Managing a cryptocurrency portfolio can be overwhelming, especially when juggling multiple coins across different exchanges. A Crypto Portfolio Tracker Excel Template offers a simple, flexible, and highly customizable way to monitor your investments, track performance, and make informed decisions. In this article, I’ll walk you through how to create, customize, and use an Excel-based portfolio tracker, even if you’re a beginner.

Why Use an Excel Template for Crypto Portfolio Tracking?

While automated crypto portfolio apps exist, Excel templates have several advantages:

- Flexibility: Customize fields to fit your needs, such as adding unique columns like purchase reason, tax calculations, or specific timeframes.

- Privacy: No need to share sensitive wallet information or API keys with third-party apps.

- Cost-Effectiveness: Excel templates are free (or low-cost) and don’t require premium subscriptions.

- Offline Access: Manage your portfolio without internet connectivity.

With the right setup, an Excel-based tracker can become your go-to solution for a complete overview of your holdings.

Setting Up Your Crypto Portfolio Tracker in Excel

1. Planning Your Template Structure

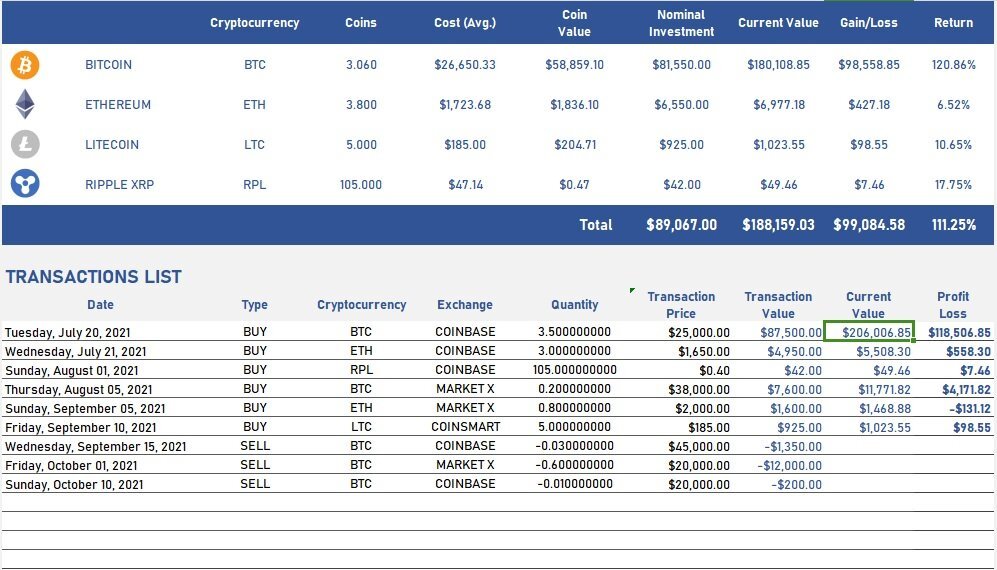

Before you start building, decide which data points to track. Below are some must-have fields:

- Coin/Token Name: E.g., Bitcoin (BTC), Ethereum (ETH), etc.

- Purchase Date: Date when you acquired the crypto.

- Purchase Price: Cost per unit at the time of purchase.

- Quantity: Amount of crypto purchased.

- Current Price: Live price data or manually updated values.

- Value: Formula to calculate current holding value (

Quantity × Current Price). - Profit/Loss: Formula for current profit/loss (

Value – (Purchase Price × Quantity)).

Optionally, include:

- Exchange name (e.g., Binance, Coinbase).

- Wallet type (e.g., cold wallet, hot wallet).

- Notes (e.g., reason for purchase).

2. Using Excel Formulas for Automation

To make the tracker functional:

- Profit/Loss Formula:

= (Current_Price × Quantity) – (Purchase_Price × Quantity) - Portfolio Total Value: Use

SUM()to calculate the sum of your holdings. - Percentage Allocation:

(Value of Coin ÷ Total Portfolio Value) × 100

These formulas simplify calculations and ensure accuracy.

3. Fetching Real-Time Crypto Prices

While Excel doesn’t natively pull live crypto prices, you can integrate price data via:

- Google Sheets Integration: Use the

CRYPTOFINANCEadd-on to import live prices. - Manual Updates: Add a “Price Data” tab in your template to update daily.

- Third-Party APIs: Services like CoinGecko or CoinMarketCap offer free APIs that you can link to Excel via Power Query.

Features to Enhance Your Crypto Tracker

1. Visual Dashboards

Creating visual elements like charts and graphs can give you an at-a-glance view of your portfolio:

- Use pie charts for portfolio allocation.

- Add line graphs to track the performance of specific coins over time.

- Heat maps can highlight which coins are performing well or poorly.

2. Tax Calculation

Cryptocurrency transactions are subject to taxes in most jurisdictions. Include:

- Taxable Events: Trades, conversions, or sales of crypto.

- Capital Gains:

(Selling_Price – Purchase_Price) × Quantity - Tax Rate: Use conditional formulas based on tax slabs in your country.

If you’re in the U.S., the IRS cryptocurrency FAQ is an excellent resource for tax rules.

3. Multi-Currency Support

If you deal in fiat beyond USD (like EUR, GBP, or INR), add exchange rate columns to track conversions.

Downloadable Crypto Portfolio Tracker Templates

Several pre-made Excel templates are available online to save time. Some trusted resources include:

These templates often include advanced features like ROI calculators and historical data tracking.

Best Practices for Maintaining Your Crypto Portfolio Tracker

- Update Prices Regularly: Whether manually or via automation, keeping prices current ensures accurate calculations.

- Backup Your Data: Store your Excel file on cloud platforms like Google Drive or OneDrive to prevent data loss.

- Review Performance Monthly: Analyze which coins are underperforming and decide if rebalancing your portfolio is necessary.

- Add Notes for Trades: Use the notes column to record why you bought or sold specific assets—helpful for reflecting on investment decisions later.

Final Thoughts

Creating a Crypto Portfolio Tracker Excel Template isn’t just about keeping tabs on your investments—it’s about gaining deeper insights into your financial decisions. With proper setup and regular maintenance, your tracker can become an invaluable tool for navigating the dynamic world of cryptocurrency.

crypto portfolio tracker excel template

Frequently Asked Questions (FAQs)

Yes, using third-party APIs like CoinGecko or integrations like Google Sheets’ CRYPTOFINANCE plugin, you can fetch live prices into Excel.

It depends. Excel offers privacy, customization, and offline access. Apps like Blockfolio or Delta, on the other hand, provide automation and user-friendly dashboards.

Use the formula:ROI = ((Current_Value – Total_Investment) ÷ Total_Investment) × 100

Tax software: CoinTracking or Koinly for tax reporting.

Market Analysis: TradingView for in-depth charting.

Backup Tools: Cloud services for secure storage.