A strong demand letter for payment template is an official, written document that details a debt. Moreover, demand Letters for Payment also outline how debt should be paid, and the consequences if it isn’t paid by a certain date. Parties who are seeking to recover a debt often attempt to do so through other means than small claims court or a lawsuit. Further, consider a demand for a payment letter as an initial, non-confrontational approach to collecting a debt. Typical contents of the letter include:

- Date Debt was incurred: When the unpaid was completed;

- Details of Debt: A description of the debt;

- Expectations for payment: A clear and definitive expectation of payment, including the date by which payment is due;

- Consequences for non-payment: If, for instance, an author intends to sue for an unpaid debt, this information should be included in the letter.

Requirement of Demand for Payment Letter

Any time you owe someone money, a letter of demand for payment should be sent. Similarly, every situation is unique and requires a unique approach. Moreover, if you are a contractor and have completed work as agreed, you should not send a demand for payment on the date the work is completed. Invoice templates can be used at this point. You may demand payment if you are not paid within the time specified in the agreement. Likewise, if you were charged for a service you did not receive or for a product you did not receive, you are entitled to a refund. It is unnecessary to send a demand for payment when a simple phone call will do. Most of the time, when companies mistakenly charge you, a phone call will resolve the issue. However, if you have contacted the company and explained the problem, and they have indicated they will fix it, but have not done so in a reasonable amount of time, a demand for payment may be appropriate. It may also be appropriate to file a demand for payment if a company refuses to credit your account. Likewise, overall, you should use demand for payment letters whenever you believe you have a legal claim to a debt. You will need to use your payment demand as evidence in a court case, so be polite, stick to the facts, and make your expectations clear without being disrespectful.

What Happens If You Don’t Use a Demand for Payment Letter Template?

When you didn’t send a demand for payment, there are a couple of potential consequences. However, the first is that you may not get money. Remember that just as you have a lot going on in your life, so do the people who owe you money, and it is possible they simply forgot about their debt. It’s possible they believe their spouse settles well. Your company may be losing money if you don’t send a demand letter. Further, if you do not file a demand for payment, you may not be able to file a lawsuit. To file a lawsuit, a plaintiff must provide a factual basis for the claim. In many cases, this factual basis is identical to that in the demand letter. As a result, filing a demand for payment before filing a lawsuit doesn’t add to your workload. Rather, it reduces your workload, as it often results in payment, and even if it does not, you have the information you need already written down.

Common Uses of a Demand Letter for Payment

The two most common situations when a demand for payment should use:

- You owe someone money, and

- Someone has charged you for something you didn’t receive (or, didn’t receive as advertised).

When Someone owes your money

When someone owes you money, a demand for payment should use both personally and professionally. One example would be lending someone money. After several months, they stopped paying according to the agreement. In this case, a demand letter for a payment template is appropriate. Alternatively, you might have provided professional services, such as designing a website or building a retaining wall. When you send your invoices with a due date, nothing happens. This is a perfect situation for using a demand for payment letter.

You don’t owe someone money when they charge you

When using the internet and automated payments, messages lose. As a result, you may automatically pay the bill for a service you didn’t receive. For instance, you may subscribe to weekly housekeeping. When your housekeeping professional becomes ill and doesn’t find a replacement, you have to pay the bill by the billing service even though you did not receive the service. Make a polite call to resolve this issue. Sometimes, however, that’s not always the case. Then a payment demand should be ready. It’s also possible that you ordered something that wasn’t usable after it arrived. As a member of the fruit of the month club, you expect not only fruit but also a fruit that is not going to spoil. Maybe your shaving club sends razors to you every month. Your first step is to contact the retailer if your fruit arrives is near to spoil or if your razors broke. The remedy could be sending you fresh fruit, new razors, or credit your account. In both cases, if your contract clearly outlines the expectations of both parties, a demand for payment may be appropriate. Requests for customer service handles by employees with little power or incentive. It may be the first time a concern elevates from a line customer service representative to a manager or a member of the legal team.

How to Write a Payment Demand Letter?

In a payment demand letter, certain fundamental information should include. The following information is provided:

- Parties: both the person owing the debt and the person owing it you can identify.

- Whether debt you did by the completion of unpaid work; or

- Date debt was improperly charged: If the dispute involves charges for services not rendered or other improper charges, the date of the charge;

- Descriptive facts about the debt, including:

- Debt details: facts describing the nature of the debt, such as:

- the terms of the agreement;

- its amount; and its duration.

- how it didn’t follow.

- Information on previous attempts to collect the debt: calls made, emails sent, invoices mailed;

- Payment expectations: expectations should be clear and definitive, including a deadline for payment;

- Consequences: In the demand for payment, if the author intends to sue if the debt did not pay, this should be in detail.

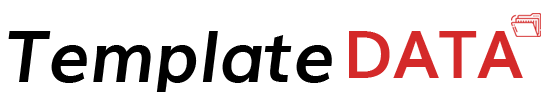

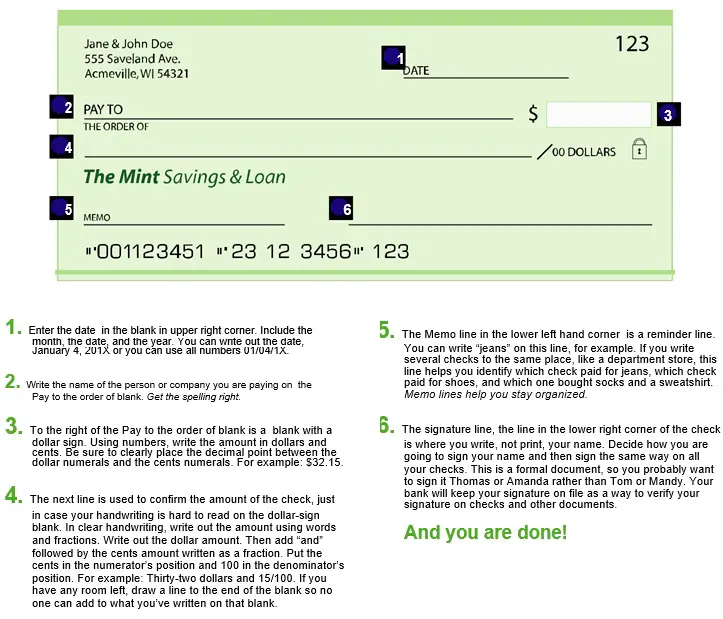

- Signature: the author must sign the document. Here is a sample demand for a payment letter:

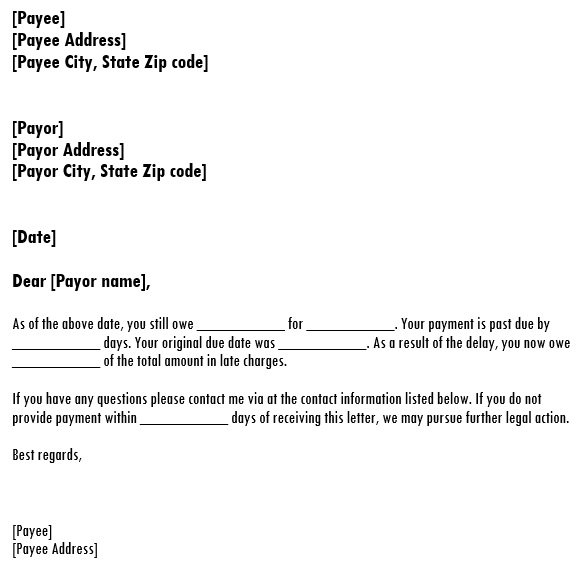

Demand For Payment Letter Sample

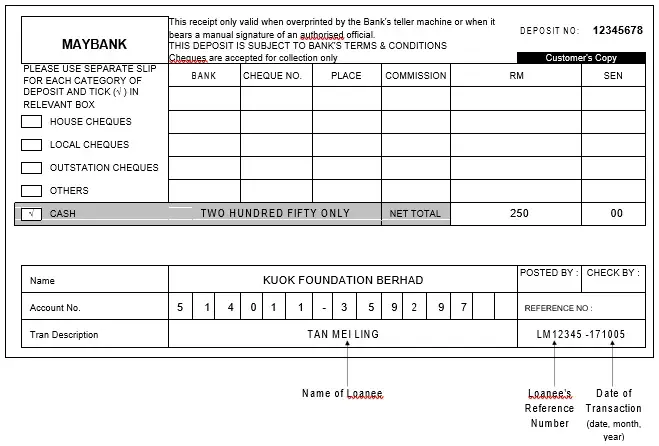

You should use a method that provides you with proof of receipt when submitting a payment demand. You can complete through a return service request, certified mail, or a signature program offered by a private delivery service. You should also check Payment Receipt Template.

free demand letter for payment template

fillable demand letter for payment template

sample demand letter for payment template

final demand letter for payment template

demand for payment without prejudice

strong demand letter for payment template

Is it necessary to notarize a demand for payment?

Demands for payment should not not arise. In court, you may, however, need to swear to the truth of the allegations you make about your case. Therefore, just like with an affidavit, you should limit your demand for payment to facts. A court may later accept your demand as evidence.

How can I negotiate payment terms if I send a demand?

You can negotiate payment or stick to your original terms. It is up to you to decide what is best for you. However, make sure you document this exchange in writing.

Conclusion

Demand letter for payment template not only help in recovering defaults, but also build the company’s image. It should clearly state the amount owed and the due date. Despite the possibility of a genuine problem from the client-side, a timeline should be earlier and they should agree upon it.