Starting a Limited Liability Company (LLC) in New York is an exciting venture, but it comes with its fair share of legal requirements and documentation. One crucial document that every New York LLC should have is an operating agreement. This comprehensive guide will walk you through everything you need to know about the New York LLC operating agreement template, from their importance to the key elements they should include.

What is an LLC Operating Agreement?

An LLC operating agreement is a legal document that outlines the ownership structure and operating procedures of a Limited Liability Company. While not legally required in New York, having an operating agreement is highly recommended as it provides clarity and protection for all members of the LLC.

Why is an Operating Agreement Important for New York LLCs?

- Legal Protection: It helps maintain your LLC status and personal liability protection.

- Conflict Resolution: It provides a framework for resolving disputes among members.

- Customization: It allows you to customize the management and operation of your LLC.

- Credibility: It enhances your LLC’s credibility with banks, investors, and potential partners.

Key Components of a New York LLC Operating Agreement

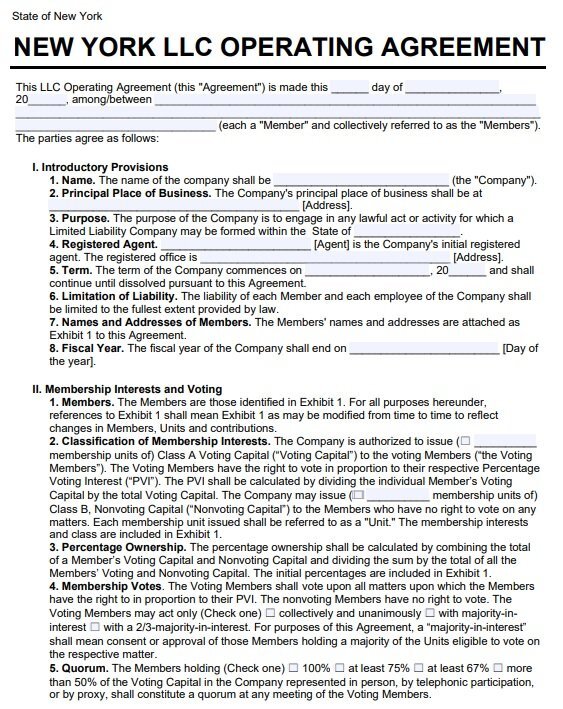

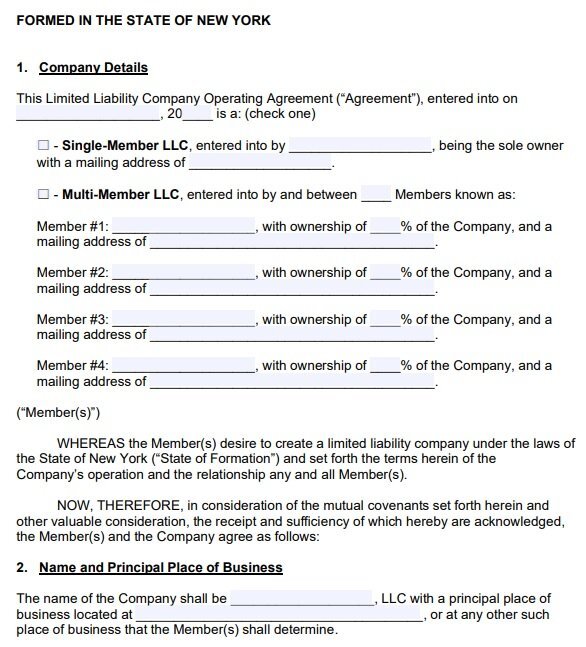

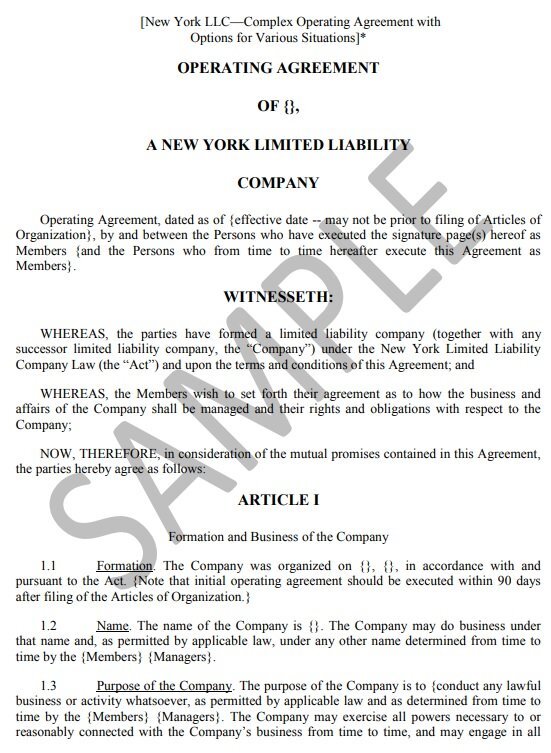

1. Company Information

Start your operating agreement with basic information about your LLC:

- Company name (as registered with the New York Department of State)

- Principal place of business

- Statement of intent

- Duration of the LLC (if not perpetual)

2. Membership Details

Clearly outline the membership structure of your LLC:

- Names and addresses of all members

- Membership classes (if applicable)

- Voting rights and procedures

- Ownership percentages

- Initial capital contributions

3. Management Structure

Specify how your LLC will be managed:

- Member-managed or manager-managed structure

- Roles and responsibilities of managers (if applicable)

- Decision-making processes

- Meeting schedules and procedures

4. Capital Contributions and Distributions

Detail the financial aspects of your LLC:

- Initial capital contributions of each member

- Additional capital contribution requirements

- Profit and loss allocation

- Distribution methods and schedules

5. Membership Changes

Address potential changes in membership:

- Procedures for admitting new members

- Process for member withdrawals or expulsions

- Transfer of membership interests

- Right of first refusal for existing members

6. Dissolution and Liquidation

Outline the process for ending the LLC:

- Events triggering dissolution

- Liquidation procedures

- Asset distribution upon dissolution

7. Amendment Procedures

Specify how the operating agreement can be changed:

- Voting requirements for amendments

- Notice procedures for proposed changes

8. Dispute Resolution

Include mechanisms for resolving conflicts:

- Mediation or arbitration clauses

- Jurisdiction for legal proceedings

Drafting Your New York LLC Operating Agreement

While templates can provide a good starting point, it’s crucial to tailor your operating agreement to your specific LLC. Here are some tips for drafting an effective agreement:

- Be Comprehensive: Address all potential scenarios, even if they seem unlikely.

- Use Clear Language: Avoid legal jargon and write in plain, understandable terms.

- Consider Future Growth: Include provisions that accommodate potential expansion or changes.

- Consult Professionals: Work with an attorney and accountant to ensure all legal and financial bases are covered.

Common Mistakes to Avoid

- Copying Generic Templates: While templates can be helpful, avoid using them without customization.

- Neglecting Tax Implications: Consult with a tax professional to understand how your operating agreement affects your LLC’s tax status.

- Ignoring State-Specific Requirements: Ensure your agreement complies with New York state laws.

- Lack of Specificity: Vague terms can lead to disputes later on.

New York-Specific Considerations

When drafting your New York LLC operating agreement template, keep these state-specific factors in mind:

- Publication Requirement: New York requires LLCs to publish a notice of formation in two newspapers. Your operating agreement should address responsibility for this requirement.

- Professional LLCs: If your LLC is a Professional LLC (PLLC), your operating agreement must comply with additional regulations set by New York state.

- Single-Member LLCs: Even if you’re the sole member, having an operating agreement can help maintain your limited liability status.

- Naming Conventions: Ensure your LLC name in the operating agreement matches exactly with the name on file with the New York Department of State.

Steps to Create Your New York LLC Operating Agreement

- Gather Information: Collect all necessary details about your LLC and its members.

- Choose a Template or Draft from Scratch: Decide whether to use a template as a starting point or create a custom document.

- Customize the Agreement: Tailor the document to your LLC’s specific needs and goals.

- Review with Members: If you have multiple members, review the draft with all parties involved.

- Consult Professionals: Have an attorney and accountant review the agreement.

- Execute the Agreement: Have all members sign and date the final document.

- Store Safely: Keep the original document in a secure location and provide copies to all members.

Updating Your Operating Agreement

Your operating agreement should evolve with your business. Schedule regular reviews (annually is recommended) to ensure it remains relevant and up-to-date. Some events that might trigger a need for updates include:

- Changes in membership

- Shifts in management structure

- Alterations to profit distribution methods

- Significant changes in business operations

Resources for New York LLC Operating Agreements

- New York State Department of State – Limited Liability Companies

- Cornell Law School – New York Consolidated Laws, Limited Liability Company Law

- U.S. Small Business Administration – Choose a Business Structure

Conclusion

A well-crafted operating agreement is essential for the smooth operation and long-term success of your New York LLC. By taking the time to create a comprehensive, customized document, you’re setting a strong foundation for your business. Remember, while templates and guides can be helpful, it’s always wise to consult with legal and financial professionals to ensure your operating agreement fully protects your interests and complies with New York state laws.

new york llc operating agreement form

new york state llc operating agreement template

sample operating agreement llc new york

Frequently Asked Questions

No, New York state law doesn’t mandate operating agreements for LLCs. However, having one is strongly recommended for protection and clarity.

Yes, you can draft your own agreement. However, it’s advisable to have it reviewed by a legal professional to ensure it’s comprehensive and compliant with state laws.

It’s recommended to review your agreement annually and update it whenever significant changes occur in your business or membership structure.

While not legally required, single-member LLCs can benefit from having an operating agreement to reinforce the separation between personal and business assets.

Generally, no. Your operating agreement must comply with New York state laws. If any provision conflicts with state law, that provision may be deemed invalid.