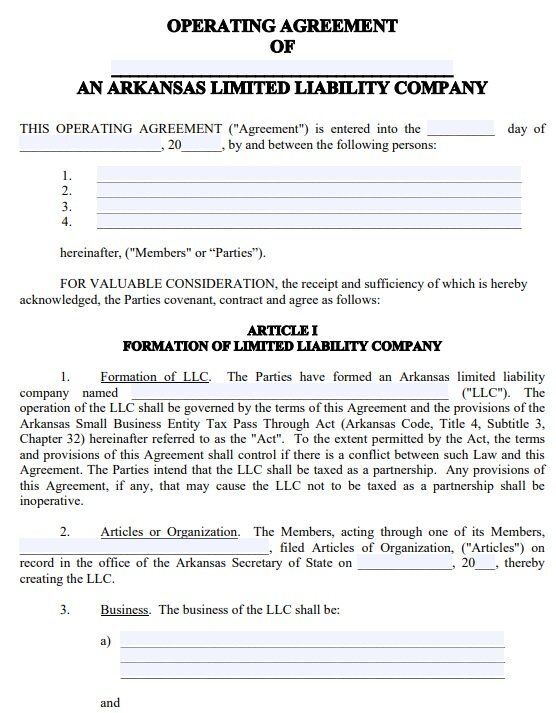

Starting an LLC in Arkansas requires careful planning and documentation, with one of the most crucial documents being the operating agreement. While Arkansas doesn’t legally mandate an operating agreement, having one is essential for protecting your business interests and establishing clear operational guidelines. In this comprehensive guide, we’ll explore everything you need to know about creating an effective Arkansas LLC Operating Agreement Template.

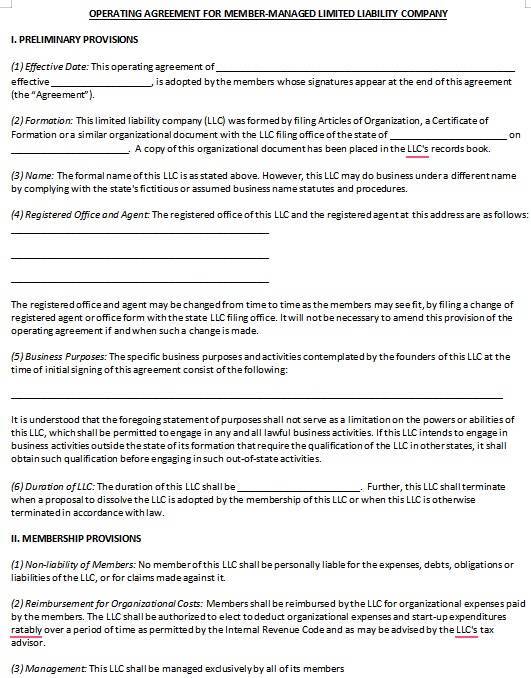

What is an Operating Agreement?

An operating agreement is a legal document that outlines the ownership structure, management responsibilities, and operational procedures of your LLC. This internal document serves as a roadmap for your business operations and helps prevent potential disputes among members.

Key Components of an Arkansas LLC Operating Agreement Template

1. Company Information and Formation Details

Your operating agreement should begin with basic information about your LLC:

- Company name and principal address

- Formation date and state of organization

- Registered agent information

- Statement of purpose

- Duration of the LLC (perpetual or specific term)

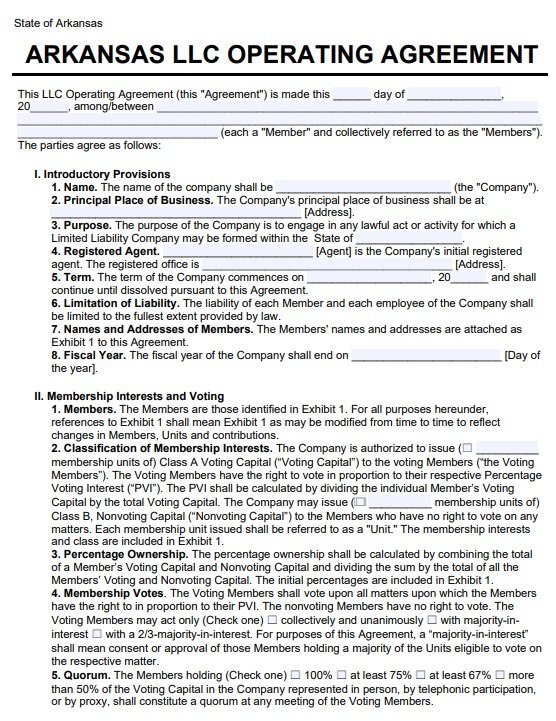

2. Membership Structure and Ownership

This section details the ownership breakdown of your LLC:

- Names and contact information of all members

- Capital contributions of each member

- Ownership percentages

- Voting rights and procedures

- Procedures for admitting new members

3. Management Structure

Define how your LLC will be managed:

Member-Managed Structure

- Roles and responsibilities of members

- Decision-making processes

- Voting requirements for major decisions

Manager-Managed Structure

- Manager selection process

- Manager responsibilities and limitations

- Compensation structure

- Removal procedures

4. Financial Provisions

Detail the financial aspects of your LLC:

- Initial capital contributions

- Additional capital calls

- Profit and loss allocation

- Distribution methods and schedules

- Tax treatment and classifications

- Banking procedures

- Fiscal year designation

5. Meetings and Voting

Establish protocols for:

- Regular and special meetings

- Notice requirements

- Quorum requirements

- Voting procedures and rights

- Record-keeping requirements

6. Transfer of Membership Interest

Address ownership transfer scenarios:

- Right of first refusal

- Restrictions on transfers

- Procedures for voluntary transfers

- Involuntary transfers (death, disability, divorce)

- Buy-sell provisions

7. Dissolution and Liquidation

Include procedures for:

- Events triggering dissolution

- Winding-up process

- Asset distribution

- Member responsibilities during dissolution

- Final tax obligations

Best Practices for Creating Your Operating Agreement

1. Customize to Your Needs

While templates are helpful starting points, customize your agreement to address your specific business needs. Consider consulting with a legal professional for guidance. Learn more about customizing LLC documents

2. Be Comprehensive

Include provisions for various scenarios:

- Dispute resolution procedures

- Amendment processes

- Member buyout terms

- Confidentiality requirements

- Non-compete clauses

3. Regular Updates

Review and update your operating agreement periodically to ensure it remains relevant and compliant with current laws. Stay updated with Arkansas business laws

Common Mistakes to Avoid

- Using generic templates without customization

- Omitting crucial provisions

- Unclear language and ambiguous terms

- Inconsistent provisions

- Failing to have all members sign the agreement

Legal Requirements and Compliance

While Arkansas doesn’t require filing your operating agreement with the state, maintain compliance with:

- Arkansas Small Business and Technology Development Center guidelines

- State LLC laws and regulations

- Federal tax requirements

- Industry-specific regulations

Check Arkansas LLC compliance requirements

Creating Your Operating Agreement

Step-by-Step Process

- Gather Information

- Business details

- Member information

- Management structure

- Financial arrangements

- Draft the Agreement

- Use clear, specific language

- Include all essential components

- Ensure compliance with state laws

- Review and Revise

- Legal review recommended

- Member review and input

- Final adjustments

- Execute the Agreement

- All members sign

- Notarization (optional but recommended)

- Secure storage of copies

Special Considerations for Arkansas LLCs

State-Specific Requirements

- Compliance with Arkansas Code § 4-32-101 et seq.

- Secretary of State filing requirements

- Annual reporting obligations

- Tax considerations

Industry-Specific Provisions

Consider including provisions specific to your industry:

- Professional service requirements

- Licensing obligations

- Industry-specific regulations

- Special liability provisions

Operating Agreement Amendments

When to Amend

- Change in membership

- Management structure changes

- Capital contribution modifications

- Business model updates

- Legal requirement changes

Amendment Process

- Review current agreement

- Draft amendments

- Member approval

- Documentation and storage

Arkansas LLC Operating Agreement Template

Arkansas LLC Operating Agreement

arkansas multi member llc operating agreement template

Additional Resources

- Arkansas Secretary of State Business Services

- Arkansas Small Business Administration

- Arkansas Bar Association Business Law Resources

- Arkansas Small Business and Technology Development Center

Frequently Asked Questions

No, but it’s highly recommended for protecting your business and members’ interests.

Yes, but professional legal review is recommended to ensure completeness and compliance.

Review annually and update as needed when significant changes occur in your business.

Notarization isn’t required but can provide additional legal validity.

Yes, with proper member approval according to the amendment procedures outlined in your agreement.