The General Ledger Template sets out the layout and style of the pages of the company’s General Ledger. It consists of specific ledger elements which uses to record financial transactions. A General ledger is a bookkeeping document which uses to maintain and record financial transactions and information made by the business community.

The ledger account is also known by the name of T-Accounts. Moreover, with the help of a ledger and journal, it is easy for businessmen to monitor their financial transactions. The ledger helps speed up the workflow because you can locate all your financial information in a single document.

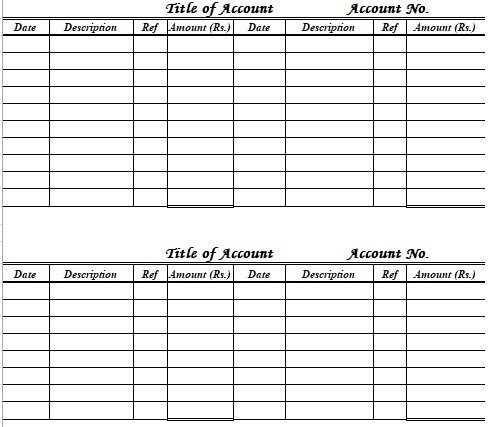

T ledger account sheet

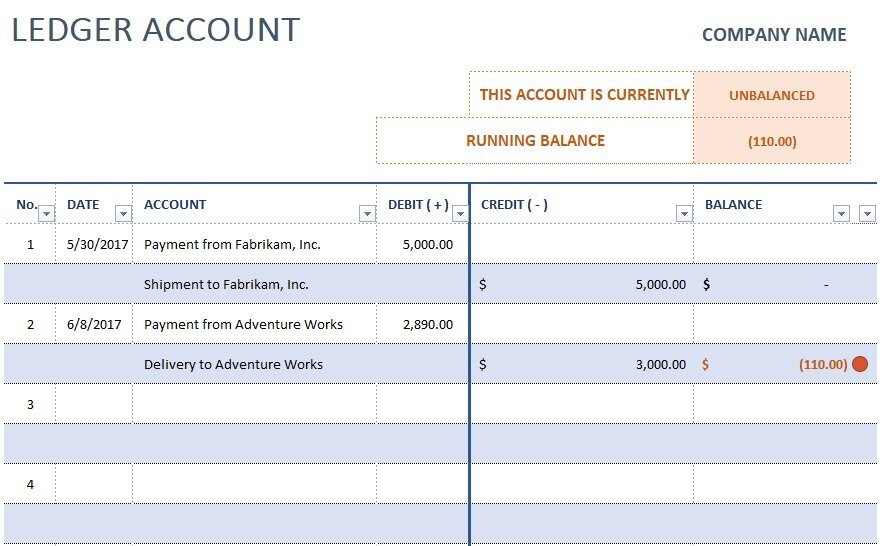

standard general ledger template excel

oracle general ledger user guide

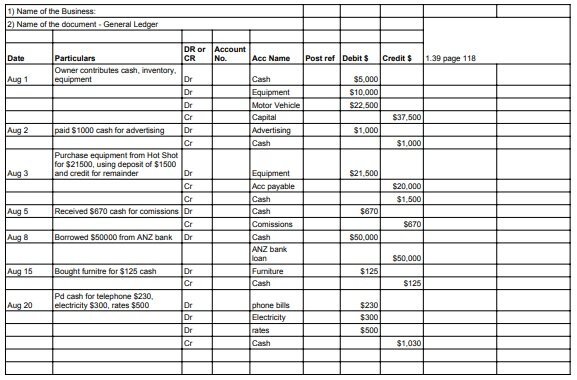

printable general ledger template

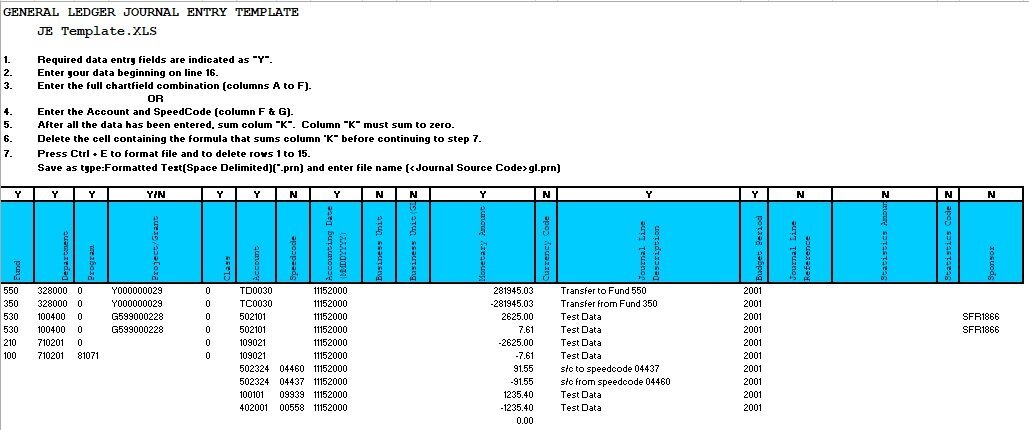

general ledger journal entry template

printable general ledger template 1

printable general ledger template 2

fillable general ledger template

printable general ledger template 3

printable general ledger template 4

Importance of General Ledger

The ledger provides the necessary information to the accountant. It is for him to create a financial statement. Therefore, the ledger plays a vital role to inform the businessman about his business financial well-being. A general ledger also helps in several aspects which include the following:

Research

A general ledger gives help and benefit to the people to find out and research about the financial recording differences. Moreover, you can identify the source of discrepancy and reduce the effect on your business. The businessman can also easily detect the long-term impact the change of business has had on the business finances. As a result, businessmen can find more areas where there is more investment or financial cuts.

Audit

During the audit, the business community rely on the general ledger. This is such a document that provides all information to the auditor. It is easy for him to verify the financial records. Moreover, the general ledger provides help to the businessmen that the operations are legit and they work within their legal limits. This enables auditors to access the financial transactions recorded in the ledger account. As a result, the auditor can verify the type of transactions conducted in the business and the movement of money into and out of the business.

Budget Preparation

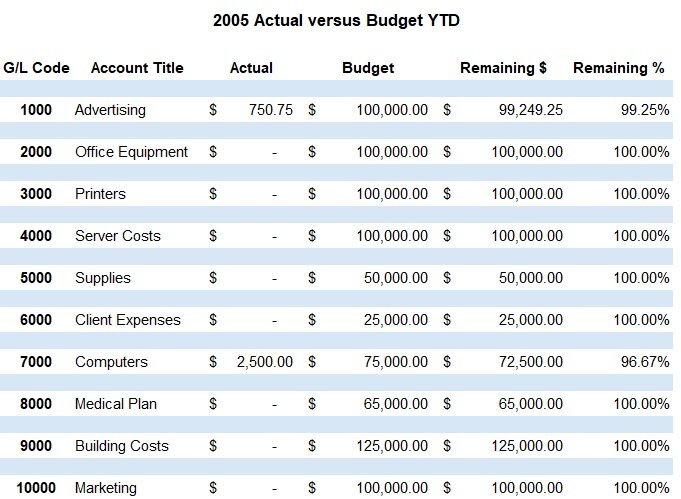

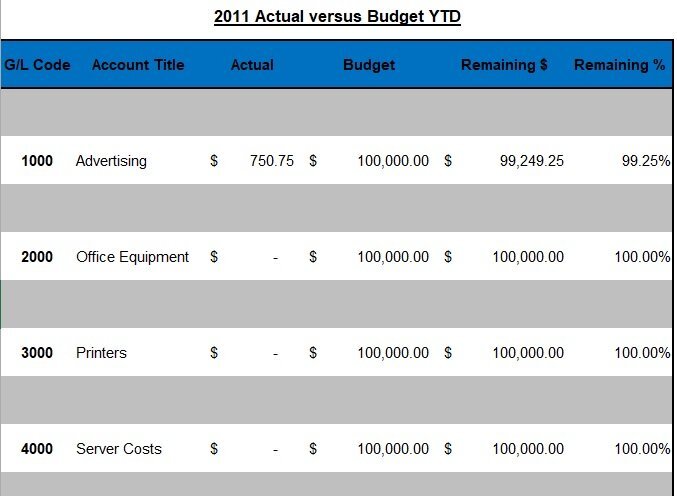

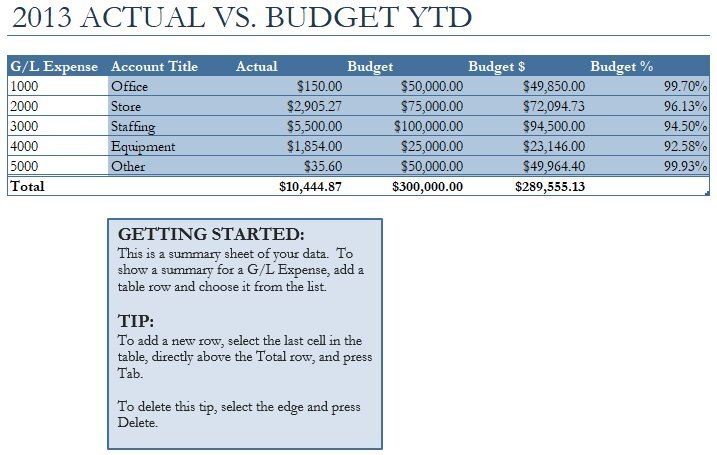

You can also use a general ledger in the budget preparation process. The ledger consists of the business’s income and expenses, which can be used in the formation of the budget formulation process. In addition, you can use the previous entries of the ledger which uses for future income and expenses. As a result, this process will be more effective and you can reconsider current and one time expenses that the business may experience.

Examples of General Ledger Accounts

A general ledger can be divided into different categories known as ‘accounts’. This means that you have control over the accuracy of the ledger.

There are the following examples of ledger accounts.

- Inventory Account

- Sales Account

- Amount payable

- Creditor account

- Labor

- General Expenses

General Journal Vs General Ledger

The initial records of a business are through the general journal document. Similarly, you can say a general journal is an original book entry. Initially, records are posted in their concerned accounts in the general ledger. Further, accounts are calculated, and then you balanced it and finally transferred it to the trial balance. The trial balance is keeping all the general ledger accounts and you can see that the debit and credit sides are matching with each other. As a result, the main difference between a general journal and a general ledger is that the journal is the first entry record before information can be recorded to a general ledger.

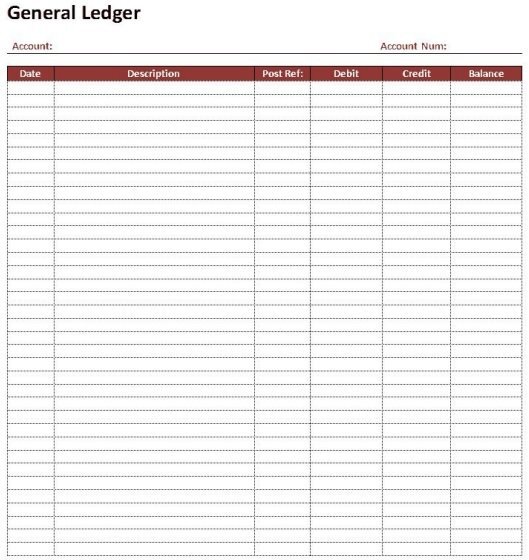

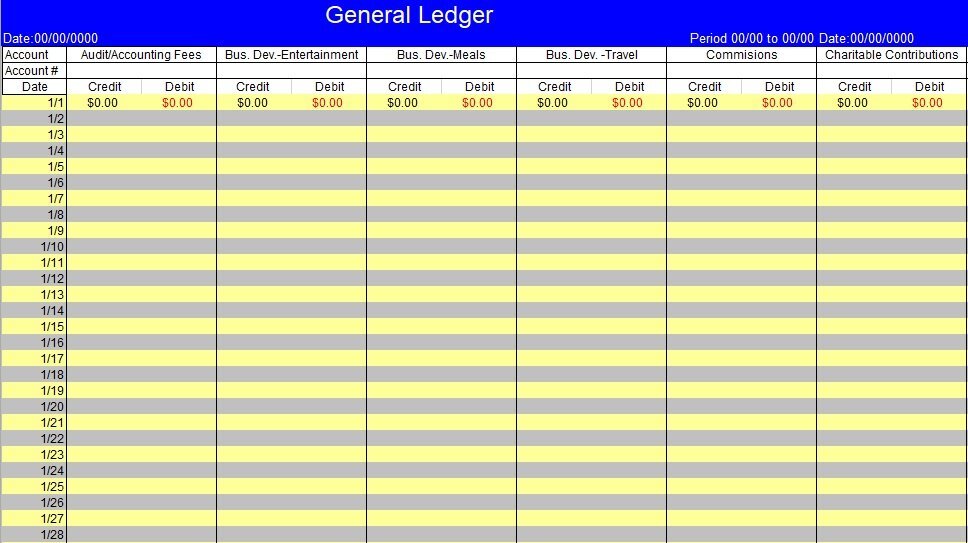

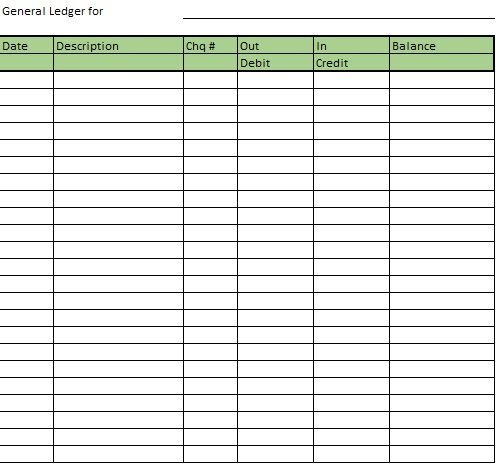

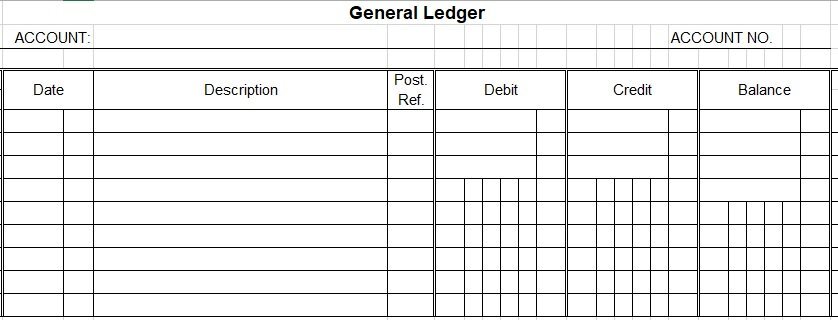

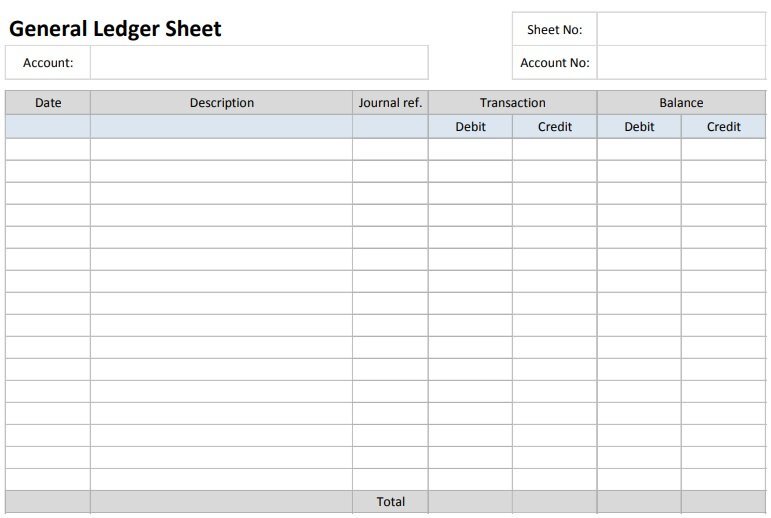

Format of a General Ledger

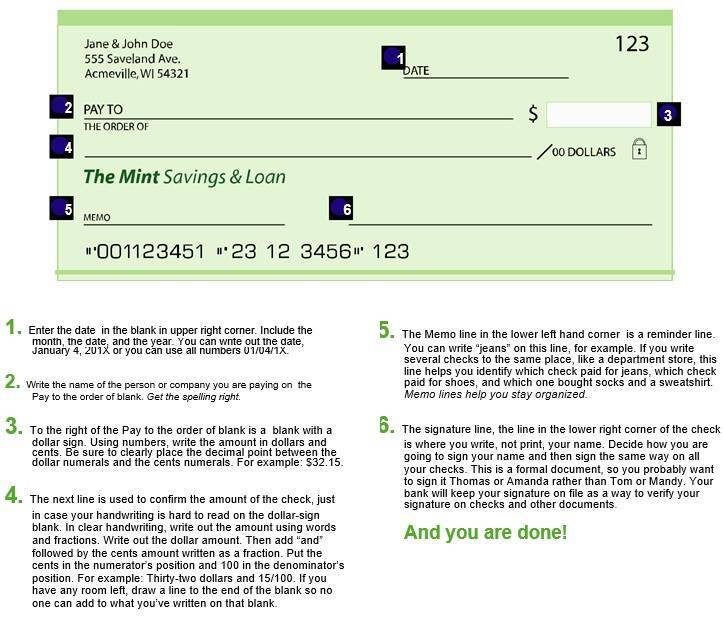

When you are drafting a general ledger, you should make sure that the account name and account number should be at the top of the ledger table. Moreover, you can track specific ledger accounts with the help of account names and account numbers, for example, the cash account. A General ledger contains three more entries on the left of the page which are date, description and journal number. The data explain to you the period in which entry finalizes. Through description, it clears the content of each entry. The journal number uses to index the entry and make sure that the information retrieves from the ledger.

The right side of the general ledger contains debit, credit transactions and balance. Similarly, the debit transaction represents the money out of an account, and the credit transaction in which the money into the account. The debit and credit entry in the general ledger helps the businessman to record the change in the value brought by financial transactions. Equally, the balance which is stated enables the businessmen to track the amount owed by calculating the difference between the debit and credit amounts.

Using An Accounting General Ledger Template

There is a particular way in which the user of a general ledger template goes in the process of using it to attain the proper form of results.

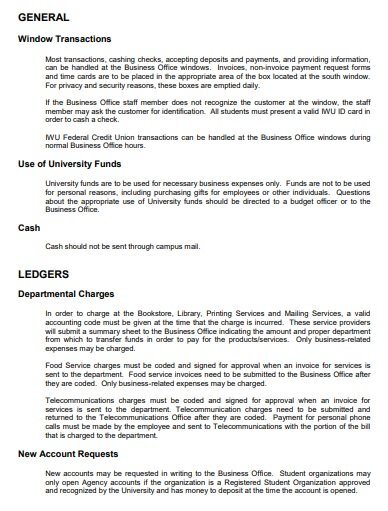

Use a general ledger template

A business person should use a general ledger template. Moreover, this ensures that the information in the ledger is consistent and properly updated. In Addition, you can save time just by filling in the information in the download document.

Print a blank template and make entries

You can download the blank template and fill it out as per your need. Moreover, you need to check that the design of the template is proper. You should check that the template is functional in Ms Excel and Ms Word depending on preference. Further, this allows you to access the template for your transactions. Once the template is ready, you can start filling in the financial information.

Buy General Ledger Book from the bookstore

You can purchase a general ledger book from a bookstore. Moreover, you can enable manual financial transaction records. You can retrieve the information from the general ledger pages. As a result, you can customize your general ledger book.

Filling Accounting Ledger in a Template

The information which is in the general ledger is easy to maintain and you can create accurate manual financial statements. Therefore, you should have a good understanding before filling in the general ledger.

printable general ledger template 5

printable general ledger template 6

printable general ledger template 7

printable general ledger template 8

general journal template

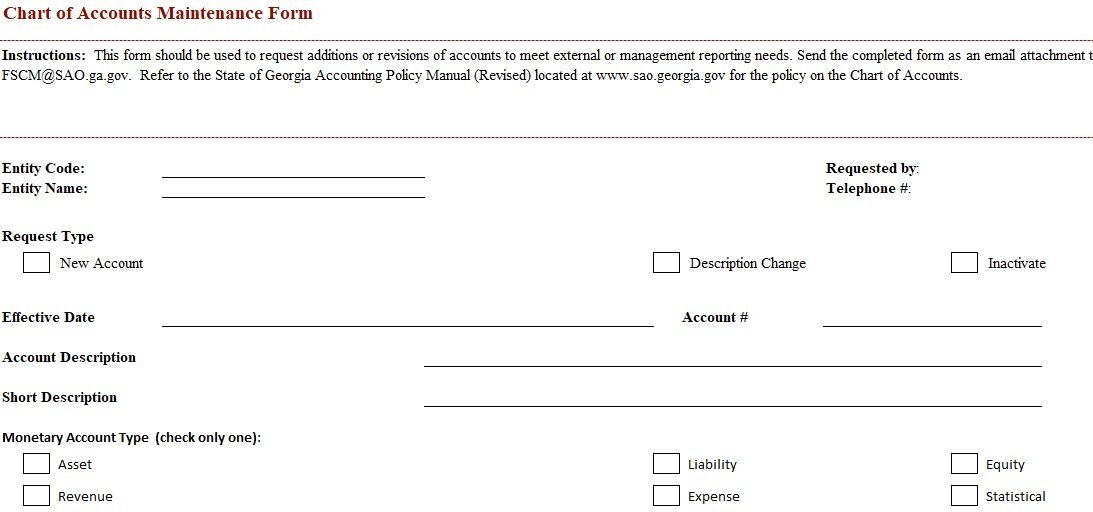

chart of accounts maintenance form

accounting general ledger example

The accompanying data ought to be kept in the general ledger template:

A particular transaction

You ought to utilize the overall record format to take apart unambiguous record exchanges like Receivables, Cash, Sales, and so on. Separating record accounts assists you with keeping a point-by-point record for future reference. It likewise guarantees that you can without much of a stretch follow blunders or errors made during the bookkeeping system in light of the fact that the data isn’t at first summed up.

Consolidated data in a single template

You ought to join the data acquired in the particular record accounts into one general ledger template. This gives him an outline of what financial transactions did in a period. A business with intricate or unpredictable exchanges can likewise have the option to utilize a general ledger template to catch all its account transactions. The uncommon example of transactions can be challenging to keep in a particular record account as such an overall record guarantees that all exchange data is caught.

Amount(s) in significant credit or charge segment

You ought to put sums in the credit and charge part of a general ledger template to guarantee that you balance your books. This additionally assists him with guaranteeing that you don’t overstretch your monetary reach by holding your credit and charge sums under control. You can likewise survey in the event that you stay aware of your leasers to guarantee you don’t default installments.

Balance part of the layout

The balancing segment of the general ledger template empowers you to work out the sum spent or procured during exchanges. This aids in calculating in the event that the business is executing loss or benefit. It additionally guarantees that you can rapidly distinguish between cash owed and what you now have.

Recorded transactions

The transaction records of the general ledger template ought to be written in important records as they happen. This guarantees that you can keep your records refreshed with every transaction that happens. Furthermore, the customary updates made in the overall record accounts facilitate the accounting system by guaranteeing that you don’t need to review every transaction at a later period or filter through a few reports to recover the transaction data.

Notes segment to follow new Information

You ought to likewise add notes in the general ledger template to assist him with monitoring new data. The note added will assist him with distinguishing when critical financial changes happened.

For instance:

In the event that you have taken care of a bank, adding such a note will influence the passages made in another record as it will have one less loan boss.

Summarized debits and credits at the base

The debits and credits ought to be accumulated at the lower part of the general ledger template. This assists with distinguishing assuming that the record is losing cash. A high credit balance is frequently expected because of cash owed to creditors. The aftereffects of including the charge and acknowledge accounts give you an outline of for the most part how much cash is flowing into and out of the business.

Matching debits and credits

You ought to ensure that the debits and credits add up and coordinate with one another on the general ledger template. Each financial transaction ought to influence two records, making them gain or lose something similarly.

For instance:

Things bought are charged as resources while the cash utilized in the buy is credited. Consequently, the aggregate debited will match the total credited.

Extra advances

There are a couple of general and fundamental advances that you should take after totally finishing up the overall record layout to achieve the maximum benefit.

Make balance sheets

When you fill a general ledger template, you ought to make an accounting report for yourself to have an outline of the business’s monetary well-being at a particular time. The asset report will likewise assist with tracking resources and liabilities at a given period which can then be utilized to evaluate the precision of the data contained in the overall record.

Make yourself acquainted with the accounting cycle

You ought to guarantee that you know about your accounting cycle to refresh and keep up with business funds. The accounting cycle additionally empowers you to store historical transaction data from your journal and arrange your account entries. This guarantees that you have an exact accounting system through a given period.

Conclusion

A General ledger template is such a document which uses for the businessman to record his financial transaction. Further, it contains the columns on either side of the page. You can download a sample and customize it as per need. The business community make sure that they contain four major information like the chart of accounts, the financial transactions, the account balances and account period.

FAQS:

What is a General Ledger design?

A general ledger design is a format that the money manager can use to record his monetary exchanges. It incorporates the number of sections an overall record ought to have on one or the other side of the page.

How might a general ledger be made in Excel?

To make a general ledger of success, the financial specialist should initially set up a worksheet. The worksheet contains different formulas that he can use, to summarize and journal into the fitting records. He can likewise utilize the excel pivot table highlights, to sum up, his journal data and fabricate a general ledger.

What are the four segments that ought to be in a general ledger?

A money manager should guarantee his overall record contains the four significant segments: the diagram of records, the financial transactions, the account adjustments, and the accounting time frame. This empowers the finance manager to capture financial transactions.

What is the standard paper aspect and size for a general ledger?

The standard paper size of a general ledger goes from letter lawful (8.5″ x 11″), record (8.5″ x 14″) and newspaper (17″ x 11″). These aspects have their format to guarantee that the general ledger has an expert look.

![20 Free Creative Brief Templates [MS Word] free creative brief template 12](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/free-creative-brief-template-12-150x150.jpg)

![20+ Free Balance Sheet Templates & Samples [Excel] trial balance sheet excel](https://cdn-ildebcd.nitrocdn.com/jnQCRkBozueuJprueOUxlAYnHGPdsTNY/assets/images/optimized/rev-d7007a4/templatedata.net/wp-content/uploads/2021/09/trial-balance-sheet-excel-150x150.jpg)