Creating a last will and testament template is a crucial step in ensuring your final wishes are respected and your loved ones are taken care of after you’re gone. For Alabama residents, understanding the specific requirements and nuances of the state’s laws is essential. This comprehensive guide will walk you through everything you need to know about creating an Alabama last will and testament template, from legal requirements to practical considerations.

Understanding the Basics of an Alabama Last Will and Testament

A last will and testament, often simply called a “will,” is a legal document that outlines how you want your assets distributed after your death. In Alabama, the law governing wills is found in the Code of Alabama, Title 43, Chapter 8.

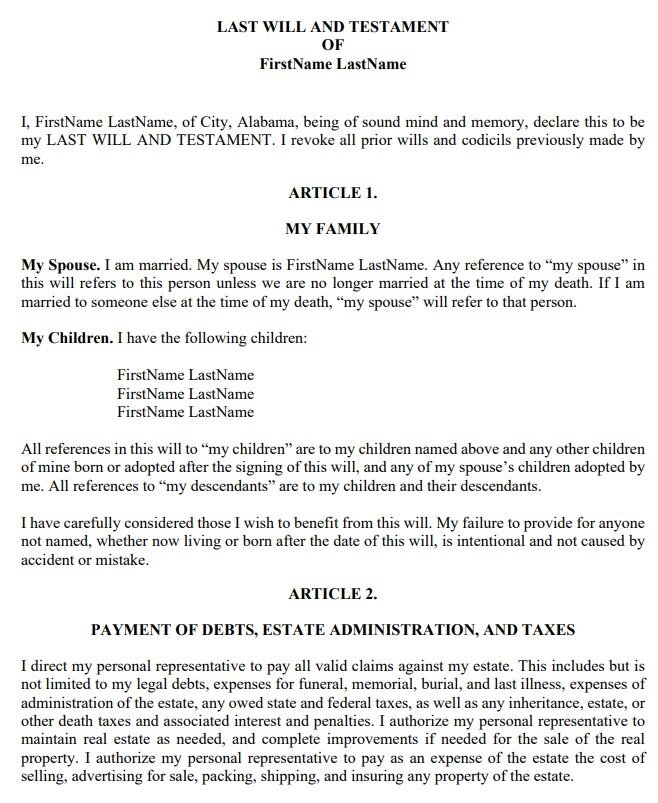

Key Elements of an Alabama Will

- Testator Information: Your full name and address as the person making the will (known as the testator).

- Declaration of Testamentary Capacity: A statement confirming you are of sound mind and creating the will voluntarily.

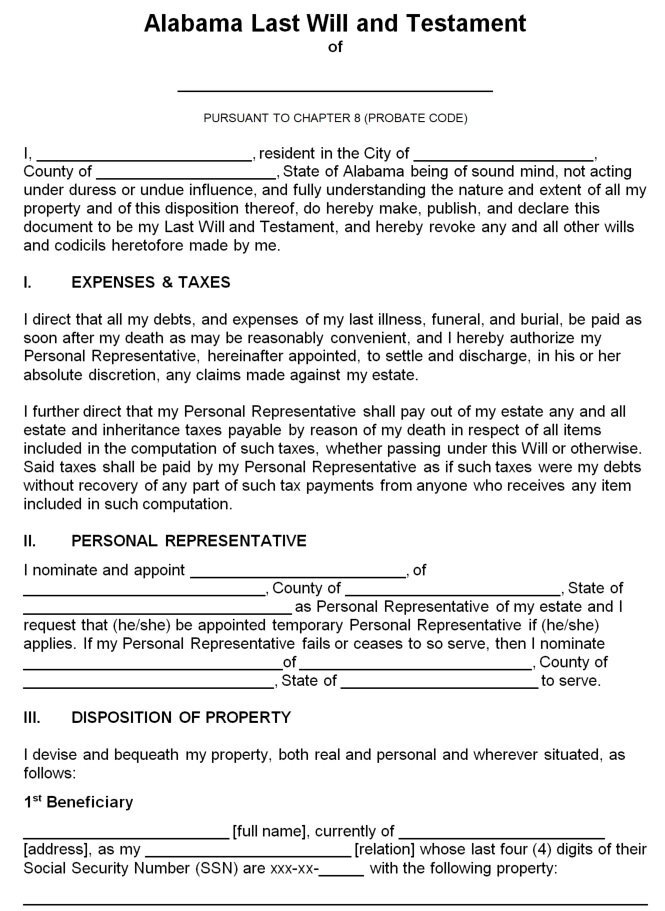

- Beneficiary Designations: Names and details of the individuals or organizations you wish to inherit your assets.

- Asset Distribution: Specific instructions on how your property should be distributed.

- Executor Appointment: Naming the person responsible for carrying out your will’s instructions.

- Guardian Designation: If applicable, naming a guardian for minor children.

- Signature and Witnessing: Your signature and those of at least two witnesses.

Legal Requirements for an Alabama Will

To ensure your will is legally valid in Alabama, it must meet certain criteria:

Age and Capacity

You must be at least 18 years old and of sound mind to create a valid will in Alabama. The law presumes you have the mental capacity to make a will unless proven otherwise.

Writing Requirement

Alabama law requires that a will be in writing. While handwritten (holographic) wills are recognized in Alabama, they can be more challenging to prove valid. It’s generally recommended to type your will for clarity.

Signature Requirements

You must sign your will, or direct someone else to sign it in your presence if you’re unable to do so yourself. This must be done in the presence of at least two witnesses.

Witness Requirements

At least two competent witnesses must sign the will in your presence. These witnesses should not be beneficiaries named in the will to avoid potential conflicts of interest.

Learn more about Alabama’s legal requirements for wills

Creating Your Alabama Last Will and Testament

Now that we understand the basics and legal requirements, let’s explore the process of creating your will.

Step 1: Inventory Your Assets

Begin by listing all your assets, including:

- Real estate properties

- Bank accounts

- Investments

- Personal property (vehicles, jewelry, artwork, etc.)

- Digital assets (online accounts, cryptocurrencies)

Step 2: Decide on Beneficiaries

Determine who you want to inherit your assets. This may include:

- Family members

- Friends

- Charities or organizations

Consider any specific bequests you want to make, such as leaving a particular item to a certain person.

Step 3: Choose an Executor

Select a responsible person to serve as your executor. This individual will be responsible for:

- Managing your estate

- Paying any debts or taxes

- Distributing assets according to your will

It’s wise to name an alternate executor in case your first choice is unable or unwilling to serve.

Step 4: Consider Guardianship

If you have minor children, designate a guardian to care for them in the event of your death. Discuss this decision with the potential guardian beforehand.

Step 5: Draft the Will

Using the Alabama last will and testament template, draft your will. Be sure to include:

- Your full name and address

- A statement declaring this as your last will and testament

- Specific bequests and general asset distribution instructions

- Executor appointment

- Guardian designation (if applicable)

- Residuary clause (to cover any assets not specifically mentioned)

Step 6: Review and Revise

Carefully review your draft will. Consider consulting with an estate planning attorney to ensure everything is in order and complies with Alabama law.

Step 7: Execute the Will

Sign your will in the presence of at least two witnesses, who should then sign as well. While not required in Alabama, having the will notarized can add an extra layer of authenticity.

Find more information on executing a will in Alabama

Special Considerations for Alabama Wills

Spouse’s Elective Share

Alabama is not a community property state, but it does have laws protecting a surviving spouse’s rights. A surviving spouse can claim an “elective share” of the deceased spouse’s estate, which is often one-third of the estate.

Probate Process

Understanding Alabama’s probate process can help you make informed decisions when creating your will. Probate is the legal process of administering a deceased person’s estate, including validating the will.

Learn about Alabama’s probate process

Self-Proving Affidavit

While not required, attaching a self-proving affidavit to your will can simplify the probate process. This document, signed by you and your witnesses before a notary, confirms the will’s validity without requiring the witnesses to testify in court.

Updating Your Alabama Will

Life changes, and your will should reflect those changes. Consider reviewing and updating your will after major life events such as:

- Marriage or divorce

- Birth or adoption of children

- Significant changes in financial situation

- Moving to a different state

To update your will, you can either create a new one or add a codicil (an amendment to your existing will). Ensure any updates follow the same legal requirements as the original will.

Digital Assets and Online Accounts

In today’s digital age, don’t forget to include instructions for your digital assets in your will. This may include:

- Social media accounts

- Email accounts

- Cryptocurrency

- Digital photos and files

Consider appointing a digital executor to manage these assets specifically.

Read more about digital estate planning

Common Mistakes to Avoid

When creating your Alabama last will and testament, be aware of these common pitfalls:

- Not updating the will regularly: Life changes, and your will should too.

- Forgetting to include digital assets: Ensure your online presence is accounted for.

- Failing to consider tax implications: Consult with a tax professional to understand potential estate taxes.

- Not naming alternate beneficiaries: This can cause complications if a primary beneficiary predeceases you.

- Improper witnessing: Ensure your will is properly witnessed to avoid validity issues.

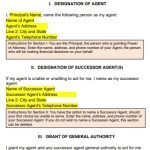

Alternative Options

While a last will and testament is crucial, consider exploring other estate planning tools that may complement your will:

- Living Trust: Can help avoid probate and provide more control over asset distribution.

- Power of Attorney: Allows someone to make decisions on your behalf if you become incapacitated.

- Advance Healthcare Directive: Specifies your wishes for medical treatment in case you can’t communicate them yourself.

Explore more estate planning options

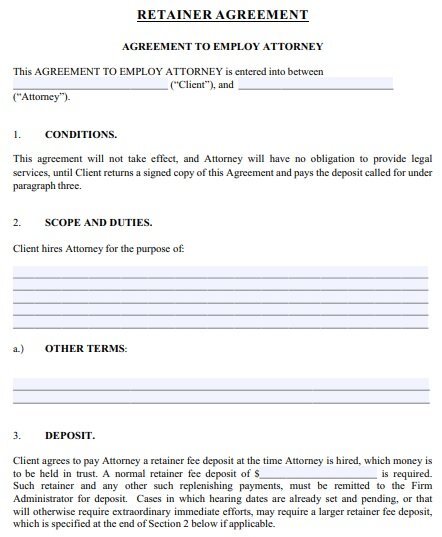

Seeking Professional Help

While it’s possible to create a will using a template, complex estates or unique situations may benefit from professional guidance. Consider consulting with an estate planning attorney to ensure your will accurately reflects your wishes and complies with Alabama law.

alabama last will and testament template

free alabama last will and testament form

Conclusion

Creating an Alabama last will and testament is a significant step in planning for your family’s future. By understanding the legal requirements, carefully considering your assets and beneficiaries, and regularly updating your will, you can ensure your final wishes are respected and your loved ones are provided for after you’re gone.

Remember, while this guide provides a comprehensive overview, every situation is unique. Don’t hesitate to seek professional advice to address your specific needs and circumstances.

Frequently Asked Questions

While not legally required, consulting with an attorney can ensure your will is properly drafted and legally valid, especially for complex estates.

Yes, Alabama recognizes holographic (handwritten) wills, but they must be entirely in your handwriting and signed to be valid.

It’s advisable to review your will every 3-5 years or after any major life changes such as marriage, divorce, birth of children, or significant changes in assets.

If you die without a will (intestate), Alabama’s intestacy laws will determine how your assets are distributed, which may not align with your wishes.

While you can leave your spouse out of your will, Alabama law allows a surviving spouse to claim an elective share of the estate, typically one-third.

While it may be recognized, it’s best to create a new will that complies with your new state’s laws to avoid any potential issues.

While you can, it’s often better to communicate these wishes separately, as the will may not be read until after the funeral.