Creating a last will and testament is a crucial step in estate planning, ensuring your final wishes are respected and your assets are distributed according to your desires. For Wisconsin residents, understanding the specific requirements and nuances of the state’s laws is essential. This comprehensive guide will walk you through everything you need to know about creating a Wisconsin last will and testament template, from legal requirements to practical tips for drafting your document.

The Importance of a Last Will and Testament

A last will and testament, commonly referred to as a “will,” is a legal document that outlines how you want your assets and property distributed after your death. It’s a fundamental tool for estate planning that can:

- Ensure your wishes are carried out

- Protect your loved ones and dependents

- Minimize potential conflicts among family members

- Specify guardianship for minor children

- Designate an executor to manage your estate

Without a valid will, your estate will be distributed according to Wisconsin’s intestacy laws, which may not align with your personal wishes.

Legal Requirements for a Wisconsin Will

To create a legally binding will in Wisconsin, you must adhere to specific requirements set forth by state law:

1. Age and Capacity

- You must be at least 18 years old

- You must be of “sound mind,” meaning you understand the nature and extent of your property and the natural objects of your bounty

2. Writing and Signing

- The will must be in writing

- It must be signed by the testator (the person making the will) or by another person at the testator’s direction and in their presence

3. Witnesses

- The will must be signed by at least two competent witnesses

- Witnesses must sign the will in the presence of the testator and each other

Learn more about Wisconsin’s legal requirements for wills

Types of Wills Recognized in Wisconsin

Wisconsin recognizes several types of wills:

- Formal Wills: These are typewritten documents that meet all the legal requirements mentioned above.

- Holographic Wills: Handwritten wills are not officially recognized in Wisconsin unless they meet all the formal requirements, including proper witnessing.

- Oral Wills: Also known as nuncupative wills, these are only valid for military personnel in active service and must be properly documented and witnessed.

- Electronic Wills: As of 2024, Wisconsin does not recognize purely electronic wills.

Essential Elements of a Wisconsin Last Will and Testament

When creating your will, be sure to include the following key components:

1. Testator Information

- Full legal name

- Address

- Statement declaring this as your last will and testament

2. Executor Designation

- Name your chosen executor

- Include alternate executors in case your first choice is unable or unwilling to serve

3. Beneficiary Designations

- Clearly identify your beneficiaries

- Specify what assets or property each beneficiary should receive

4. Specific Bequests

- List any specific items or amounts you wish to leave to particular individuals

5. Residuary Estate

- Specify how you want the remainder of your estate distributed after specific bequests

6. Guardianship Provisions

- If you have minor children, name a guardian to care for them

- Consider naming an alternate guardian as well

7. Debts and Taxes

- Include instructions for paying off debts and taxes from your estate

8. Signature and Date

- Sign and date the will in the presence of witnesses

9. Witness Signatures

- Ensure at least two competent witnesses sign the will

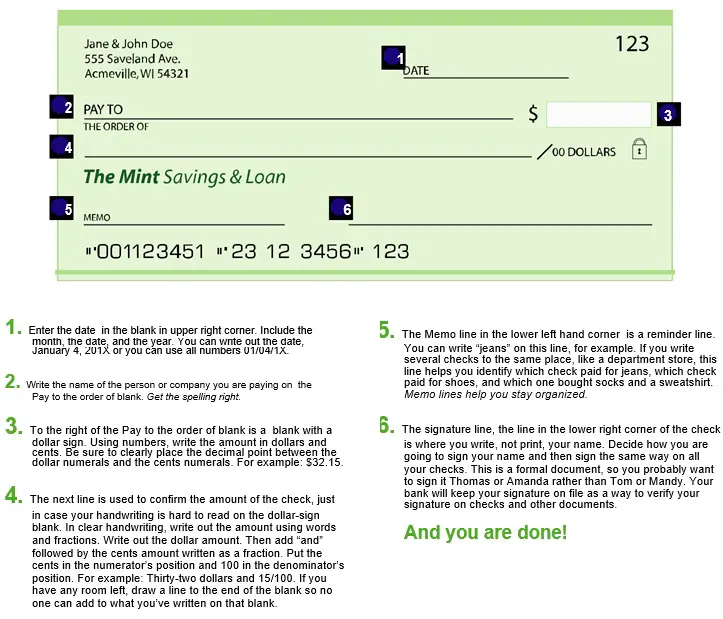

Step-by-Step Guide to Creating Your Wisconsin Will

Follow these steps to create your last will and testament:

- Inventory Your Assets: Make a comprehensive list of all your assets, including real estate, personal property, bank accounts, and investments.

- Decide on Beneficiaries: Determine who you want to inherit your assets and in what proportions.

- Choose an Executor: Select a responsible and trustworthy person to manage your estate.

- Consider Guardianship: If you have minor children, decide who should be their guardian.

- Write Your Will: Use a Wisconsin-specific template or consult with an attorney to draft your will.

- Review and Revise: Carefully review your will and make any necessary revisions.

- Sign and Witness: Sign your will in the presence of at least two competent witnesses.

- Store Safely: Keep your will in a secure location and inform your executor of its whereabouts.

Find more estate planning resources at the State Bar of Wisconsin

Common Mistakes to Avoid

When creating your Wisconsin last will and testament template, be careful to avoid these common pitfalls:

- Not updating your will regularly: Life changes such as marriages, divorces, births, or deaths may necessitate updates to your will.

- Failing to name alternate beneficiaries or executors: This can lead to complications if your primary choices are unavailable.

- Being too vague: Clear, specific language is crucial to prevent misinterpretation.

- Not considering tax implications: Proper estate planning can help minimize tax burdens on your beneficiaries.

- Forgetting to include digital assets: In today’s digital age, consider how you want your online accounts and digital property handled.

- Not properly executing the will: Failing to meet Wisconsin’s legal requirements can invalidate your will.

The Role of an Attorney

While it’s possible to create a will using online templates or software, consulting with an experienced estate planning attorney can provide several benefits:

- Ensuring your will complies with Wisconsin law

- Addressing complex family or financial situations

- Minimizing potential tax implications

- Avoiding common mistakes and oversights

- Providing peace of mind that your wishes will be carried out

Find a qualified estate planning attorney through the Wisconsin State Bar

Storing and Updating Your Will

Once you’ve created your will, proper storage and maintenance are crucial:

Safe Storage

- Keep your original will in a secure location, such as a fireproof safe or safe deposit box

- Inform your executor of the will’s location

- Consider providing a copy to your attorney for safekeeping

Regular Updates

Review and update your will regularly, especially after major life events such as:

- Marriage or divorce

- Birth or adoption of children

- Death of a beneficiary or executor

- Significant changes in financial circumstances

- Moving to another state

Wisconsin’s Intestacy Laws

If you die without a valid will in Wisconsin, your estate will be distributed according to the state’s intestacy laws. These laws may not align with your wishes, potentially leading to unintended consequences for your loved ones.

Learn more about Wisconsin’s intestacy laws

Special Considerations for Wisconsin Residents

Marital Property

Wisconsin is a community property state, which means that marital property is generally split 50/50 between spouses. This can affect how you distribute assets in your will.

Disinheritance

While you have the right to disinherit individuals in your will, Wisconsin law provides certain protections for spouses and minor children.

Estate Taxes

As of 2024, Wisconsin does not have a state estate tax. However, federal estate taxes may still apply to larger estates.

wisconsin last will and testament form

wisconsin last will and testament template

Conclusion

Creating a last will and testament is a crucial step in ensuring your final wishes are respected and your loved ones are provided for after your passing. By understanding Wisconsin’s specific requirements and following the guidelines outlined in this comprehensive guide, you can create a legally binding document that gives you peace of mind and protects your legacy.

Remember, while templates and online resources can be helpful starting points, consulting with a qualified estate planning attorney can provide invaluable guidance, especially for complex situations. Take the time to create, properly execute, and regularly update your Wisconsin last will and testament template to secure your family’s future and honor your life’s work.

Frequently Asked Questions

While handwritten (holographic) wills are not officially recognized in Wisconsin, a handwritten will that meets all the formal requirements, including proper witnessing, can be valid.

Notarization is not required for a will to be valid in Wisconsin. However, including a self-proving affidavit, which does require notarization, can simplify the probate process.

Yes, you can change your will at any time as long as you’re of sound mind. This can be done through a codicil (an amendment to your will) or by creating an entirely new will.

If a beneficiary predeceases you, their inheritance typically passes to their descendants unless your will specifies otherwise. It’s important to include contingent beneficiaries in your will to address this possibility.

While you can include funeral instructions in your will, it’s often better to create a separate document for this purpose, as your will may not be read until after the funeral.