fix an issue.

Default of the property manager. Express the number of days after receipt of the occupant’s written notification that the landowner needs to fix an issue.

The property manager should put forth a sensible, confident attempt to begin fixing an issue that would sensibly take more time than a particular number of days. Express the number of days it will take to fix the issue.

Stage 20 – Compose Random Details

Administering Regulation: Pick the state’s regulations that will administer the development of this business rent arrangement.

Debate Resolution: Note whether the inhabitant and landowner will determine debates assuming that there are any questions through court suit, restricting assertion, intercession, or intervention then mediation.

free commercial lease agreement template

printable commercial lease agreement template

short term commercial lease agreement

free commercial lease agreement template

standard form commercial lease template

sample commercial lease agreement

free commercial lease agreement template

free commercial lease agreement template

professional commercial lease agreement template

Conclusion

A Commercial Lease is an authoritative report that frames the freedoms as well as expectations of a landowner’s business property and an inhabitant who needs to lease the space to use for business purposes.

The arrangement distinguishes the base lease the inhabitant owes every month as well as other potential expenses like working expenses, charges, upkeep, and stopping.

FAQS (Frequently Asked Questions)

It depends on where you reside, the length of the lease term, and the property’s rental worth, a commercial lease might not need to be recorded as a hard copy to be enforceable.

In any case, regardless of whether it’s legally necessary, we suggest continuously utilizing a composed rent consent to assist with safeguarding you if a question arises.

Regardless of whether you can legitimately lease a business property without a rent agreement in your state, you face a critical challenge by not making a commercial lease arrangement.

The understanding assists you with obviously characterizing all the rent terms and having verification of precisely what you and the other party settled upon if a question emerges.

Recall that forcing a business to leave an investment property utilizing a Residential Lease Agreement is, by and large, unlawful.

On the off chance that you have any inquiries regarding the provisions of your commercial lease arrangement, converse with the other party or look for legitimate counsel.

The most well-known commercial lease is the rate rent, frequently utilized in shopping and strip shopping centres. This kind of commercial lease charges the occupant base lease in addition to a percent of their month-to-month deals.

![Free Lease Extension Addendum Templates & Renewal Agreements [Word] free lease extension addendum 4](https://templatedata.net/wp-content/uploads/2021/12/free-lease-extension-addendum-4-150x150.jpg)

![Printable Sublease Agreement Templates [MS Word] free sublease agreement template 9](https://templatedata.net/wp-content/uploads/2021/10/free-sublease-agreement-template-9-150x150.jpg)